Market Introduction

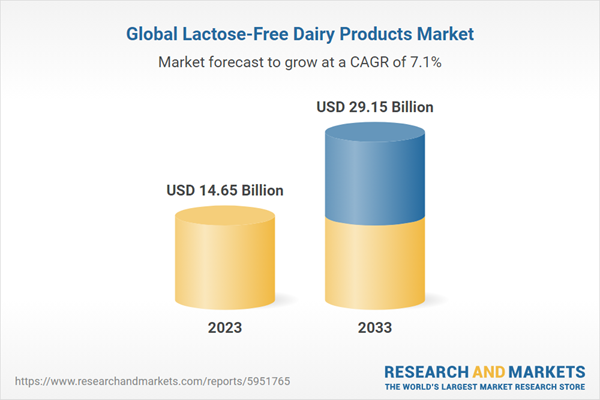

The lactose-free dairy products market, a subset of the allergen-free food market, caters to individuals who are lactose intolerant or prefer dairy items without lactose. These products are created by incorporating lactase, an enzyme that breaks down lactose, into regular dairy products or by utilizing alternative milk sources such as soy, almond, or coconut. The market is anticipated to exhibit a compound annual growth rate (CAGR) of 7.12% from 2023 to 2033, with a projected value of $29,158.8 million by 2033. Key growth drivers include the escalating prevalence of lactose intolerance, heightened demand for low-sugar and low-calorie options, expansion of distribution channels, and innovations in products by key industry players.Industrial Impact

The global lactose-free dairy products market, catering to lactose-intolerant and health-conscious consumers, is set to grow at a CAGR of 7.12% from 2023 to 2033. Key drivers include increasing demand for healthier dairy alternatives, a rising lactose-intolerant population, growing consumer purchasing power, and innovative product offerings by industry leaders. Challenges involve consumer taste preferences, competition from substitutes such as nuts and cereals, and regulatory issues. Opportunities lie in expanding private label options, enhancing distribution channels, and raising awareness of lactose-free dairy benefits. The market features intense competition among both local and international players, with major companies such as Danone, Nestlé, Valio, Arla Foods, and Lactalis employing diverse strategies such as product development, mergers, and partnerships to gain a competitive edge and expand market share.Market Segmentation:

Segmentation 1: by Distribution

- Direct

- Retail

Retail Segment to Dominate the Global Lactose-Free Dairy Products Market (by Application)

The dominance of retail applications in the global lactose-free dairy products market can be attributed to several factors. Firstly, the increasing prevalence of lactose intolerance worldwide has driven consumer demand for alternative dairy products, leading retailers to expand their offerings to cater to this growing market. Additionally, the convenience of purchasing lactose-free dairy products in retail outlets, including supermarkets, hypermarkets, and specialty stores, enhances accessibility for consumers. The ability to compare and choose from a diverse range of lactose-free options in a single shopping location further boosts the retail segment. Furthermore, aggressive marketing strategies and product placement in retail settings contribute to heightened consumer awareness and preference for lactose-free alternatives, consolidating the retail sector's dominance in capturing the global market for lactose-free dairy products.Segmentation 2: by Product

- Milk

- Yogurt

- Cheese

- Ice Cream

- Others

Milk Segment to Dominate the Global Lactose-Free Dairy Products Market (by Product)

The dominance of milk products in the global lactose-free dairy products market can be attributed to their widespread popularity and nutritional value. Milk products, such as yogurt, cheese, and milk itself, are staples in many diets worldwide, prompting a high demand for lactose-free alternatives. Additionally, advancements in technology have enabled the development of flavourful and comparable lactose-free options, retaining the familiar taste and texture of traditional dairy. Growing awareness of lactose intolerance and preference for lactose-free options among health-conscious consumers further contribute to the dominance of milk products in this market. Overall, the well-established appeal and adaptability of milk-based products play a key role in their prominence in the global lactose-free dairy market.Segmentation 3: by Source

- Animal

- Plant

Animal Segment to Dominate the Global Lactose-Free Dairy Products Market (by Source)

The dominance of animal-based products in the global lactose-free dairy market can be attributed to their established popularity, taste familiarity, and widespread availability. Consumers often associate dairy with traditional flavors and textures, making it challenging for plant-based alternatives to fully replace animal-derived options. Additionally, the existing dairy industry infrastructure and supply chain contribute to the continued prevalence of animal-based lactose-free products in the market.Segmentation 4: by Category

- Organic

- Conventional

Conventional Segment to Dominate the Global Lactose-Free Dairy Products Market (by Category)

The dominance of conventional products in the global lactose-free dairy products market can be attributed to strategic acquisitions, partnerships, and mergers by key industry players. These collaborations allow companies to quickly expand their product portfolios, leverage established distribution networks, and capitalize on complementary strengths, ultimately gaining a competitive edge in the rapidly growing lactose-free dairy sector. The conventional growth approach facilitates quicker market penetration and enhances market share, contributing to the overall dominance of conventional products in this market.Segmentation 5: by Region

- North America: U.S., Mexico, and Canada

- Europe: France, Germany, Italy, Spain, U.K., and Rest-of-Europe

- Asia-Pacific: China, Japan, India, South Korea, Australia, and Rest-of-Asia-Pacific

- South America: Brazil, Argentina, and Rest-of-South America

- Middle East and Africa: Israel, Turkey, South Africa, and Rest-of-Middle East and Africa

Recent Developments in the Global Lactose-Free Dairy Products Market

- In February 2024, Perfect Day and Unilever's Breyers collaborated to launch Breyers Lactose-Free Chocolate, using Perfect Day's dairy protein from precision fermentation. The product offers a sustainable and indulgent experience with reduced environmental impact. Perfect Day's whey protein maintains flavor and texture while cutting water consumption by up to 99% and greenhouse gas emissions by up to 97%. This aligns with Breyers' commitment to dietary-friendly frozen treats without compromising taste

- In February 2022, Chobani unveiled two new dairy products, i.e., Chobani Ultra-Filtered Milk, a protein-rich, lactose-free option, and Chobani Half & Half. Both products are crafted from locally sourced milk and are packaged in widely recyclable paper-based packaging. This expansion aims to increase Chobani's presence in the refrigerated aisle while aligning with sustainability efforts through eco-friendly packaging.

- In November 2020, DSM introduced the Maxilact Super lactase enzyme for producing lactose-free and sugar-reduced dairy items. Designed for various applications such as milk, milk drinks, and yogurts, the enzyme breaks down lactose into sweeter forms, reducing sugar levels by up to 20%. DSM claims a 33% reduction in hydrolysis time, enhancing production efficiency. Maxilact Super is free from invertase and arylsulfatase, addressing off-flavor concerns and stability during shelf life. This release responds to consumer preferences for sugar reduction and increasing demand for lactose-free options, aligning with health-conscious choices.

Demand - Drivers, Challenges, and Opportunities

Market Driver: Rising Lactose Intolerance

- The lactose-free dairy market is poised for growth due to a projected rise in lactose intolerance cases. This digestive condition, affecting 65% of the global population, has fuelled demand for lactose-free milk, yogurt, cheese, and alternative dairy products.

- The market addresses this demand by employing processes to break down lactose or using alternative milk sugars. With varying prevalence rates among different populations, the increasing number of lactose-intolerant individuals is a key driver for the market's expansion.

Market Challenge: High Cost of Lactose-Free Products

- The production of lactose-free dairy involves substantial upfront investments, increased energy consumption, and maintenance costs, impacting overall production expenses. Extended processing times and additional infrastructure needs contribute to reduced throughput efficiency and heightened quality control measures, posing a significant impact on cost dynamics for producers.

- Significant processing challenges arise in lactose-free dairy production, particularly concerning temperature and time effects on conventional lactases. Batch processing applications may require up to 24 hours of hydrolyzation at low temperatures, leading to reduced throughput and necessitating additional storage and hydrolyzation tanks. This, in turn, prompts investments in extra storage facilities and specialized filters, requiring frequent cleaning and replacement to maintain production efficiency.

Market Opportunity: Rising Demand in Quick-Service Restaurants (QSRs)

The growth in the quick-service restaurant (QSR) segment is influenced by the increasing working population seeking convenient, packaged food and beverages to save time. However, this convenience exposes consumers to health risks such as gut inflammation, cancer, cardiovascular disease, and obesity. The global prevalence of obesity, with 39 million children under five reported as obese or overweight in 2020, has heightened awareness of healthier eating habits. Consequently, consumers are turning to lactose-free food options, driving the growth of the lactose-free dairy products market. This trend presents a growth opportunity for global lactose-free dairy product producers as they meet the demand for healthier alternatives in the market.How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different applications of lactose-free dairy products in the market. The market is poised for significant expansion with ongoing technological advancements, increased investments, and growing awareness of the use of lactose-free dairy products. Therefore, lactose-free dairy products are a high-investment and high-revenue generating model.Growth/Marketing Strategy: The global lactose-free dairy products market is growing at a rapid pace. The market offers enormous opportunities for existing and emerging market players. Some of the strategies covered in this segment are mergers and acquisitions, product launches, partnerships and collaborations, business expansions, and investments. The strategies preferred by companies to maintain and strengthen their market position primarily include partnerships and collaborations.

Competitive Strategy: The key players in the global lactose-free dairy products market analyzed and profiled in the study include manufacturers of lactose-free dairy products. Additionally, a comprehensive competitive landscape such as partnerships, agreements, and collaborations are expected to aid the reader in understanding the untapped revenue pockets in the market.

Research Methodology

Factors for Data Prediction and Modeling

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The currency conversion rate has been taken from the historical exchange rate of the Oanda website.

- Nearly all the recent developments from January 2020 to February 2024 have been considered in this research study.

- The information rendered in the report is a result of in-depth primary interviews, surveys, and secondary analysis.

- Where relevant information was not available, proxy indicators and extrapolation were employed.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- Technologies currently used are expected to persist through the forecast with no major technological breakthroughs.

Market Estimation and Forecast

This research study involves the usage of extensive secondary sources, such as certified publications, articles from recognized authors, white papers, annual reports of companies, directories, and major databases to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global lactose-free dairy products market.The process of market engineering involves the calculation of the market statistics, market size estimation, market forecast, market crackdown, and data triangulation (the methodology for such quantitative data processes is explained in further sections). The primary research study has been undertaken to gather information and validate the market numbers for segmentation types and industry trends of the key players in the market.

Primary Research

The primary sources involve industry experts from the global lactose-free dairy products market and various stakeholders in the ecosystem. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.The key data points taken from primary sources include:

- validation and triangulation of all the numbers and graphs

- validation of reports segmentation and key qualitative findings

- understanding the competitive landscape

- validation of the numbers of various markets for market type

- percentage split of individual markets for geographical analysis

Secondary Research

This research study involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as Hoovers, Bloomberg, Businessweek, and Factiva, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global market. In addition to the aforementioned data sources, the study has been undertaken with the help of other data sources and websites, such as GFI and the Delft University of Technology.Secondary research was done in order to obtain crucial information about the industry's value chain, revenue models, the market's monetary chain, the total pool of key players, and the current and potential use cases and applications.

The key data points taken from secondary research include:

- segmentations and percentage shares

- data for market value

- key industry trends of the top players of the market

- qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.Leading Companies in the Lactose-Free Dairy Products Market

- Arla Foods amba

- Valio Oy

- Nestlé

- Dairy Farmers of America, Inc.

- Organic Valley

- Danone

- Granarolo S.p.A.

- Lactalis International

- Hiland Diary

- Saputo Inc.

- SmithFoods, Inc.

- Cabot Creamery

- Alpro

- Almarai

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Nestlé

- Valio Oy

- Arla Foods amba

- LACTAID

- Dairy Farmers of America, Inc.

- Organic Valley

- Danone

- Granarolo S.p.A.

- Lactalis International

- Hiland Diary

- Saputo Inc.

- SmithFoods, Inc.

- Cabot Creamery

- Alpro

- Almarai

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 152 |

| Published | April 2024 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value ( USD | $ 14.65 Billion |

| Forecasted Market Value ( USD | $ 29.15 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |