The growth of the pro AV market is significantly driven by advancements in digital technologies, enhancing audiovisual experiences for both businesses and consumers. Moreover, greater incorporation of artificial intelligence (AI) and machine learning (ML) into AV systems is streamlining content delivery and engagement. Apart from this, greater emphasis on live events is contributing to market expansion. This pro AV market trend is especially pronounced in India, where the number of live events climbed from 26,359 to 30,687 in 2024, a year-on-year increase of 39%, according to an industry report. Increased demand for high-quality audiovisual solutions to facilitate these events is fueling innovation in Pro AV technologies. In addition, the movement toward immersive technologies such as virtual and augmented reality is raising demand for high-quality AV solutions. Also, the increase in remote work and hybrid collaboration is growing the demand for smooth, secure AV systems.

The market in the United Sates is propelled by the increasing investments in smart infrastructure and urban development, which is leading to higher demand for integrated AV systems in both commercial and residential projects. For instance, on June 20, 2024, the U.S. General Services Administration (GSA) reported an USD 80 Million funding from the Inflation Reduction Act to deploy smart building technologies in about 560 federal buildings across the country. Moreover, the growing usage of virtual events and video conferencing technologies, spurred on by the pandemic, is one of the key drivers supporting market growth. Besides this, ongoing improvements in 4K and 8K display technology are still further increasing demand for high-definition AV solutions. Further, widespread adoption of interactive learning tools within education, is generating new opportunities in the market for the latest Pro AV solutions.

Pro AV Market Trends:

Corporate collaboration and training

Pro AV has become integral to corporate environments, facilitating effective communication, collaboration, and training, which is providing an impetus to pro AV market growth. Modern office spaces are equipped with video conferencing systems, wireless presentation solutions, and interactive displays to foster teamwork and productivity. According to an industry report, In the United States, around 22 million adults, or 14% of the workforce, are working from home as of 2024. This shift in work dynamics has significantly increased the demand for pro AV technologies, which are crucial in facilitating seamless communication and collaboration across remote and hybrid teams. With businesses adopting flexible work models, pro AV solutions such as video conferencing systems, interactive displays, and wireless presentation tools are essential for maintaining productivity and ensuring effective information sharing. In addition to this, the training sector relies on pro AV for immersive simulations, employee development, and onboarding processes. As the corporate world recognizes the significance of efficient communication and skill development, the pro AV market share continues to thrive as a critical enabler of these objectives.Continual technological advancements

Emerging innovations in display technologies, such as 4K and 8K resolution screens, OLED displays, and LED video walls, are leading t to enhanced visual experiences. Similarly, audio technologies, such as immersive sound systems and high-definition audio processing is improving the auditory aspect of these solutions. The global home audio equipment market reached USD 33.3 Billion in 2024 and is projected to double, reaching USD 66.5 Billion by 2033, at a CAGR of 7.57% during 2025-2033, according to the publisher. These advancements enhance the quality of presentations and entertainment and enable the integration of AV in various sectors, including education, healthcare, corporate, and entertainment. Furthermore, pro AV market forecast indicate that the ongoing convergence of pro AV with IT and networking technologies is set to revolutionize these systems, enhancing their versatility, scalability, and ease of management. This evolution is positioning pro AV solutions better to address the dynamic demands of modern enterprises and institutions. As a result, businesses and organizations are increasingly adopting AV solutions to stay competitive and provide superior experiences to their audiences.Education technology integration

Interactive whiteboards, high-definition projectors, and collaborative audio systems facilitate engaging lessons in both physical classrooms and virtual learning environments. These technologies encourage student participation and improve knowledge retention, which is creating a positive pro AV market outlook. The ongoing evolution of remote and hybrid learning models further fuels the demand for AV equipment, ensuring that students have access to quality education regardless of their location. As educational institutions invest in modernizing their infrastructure, the market stands to benefit from this essential sector. In 2024, the global e-learning market size reached USD 342.4 Billion, and looking ahead, the publisher expects it to grow to USD 682.3 Billion by 2033, exhibiting a CAGR of 8.0% during 2025-2033. Furthermore, the systems are utilized for administrative purposes, including campus-wide announcements, event promotion, and safety alerts. Digital signage and campus-wide audio systems ensure efficient communication within educational institutions.Pro AV Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global pro AV market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on solution, distribution channel, and application.Analysis by Solution:

- Products

- Display

- AV Acquisition and Delivery Products

- Projectors

- Sound Reinforcement Products

- Conferencing Products

- Other Products

- Services

- Installation Services

- Maintenance Services

- IT Networking Services

- System Designing Services

- Other Services

Analysis by Distribution Channel:

- Direct Sales

- Distributors

Analysis by Application:

- Home Use

- Commercial

- Education

- Government

- Hospitality

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Pro AV Market Analysis

The United States holds a substantial share of the North America pro AV market with 83.40% in 2024. The market in the United States is experiencing significant growth due to advancements in display technology, hybrid work solutions, and digital signage expansion. The rise in immersive experiences in entertainment, education, and corporate sectors is driving investments in high-quality AV solutions. AI-powered automation and cloud-based AV services are transforming content delivery and management. The integration of AV with IoT and smart building technologies is also supporting the market. Live events, virtual collaboration, and experiential retail are among the key sectors driving adoption. The ongoing digital transformation in education and healthcare further enhances market opportunities. The expansion of e-learning and remote collaboration tools is creating sustained pro AV market demand, with significant growth expected in the online learning industry. According to reports, the online learning sector in the United States is projected to reach a staggering worth of USD 687 Billion by 2030. This rapid expansion is fueling investments in advanced AV technologies that support interactive and high-quality virtual learning experiences. Innovation in LED walls, projection mapping, and high-resolution displays is expected to drive the market forward, enhancing visual communication and audience engagement across various industries.Europe Pro AV Market Analysis

The Europe pro AV market is experiencing significant growth due to digital transformation investments in corporate, education, retail, and entertainment sectors. Cloud-based AV solutions and AI-driven automation are improving operational efficiency and user experience. Smart meeting rooms, digital signage, and interactive displays are becoming essential for businesses. Hybrid work models are propelling the demand for advanced video conferencing and collaboration tools. The region's emphasis on sustainability is also influencing the market, with energy-efficient displays and eco-friendly AV solutions gaining traction. The increasing integration of AR/VR in training and immersive experiences is expanding the scope of Pro AV applications. Furthermore, investment in technology continues to rise, with Tech EU reporting that European tech companies raised over €74.4 Billion in 2024, highlighting the region’s commitment to digital innovation. As organizations focus on enhancing audience engagement and content delivery, the market is expected to continue its upward trajectory, supported by continuous advancements in display, audio, and automation technologies.Asia Pacific Pro AV Market Analysis

The Asia Pacific pro AV market is experiencing rapid growth due to digital transformation initiatives in the education, corporate, retail, and entertainment sectors. The demand for high-resolution displays, interactive technologies, and cloud-based AV solutions is fueling market expansion. Hybrid work environments and online learning are increasing the need for advanced video conferencing and collaboration tools. Smart cities and IoT integration are enhancing the adoption of intelligent display and automation solutions. Moreover, large-scale investments in entertainment, gaming, and immersive experiences are also leading to a higher requirement for high-quality AV systems. Furthermore, the increasing revenue from the technology sector is positively impacting the Pro AV market. According to Invest India, the estimated revenue of India’s technology industry, including hardware, reached USD 254 Billion in FY24, marking a USD 9 Billion increase over the previous year. Advanced technologies are gaining Prominence in business and consumer applications, driving demand for innovative AV solutions. As businesses and institutions adopt next-generation technologies, the market is expected to grow significantly.Latin America Pro AV Market Analysis

The Latin America pro AV market is expanding due to digital signage, corporate communication solutions, and immersive entertainment technologies. Businesses invest in advanced systems for customer engagement, training, and collaboration. Hybrid work, online learning, and AI-driven automation are increasing efficiency. In addition to this, digital transformation initiatives are Propelling the growth of the market. A key indicator of this trend is the expansion of the smart TV market, which is seeing robust growth in the region. According to the publisher, the Mexico smart TV market size reached USD 3.7 Billion in 2024 and is expected to reach USD 10.8 Billion by 2033, exhibiting a CAGR of 12.50% during 2025-2033. Furthermore, the market is experiencing a surge in demand for high-resolution displays and advanced AV solutions, indicating continued growth in various industries.Middle East and Africa Pro AV Market Analysis

The Middle East and Africa market is growing due to increasing investments in smart infrastructure, digital transformation, and immersive entertainment experiences. Advanced display technologies, AI-powered automation, and cloud-based solutions enhance business communication and customer experiences. The demand for large-format displays, Projection mapping, and high-resolution LED technology is increasing, particularly in event management and public spaces, which is positively impacting market growth. Furthermore, the growing focus on smart cities and connected environments is driving the adoption of innovative AV solutions. Notably, the display market in Saudi Arabia reached USD 1.59 billion in 2024, and according to the publisher, it is expected to grow to USD 2.14 billion by 2033 at a CAGR of 3.36% during 2025-2033. This growth reflects the expanding role of display technologies in various applications across the region.Competitive Landscape:

The leading players in the market are heavily investing in research and development (R&D) activities to introduce cutting-edge pro AV technologies. This includes advancements in display technology, audio systems, and control solutions. They aim to stay ahead of the competition by offering Products that Provide superior performance, energy efficiency, and innovative features. In addition to this, several key players are expanding their presence globally by establishing partnerships, distribution networks, and subsidiaries in emerging markets. This strategy allows them to tap into the growing demand for AV solutions in regions, such as Asia Pacific, Latin America, and the Middle East. Furthermore, companies are offering customizable solutions and integration services. Businesses work closely with clients to design and implement AV systems tailored to their unique requirements, ensuring seamless integration with existing infrastructure.The report Provides a comprehensive analysis of the competitive landscape in the pro AV market with detailed Profiles of all major companies, including:

- Anixter International Inc. (Wesco International Inc.)

- AVI Systems Inc.

- AVI-SPL Inc.

- Biamp Systems LLC

- CCS Presentation Systems LLC

- Ford Audio-Video Systems LLC

- New ERA Technology Inc.

- Professional Audio-Visual Ltd.

- Solutionz Inc

- Telerent Leasing Corp. (ITOCHU International Inc.)

- Vistacom Inc.

Key Questions Answered in This Report

1. How big is the pro AV market?2. What is the future outlook of the pro AV market?

3. What are the key factors driving the pro AV market?

4. Which region accounts for the largest pro AV market?

5. Which are the leading companies in the global pro AV market?

Table of Contents

Companies Mentioned

- Anixter International Inc. (Wesco International Inc.)

- AVI Systems Inc.

- AVI-SPL Inc.

- Biamp Systems LLC

- CCS Presentation Systems LLC

- Ford Audio-Video Systems LLC

- New ERA Technology Inc.

- Professional Audio Visual Ltd.

- Solutionz Inc.

- Telerent Leasing Corp. (ITOCHU International Inc.)

- Vistacom Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 121 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

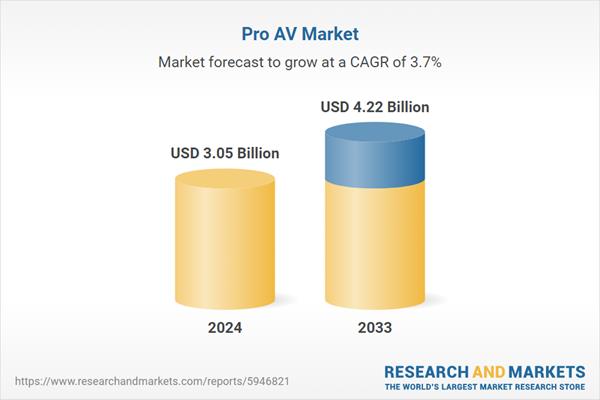

| Estimated Market Value ( USD | $ 3.05 Billion |

| Forecasted Market Value ( USD | $ 4.22 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |