The US market dominated the North America Pepperoni Foods Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $721.8 million by 2031. The Canada market is experiencing a CAGR of 10.4% during (2024 - 2031). Additionally, The Mexico market would exhibit a CAGR of 9.4% during (2024 - 2031).

Pepperoni is a spiced, dried, and cured sausage typically composed of pork and beef. It is composed of ground beef and pork combined with paprika, red pepper flakes, and garlic; these ingredients contribute to the dish's distinctive flavor and red hue. Curing the meat with sodium salt and sodium nitrate inhibits the development of undesirable microorganisms. Additionally, it is utilized as a topping for pizzas, sauces and dips, sandwiches and wraps, pasta dishes, salads, and snacks. It finds extensive application in diverse culinary contexts due to its high protein content, flavor profile, versatility, and delightful texture.

The market is anticipated to expand as the demand for fast foods and convenience foods increases, the public becomes more informed about the benefits of meat-based products, and innovative and effective plant-based pepperoni continues to be developed. Further, market expansion is facilitated by opportunistic elements, including collaboration, innovation, and launch.

As the processed food and beverage industry expands in Canada, there is a growing demand for ingredients like pepperoni. According to the Canadian government, the food and beverage processing sector accounted for $156.5 billion in sales of manufactured goods in 2022, making it the largest manufacturing industry in the country in terms of yield. In terms of GDP, it represented 1.7% and 18.2% of all manufacturing sales. In 2022, processed food and beverage exports reached a record $54.3 billion, up 14.1% from 2021, accounting for 34.7% of the output value. Therefore, the expansion of the food sector and processed food industry is propelling the market's growth.

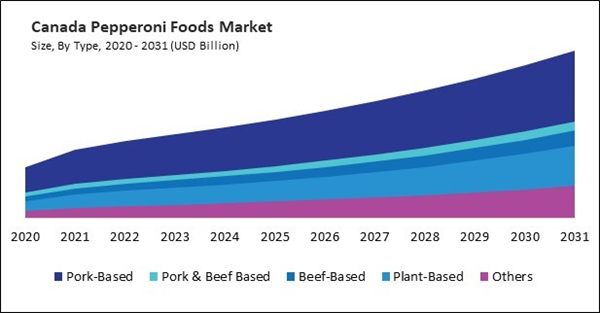

Based on End User, the market is segmented into Food Service Industry, Food Manufacturer, and Retail. Based on Application, the market is segmented into Pizza, Sandwiches, Burgers, Dips & Sauces and Others. Based on Type, the market is segmented into Pork-Based, Pork & Beef Based, Beef-Based, Plant-Based and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Maple Leaf Foods, Inc.

- Hormel Foods Corporation

- Bridgford Foods Corporation

- WH Group Limited

- Tyson Foods, Inc.

- Boar's Head Brand

- Carl Buddig and Company

- Battistoni Italian Specialty Meats, LLC

- CTI Foods, LLC

- Pocino Foods Company

Market Report Segmentation

By End User- Food Service Industry

- Food Manufacturer

- Retail

- Pizza

- Sandwiches

- Burgers

- Dips & Sauces

- Others

- Pork-Based

- Pork & Beef Based

- Beef-Based

- Plant-Based

- Others

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- Maple Leaf Foods, Inc.

- Hormel Foods Corporation

- Bridgford Foods Corporation

- WH Group Limited

- Tyson Foods, Inc.

- Boar's Head Brand

- Carl Buddig and Company

- Battistoni Italian Specialty Meats, LLC

- CTI Foods, LLC

- Pocino Foods Company