Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Market Drivers

Government Incentives and Policy Support

Government initiatives are fostering the growth of electric mobility, including one-wheel electric scooters. In Canada, policymakers are actively promoting zero-emission vehicles (ZEVs) to meet ambitious environmental goals. Programs such as tax rebates, grants, and subsidies for electric vehicles help lower the initial purchase cost, making these scooters more accessible to a wider range of consumers. Support for electric infrastructure development, such as charging stations, also contributes to the increased adoption of electric scooters. The alignment of such policies with climate action strategies accelerates the shift toward sustainable transportation.Growing concern over environmental issues is pushing individuals to seek eco-friendly transportation options. One-wheel electric scooters are seen as a sustainable mode of transport due to their zero emissions and reduced energy consumption compared to traditional vehicles. As cities and individuals look for ways to minimize their carbon footprints, the appeal of one-wheel scooters as a green alternative strengthens. Consumers are actively searching for options that reduce air pollution, contributing to a broader societal movement toward sustainability.

The Canadian government is actively promoting the adoption of electric vehicles (EVs) to reduce greenhouse gas emissions. Transportation accounts for approximately 25% of Canada's greenhouse gas emissions, highlighting the need for cleaner mobility solutions. To further encourage this transition, the government has invested over USD 1 billion to promote electric vehicles among consumers. Additionally, the Zero Emission Vehicle Infrastructure Program (ZEVIP), a 5-year USD 280 million initiative, aims to build charging and refueling stations across Canada, enhancing the accessibility of EV infrastructure .

Key Market Challenges

Safety Concerns

One of the primary challenges for the growth of the one-wheel electric scooter market is the safety risks associated with riding these scooters. Due to their design, users must have a certain level of balance and skill to ride safely, which can deter potential buyers. Inexperienced riders may struggle to maintain control, leading to accidents or falls. The lack of protective gear regulations further exacerbates the issue, as riders may not always wear the necessary safety equipment, increasing the likelihood of injury. Another challenge for one-wheel electric scooters is the lack of supporting infrastructure.Many cities do not yet have dedicated lanes or pathways designed specifically for electric scooters. Without proper infrastructure, users face challenges in navigating roads safely, especially in areas with heavy vehicle traffic. The absence of charging stations in urban centers also makes it difficult for users to keep their scooters powered throughout the day. The expansion of infrastructure is crucial to the widespread adoption of electric scooters.

Key Market Trends

Integration of Smart Technologies

The integration of smart technologies is a growing trend in the one-wheel electric scooter market. Many new models feature Bluetooth connectivity, GPS tracking, and app support, allowing users to monitor their scooter’s performance, battery levels, and other key metrics in real-time. This technology also enhances the safety features, with some models incorporating real-time alerts about speed limits, maintenance needs, or potential risks. These innovations provide a more personalized and controlled riding experience, which is increasing the appeal of one-wheel electric scooters.Manufacturers are focusing on making one-wheel electric scooters lighter and more portable to meet consumer demands for convenience. Lightweight materials such as carbon fiber and advanced alloys are being used in the construction of scooters, reducing their weight while maintaining durability. These designs are easier to carry and store, making them ideal for city dwellers with limited space. As people look for transport solutions that can be easily packed or carried, this trend is expected to drive further adoption.

Key Market Players

- Future Motion, Inc.

- Inmotion Technologies Co., Ltd.

- King Song Intelligent Control Technology Co., Ltd.

- Segway-Ninebot Ltd.

- Gotway (Begode)

- Boosted Inc.

- Solowheel (invented by Inventist, Inc.)

- EUC World

- Razor USA LLC

- One Wheel (Onewheel)

Report Scope:

In this report, the Canada One Wheel Electric Scooter Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Canada One Wheel Electric Scooter Market, By Type:

- Electric Unicycle

- Electric One-Wheel Hoverboard

Canada One Wheel Electric Scooter Market, By Application:

- Off-Road Activities

- Commuting

Canada One Wheel Electric Scooter Market, By Distribution Channel:

- Online

- Offline

Canada One Wheel Electric Scooter Market, By Region:

- Quebec

- Ontario

- Alberta

- British Columbia

- Saskatchewan & Manitoba

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Canada One Wheel Electric Scooter Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Future Motion, Inc.

- Inmotion Technologies Co., Ltd.

- King Song Intelligent Control Technology Co., Ltd.

- Segway-Ninebot Ltd.

- Gotway (Begode)

- Boosted Inc.

- Solowheel (invented by Inventist, Inc.)

- EUC World

- Razor USA LLC

- One Wheel (Onewheel)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | August 2025 |

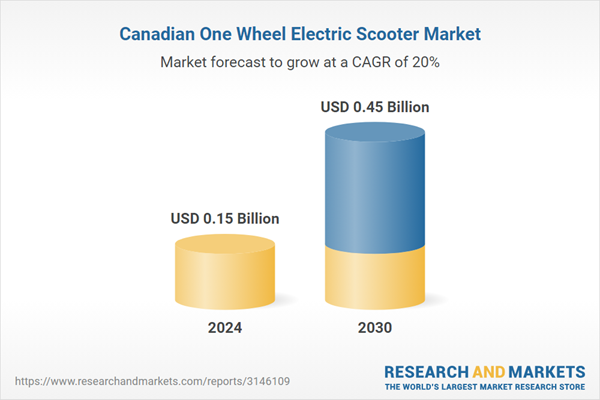

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 0.15 Billion |

| Forecasted Market Value ( USD | $ 0.45 Billion |

| Compound Annual Growth Rate | 20.0% |

| Regions Covered | Canada |

| No. of Companies Mentioned | 10 |