Global Automotive Aftermarket Market - Key Trends & Drivers Summarized

The automotive aftermarket encompasses a vast and dynamic industry dedicated to the manufacturing, remanufacturing, distribution, retailing, and installation of all vehicle parts, equipment, chemicals, and accessories following the sale of the automobile by the original equipment manufacturer (OEM). This sector provides a broad range of services and products, including replacement parts for maintenance and repairs, performance-enhancing components, vehicle accessories, and customization items. The aftermarket is crucial for ensuring the longevity, performance, and aesthetic enhancement of vehicles, offering consumers an array of options beyond the initial warranty period. It caters to a wide variety of vehicles, from passenger cars to commercial trucks, and plays a significant role in the global automotive economy by supporting an extensive network of manufacturers, distributors, retailers, and service providers.Trends in the automotive aftermarket are shaped by technological advancements, shifts in consumer behavior, and evolving regulatory landscapes. The rise of e-commerce has revolutionized the way consumers purchase aftermarket products, providing easy access to a vast selection of parts and accessories through online platforms. This shift has allowed consumers to compare prices, read reviews, and find specific parts more efficiently, thereby transforming traditional purchasing methods. Additionally, technological advancements in automotive engineering, such as the integration of advanced driver-assistance systems (ADAS), telematics, and connected car technologies, have increased the demand for specialized aftermarket components. These technologies require sophisticated maintenance and repair solutions, which the aftermarket industry is rapidly developing to meet. The increasing popularity of electric vehicles (EVs) is another significant trend reshaping the aftermarket landscape. As EV adoption grows, there is a rising need for specialized parts such as batteries, charging equipment, and unique maintenance tools. Furthermore, sustainability trends are driving the development of eco-friendly products and practices within the sector, aligning with broader environmental goals and regulations.

The growth in the automotive aftermarket market is driven by several factors, including the increasing average age of vehicles, advancements in automotive technologies, and evolving consumer preferences. The average age of vehicles on the road is steadily increasing, which in turn heightens the need for maintenance, repair, and replacement parts. As cars and trucks are kept longer, the demand for aftermarket products continues to rise, supporting the market's expansion. Technological advancements have led to more sophisticated and diverse product offerings that cater to both traditional internal combustion engine (ICE) vehicles and modern electric and hybrid models. The integration of complex systems such as ADAS and connectivity features has created a demand for advanced diagnostic tools and specialized components in the aftermarket sector. Consumer behavior is also shifting, with an increasing number of vehicle owners interested in customization and performance enhancements. This trend drives the market for high-performance aftermarket products, from engine components to aesthetic modifications. The expansion of e-commerce platforms has further stimulated market growth by making it easier for consumers and businesses to access a wide range of aftermarket parts and services. This accessibility has broadened the market's reach and allowed for more competitive pricing and better customer service. Additionally, environmental regulations and the push towards sustainability are encouraging the development and adoption of eco-friendly aftermarket products, such as biodegradable lubricants, low-VOC paints, and recycled materials. These factors collectively contribute to the robust growth and dynamic evolution of the automotive aftermarket industry, making it an essential component of the automotive value chain.

Report Scope

The report analyzes the Automotive Aftermarket market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Category (Mechanical Products, Exterior & Structural Products, Electrical Products, Electronic Products, Motor Oil, Fluids & Additives, Appearance Chemicals).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Mechanical Products segment, which is expected to reach US$256.7 Billion by 2030 with a CAGR of 3.8%. The Exterior & Structural Products segment is also set to grow at 3.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $130.9 Billion in 2024, and China, forecasted to grow at an impressive 6.9% CAGR to reach $127.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Aftermarket Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Aftermarket Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Aftermarket Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, Alps Alpine Co., Ltd., Akebono Brake Industry Co., Ltd., Advance Auto Parts, Inc., Akebono Brake Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 186 companies featured in this Automotive Aftermarket market report include:

- 3M Company

- Alps Alpine Co., Ltd.

- Akebono Brake Industry Co., Ltd.

- Advance Auto Parts, Inc.

- Akebono Brake Corporation

- 3M Collision Repair Solutions

- ABS Friction, Inc.

- Allied Nippon Private Limited

- Amalie Oil Co.

- Apollo Tyres Ltd.

- ASIMCO Technologies Group Ltd.

- ATC Drivetrain LLC

- AP Exhaust Technologies, Inc.

- ADVICS North America, Inc.

- Aisin Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Alps Alpine Co., Ltd.

- Akebono Brake Industry Co., Ltd.

- Advance Auto Parts, Inc.

- Akebono Brake Corporation

- 3M Collision Repair Solutions

- ABS Friction, Inc.

- Allied Nippon Private Limited

- Amalie Oil Co.

- Apollo Tyres Ltd.

- ASIMCO Technologies Group Ltd.

- ATC Drivetrain LLC

- AP Exhaust Technologies, Inc.

- ADVICS North America, Inc.

- Aisin Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 456 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

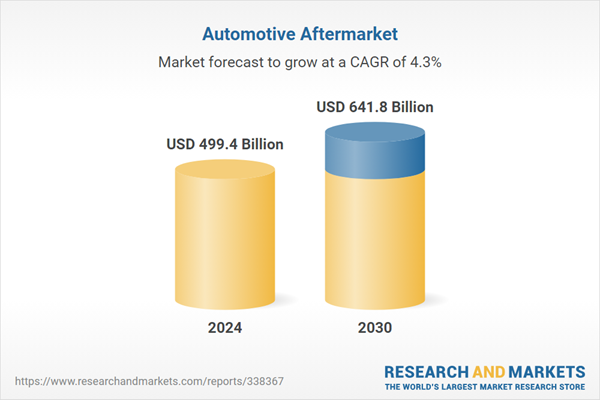

| Estimated Market Value ( USD | $ 499.4 Billion |

| Forecasted Market Value ( USD | $ 641.8 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |