Global Petroleum, Natural and Synthetic Waxes Market - Key Trends and Drivers Summarized

What Lies Beneath: How Are Petroleum, Natural, and Synthetic Waxes Mined and Refined?

Petroleum and wax industries play a crucial role in the global economy, tapping into the vast resources beneath the Earth's surface. Petroleum waxes are derived during the refining process of crude oil. When crude oil is processed, various fractions are separated based on their boiling points. Waxes are found in the heavier fractions, which are further processed to yield paraffin and microcrystalline waxes. Natural waxes, on the other hand, such as beeswax and carnauba wax, are harvested from biological sources - beeswax from beehives and carnauba from the leaves of Brazilian palm trees. Synthetic waxes are manufactured through chemical synthesis, using ingredients like ethylene to produce polymers that mimic the properties of natural waxes. Each type of wax has unique properties that determine its suitability for different applications, ranging from candle-making to coatings and packaging.How Do Different Industries Utilize These Versatile Substances?

The versatility of waxes across various industries cannot be overstated. In the cosmetics industry, waxes are vital for creating products that require a solid yet pliable texture, such as lipsticks and eyeliners. The food industry uses waxes to coat fruits and vegetables, enhancing appearance while prolonging freshness. In the packaging sector, waxes provide a moisture-resistant coating for cardboard and paper, protecting goods during transport. Additionally, the pharmaceutical industry employs waxes in the formulation of time-release pills, aiding in the controlled dissolution of medication. Beyond these applications, waxes are also essential in the automotive industry for polishes and coatings that protect vehicles from moisture and UV radiation.What Are the Environmental and Regulatory Impacts on Wax Production?

Environmental considerations and regulatory frameworks significantly influence the production and use of waxes. The petroleum wax segment faces scrutiny due to its association with fossil fuels, leading to tighter regulations on emissions and environmental protection standards. This scrutiny accelerates the shift towards more sustainable wax alternatives, such as plant-based and synthetic options that offer similar functional benefits without the environmental drawbacks. Regulatory bodies across the globe are imposing stringent guidelines that mandate the reduction of volatile organic compounds (VOCs) emitted during the production of petroleum-based waxes. These regulations not only drive improvements in processing technologies but also encourage the adoption of eco-friendly waxes in industries that are increasingly conscious of their environmental footprint.What Drives the Growth in the Wax Market?

The expansion of the wax market is propelled by a blend of technological advancements, end-use market growth, and evolving consumer behaviors. Innovation in wax formulation and processing technology allows for enhanced properties like increased melting points and greater biodegradability, making waxes appealing for a broader range of applications. The growth in industries such as cosmetics, pharmaceuticals, and food packaging directly correlates with increased demand for high-quality waxes. Consumer preferences are shifting towards sustainable and natural products, significantly influencing the market dynamics and encouraging manufacturers to invest in natural and synthetic wax production. Furthermore, the global expansion of retail and online marketplaces creates additional avenues for wax-based products, thus broadening the consumer base and fueling market growth. These factors collectively contribute to the robust growth trajectory anticipated for the wax industry in the coming years.Report Scope

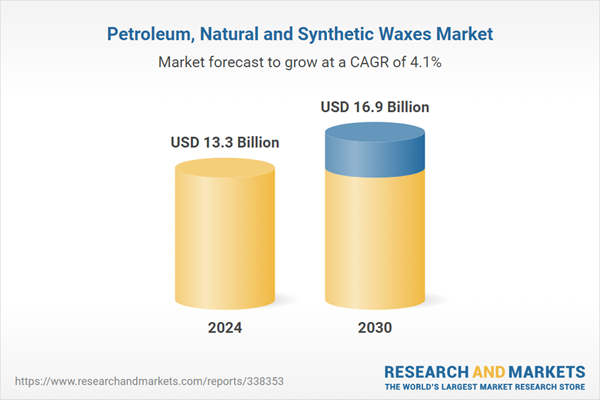

The report analyzes the Petroleum, Natural and Synthetic Waxes market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Segment (Petroleum & Mineral Waxes, Synthetic Waxes, Natural Waxes).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Petroleum & Mineral Waxes segment, which is expected to reach US$10.1 Billion by 2030 with a CAGR of 3.3%. The Synthetic Waxes segment is also set to grow at 5.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.6 Billion in 2024, and China, forecasted to grow at an impressive 6.8% CAGR to reach $3.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Petroleum, Natural and Synthetic Waxes Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Petroleum, Natural and Synthetic Waxes Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Petroleum, Natural and Synthetic Waxes Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BASF SE, Blended Waxes Inc., Clariant International Ltd., Dow Inc., Evonik Industries AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 13 companies featured in this Petroleum, Natural and Synthetic Waxes market report include:

- BASF SE

- Blended Waxes Inc.

- Clariant International Ltd.

- Dow Inc.

- Evonik Industries AG

- ExxonMobil Fuels & Lubricants

- Honeywell International, Inc.

- Koster Keunen (Holland) B.V

- Micro Powders Inc.

- Paramelt BV

- Romonta GmbH

- Sasol Limited

- Strahl & Pitsch Inc.

- The International Group Inc.

- Vantage Performance Materials

- Wachs-u. Ceresin-Fabriken TH. C. TROMM GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BASF SE

- Blended Waxes Inc.

- Clariant International Ltd.

- Dow Inc.

- Evonik Industries AG

- ExxonMobil Fuels & Lubricants

- Honeywell International, Inc.

- Koster Keunen (Holland) B.V

- Micro Powders Inc.

- Paramelt BV

- Romonta GmbH

- Sasol Limited

- Strahl & Pitsch Inc.

- The International Group Inc.

- Vantage Performance Materials

- Wachs-u. Ceresin-Fabriken TH. C. TROMM GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 259 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 13.3 Billion |

| Forecasted Market Value ( USD | $ 16.9 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |