Global Spices and Seasonings Market - Key Trends and Drivers Summarized

How Do Spices influence Our Health?

Spices have played a significant role in human health for centuries, serving not just as flavor enhancers in cuisine but also as potent medicinal agents. Each spice carries unique phytochemicals that confer various health benefits; for instance, turmeric contains curcumin, which is renowned for its anti-inflammatory and antioxidant properties, helping to combat inflammation and reduce oxidative stress in the body. Similarly, cinnamon is valued for its ability to regulate blood sugar levels, making it particularly beneficial for people with diabetes. Capsaicin, found in chili peppers, boosts metabolism and may aid in weight loss, while ginger aids digestion and alleviates symptoms of nausea. Beyond these physiological benefits, spices have also been shown to possess antimicrobial properties, helping to preserve food and prevent spoilage. Incorporating a diverse range of spices into the diet can thus not only elevate the flavor of dishes but also contribute to better health and wellness, reflecting their indispensable role in nutrition and natural therapy.How Do Spices and Seasonings Enrich Our Culinary Experiences?

Spices and seasonings have been pivotal in culinary arts, medicine, and preservation for millennia, enhancing the flavor, aroma, and color of food across global cuisines. Originating from the most ancient civilizations, spices like pepper, cinnamon, and turmeric were once so valuable they were used as currency. Today, they continue to play a crucial role in modern kitchens and commercial food production. Spices profoundly influence gastronomy by enhancing the flavor, color, and aroma of food, transforming simple ingredients into rich and complex culinary experiences. They are the backbone of regional cuisines around the world, defining dishes and establishing unique food identities - from the smoky cumin in Mexican tacos to the pungent turmeric in Indian curries. Spices stimulate the palate and can alter the perception of a dish's temperature, making food taste warmer or cooler. They also play a crucial role in marination and preservation processes, helping to break down tough fibers in meats and extending the shelf life of prepared foods. Moreover, spices encourage culinary innovation, inspiring chefs to experiment with new flavor combinations and techniques, thus continually pushing the boundaries of traditional cooking. By elevating sensory experiences and preserving food traditions while inspiring new ones, spices are indispensable in the world of gastronomy. Seasonings, which include a blend of spices and other flavor-enhancing ingredients like herbs and salts, further diversify the palette available to both home cooks and professional chefs. These ingredients not only elevate the taste of dishes but also boast a variety of health benefits, from anti-inflammatory properties to metabolism-boosting effects. Their use transcends mere flavoring, often defining the cultural and regional identity of culinary traditions.What Technological Advancements Are Influencing the Production of Spices and Seasonings?

The production and processing of spices and seasonings have been significantly transformed by technological advancements. Modern agriculture techniques have improved the cultivation of spice plants with better yield and quality control, ensuring consistency and purity in the spices produced. Post-harvest technologies such as solar dryers and freeze-drying methods help preserve the original aroma and flavor of spices, enhancing their shelf life and nutritional value. Additionally, the use of automated sorting and grinding technologies ensures efficiency and hygiene in spice processing, minimizing contamination risks and preserving the essential oils that carry the flavors. Innovations in packaging technology also play a crucial role, as advanced packaging solutions help protect spices from moisture and oxidation, thereby maintaining their potency over extended periods.How Are Changing Consumer Preferences Shaping the Spices and Seasonings Industry?

Changing consumer preferences have a significant impact on the spices and seasonings industry. As global cuisine becomes increasingly accessible, there is a growing appetite for authentic and exotic flavors, which drives demand for both traditional and novel spices and seasonings. The rise in health consciousness among consumers has also prompted a shift towards natural and organic products, including spices and herbs known for their health benefits. Moreover, there is an increasing trend toward clean labeling, with consumers demanding transparency regarding the ingredients in their food. This shift influences manufacturers to offer products free from artificial additives and preservatives, which in turn fosters innovation in natural preservation techniques and product formulations. The food industry's response to these demands not only caters to a more health-aware and globally curious consumer base but also drives further diversification in the market offerings.What Drives the Growth in the Spices and Seasonings Market?

The growth in the spices and seasonings market is driven by several factors, starting with the expanding global food and beverage industry, which continuously demands new and diverse flavors to meet consumer expectations. The rise in ethnic cuisines and gourmet cooking at home, fueled by food networks and culinary shows, also contributes significantly to the growth of this market. Technological advancements in processing and packaging help maintain the quality and extend the reach of spice products, appealing to a broader consumer base. Additionally, the increasing awareness of the health benefits associated with natural spices and herbs encourages more consumers to incorporate these ingredients into their diets. Economic factors such as increased disposable income and urbanization also play critical roles, as they enhance consumer ability and willingness to experiment with new flavors and premium products. Together, these dynamics ensure sustained interest and investment in the spices and seasonings sector, making it a continually evolving and vibrant part of the global food industry.Report Scope

The report analyzes the Spices and Seasonings market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Herbs, Spices, Salt & Substitutes, Other Products); Application (Bakery & Confectionery, Meat & Poultry, Frozen Food, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Herbs segment, which is expected to reach US$5.5 Billion by 2030 with a CAGR of 3.4%. The Spices segment is also set to grow at 4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.4 Billion in 2024, and China, forecasted to grow at an impressive 6% CAGR to reach $4.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Spices and Seasonings Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Spices and Seasonings Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Spices and Seasonings Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ajinomoto Co., Inc., Ariake Japan Company Limited, Asenzya, B&G Foods, Inc., Fuchs North America and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 154 companies featured in this Spices and Seasonings market report include:

- Ajinomoto Co., Inc.

- Ariake Japan Company Limited

- Asenzya

- B&G Foods, Inc.

- Fuchs North America

- Golden West Specialty Foods, Inc.

- Griffith Foods, Inc.

- Harris Freeman & Company Inc.

- McCormick & Co., Inc.

- Mehran Spice & Food Industries

- Old Mansion Foods

- Old World Spices & Seasonings

- Oregon Spice Company

- Rocky Mountain Spice Company

- S&B Foods Inc.

- Synthite Industries Ltd.

- The Bart Ingredients Company Ltd.

- The Spice Way

- Vanns Spices Ltd.

- Victoria Gourmet, Inc.

- Williams Foods, Inc.

- Wixon

- Xcell International Corp.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ajinomoto Co., Inc.

- Ariake Japan Company Limited

- Asenzya

- B&G Foods, Inc.

- Fuchs North America

- Golden West Specialty Foods, Inc.

- Griffith Foods, Inc.

- Harris Freeman & Company Inc.

- McCormick & Co., Inc.

- Mehran Spice & Food Industries

- Old Mansion Foods

- Old World Spices & Seasonings

- Oregon Spice Company

- Rocky Mountain Spice Company

- S&B Foods Inc.

- Synthite Industries Ltd.

- The Bart Ingredients Company Ltd.

- The Spice Way

- Vanns Spices Ltd.

- Victoria Gourmet, Inc.

- Williams Foods, Inc.

- Wixon

- Xcell International Corp.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 329 |

| Published | February 2026 |

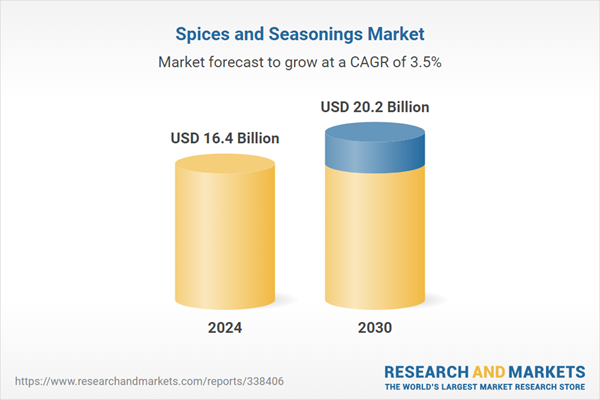

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 16.4 Billion |

| Forecasted Market Value ( USD | $ 20.2 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |