Market Lifecycle Stage

The colorectal cancer screening and diagnostics market is currently at a growing stage with a robust growth trajectory, propelled by the rising demand for at-home colorectal cancer screening and diagnostics. The market is characterized by a mix of well-established companies and innovative startups, all competing to offer advanced solutions that cater to the evolving demands of research and diagnostics.Industrial Impact

The global colorectal cancer screening and diagnostics market’s impact is profound and multifaceted, influencing healthcare practices, patient outcomes, and economic dynamics within the healthcare sector. The market's growth is driving a significant shift toward early detection and prevention, leading to improved survival rates and quality of life for patients. This shift is also catalyzing a transition in healthcare focus from treatment to prevention, encouraging the development of public health policies and insurance coverage that support regular screening.Economically, the expansion of the colorectal cancer screening and diagnostics market has been contributing to the healthcare industry's growth, owing to increased investments in research and development of more accurate and less invasive screening technologies. These innovations not only enhance patient compliance and comfort but also have the potential to reduce long-term healthcare costs by preventing advanced disease stages that require more intensive and expensive treatments.

The global colorectal cancer screening and diagnostics market continues to drive transformative advancements across industries, with far-reaching implications for human health and environmental sustainability.

Market Segmentation:

Segmentation 1: by Type

- Stool DNA Test

- Fecal Immunochemical Test (FIT)

- Fecal Occult Blood Test (FOBT)

- Colonoscopies and Sigmoidoscopies

- Biomarkers Test

Colonoscopies and Sigmoidoscopies to Dominate the Global Colorectal Cancer Screening and Diagnostics Market (by Type)

Based on type, the colonoscopies and sigmoidoscopies segment dominated the global colorectal cancer screening and diagnostics market in FY2022. This category includes colonoscopes and sigmoidoscopes, which are considered a gold standard for diagnosis and screening for colorectal cancer. Colonoscopy allows for a detailed examination of the entire colon and rectum, enabling the detection of not only cancers but also precancerous polyps, which can be removed during the same procedure to prevent cancer development. Sigmoidoscopy, while more limited in scope, examining only the lower part of the colon, still plays a crucial role in screening efforts, especially in cases where a full colonoscopy might not be necessary or feasible.Segmentation 2: by End User

- Hospitals and Clinics

- Ambulatory Centers

- Clinical Laboratories

- Others

Hospitals and Clinics Segment to Hold its Dominance in the Global Colorectal Cancer Screening and Diagnostics Market (by End User)

Based on end user, the hospitals and clinics accounted for the largest share of the global colorectal cancer screening and diagnostics market in FY2022 due to the comprehensive healthcare services offered by them, including advanced diagnostic facilities and the availability of specialized care, which enable early detection and management of colorectal cancer.Segmentation 3: by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Recent Developments in the Global Colorectal Cancer Screening and Diagnostics Market

- In February 2024, Exact Sciences Corporation announced gearing up for the launch of a new slate of assays over the next few years, including a new iteration of its well-established stool-based colorectal cancer screening test, Cologuard, a complementary blood-based assay and a test for minimal residual disease detection.

- In February 2024, Freenome Holdings, Inc. announced that it raised $254 million in a new funding round led by Swiss drugmaker Roche to develop tests that could potentially detect multiple early-stage cancers and is currently developing screening tests focused on colorectal and lung cancers.

- In May 2023, Guardant Health collaborated with the Ohio State University Comprehensive Cancer Center to study colorectal cancer screening adherence.

- In May 2023, Guardant Health submitted a premarket approval application to the U.S. Food and Drug Administration for a Shield blood test.

- In April 2023, Mainz Biomed revealed a collaboration with the Instituto de Microecologia aimed at broadening ColoAlert's commercial reach in both Spain and Portugal.

- In May 2023, Olympus Corporation introduced the CF-HQ1100DL/I colon videoscope, a device specifically created for the inspection of the lower digestive system, covering areas such as the anus, rectum, sigmoid colon, colon, and ileocecal valve. This launch would serve to enhance Olympus's range of products within the colorectal cancer screening and diagnostics sector.

Demand - Drivers, Restraints, and Opportunities

Market Demand Drivers:

Rising Incidence of Colorectal Cancer and Increasing Financial Burden on Healthcare: The increasing healthcare expenditure related to colorectal cancer reflects the growing costs associated with its prevention, diagnosis, treatment, and management. As the incidence of colorectal cancer rises, the economic burden of the disease is also increasing. These costs include direct medical costs such as hospitalization, surgery, chemotherapy, and radiation therapy.Market Restraints:

Limited Sensitivity of FIT/FOBT Testing Kits: While non-invasive testing techniques for colorectal cancer, such as fecal immunochemical tests and stool DNA tests, have shown significant potential in cancer detection, they do have some limitations. One of the major limitations is their limited sensitivity, meaning they may not detect all cases of colorectal cancer, particularly in the early stages. This can result in false negatives and delayed diagnosis, which can impact patient outcomes.Market Opportunities:

Expansion of Screening Programs: Population-wide screening programs are proving to be a lucrative opportunity for the colorectal cancer screening and diagnostic market by leading to an increased number of individuals being screened for colorectal cancer, leading to earlier detection and treatment of the disease. By improving access to screening, these programs can also reduce healthcare costs and improve patient outcomes associated with more advanced stages of the disease, thereby resulting in a strong interest in these testing methodologies by various government and NGO screening programs.How can this report add value to an organization?

Workflow/Innovation Strategy: The global colorectal cancer screening and diagnostics market (by product) has been segmented into detailed segments, including different types of tests, such as fecal immunochemical tests, fecal occult tests, stool DNA tests, biomarker tests, and colonoscopies and sigmoidoscopies.Growth/Marketing Strategy: A strategic growth and marketing approach for the colorectal cancer screening and diagnostics market would involve positioning the company as a leader in innovative solutions that address the evolving needs of hospitals, clinicians, laboratories, and pharmaceutical partners. This would entail leveraging technological advancements to develop products with enhanced sensitivity and specificity while also investing in comprehensive, collaborative partnerships to foster customer loyalty and drive market penetration.

Competitive Strategy: Key players in the global colorectal cancer screening and diagnostics market have been focusing on innovation, differentiation, and strategic collaborations to gain a competitive edge. By investing in research and development, companies can develop novel screening and diagnostics methods, improve test sensitivity, and expand application areas.

Methodology

Key Considerations and Assumptions in Market Engineering and Validation

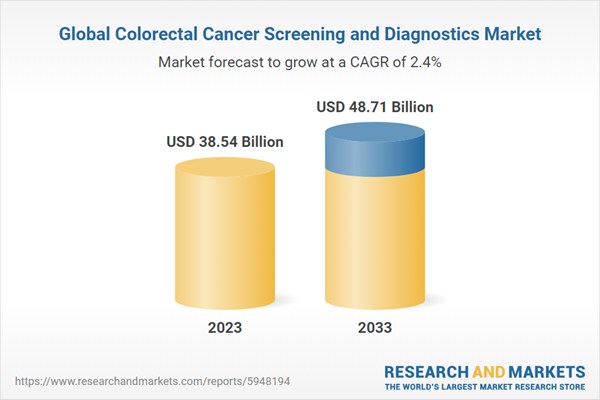

- The base year considered for the calculation of the market size is 2022. The historical year analysis has been done from FY2020 to FY2021, and the market size has been calculated for FY2022 and projected for the period 2023-2033.

- The geographical distribution of the market revenue has been estimated to be the same as the company’s net revenue distribution. All the numbers have been adjusted to two digits after decimals for report presentation reasons. However, the real figures have been utilized for compound annual growth rate (CAGR) estimation. CAGR has been calculated from 2023 to 2033.

- The market has been mapped based on different types of products available in the market and based on several indications. All the key manufacturing companies that have a significant number of types of tests for the global colorectal cancer screening and diagnostics market have been considered and profiled in the report.

- In the study, the primary respondent’s verification has been considered to finalize the estimated market for the global colorectal cancer screening and diagnostics market.

- The latest annual reports of each market player have been taken into consideration for market revenue calculation.

- Market strategies and developments of key players have been considered for the calculation of sub-segment split.

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year. The currency conversion rate has been taken from the historical exchange rate of the Oanda website or from the annual reports of the respective company, if stated.

Primary Research

The key data points taken from primary sources Include:

- validation and triangulation of all the numbers and graphs

- validation of reports segmentation and key qualitative findings

- validation of the numbers of various markets for market type

- percentage split of individual markets for geographical analysis

Secondary Research

Open Sources

- National Center for Biotechnology Information (NCBI), PubMed, Science Direct, World Bank Group, and World Health Organization (WHO)

- Annual reports, SEC filings, and investor presentations of the leading market players

- Company websites and detailed study of their portfolio

- Gold standard magazines, journals, whitepapers, press releases, and news articles

- Databases

The key data points taken from secondary sources Include:

- Segmentations, split-ups, and percentage shares

- Data for market value

- Key industry trends of the top players in the market

- Qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- Quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

In the colorectal cancer screening and diagnostics market, several key players dominate the landscape with their diverse range of products and solutions. Exact Sciences Corporation, Danaher Corporation, Guardant Health, Inc., Mainz Biomed NV, and New Horizon Health are among the prominent market players offering tests and colonoscopies and sigmoidoscopies for colorectal cancer screening and diagnostics within the market.The competition in the colorectal cancer screening and diagnostics market has been characterized by a dynamic and intensely competitive landscape with a variety of market players. This competition has been further fuelled by factors such as technological advancements, increasing demand for early detection methods, and the presence of numerous companies offering innovative solutions and services in this field.

Some of the prominent established names in this market are:

- DiaCarta, Inc.

- Danaher Corporation

- Epigenomics AG

- Eiken Chemical Co., Ltd.

- Exact Sciences Corporation

- Freenome Holdings, Inc.

- FUJIFILM Holdings Corporation

- Guardant Health, Inc.

- Lepu Medical Technology (Beijing) Co., Ltd.

- New Horizon Health

- Novigenix SA

- Prenetics Global Limited

- Olympus Corporation

- HOYA Corporation

- QuidelOrtho Corporation

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- DiaCarta, Inc.

- Danaher Corporation

- Epigenomics AG

- Eiken Chemical Co., Ltd.

- Exact Sciences Corporation

- Freenome Holdings, Inc.

- FUJIFILM Holdings Corporation

- Guardant Health, Inc.

- Lepu Medical Technology (Beijing) Co., Ltd.

- Mainz Biomed NV

- New Horizon Health

- Novigenix SA

- Prenetics Global Limited

- Olympus Corporation

- HOYA Corporation

- QuidelOrtho Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | March 2024 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value ( USD | $ 38.54 Billion |

| Forecasted Market Value ( USD | $ 48.71 Billion |

| Compound Annual Growth Rate | 2.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |