Smart Contracts is the fastest growing segment, North America is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The global blockchain in agriculture market is substantially driven by the imperative for enhanced supply chain traceability and transparency, as stakeholders increasingly demand verifiable information about product origins and journeys. This technology provides an immutable record of every transaction and movement, from farm to consumer, building a robust digital trail that traditional systems cannot match. The enhanced visibility allows for quicker issue identification and greater accountability across the entire value chain. For instance, according to Walmart's Global Tech, in May 2025, "How Walmart's Food Supply Chain Used Blockchain to Enhance Traceability" article, the company reduced the time to trace mangoes from nearly seven days to 2.2 seconds, demonstrating significant improvement in efficiency and response capability.Key Market Challenges

The substantial investment required for implementing blockchain solutions represents a significant constraint on the growth of the Global Blockchain in Agriculture Market. These high initial costs encompass not only infrastructure development and specialized software but also extensive training for all stakeholders, particularly challenging for small and medium-sized farming operations. The inherent complexity of integrating these advanced technologies further compounds this financial hurdle, creating a considerable barrier to widespread adoption across diverse agricultural value chains.Key Market Trends

The rise of blockchain-enabled agri-finance and micro-lending solutions addresses critical capital access gaps for farmers. This technology facilitates secure and transparent financial transactions, enhancing creditworthiness and reducing traditional intermediation costs. According to the U. S. Department of Agriculture's Economic Research Service, in February 2023, automated guidance technology was applied to over 50 percent of acreage planted for corn, cotton, rice, sorghum, soybeans, and winter wheat across the U. S., indicating a foundational readiness for advanced digital financial tools. This digital transformation extends to finance, as exemplified by applications such as Hello Tractor and Agrikore, which provide access to mechanized services and financing to smallholder farmers, thereby improving their livelihoods and productivity.Key Market Players Profiled:

- IBM Corporation

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- Accenture PLC

- AirDAO.io

- AgriLedger

- Ripe Technology Inc

- OriginTrail d.o.o

- TE-Food International GmbH.

Report Scope:

In this report, the Global Blockchain in Agriculture Market has been segmented into the following categories:By Type:

- Public

- Private

- Hybrid/Consortium

By Organization Size:

- Large Enterprises

- SMEs

By Application:

- Product Traceability, Tracking, & Visibility

- Payment, & Settlement

- Smart Contracts

- Governance

- Risk & Compliance Management

By Stakeholder:

- Growers

- Food Manufacturers/Processors

- Retailers

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Blockchain in Agriculture Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- IBM Corporation

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- Accenture PLC

- AirDAO.io

- AgriLedger

- Ripe Technology Inc

- OriginTrail d.o.o

- TE-Food International GmbH.

Table Information

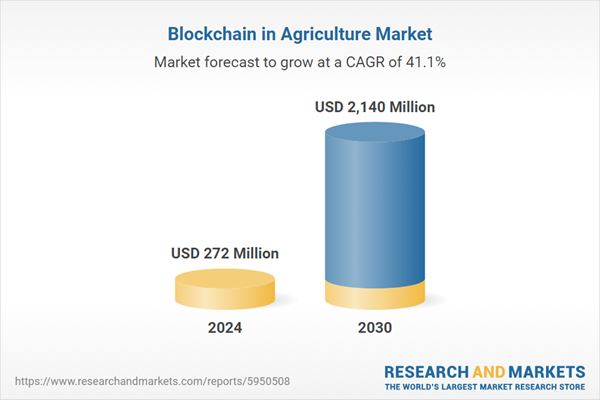

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | November 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 272 Million |

| Forecasted Market Value ( USD | $ 2140 Million |

| Compound Annual Growth Rate | 41.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |