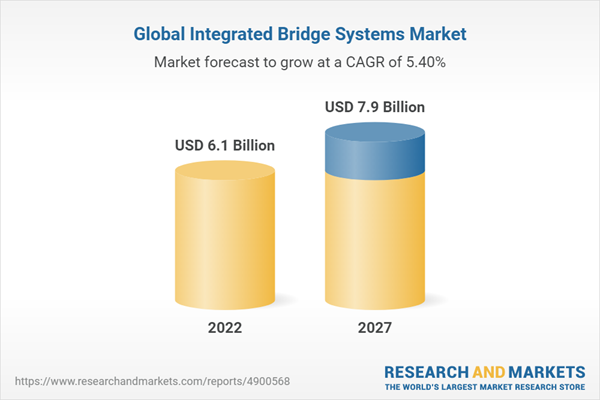

The integrated bridge systems market is projected to grow from USD 6.1 Billion in 2022 to USD 7.9 Billion by 2027, at a CAGR of 5.4% from 2022 to 2027. Rising preference for maritime tourism is expected to drive the integrated bridge systems market growth during the forecast period.

According to a United Nations report in 2017, the population worldwide will go up to 8.6 billion by 2030, and most of the population growth will take place in Asian countries. This population explosion will mark a remarkable shift toward urbanization in China, Southeast Asian countries, Bangladesh, Nigeria, and Turkey. As eight out of 10 world’s largest cities will become port cities, there will be tremendous opportunities for shipbuilding and marine technology business in the future. Today, with major importance being given to safety norms, the building of a new ship includes IBS and other related equipment. In addition, 65.31% of the world container port share volume is from China, and 14.39% is from Europe. Increasing population and growing GDPs have led to the development of some of the world’s largest and busiest ports in Asian countries. As the number and size of these Asian ports grow, the integrated bridge system manufacturers for commercial ships mainly located in these countries will be at an advantage.

Besides, mergers, acquisitions, and contracts were among the key strategies adopted by leading players to sustain their position in the integrated bridge systems market. Apart from these strategies, key market players also engaged in new product launches. Companies such as Raytheon Technologies Corporation (US), Furuno Electric Co. Ltd. (Japan), Wärtsilä Corporation (Finland), and Kongsberg (Norway) have adopted the strategy of new product launches to develop their business and strengthen their product portfolio in the integrated bridge systems market.

Based on subsystem, the INS is expected to lead market with the largest share in 2022

Based on subsystem, the integrated bridge systems market has been segmented into integrated navigation system (INS), automatic weather observation system (AWOS), voyage data recorder (VDR), and automatic identification system (AIS). Among these, the INS segment registered largest share in the base year. The navigational safety of a vessel is given a lot of importance. With advancements in technology, systems such as integrated navigation systems have been developed to provide vessels with real-time navigation. The integrated navigation system is a part of the integrated bridge system. Components of the integrated navigation system include navigation/ARPA radar, electromagnetic log, differential global positioning system, ECDIS, gyro, echo sounder, transmitting magnetic compass, and autopilot. Other components can also be equipped with the system according to the requirement of the vessel. An increasing focus on the development of sense and avoid systems and demand for accurate and precise navigation for ships have driven the growth of the integrated navigation systems.

Based on Component, software segment registered largest share in base year

Based on component, the integrated bridge systems market has been classified into hardware and software. Hardware components include displays, controls, data storage devices, sensors, and alarms. Software is an integral part of the integrated bridge system and supports the overall operation and integration of different components of the system. It is an interface for the display of information. The market for software is projected to grow at a higher rate than hardware due to an increase in the adoption of advanced systems, which require the application of software to integrate with other integrated bridge systems.

The Asia Pacific region dominated the market with largest share in 2022

The integrated bridge systems market in Asia Pacific is projected to grow at the highest CAGR during the forecast period. The geographic analysis of this region includes China, South Korea, Japan, the Philippines, Singapore, and the Rest of APAC. One-third of the global container traffic flows through ports in China. According to the World Shipping Council, the first 10 busiest container ports are in Asia. There is a growing trend by traditional large shipbuilders from countries such as South Korea, China, Japan as well as Southeast Asia toward enhancing offshore capabilities and providing a single marine solution for both, shipbuilding and offshore, thus driving the growth of the commercial integrated bridge systems market in the region. Shipbuilding companies from China, South Korea, and Japan are the largest players in four major market segments, namely, tankers, bulk carriers, container ships, and offshore vessels.

The break-up of the profiles of primary participants in the Integrated bridge systems Market is as follows:

- By Company Type: Tier 1-35%; Tier 2-45%; and Tier 3-20%

- By Designation: C Level Executives-35%; Directors-25%; and Others-40%

- By Region: Asia Pacific-45%; North America-25%; Europe-15%; Middle East-10%; and Rest of the World-5%

Major players in the integrated bridge systems market are Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), Wärtsilä Corporation (Finland), Kongsberg (Norway), and Furuno Electric Co. Ltd. (Japan). These companies adopted strategies including system and software development and service launches, contracts, partnerships, agreements, and expansions to sustain their position in the market. Also focusing on expanding distribution networks in the defense and commercial business across North America, Europe, Asia Pacific and other regions in turn driving the demand for IBSs.

Research Coverage

This research report categorizes the integrated bridge systems market into ship type, end user, sub-system, component, and region. based on ship type the market is divided into commercial ships and defense ships. On the basis of end user, the market is fragmented into OEM and aftermarket. By sub-sub-system, the market is classified into integrated navigation system (INS), automatic weather observation system (AWOS), voyage data recorder (VDR), and automatic identification system (AIS). Based on component, the market is divided into hardware and software. The integrated bridge systems market has been studied for North America, Europe, Asia Pacific, Middle East, and Rest of the World.

The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the integrated bridge systems market. A detailed analysis of the key industry players has been done to provide insights into their business overviews; solutions and services; key strategies; contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches associated with the integrated bridge systems market. Competitive analysis of upcoming startups in the integrated bridge systems market ecosystem is covered in this report.

Reasons to Buy this Report

This report is expected to help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall Integrated bridge systems market and its segments. This study is also expected to provide region-wise information about the end-use industrial sectors, wherein Integrated bridge systems is used. This report aims at helping the stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. This report is also expected to help them understand the pulse of the market and provide them with information on key drivers, restraints, challenges, and opportunities influencing the growth of the market.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on integrated bridge systems offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the integrated bridge systems market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the integrated bridge systems market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the integrated bridge systems market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the integrated bridge systems market

Table of Contents

Companies Mentioned

- Alphatron Marine B.V.

- Consilium

- Danelec Marine A/S

- Furuno Electric Co. Ltd.

- Gem Elettronica Srl

- Hensoldt UK

- Japan Radio Co. Ltd.

- Kongsberg

- L3Harris Technologies, Inc.

- Mackay Communications, Inc.

- Marine Technologies LLC

- Naudeq

- Noris Group Gmbh

- Northrop Grumman Corporation

- PC Maritime Ltd

- Praxis Automation Technology B.V.

- Prime Mover Controls Inc.

- Raytheon Technologies Corporation

- Tokyo Keiki Inc.

- Wärtsilä

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 216 |

| Published | November 2022 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 6.1 Billion |

| Forecasted Market Value ( USD | $ 7.9 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |