This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

Despite its abundance in the atmosphere, nitrogen in its gaseous form cannot be directly utilized by most organisms. Instead, it must undergo a process called nitrogen fixation to convert it into forms that can be assimilated by living organisms. This process is primarily carried out by certain bacteria, such as those found in the roots of leguminous plants or free-living in the soil. These bacteria have the remarkable ability to convert atmospheric nitrogen into ammonia (NH₃) through biological nitrogen fixation, making nitrogen available to plants in a usable form. Once assimilated by plants, nitrogen becomes an essential component of amino acids, proteins, and nucleic acids - key building blocks of life. As such, it plays a critical role in plant growth, development, and reproduction. Animals, including humans, obtain nitrogen by consuming plants or other animals that have consumed plants. In this way, nitrogen cycles through the food web, sustaining life at every trophic level. In agriculture, nitrogen is a primary component of fertilizers, which are crucial for maintaining soil fertility and boosting crop yields. Beyond its role in agriculture and biology, nitrogen finds applications across various industries. In its liquid form (liquid nitrogen), it is widely used as a refrigerant for preserving biological samples, freezing foods, and cooling machinery. It is also employed in the production of ammonia, which serves as a precursor for fertilizers, explosives, and various chemical compounds. Additionally, nitrogen gas is utilized in industries such as electronics manufacturing, metallurgy, and pharmaceuticals.

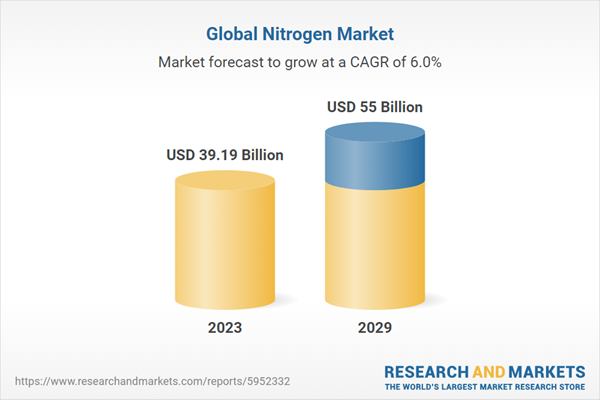

According to the report “Global Nitrogen Market Outlook, 2029”, the market is anticipated to cross USD 55 Billion by 2029, increasing from USD 39.19 Billion in 2023. The market is expected to grow with 6.04% CAGR by 2024-29. As the global population continues to increase, so does the demand for food. Nitrogen fertilizers play a crucial role in agriculture by enhancing soil fertility and boosting crop yields. With more people to feed, farmers are increasingly relying on nitrogen-based fertilizers to optimize agricultural productivity. Agricultural intensification, characterized by the adoption of high-yielding crop varieties, mechanization, and increased fertilizer use, is driving the demand for nitrogen fertilizers.

Farmers are striving to maximize crop yields to meet the demands of a growing population and capitalize on market opportunities. Advances in fertilizer production technologies have improved the efficiency and cost-effectiveness of nitrogen manufacturing processes. Innovations such as the Haber-Bosch process for ammonia synthesis have revolutionized nitrogen fertilizer production, making it more accessible and affordable for farmers worldwide. Emerging economies, particularly in regions like Asia and Africa, are witnessing rapid urbanization and economic development. As a result, there is a rising demand for nitrogen fertilizers to support the intensification of agriculture and meet the food requirements of expanding urban populations.

In response to environmental concerns associated with conventional farming practices, there is a growing emphasis on sustainable agriculture initiatives. Nitrogen management strategies, such as precision agriculture techniques, optimized fertilizer application, and nitrogen use efficiency programs, are gaining traction as farmers seek to minimize nitrogen losses and maximize resource utilization. The nitrogen industry is diversifying its product portfolio beyond traditional fertilizers to encompass a broader range of nitrogen-based products. These include specialty fertilizers, nitrogen-containing chemicals for industrial applications, and nitrogen-enhanced products for various sectors such as pharmaceuticals, electronics, and automotive.

Market Drivers

Population Growth and Food Security: The ever-increasing global population necessitates intensified agricultural production to ensure food security. Nitrogen fertilizers play a pivotal role in enhancing crop yields and soil fertility, thereby meeting the escalating demand for food. As the population continues to rise, particularly in developing regions, the demand for nitrogen fertilizers is expected to soar, driving growth in the nitrogen industry.Environmental Sustainability and Regulations: Heightened environmental awareness and stringent regulations aimed at mitigating environmental impacts are driving the adoption of nitrogen-efficient technologies and sustainable practices. Concerns over nitrogen pollution, such as eutrophication of water bodies and greenhouse gas emissions, are prompting governments and industries to implement measures to minimize nitrogen losses and optimize nitrogen use efficiency. This emphasis on sustainability is reshaping the nitrogen industry by promoting innovations in fertilizer formulations, application techniques, and nitrogen management strategies.

Market Challenges

Environmental Concerns: Nitrogen pollution poses significant environmental challenges, including water contamination, air pollution, and biodiversity loss. Excessive use of nitrogen fertilizers in agriculture contributes to nutrient runoff, leading to eutrophication of rivers, lakes, and coastal areas. Addressing these environmental concerns while meeting the global demand for food presents a complex challenge for the nitrogen industry.Energy Intensity and Carbon Footprint: The production of nitrogen fertilizers, particularly ammonia, is highly energy-intensive and contributes to greenhouse gas emissions. The Haber-Bosch process, which is commonly used for ammonia synthesis, relies on fossil fuels as a primary energy source, exacerbating the industry's carbon footprint. Developing sustainable and energy-efficient production methods, as well as reducing emissions from nitrogen manufacturing processes, are key challenges facing the nitrogen industry.

Market Trends

Precision Agriculture: Precision agriculture techniques, such as variable rate fertilization and sensor-based nitrogen management, are gaining traction in the nitrogen industry. By precisely targeting fertilizer application based on real-time data and site-specific conditions, farmers can optimize nitrogen use efficiency, reduce input costs, and minimize environmental impacts.Biological Nitrogen Fixation: Harnessing biological nitrogen fixation, either through legume crops or nitrogen-fixing bacteria, presents a promising trend in sustainable agriculture. By integrating nitrogen-fixing crops into cropping systems or inoculating soils with nitrogen-fixing bacteria, farmers can reduce reliance on synthetic fertilizers and enhance soil fertility naturally.

The compressed gas form segment dominated the market with a revenue share in 2023 attributable to the fact that compressed gas plays a pivotal role as a key component in industrial gas systems.

Increased demand for compressed nitrogen gas is driven by its versatility and applicability across diverse industries, including healthcare, electronics, manufacturing, and food packaging. Increased demand for compressed nitrogen gas in the nitrogen market can be attributed to its exceptional versatility and applicability across diverse industries, ranging from healthcare and electronics to manufacturing and food packaging. The multifaceted utility of compressed nitrogen gas makes it an indispensable resource in numerous industrial processes and applications.In the healthcare sector, compressed nitrogen gas plays a critical role in cryopreservation and cryotherapy, where its low temperature properties are leveraged to preserve biological samples or treat various medical conditions. Additionally, nitrogen gas serves as a carrier gas for medical equipment, ensuring the safe and effective delivery of pharmaceuticals and anesthesia during surgical procedures. In electronics manufacturing, nitrogen gas is indispensable for maintaining controlled environments during semiconductor fabrication processes. By displacing oxygen and moisture, nitrogen gas creates an inert atmosphere essential for preventing oxidation and ensuring the quality and reliability of electronic components.

Moreover, nitrogen gas is used for purging and cooling applications in electronics manufacturing, contributing to the production of high-performance electronic devices. Furthermore, nitrogen gas finds extensive use in the manufacturing sector for a wide range of applications, including laser cutting, welding, and metal processing. Its inert properties make it an ideal shielding gas for welding processes, protecting molten metal from atmospheric contamination and producing high-quality welds. Additionally, nitrogen gas is employed as a purging agent to remove oxygen and impurities from pipelines, tanks, and other industrial equipment, ensuring the integrity and safety of critical infrastructure. In food packaging, compressed nitrogen gas is utilized for modified atmosphere packaging (MAP), where it replaces oxygen inside packaging containers to extend the shelf life of perishable products. By inhibiting the growth of aerobic bacteria and delaying food spoilage, nitrogen gas helps maintain the freshness and quality of packaged goods, thereby reducing food waste and enhancing product shelf appeal.

Industrial applications are leading in the nitrogen market due to the widespread use of nitrogen gas as a crucial component in various manufacturing processes, including electronics, metal processing, pharmaceuticals, and food packaging.

The dominance of industrial applications in the nitrogen market stems from the indispensable role that nitrogen gas plays in a multitude of manufacturing processes across diverse industries. Nitrogen gas is a versatile and inert substance, making it an ideal choice for applications where the prevention of oxidation, inert atmosphere creation, and product preservation are paramount. In the electronics industry, nitrogen gas is extensively utilized during semiconductor manufacturing processes to create controlled environments free from oxygen and moisture, ensuring the reliability and performance of electronic components.Additionally, nitrogen gas is essential for purging and cooling applications in electronics manufacturing, contributing to the production of high-quality electronic devices. Moreover, in metal processing industries such as welding and laser cutting, nitrogen gas serves as a shielding gas to protect molten metal from atmospheric contamination, resulting in superior weld quality and precision cutting.

Its inert properties make it invaluable for creating an oxygen-free environment conducive to various metallurgical processes. In the pharmaceutical industry, nitrogen gas is utilized for blanketing, purging, and inerting applications to prevent product degradation, maintain sterility, and ensure the integrity of pharmaceutical formulations during manufacturing and packaging. Furthermore, in food packaging, nitrogen gas is employed for modified atmosphere packaging (MAP), where it displaces oxygen inside packaging containers to extend the shelf life of perishable products, reduce food spoilage, and enhance product freshness and quality.

The oil & gas/petrochemical sector is leading in the nitrogen market due to the essential role of nitrogen gas in various critical applications such as inerting, blanketing, purging, pressure testing, and enhanced oil recovery processes.

The dominance of the oil & gas/petrochemical sector in the nitrogen market is driven by the sector's extensive reliance on nitrogen gas for a wide array of indispensable applications throughout the entire oil and gas value chain. Nitrogen gas serves as a versatile and inert medium that is uniquely suited to meet the demanding requirements of various processes within the oil & gas/petrochemical industry. Inserting prevents the risk of fire, explosion, and corrosion by eliminating the presence of oxygen, thereby ensuring the safety and integrity of critical infrastructure.Moreover, nitrogen gas is utilized for blanketing applications to maintain an inert atmosphere above stored liquids, preventing oxidation, contamination, and degradation of valuable petroleum products and chemicals. Purging with nitrogen gas is another crucial application in the oil & gas/petrochemical industry, where nitrogen is used to remove hazardous or flammable gases from equipment and pipelines prior to maintenance, inspection, or commissioning activities.

Additionally, nitrogen gas is employed for pressure testing purposes to assess the integrity and reliability of pipelines, vessels, and wellheads, ensuring compliance with stringent safety standards and regulations. Furthermore, nitrogen gas plays a vital role in enhanced oil recovery (EOR) processes, where it is injected into oil reservoirs to maintain reservoir pressure, displace oil, and improve extraction efficiency. Nitrogen injection is particularly beneficial in mature oil fields where conventional extraction methods have become less effective, helping to extend the productive lifespan of oil wells and maximize hydrocarbon recovery rates.

Asia Pacific region dominated market with major revenue share in 2023. The growth is attributable to the fact that the region is experiencing rapid industrialization and urbanization, contributing to the exponential growth of the market.

The Asia-Pacific region has emerged as a frontrunner in the nitrogen market, propelled by a confluence of factors that are reshaping industrial, agricultural, and economic landscapes. Rapid industrialization and urbanization in countries like China, India, and Southeast Asian nations have fueled a surge in demand for nitrogen-based products, including fertilizers, industrial gases, and chemical intermediates. As these economies undergo rapid expansion and modernization, there is a growing need for nitrogen fertilizers to support intensive agricultural practices aimed at feeding burgeoning populations and ensuring food security.Moreover, the petrochemical and oil & gas industries in the Asia-Pacific region are witnessing significant growth, driven by rising energy consumption, infrastructural development, and investments in downstream manufacturing activities. Nitrogen gas finds widespread application in these sectors for various purposes, including blanketing and purging during oil refining processes, enhancing safety in petrochemical plants, and supporting chemical synthesis operations. Additionally, nitrogen is utilized for enhanced oil recovery (EOR) techniques, where it is injected into oil reservoirs to maintain pressure and improve extraction efficiency.

Furthermore, the Asia-Pacific region is home to a burgeoning electronics manufacturing sector, fueled by the increasing demand for consumer electronics, semiconductors, and electronic components. Nitrogen gas plays a crucial role in semiconductor fabrication processes, where its inert properties are utilized to create controlled environments essential for ensuring the quality and reliability of electronic devices. With the proliferation of digital technologies and the growing importance of electronics in various industries, the demand for nitrogen gas in the Asia-Pacific region is expected to continue its upward trajectory. Additionally, the region's rapidly expanding healthcare sector is driving demand for nitrogen gas for medical applications such as cryopreservation, medical gas packaging, and pharmaceutical manufacturing. As healthcare infrastructure improves and access to medical services expands across the region, the demand for nitrogen gas for medical purposes is anticipated to grow further.

The competitive landscape of the nitrogen industry is characterized by a diverse array of players operating across various segments of the market, including fertilizer production, industrial gases, chemical manufacturing, and technology providers. These companies compete on multiple fronts, such as product quality, pricing, innovation, geographical presence, and customer service, to gain market share and maintain a competitive edge. Major multinational companies such as Yara International, CF Industries Holdings, Inc., and Nutrien Ltd. dominate the nitrogen fertilizer segment. These companies possess significant production capacities and global distribution networks, allowing them to serve diverse agricultural markets worldwide.

They often leverage economies of scale, technological expertise, and extensive R&D investments to enhance production efficiency, develop innovative fertilizer formulations, and expand their market presence. Alongside large-scale producers, a multitude of specialty fertilizer manufacturers focus on niche markets or specific crop segments. Companies like Koch Agronomic Services, Haifa Group, and EuroChem Group AG specialize in developing and marketing specialty nitrogen fertilizers tailored to the unique needs of different crops, soil types, and environmental conditions.

These players differentiate themselves through product innovation, agronomic expertise, and personalized agronomic solutions, catering to the evolving demands of modern agriculture. Companies specializing in nitrogen-related technologies and equipment, such as Haldor Topsoe, KBR, Inc., and Casale SA, play a crucial role in the nitrogen industry. These companies provide engineering solutions, process technologies, catalysts, and equipment for ammonia synthesis, nitrogen fixation, nitrogen oxide reduction, and nitrogen recycling applications. They differentiate themselves through technological innovation, process efficiency, and customized engineering solutions, enabling nitrogen producers to enhance productivity, reduce environmental impact, and optimize resource utilization.

Recent Developments

- In April 2022, Linde plc signed another long-term arrangement to supply bulk industrial gases with a major space launch firm in Florida. Linde will deliver liquid nitrogen to the client from its air separation facility in Mims, Florida, expanding to increase production capacity by up to 50%. The extra capacity, expected to begin operations in 2023, will fulfill the new agreement's demands and increase demand from clients in the aerospace, healthcare, manufacturing, food processing, and water treatment end sectors.

- In February 2022, INOX Air Products opened its sixth air separation plant in Hosur, India, to satisfy expanding healthcare and industrial demand. The INR 3000 million (USD 36.48 billion) plant at SIPCOT Phase II was completed in just 20 months. It will produce high-purity liquid nitrogen with a capacity of up to 150 MT per day, twice the current amount.

Considered in this report

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in this report

- Nitrogen market Outlook with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Product

- Compressed Gas

- Liquid Nitrogen

By Application

- Commercial

- Industrial

By End User

- Food & Beverage

- Oil & Gas/Petrochemical

- Metal Manufacturing & Fabrication

- Electronics

- Pharmaceuticals & Healthcare

- Chemicals

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases.After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this; we have started making primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once we have primary data with us, we can start verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Nitrogen industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 173 |

| Published | March 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 39.19 Billion |

| Forecasted Market Value ( USD | $ 55 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |