Global Digital Radiography Market - Key Trends and Drivers Summarized

Why Is Digital Radiography Revolutionizing Medical Imaging?

Digital radiography (DR) is revolutionizing medical imaging by offering significant improvements over traditional film-based radiography. This technology uses digital sensors instead of film to capture images, resulting in faster image acquisition and immediate availability for review. The high-resolution images produced by digital radiography enable more accurate diagnoses and better patient outcomes. Furthermore, DR eliminates the need for chemical processing, which is not only environmentally friendly but also reduces operational costs for healthcare facilities. The integration of digital radiography with Picture Archiving and Communication Systems (PACS) and electronic medical records (EMR) streamlines the workflow, allowing for efficient storage, retrieval, and sharing of images. This seamless integration enhances the efficiency of medical imaging departments, improves patient care, and supports the trend towards more digitized and interconnected healthcare systems.How Are Technological Innovations Enhancing Digital Radiography?

Technological innovations are significantly enhancing the capabilities of digital radiography, making it an indispensable tool in modern medical diagnostics. Advances in detector technology, such as the development of flat-panel detectors, have improved image quality and reduced radiation exposure to patients. These detectors offer higher sensitivity and better resolution, allowing for clearer and more detailed images. Additionally, the incorporation of artificial intelligence (AI) and machine learning algorithms in digital radiography systems is revolutionizing image analysis. AI-powered tools can assist radiologists by automatically detecting abnormalities and highlighting areas of concern, thus improving diagnostic accuracy and efficiency. The integration of mobile digital radiography units has also expanded the accessibility of high-quality imaging to various settings, including emergency rooms, intensive care units, and remote locations. These technological advancements are driving the evolution of digital radiography, enhancing its diagnostic capabilities and broadening its application across healthcare environments.What Are the Key Applications and Benefits of Digital Radiography?

Digital radiography is widely used in various medical applications, offering numerous benefits over traditional imaging methods. In orthopedics, DR is crucial for diagnosing fractures, dislocations, and other musculoskeletal conditions, providing high-resolution images that aid in precise treatment planning. In dental practices, digital radiography is used for intraoral and panoramic imaging, delivering clear images that are essential for diagnosing dental caries, periodontal disease, and other oral health issues. Digital radiography is also extensively used in chest imaging, helping in the detection and monitoring of lung diseases such as pneumonia, tuberculosis, and lung cancer. One of the significant benefits of DR is the reduced radiation dose compared to conventional radiography, which enhances patient safety. Additionally, the immediate availability of digital images allows for quicker decision-making and reduces the time patients spend in diagnostic procedures. These benefits make digital radiography an essential component of modern medical diagnostics, contributing to improved patient care and outcomes.What Factors Are Driving the Growth in the Digital Radiography Market?

The growth in the digital radiography market is driven by several factors. Technological advancements, such as the development of advanced detectors and the integration of AI in image analysis, have significantly improved the quality and efficiency of digital radiography systems. The increasing prevalence of chronic diseases and the growing demand for early and accurate diagnosis are expanding the market for digital radiography. The shift towards value-based care and the emphasis on reducing healthcare costs are encouraging the adoption of DR, which offers faster imaging and improved workflow efficiency. Additionally, the rising awareness about the benefits of low-dose imaging techniques is driving the demand for digital radiography, as it enhances patient safety. Government initiatives and funding to improve healthcare infrastructure, particularly in emerging economies, are also contributing to the market growth. Furthermore, the COVID-19 pandemic has highlighted the importance of advanced imaging technologies in managing healthcare crises, boosting the adoption of digital radiography systems. These factors collectively ensure the robust growth of the digital radiography market, supporting the ongoing advancements in medical imaging and diagnostics.Report Scope

The report analyzes the Digital Radiography market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Computed Radiography (CR), Direct Digital Radiography (DDR)).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Digital Radiography Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Digital Radiography Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

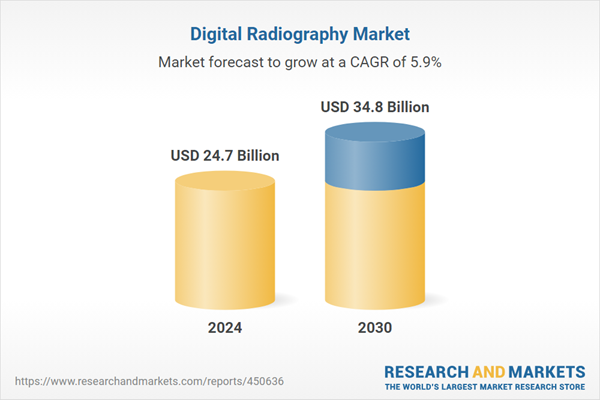

- How is the Global Digital Radiography Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Agfa HealthCare NV, Air Techniques Inc., Analogic Corporation, Canon U.S.A. Inc., Carestream Health Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 28 companies featured in this Digital Radiography market report include:

- Agfa HealthCare NV

- Air Techniques Inc.

- Analogic Corporation

- Canon U.S.A. Inc.

- Carestream Health Inc.

- Fujifilm Medical Systems U.S.A. Inc.

- GE Healthcare

- Hologic Inc.

- Imaging Dynamics Company Ltd.

- Konica Minolta Inc.

- Philips Healthcare

- Sectra AB

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Shimadzu Corporation

- Siemens Healthineers

- Swissray International Inc.

- Varex Imaging Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agfa HealthCare NV

- Air Techniques Inc.

- Analogic Corporation

- Canon U.S.A. Inc.

- Carestream Health Inc.

- Fujifilm Medical Systems U.S.A. Inc.

- GE Healthcare

- Hologic Inc.

- Imaging Dynamics Company Ltd.

- Konica Minolta Inc.

- Philips Healthcare

- Sectra AB

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Shimadzu Corporation

- Siemens Healthineers

- Swissray International Inc.

- Varex Imaging Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 166 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 24.7 Billion |

| Forecasted Market Value ( USD | $ 34.8 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |