Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Technological Advancements

Technological advancements stand as a primary driver propelling the Global Drone Logistics and Transportation Market. Continuous innovation in drone technology has revolutionized the capabilities of unmanned aerial vehicles (UAVs), making them more efficient, reliable, and adaptable for logistics and transportation purposes. Advancements in drone design, propulsion systems, payload capacities, and autonomous navigation have significantly expanded the potential applications of drones in the logistics sector. Integration of advanced sensors, AI-driven algorithms, and improved communication systems has enhanced the operational capabilities of drones, enabling them to navigate complex environments, execute precise deliveries, and ensure safety and compliance. Moreover, ongoing research and development efforts aimed at enhancing battery life, increasing range, and improving operational efficiency contribute to unlocking new possibilities for drones in logistics and transportation, driving market growth and adoption.E-commerce Growth and Last-Mile Delivery Demands

The exponential growth of e-commerce has emerged as a significant driver fueling the Global Drone Logistics and Transportation Market. The surge in online shopping activities has intensified the demand for swift and efficient last-mile delivery solutions. Drones offer a promising solution to expedite deliveries, especially in urban areas where congestion and delivery delays pose challenges for traditional transportation methods. Their ability to navigate traffic congestion and deliver packages directly to customers' doorsteps within a short timeframe aligns with the escalating demand for rapid and convenient delivery services. As e-commerce continues to flourish globally, the need for innovative last-mile delivery options drives the adoption of drones, positioning them as a key player in meeting the evolving demands of online shoppers and logistics providers.Healthcare and Medical Deliveries

The healthcare sector's increasing reliance on timely and efficient delivery of medical supplies, vaccines, and diagnostic equipment has emerged as a significant driver for the Global Drone Logistics and Transportation Market. Drones offer a game-changing solution for transporting medical supplies to remote or inaccessible areas, disaster-stricken regions, and healthcare facilities with urgent needs. Their speed, versatility, and ability to bypass infrastructural limitations make them invaluable for delivering life-saving essentials, especially during emergencies or medical crises. The COVID-19 pandemic highlighted the critical role of drones in facilitating contactless delivery of medical supplies, reinforcing their importance in the healthcare logistics chain. The growing emphasis on enhancing healthcare access and ensuring timely delivery of critical medical supplies further drives the integration of drones into healthcare logistics, fostering market growth and innovation in this sector.Regulatory Framework Evolution

The evolution of regulatory frameworks governing drone operations plays a pivotal role in shaping the Global Drone Logistics and Transportation Market. Governments worldwide are actively developing and refining regulations to ensure the safe and responsible integration of drones into airspace and logistics operations. Regulatory bodies are working towards establishing guidelines for drone registration, pilot certifications, operational standards, and airspace management to mitigate safety risks and protect public airspace. Progressive regulatory initiatives that support innovation while ensuring safety and security pave the way for expanded drone applications in logistics and transportation. Collaboration between regulatory authorities, industry stakeholders, and technology innovators to establish clear and conducive regulatory frameworks creates a conducive environment for the widespread adoption and growth of drone logistics on a global scale.Environmental and Cost Efficiency

The focus on environmental sustainability and cost efficiency acts as a significant driver propelling the Global Drone Logistics and Transportation Market. Drones offer eco-friendly and cost-effective delivery alternatives compared to traditional modes of transportation. Their electric propulsion systems contribute to reducing carbon emissions and environmental footprints, aligning with sustainability goals. Additionally, drones' operational efficiency in terms of lower fuel consumption, reduced delivery times, and optimized routes translates into cost savings for logistics companies. As businesses increasingly prioritize sustainability and cost-effectiveness in their operations, drones emerge as a favorable choice for reducing logistics-related carbon emissions and operational expenses. The alignment of drones with both environmental stewardship and financial prudence drives their adoption in the logistics and transportation sector, fostering market expansion and technological advancements.Key Market Challenges

Regulatory Hurdles and Compliance

One of the primary challenges facing the Global Drone Logistics and Transportation Market pertains to navigating complex and evolving regulatory frameworks governing drone operations. Drones operate within shared airspace, raising concerns about safety, security, and privacy. Establishing comprehensive regulations that ensure safe and responsible drone operations while accommodating the diverse needs of various stakeholders poses a significant hurdle. Governments worldwide are grappling with the task of formulating regulations that strike a balance between fostering innovation and addressing safety concerns. Harmonizing regulations across borders presents an additional challenge, considering the differences in regulatory approaches and airspace management systems among countries. Compliance with evolving regulations requires industry players to stay abreast of changing rules, invest in training and certification programs for drone operators, and implement robust safety measures. Achieving regulatory clarity and compliance is pivotal for unlocking the full potential of drones in logistics and transportation, necessitating collaboration between regulatory authorities, industry stakeholders, and technology innovators to address these challenges effectively.Airspace Integration and Traffic Management

Airspace integration and traffic management pose significant challenges to the seamless integration of drones into the Global Drone Logistics and Transportation Market. Sharing airspace with manned aircraft and managing the increasing volume of drones operating for various purposes demand efficient traffic management systems. Ensuring the safe coexistence of drones with commercial airlines and other airspace users requires sophisticated technological solutions and standardized protocols. Developing systems for real-time drone monitoring, collision avoidance, and route optimization is crucial to prevent airspace congestion and mitigate potential safety risks. Implementing reliable communication and navigation systems that facilitate safe drone operations in diverse environments, including urban areas, poses technical challenges. Moreover, establishing clear guidelines and protocols for airspace access, flight corridors, and altitude regulations for different categories of drones remains a complex task. Overcoming these challenges necessitates collaborative efforts between industry stakeholders, airspace regulators, and technology providers to develop robust traffic management solutions that ensure the safe integration of drones into shared airspace.Security and Privacy Concerns

Security and privacy concerns represent formidable challenges impacting the Global Drone Logistics and Transportation Market. Drones, being versatile and capable of collecting data and delivering goods, raise apprehensions regarding potential security threats and privacy infringements. Unauthorized access, hacking risks, and potential misuse of drones for illegal activities pose security challenges that need stringent countermeasures. Ensuring the secure transmission of data and safeguarding drone operations from cyber threats require robust cybersecurity protocols and encryption mechanisms. Additionally, addressing concerns related to the collection, storage, and utilization of personal data during drone operations is essential to protect individuals' privacy rights. Balancing the benefits of drone technology with ensuring security measures and privacy protection is critical for fostering public trust and regulatory acceptance. Collaborative efforts between technology developers, cybersecurity experts, policymakers, and regulatory bodies are imperative to address security and privacy challenges effectively.Limited Payload Capacities and Range

The limitations in drone payload capacities and range pose significant challenges to the scalability and efficiency of the Global Drone Logistics and Transportation Market. While drones have made remarkable advancements in their capabilities, their current payload capacities may be insufficient for transporting larger or heavier goods over long distances. Additionally, constraints in battery technology limit the range and endurance of drones, impacting their operational capabilities for long-haul deliveries or missions covering extensive areas. Overcoming these challenges requires advancements in battery technology to enhance energy density and extend flight endurance. Innovations in materials and propulsion systems aimed at reducing the weight of drones while increasing payload capacities are vital. Moreover, developing efficient charging or refueling infrastructure to support extended drone operations is crucial for expanding their range and enhancing their suitability for various logistics and transportation applications. Addressing these challenges through technological innovations and research efforts will be instrumental in unlocking the full potential of drones for logistics and transportation purposes.Key Market Trends

Expansion of Urban Drone Delivery Networks

One prominent trend influencing the Global Drone Logistics and Transportation Market is the rapid expansion of urban drone delivery networks. Urban areas witness increasing demand for efficient last-mile delivery solutions due to rising e-commerce activities and congestion in traditional transportation systems. Drones offer a compelling solution for expedited deliveries, bypassing traffic and delivering goods directly to consumers' doorsteps. Companies like Amazon, UPS, and Alibaba have launched pilot programs and initiatives to test and implement drone delivery services in urban settings. As regulatory frameworks evolve and technological advancements enhance drone capabilities, the trend towards establishing and scaling urban drone delivery networks is reshaping the logistics landscape, offering faster and more convenient delivery options to urban consumers.Integration of AI and IoT in Drone Operations

The integration of Artificial Intelligence (AI) and Internet of Things (IoT) technologies is a transformative trend driving innovation in the Global Drone Logistics and Transportation Market. AI algorithms and IoT sensors equip drones with advanced capabilities, enabling autonomous navigation, real-time data collection, and analysis. AI-driven analytics enhance route planning, optimize flight paths, and improve operational efficiency. IoT sensors facilitate the collection of crucial data on weather conditions, air traffic, and delivery statuses, enabling drones to make informed decisions during flights. This integration enhances the reliability, safety, and performance of drone operations, fostering more efficient logistics and transportation services across various industries.Emergence of Heavy Payload Drones

The emergence of heavy payload drones represents a significant trend reshaping the capabilities of the Global Drone Logistics and Transportation Market. Traditionally, drones have been limited in their capacity to carry heavy loads. However, advancements in drone technology and materials have led to the development of drones capable of carrying larger payloads. Heavy payload drones offer opportunities for transporting bulkier goods, medical supplies, and equipment, catering to the needs of industries such as construction, healthcare, and disaster relief. Companies are investing in RD to design drones with increased payload capacities, propelling the trend towards leveraging drones for transporting heavier cargo and expanding their applications in logistics and transportation.Rise of Autonomous Aerial Vehicles (AAVs)

The rise of Autonomous Aerial Vehicles (AAVs) represents a transformative trend in the Global Drone Logistics and Transportation Market. AAVs, also known as flying taxis or passenger drones, aim to revolutionize urban mobility by providing aerial transportation services for passengers. Companies like Volocopter, EHang, and Lilium are pioneering the development of AAVs, envisioning a future where aerial mobility becomes a viable means of transportation within cities. AAVs promise faster and more efficient commuting options, reducing congestion and travel times in urban areas. Regulatory advancements and successful pilot projects are driving the trend towards exploring AAVs as a futuristic solution for urban transportation, reshaping the landscape of mobility and logistics.

Enhanced Safety and Regulatory Compliance

Enhanced safety measures and regulatory compliance represent a crucial trend shaping the Global Drone Logistics and Transportation Market. Safety remains a paramount concern in drone operations, especially as drones share airspace with manned aircraft and operate in populated areas. Companies and regulatory bodies are collaborating to implement stringent safety standards, develop collision avoidance systems, and ensure compliance with airspace regulations. The focus on safety protocols, pilot training, and technology enhancements aims to mitigate risks and build public trust in drone operations. Furthermore, regulatory frameworks are evolving to address operational standards, flight permissions, and privacy concerns, creating a conducive environment for the safe and responsible integration of drones into logistics and transportation networks worldwide. This trend emphasizes the importance of prioritizing safety and regulatory compliance to enable the sustainable growth of the drone logistics industry.Segmental Insights

Sector Insights

The Commercial sector emerged as the dominant segment in the Global Drone Logistics and Transportation Market and is anticipated to sustain its dominance during the forecast period. The Commercial sector witnessed significant traction and adoption of drone logistics and transportation solutions across diverse industries such as e-commerce, healthcare, agriculture, and urban delivery services. The surge in e-commerce activities, coupled with the increasing demand for efficient last-mile delivery solutions, propelled the growth of commercial drone logistics. Companies like Amazon, UPS, and Alibaba, among others, led the charge by piloting and implementing drone delivery services, reshaping the landscape of urban logistics. Furthermore, the healthcare sector embraced drones for swift and reliable delivery of medical supplies, vaccines, and diagnostic equipment, especially in remote or inaccessible areas. Agriculture also witnessed the deployment of drones for crop monitoring, spraying, and precision agriculture, enhancing farming practices. The commercial sector's widespread applications in various industries, coupled with its capacity to address critical logistics challenges and streamline operations, position it to maintain its dominance in the Global Drone Logistics and Transportation Market. Additionally, continuous advancements in technology, regulatory frameworks conducive to commercial drone operations, and increasing investments in commercial drone development further solidify the commercial sector's lead in driving the innovation and expansion of drone logistics across global markets.PlatformInsights

The global drone logistics and transportation market is divided into three sub-segments which are freight drones, passenger drones, and air ambulance drones, each with distinct traits and growth prospects. In 2023, freight drones dominated the Global Drone Logistics and Transportation Market and is also expected to show its dominance during the forecast period. This dominance stems from various factors that include the surge in e-commerce demands faster delivery methods, where freight drones offer advantages like bypassing traffic and reaching remote areas efficiently. Recent advancements in battery tech, navigation systems, and payload capacity have made drones more viable for commercial use. Additionally, their cost-effectiveness compared to traditional methods contributes to their prevalence. Passenger drones, though at an early developmental stage, hold immense potential, particularly for urban transport and emergency response, currently constituting second largest market share in 2023. Looking ahead, as technology advances and regulations clarify, the market is expected to diversify. Factors like governmental regulations, public acceptance, and infrastructure development will significantly impact each segment's future. Despite freight drones leading currently, future growth forecasts a more balanced landscape. Overall, the drone logistics and transportation market is poised for substantial expansion, potentially revolutionizing how goods and people are transported with continued innovation and favorable conditions.ApplicationInsights

The Retail and Logistics segment emerged as the dominant force in the Global Drone Logistics and Transportation Market and is projected to sustain its leadership during the forecast period. The Retail and Logistics sector witnessed significant adoption of drone technology for last-mile delivery solutions, revolutionizing the way goods are transported and delivered. The exponential growth of e-commerce activities fueled the demand for faster, more efficient delivery options, prompting companies like Amazon, UPS, and Alibaba to spearhead drone-based delivery services. Drones offered a compelling solution to expedite deliveries, bypassing traffic congestion and reaching consumers' doorsteps swiftly. This sector's dominance was further bolstered by innovations in drone technology, including advancements in AI, navigation systems, and payload capacities, enhancing the reliability and efficiency of logistics operations. Additionally, the integration of drones into traditional logistics networks and the successful piloting of drone delivery services showcased the potential of drones in addressing the challenges of last-mile delivery. As the retail and logistics industry continues to prioritize rapid and efficient delivery solutions, coupled with ongoing technological advancements and regulatory support, the Retail and Logistics segment is poised to maintain its dominance in the Global Drone Logistics and Transportation Market, revolutionizing the logistics landscape worldwide.Regional Insights

North America emerged as the dominant region in the Global Drone Logistics and Transportation Market and is anticipated to maintain its dominance during the forecast period. The region's dominance stemmed from several factors contributing to the widespread adoption and advancement of drone technology in logistics and transportation. North America experienced substantial investments in research and development, fostering technological innovations and advancements in drone capabilities. Companies in the United States, such as Amazon, UPS, and Alphabet's Wing, led the way in piloting and implementing drone delivery services, particularly in urban areas, highlighting the region's proactive approach to adopting innovative logistics solutions. Moreover, favorable regulatory frameworks and initiatives supporting drone operations, coupled with collaborative efforts between industry stakeholders and regulatory authorities, facilitated the growth of the drone logistics market in North America. The region's robust infrastructure, conducive business environment, and significant investments in drone technology innovation positioned North America at the forefront of the Global Drone Logistics and Transportation Market. Additionally, continuous advancements in drone technology, coupled with increasing applications across diverse industries such as e-commerce, healthcare, and agriculture, are expected to sustain North America's dominance in driving the evolution and expansion of drone logistics and transportation during the forecast period.Report Scope:

In this report, the Global Drone Logistics and Transportation Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Drone Logistics and Transportation Market, By Sector:

- Commercial

- Military

Drone Logistics and Transportation Market, By Platform:

- Freight Drones

- Passenger Drones

- Air Ambulance Drones

Drone Logistics and Transportation Market, By Application:

- Retail and Logistic

- Food

- Medical Supplies

- Others

Drone Logistics and Transportation Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Vietnam

- South America

- Brazil

- Argentina

- Colombia

- Chile

- Peru

- Middle East Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Drone Logistics and Transportation Market.Available Customizations:

Global Drone Logistics and Transportation market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Amazon.com Inc.

- Deutsche Post DHL Group

- Wing Aviation (Alphabet Inc.)

- Zipline International Inc.

- Flytrex Aviation Ltd.

- Hardis Group

- Matternet Inc.

- Volocopter GmbH

- Pinc Solutions

- United Parcel Service of America Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | April 2024 |

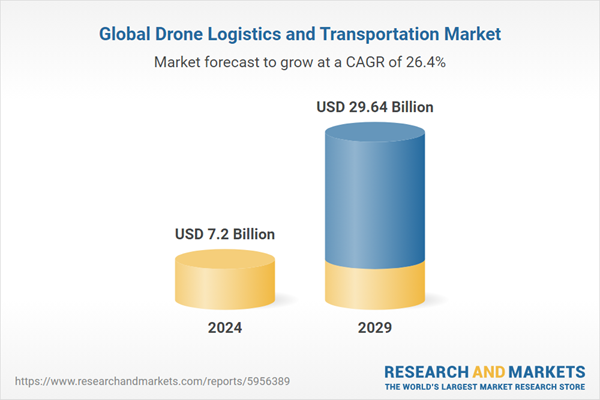

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 7.2 Billion |

| Forecasted Market Value ( USD | $ 29.64 Billion |

| Compound Annual Growth Rate | 26.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |