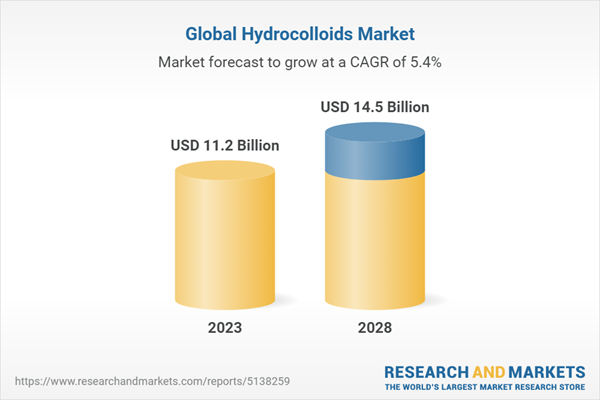

The global hydrocolloids market is estimated to be valued at USD 11.2 Billion in 2023 and is projected to reach USD 14.5 billion by 2028, at a CAGR of 5.4% during the forecast period. Hydrocolloids are widely used in many food formulations to improve quality attributes and shelf-life. Hydrocolloids expressed in food are affected by several factors, such as orientation and molecular association, water-binding and swelling, concentration, particle size, degree of dispersion, interaction with other gums, and help in improving the properties of the filling. The two main uses of hydrocolloids are as a thickening and gelling agents. They are also used for moisture retention in cakes, pies, donuts, and frozen food. Companies such as International Flavors & Fragrances Inc. (US), Ingredion (US), Cargill, Incorporated (US), Associated Archer Daniels Midland Company (US), Darling Ingredients Inc. (US), Ashland (US), and CP Kelco U.S., Inc. (US) produce and supply different types of hydrocolloids for the food and beverage industry.

The gelatin segment amongst the various types of hydrocolloids dominated the market in the year 2022.

Although gelatin is widely used in the food industry, its addition to food creates problems for certain people. Some people object to the use of gelatin for religious or ethical reasons because it is produced from animal tissues or because it is made from the tissues of specific animals. Some plant materials form gels in water and can be substituted for gelatin, but they have slightly different properties from animal products. Nevertheless, they are a good option for people who do not want to use a substance obtained from animals. Two of these gelatin substitutes are agar (also called agar-agar) and carrageenan. Gelatin is also used in the pharmaceutical industry; it is used as an excipient in the production of hard capsules and soft gels.

The animal segment of hydrocolloids market accounted for the largest share in the year 2022

Hydrocolloids of animal origin are produced using skins and bones of different sources, such as beef, pork, and fish. Gelatin is one of the major hydrocolloids derived from animal sources having applications in the confectionery industry. The animal-derived hydrocolloids generally form water in oil emulsions. They are quite likely to cause allergies and are susceptible to microbial growth and rancidity. Gelatin is a protein substance derived from collagen, a natural protein present in the tendons, ligaments, and tissues of mammals. It is produced by boiling the connective tissues, bones, and skins of animals, usually cows and pigs. Gelatin's ability to form strong, transparent gels and flexible films that are easily digested, soluble in hot water, and capable of forming a positive binding action, have made it a valuable commodity in food processing, pharmaceuticals, photography, and paper production.

The thickener segment by function of hydrocolloids market accounted for the largest share in the year 2022.

Hydrocolloids are widely used as thickeners in various food products, such as soups, salad dressings, gravies, sauces, and toppings. The main reason for using hydrocolloids as thickeners is that they easily disperse when in contact with water to provide a thickening effect to the emulsion. Major hydrocolloids used as thickeners include xanthan gum, guar gum, LBG, gum Arabic, and CMC. The thickening effect produced by these hydrocolloids depends on the type of hydrocolloid used, its concentration, as well as the food system in which it is used. It also depends on the pH of the food system and temperature. Ketchup is one of the most common food items where hydrocolloids find their application.

The food & beverage segment by application of hydrocolloids market accounted for the largest share in the year 2022.

Hydrocolloids are functional carbohydrates used in many types of food to enhance their shelf life and quality. They are used to modify the viscosity and texture of food products, such as ice cream, salad dressings, gravies, processed meats, and beverages. They are chiefly used to modify the rheology of the food system, specifically viscosity and texture. Some are used alone, while others are used in synergistic combinations. They are used as thickening agents. However, some of these additives can be used in forming gels. Much of this is related to the way each ingredient reacts to water, including its solubility and how it performs when exposed to varying temperatures. As water is immobilized, the gel can take on unique characteristics depending on the types of hydrocolloids used.

North American market for hydrocolloids is projected to grow at the highest CAGR during the forecast period.

Consumers in the North American market are on the lookout for minimally processed convenience foods with good textures and long storage lives. This has heightened the need for appropriate food safety measures. It has also leveraged food additives to improve quality, texture, and extend shelf life, which are becoming increasingly important and critical. The burgeoning demand for such convenience food products is expected to have a high impact on the hydrocolloid market in North America. With the challenge posed by the growing concern among consumers with respect to chemical methods and additives to enhance food quality and shelf life, manufacturers are exploring newer technologies and hydrocolloids, which would be efficient alternatives to synthetic products. The popular perception that natural additives are a healthier option is driving the trend in the hydrocolloids market in North America.

In the process of determining and verifying the market size for several segments and sub-segments gathered through secondary research, extensive primary interviews have been conducted with the key experts.

The break-up of Primaries:

- By Company Type: Tier 1 - 23%, Tier 2 - 30%, and Tier 3 - 47%

- By Designation: C level - 24%, director level - 36%, Executives - 40%

- By Geography: North America- 20%, Europe - 30%, Asia Pacific - 45%, and RoW - 5%

Research Coverage:

The report segments the hydrocolloids market on the basis of type, source, application, function, and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges of the global hydrocolloids market.

Reasons to buy this report:

- To get a comprehensive overview of the hydrocolloids market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions in which the hydrocolloids market is flourishing

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

Figure 1 Market Segmentation

1.3.1 Inclusions and Exclusions

1.4 Regions Covered

1.5 Years Considered

1.6 Units Considered

1.6.1 Currency (Value Unit)

Table 1 USD Exchange Rates Considered, 2018-2021

1.6.2 Volume Unit

1.7 Stakeholders

1.8 Summary of Changes

2 Research Methodology

2.1 Research Data

Figure 2 Hydrocolloids Market: Research Design

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primary Interviews

Figure 3 Breakdown of Primary Interviews: by Company Type, Designation, and Region

2.2 Market Size Estimation

Figure 4 Hydrocolloids Market Size Estimation: Supply Side (1/2)

Figure 5 Hydrocolloids Market Size Estimation: Supply Side (2/2)

Figure 6 Hydrocolloids Market Size Estimation: Demand Side

2.2.1 Market Size Estimation: Bottom-Up Approach

Figure 7 Hydrocolloids Market Size Estimation: Bottom-Up Approach

2.2.2 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Hydrocolloids Market Size Estimation: Top-Down Approach

2.3 Data Triangulation

Figure 9 Data Triangulation Methodology

2.4 Recession Impact Analysis

2.5 Assumptions

2.6 Research Limitations & Associated Risks

3 Executive Summary

Table 2 Hydrocolloids Market Snapshot, 2023 vs. 2028

Figure 10 Hydrocolloids Market, by Application, 2023 vs. 2028 (USD Million)

Figure 11 Hydrocolloids Market, by Type, 2023 vs. 2028 (USD Million)

Figure 12 Hydrocolloids Market, by Source, 2023 vs. 2028 (USD Million)

Figure 13 Hydrocolloids Market Size, by Function, 2023 vs. 2028 (USD Million)

Figure 14 Hydrocolloids Market Share (Value), by Region, 2022

4 Premium Insights

4.1 Attractive Opportunities for Hydrocolloids Market Players

Figure 15 North America to Account for Highest Growth Rate During Forecast Period

4.2 Europe: Hydrocolloids Market, by Key Function and Country

Figure 16 France and Thickeners Segments Accounted for Largest Respective Shares in 2022

4.3 Hydrocolloids Market, by Type, 2023 vs. 2028

Figure 17 Gelatin to Dominate Market During Forecast Period

4.4 Hydrocolloids Market, by Source, 2023 vs. 2028

Figure 18 Animal Source to Dominate Market During Forecast Period

4.5 Hydrocolloids Market, by Function, 2023 vs. 2028

Figure 19 Stabilizers to Account for Largest Market Share During Forecast Period

4.6 Hydrocolloids Market, by Application, 2023 vs. 2028

Figure 20 Food & Beverages to Dominate Market During Forecast Period

4.7 Hydrocolloids Market, by Application and Region, 2023 vs. 2028

Figure 21 North America and Food & Beverages to Dominate During Forecast Period

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 22 Market Dynamics: Hydrocolloids Market

5.2.1 Drivers

5.2.1.1 Multifunctionality of Hydrocolloids to Lead to Wide Range of Applications

Table 3 Applications and Functionalities of Various Hydrocolloids

5.2.1.2 Rise in Demand for Clean-Label Products due to Rise in Health and Wellness Trend

5.2.1.3 Expansion of Ready Meal and Convenience Food Industry to Catalyze Demand

5.2.2 Restraints

5.2.2.1 Stringent Regulations and International Quality Standards

5.2.2.2 Inadequate Supply of Raw Materials and Price Fluctuation

5.2.3 Opportunities

5.2.3.1 Emerging Markets in Asia-Pacific and Africa

5.2.3.2 Hydrocolloids to Replace and Reduce Other Ingredients in Food Products

5.2.3.3 Increase in Investments in R&D

5.2.4 Challenges

5.2.4.1 Intense Competition and Product Rivalry due to Similar Products

5.2.4.2 Unclear Labeling to Lead to Ambiguity and Uncertainty

6 Industry Trends

6.1 Introduction

6.2 Technology Analysis

6.2.1 Protein Hydrolysis

6.2.2 Alcohol Precipitation

6.2.3 Crosslinking of Polysaccharides

6.2.4 Co-Gelation

6.3 Value Chain Analysis

Figure 23 Hydrocolloids Market: Value Chain

6.4 Supply Chain

Figure 24 Product Development and Distribution to ADD Value to Supply Chain for Hydrocolloids

6.5 Ecosystem

6.5.1 Upstream

6.5.2 Downstream

Figure 25 Hydrocolloids Market: Ecosystem Map

6.6 Trends/Disruptions Impacting Customer's Business

Figure 26 Trends/Disruptions Impacting Customer's Business

6.7 Porter's Five Forces Analysis

Table 4 Hydrocolloids Market: Porter's Five Forces Analysis

6.7.1 Intensity of Competitive Rivalry

6.7.2 Bargaining Power of Suppliers

6.7.3 Bargaining Power of Buyers

6.7.4 Threat of Substitutes

6.7.5 Threat of New Entrants

6.8 Price Trend Analysis

6.8.1 Average Selling Prices, by Key Type

Figure 27 Global Average Selling Prices, by Key Type

Table 5 Gelatin: Average Selling Price (ASP), by Region, 2020-2022 (USD/Ton)

Table 6 Pectin: Average Selling Price (ASP), by Region, 2020-2022 (USD/Ton)

Table 7 Cmc: Average Selling Price (ASP), by Region, 2020-2022 (USD/Ton)

6.9 Patent Analysis

Figure 28 Patents Granted for Hydrocolloids Market, 2013-2022

Figure 29 Regional Analysis of Patents Granted for Hydrocolloids Market, 2013-2022

Table 8 Key Patents Pertaining to Hydrocolloids, 2013-2022

6.10 Key Conferences and Events

Table 9 Key Conferences and Events in Hydrocolloids Market, 2023

6.11 Case Studies

6.11.1 Case Study 1

Table 10 Food Hydrocolloid Batch-To-Batch Variation (Usa)

6.11.2 Case Study 2

Table 11 Assessment of Novel Fat Replacer

6.12 Tariff and Regulatory Landscape

Table 12 North America: Regulatory Bodies, Government Agencies, and Other Organizations

Table 13 Europe: Regulatory Bodies, Government Agencies, and Other Organizations

Table 14 Asia-Pacific: Regulatory Bodies, Government Agencies, and Other Organizations

Table 15 South America: Regulatory Bodies, Government Agencies, and Other Organizations

6.13 Trade Analysis

Table 16 Top 10 Importers and Exporters, 2021

Table 17 Top 10 Importers and Exporters, 2020

Table 18 Top 10 Importers and Exporters, 2019

Table 19 Top 10 Importers and Exporters, 2018

7 Hydrocolloids Market: Regulations

7.1 Introduction

7.2 Codex Alimentarius

7.3 European Commission

Table 20 List of Hydrocolloids Used in the Food Industry

8 Hydrocolloids Market, by Type

8.1 Introduction

Figure 30 Gelatin to Lead Hydrocolloids Market During Forecast Period (USD Million)

Table 21 Hydrocolloids Market, by Type, 2018-2022 (USD Million)

Table 22 Hydrocolloids Market, by Type, 2023-2028 (USD Million)

Table 23 Hydrocolloids Market, by Type, 2018-2022 (Kt)

Table 24 Hydrocolloids Market, by Type, 2023-2028 (Kt)

8.2 Gelatin

8.2.1 Wide Use of Gelatin in Food Application

Table 25 Gelatin: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 26 Gelatin: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

Table 27 Gelatin: Hydrocolloids Market, by Region, 2018-2022 (Kt)

Table 28 Gelatin: Hydrocolloids Market, by Region, 2023-2028 (Kt)

8.3 Xanthan Gum

8.3.1 Xanthan Gum's Wide Usage as Thickener in Different Industries

Table 29 Xanthan Gum: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 30 Xanthan Gum: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

Table 31 Xanthan Gum: Hydrocolloids Market, by Region, 2018-2022 (Kt)

Table 32 Xanthan Gum: Hydrocolloids Market, by Region, 2023-2028 (Kt)

8.4 Carrageenan

8.4.1 Usage of Carrageenan as Gelatin Alternative in Jelly-based Products

Table 33 Carrageenan: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 34 Carrageenan: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

Table 35 Carrageenan: Hydrocolloids Market, by Region, 2018-2022 (Kt)

Table 36 Carrageenan: Hydrocolloids Market, by Region, 2023-2028 (Kt)

8.5 Alginates

8.5.1 Application of Alginate to Coat Fruits and Vegetables as Microbial and Viral Protection Products

Table 37 Alginates: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 38 Alginates: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

Table 39 Alginates: Hydrocolloids Market, by Region, 2018-2022 (Kt)

Table 40 Alginates: Hydrocolloids Market, by Region, 2023-2028 (Kt)

8.6 Agar

8.6.1 Preference of Agar Over Synthetic Materials as Alternative Source of Raw Materials for Pharmaceutical Applications

Table 41 Agar: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 42 Agar: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

Table 43 Agar: Hydrocolloids Market, by Region, 2018-2022 (Kt)

Table 44 Agar: Hydrocolloids Market, by Region, 2023-2028 (Kt)

8.7 Pectin

8.7.1 Usage of Pectin as Viscosity Enhancer due to Gelling Ability

Table 45 Pectin: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 46 Pectin: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

Table 47 Pectin: Hydrocolloids Market, by Region, 2018-2022 (Kt)

Table 48 Pectin: Hydrocolloids Market, by Region, 2023-2028 (Kt)

8.8 Guar Gum

8.8.1 Use of Guar Gum in Different Industries as a Stabilizer

Table 49 Guar Gum: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 50 Guar Gum: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

Table 51 Guar Gum: Hydrocolloids Market, by Region, 2018-2022 (Kt)

Table 52 Guar Gum: Hydrocolloids Market, by Region, 2023-2028 (Kt)

8.9 Locust Bean Gum

8.9.1 Locust Bean Gum to Decrease Blood Sugar and Blood Fat Levels

Table 53 Lbg: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 54 Lbg: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

Table 55 Lbg: Hydrocolloids Market, by Region, 2018-2022 (Kt)

Table 56 Lbg: Hydrocolloids Market, by Region, 2023-2028 (Kt)

8.10 Gum Arabic

8.10.1 Gum Arabic Acts as Stabilizer to Extend Product's Shelf Life

Table 57 Gum Arabic: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 58 Gum Arabic: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

Table 59 Gum Arabic: Hydrocolloids Market, by Region, 2018-2022 (Kt)

Table 60 Gum Arabic: Hydrocolloids Market, by Region, 2023-2028 (Kt)

8.11 Carboxymethyl Cellulose (CMC)

8.11.1 Usage of Cmc as Thickener and Stabilizer in Food Products

Table 61 Cmc: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 62 Cmc: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

Table 63 Cmc: Hydrocolloids Market, by Region, 2018-2022 (Kt)

Table 64 Cmc: Hydrocolloids Market, by Region, 2023-2028 (Kt)

8.12 Microcrystalline Cellulose (MCC)

8.12.1 Application of Mcc as Cellulose Derivative in the Food Industry

Table 65 Mcc: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 66 Mcc: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

Table 67 Mcc: Hydrocolloids Market, by Region, 2018-2022 (Kt)

Table 68 Mcc: Hydrocolloids Market, by Region, 2023-2028 (Kt)

9 Hydrocolloids Market, by Source

9.1 Introduction

Figure 31 Animal Hydrocolloids Segment to Dominate Market During Forecast Period (USD Million)

Table 69 Hydrocolloids Market, by Source, 2018-2022 (USD Million)

Table 70 Hydrocolloids Market, by Source, 2023-2028 (USD Million)

9.2 Botanical

9.2.1 Botanical Hydrocolloids Considered as ‘Clean Label’ and Safe Option Against Synthetic Additives

Table 71 Botanical: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 72 Botanical: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

9.3 Microbial

9.3.1 Wide Usage of Microbial-Sourced Hydrocolloids Such as Xanthan Gum

Table 73 Microbial: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 74 Microbial: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

9.4 Animal

9.4.1 Animal-Derived Gelatin to Occupy Major Market Share

Table 75 Animal: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 76 Animal: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

9.5 Seaweed

9.5.1 Application of High-Value Seaweed Hydrocolloids as Thickening Agents in Pharmaceuticals and Biotechnological Applications

Table 77 Seaweed: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 78 Seaweed: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

9.6 Synthetic

9.6.1 Resistance to Microbial Degradation to be a Major Advantage of Synthetic Hydrocolloids Over Natural Hydrocolloids

Table 79 Synthetic: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 80 Synthetic: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

10 Hydrocolloids Market, by Function

10.1 Introduction

Figure 32 Stabilizers Segment to Dominate Market During Forecast Period (USD Million)

Table 81 Hydrocolloids Market, by Function, 2018-2022 (USD Million)

Table 82 Hydrocolloids Market, by Function, 2023-2028 (USD Million)

10.2 Thickeners

10.2.1 Application of Thickening Agents in Soups, Salad Dressings, Gravies, Sauces, and Toppings

Table 83 Hydrocolloids Used as Thickening Agents

Table 84 Thickeners: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 85 Thickeners: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

10.3 Stabilizers

10.3.1 Hydrocolloids Act as Stabilizers in Dairy Products, Beverages, and Desserts

Table 86 Stabilizers: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 87 Stabilizers: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

10.4 Gelling Agents

10.4.1 Usage of Hydrocolloid Gelation in Various Food Applications

Table 88 Hydrocolloids Used as Gelling Agents

Table 89 Gelling Agents: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 90 Gelling Agents: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

10.5 Fat Replacers

10.5.1 Preference of Consumers of Reduced-Fat Products in Their Routine Diet

Table 91 Fat Replacers: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 92 Fat Replacers: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

10.6 Coating Materials

10.6.1 Usage of Hydrocolloids in Edible Film-Forming Functions

Table 93 Coating Materials: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 94 Coating Materials: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

10.7 Other Functions

10.7.1 Hydrocolloids to Gain Popularity as Emulsifiers and Moisture-Binding Agents

Table 95 Other Functions: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 96 Other Functions: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

11 Hydrocolloids Market, by Application

11.1 Introduction

Figure 33 Food & Beverages Segment to Dominate Market During Forecast Period

Table 97 Hydrocolloids Market, by Application, 2018-2022 (USD Million)

Table 98 Hydrocolloids Market, by Application, 2023-2028 (USD Million)

11.2 Food & Beverages

11.2.1 Hydrocolloids to Replace Fat by Using Starches Soluble in Water

Table 99 Food & Beverages: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 100 Food & Beverages: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

11.2.2 Bakery & Confectionery

11.2.2.1 Hydrocolloids to Improve Quality of Bakery Products by Providing Texture, Stability, and Extended Shelf-Life

11.2.3 Meat & Poultry Products

11.2.3.1 Hydrocolloids to Improve Cooking Yield, Texture, and Slice Characteristics

11.2.4 Sauces & Dressings

11.2.4.1 Hydrocolloids to be Used in Sauces and Dressing Applications

11.2.5 Dairy Products

11.2.5.1 Food Hydrocolloids Used as Stabilizers, Thickeners, and Gelling Agents

11.2.6 Others

11.3 Cosmetics & Personal Care Products

11.3.1 Use of Hydrocolloids as Viscosity Control Agents due to Their Thickening and Gelling Properties

Table 101 Cosmetics & Personal Care Products: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 102 Cosmetics & Personal Care Products: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

11.4 Pharmaceuticals

11.4.1 Potential of Naturally Occurring Hydrocolloids in Drug Formulation due to Extensive Application as Food Additives

Table 103 Pharmaceuticals: Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 104 Pharmaceuticals: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

12 Hydrocolloids Market, by Region

12.1 Introduction

Figure 34 Hydrocolloids Market Growth Rate, by Key Country, 2023-2028

Table 105 Hydrocolloids Market, by Region, 2018-2022 (USD Million)

Table 106 Hydrocolloids Market, by Region, 2023-2028 (USD Million)

Table 107 Hydrocolloids Market, by Region, 2018-2022 (Kt)

Table 108 Hydrocolloids Market, by Region, 2023-2028 (Kt)

12.2 North America

Figure 35 North America: Hydrocolloids Market Snapshot

12.2.1 Recession Impact Analysis

Figure 36 North America: Recession Impact Analysis

Table 109 North America: Hydrocolloids Market, by Country, 2018-2022 (USD Million)

Table 110 North America: Hydrocolloids Market, by Country, 2023-2028 (USD Million)

Table 111 North America: Hydrocolloids Market, by Type, 2018-2022 (USD Million)

Table 112 North America: Hydrocolloids Market, by Type, 2023-2028 (USD Million)

Table 113 North America: Hydrocolloids Market, by Type, 2018-2022 (Kt)

Table 114 North America: Hydrocolloids Market, by Type, 2023-2028 (Kt)

Table 115 North America: Hydrocolloids Market, by Application, 2018-2022 (USD Million)

Table 116 North America: Hydrocolloids Market, by Application, 2023-2028 (USD Million)

Table 117 North America: Hydrocolloids Market, by Source, 2018-2022 (USD Million)

Table 118 North America: Hydrocolloids Market, by Source, 2023-2028 (USD Million)

Table 119 North America: Hydrocolloids Market, by Function, 2018-2022 (USD Million)

Table 120 North America: Hydrocolloids Market, by Function, 2023-2028 (USD Million)

12.2.2 US

12.2.2.1 Higher Demand for Low-Fat Food Products to Drive Market Growth

Table 121 US: Hydrocolloids Market, by Application, 2018-2022 (USD Million)

Table 122 US: Hydrocolloids Market, by Application, 2023-2028 (USD Million)

12.2.3 Canada

12.2.3.1 Substantial Growth of Functional Food Segment to Trigger Demand for Different Hydrocolloids

Table 123 Canada: Hydrocolloids Market, by Application, 2018-2022 (USD Million)

Table 124 Canada: Hydrocolloids Market, by Application, 2023-2028 (USD Million)

12.2.4 Mexico

12.2.4.1 Rise in Consumption of Dairy Products to Drive Market Growth

Table 125 Mexico: Hydrocolloids Market, by Application, 2018-2022 (USD Million)

Table 126 Mexico: Hydrocolloids Market, by Application, 2023-2028 (USD Million)

12.3 Europe

12.3.1 Recession Impact Analysis

Figure 37 Europe: Hydrocolloids Market: Recession Impact Analysis

Table 127 Europe: Hydrocolloids Market, by Country, 2018-2022 (USD Million)

Table 128 Europe: Hydrocolloids Market, by Country, 2023-2028 (USD Million)

Table 129 Europe: Hydrocolloids Market, by Type, 2018-2022 (USD Million)

Table 130 Europe: Hydrocolloids Market, by Type, 2023-2028 (USD Million)

Table 131 Europe: Hydrocolloids Market, by Type, 2018-2022 (Kt)

Table 132 Europe: Hydrocolloids Market, by Type, 2023-2028 (Kt)

Table 133 Europe: Hydrocolloids Market, by Application, 2018-2022 (USD Million)

Table 134 Europe: Hydrocolloids Market, by Application, 2023-2028 (USD Million)

Table 135 Europe: Hydrocolloids Market, by Source, 2018-2022 (USD Million)

Table 136 Europe: Hydrocolloids Market, by Source, 2023-2028 (USD Million)

Table 137 Europe: Hydrocolloids Market, by Function, 2018-2022 (USD Million)

Table 138 Europe: Hydrocolloids Market, by Function, 2023-2028 (USD Million)

12.3.2 Germany

12.3.2.1 Increase in Consumption of Different Baked Goods to Drive Market

Table 139 Germany: Hydrocolloids Market, by Application, 2018-2022 (USD Million)

Table 140 Germany: Hydrocolloids Market, by Application, 2023-2028 (USD Million)

12.3.3 UK

12.3.3.1 Presence of Large Food Sector as Well as Cosmetic Industry to Propel Market Growth

Table 141 UK: Hydrocolloids Market, by Application, 2018-2022 (USD Million)

Table 142 UK: Hydrocolloids Market, by Application, 2023-2028 (USD Million)

12.3.4 France

12.3.4.1 High Consumption of Confectionery Products to Drive Market

Table 143 France: Hydrocolloids Market, by Application, 2018-2022 (USD Million)

Table 144 France: Hydrocolloids Market, by Application, 2023-2028 (USD Million)

12.3.5 Italy

12.3.5.1 Wide Presence of Dairy Sector and Increased Production of Ice Cream to Increase Use of Hydrocolloids

Table 145 Italy: Hydrocolloids Market, by Application, 2018-2022 (USD Million)

Table 146 Italy: Hydrocolloids Market, by Application, 2023-2028 (USD Million)

12.3.6 Spain

12.3.6.1 Demand for Healthier Processed Food to Increase Demand for Natural Hydrocolloids

Table 147 Spain: Hydrocolloids Market, by Application, 2018-2022 (USD Million)

Table 148 Spain: Hydrocolloids Market, by Application, 2023-2028 (USD Million)

12.3.7 Rest of Europe

Table 149 Rest of Europe: Hydrocolloids Market, by Application, 2018-2022 (USD Million)

Table 150 Rest of Europe: Hydrocolloids Market, by Application, 2023-2028 (USD Million)

12.4 Asia-Pacific

12.4.1 Recession Impact Analysis

Figure 38 Asia-Pacific Hydrocolloids Market: Recession Impact Analysis

Table 151 Asia-Pacific: Hydrocolloids Market, by Country, 2018-2022 (USD Million)

Table 152 Asia-Pacific: Hydrocolloids Market, by Country, 2023-2028 (USD Million)

Table 153 Asia-Pacific: Hydrocolloids Market, by Type, 2018-2022 (USD Million)

Table 154 Asia-Pacific: Hydrocolloids Market, by Type, 2023-2028 (USD Million)

Table 155 Asia-Pacific: Hydrocolloids Market, by Type, 2018-2022 (Kt)

Table 156 Asia-Pacific: Hydrocolloids Market, by Type, 2023-2028 (Kt)

Table 157 Asia-Pacific: Hydrocolloids Market, by Application, 2018-2022 (USD Million)

Table 158 Asia-Pacific: Hydrocolloids Market, by Application, 2023-2028 (USD Million)

Table 159 Asia-Pacific: Hydrocolloids Market, by Source, 2018-2022 (USD Million)

Table 160 Asia-Pacific: Hydrocolloids Market, by Source, 2023-2028 (USD Million)

Table 161 Asia-Pacific: Hydrocolloids Market, by Function, 2018-2022 (USD Million)

Table 162 Asia-Pacific: Hydrocolloids Market, by Function, 2023-2028 (USD Million)

12.4.2 China

12.4.2.1 Rise in Demand for Healthy Beverages and Dairy Products to Drive Market Growth

Table 163 China: Hydrocolloids Market, by Application, 2018-2022 (USD Million)

Table 164 China: Hydrocolloids Market, by Application, 2023-2028 (USD Million)

12.4.3 Japan

12.4.3.1 Demand for Variety of Japanese Beverages to Drive Market

Table 165 Japan: Hydrocolloids Market, by Application, 2018-2022 (USD Million)

Table 166 Japan: Hydrocolloids Market, by Application, 2023-2028 (USD Million)

12.4.4 Australia & New Zealand

12.4.4.1 Consumption of Beverages to Increase Demand for Different Preservative Manufacturers

Table 167 Australia & New Zealand: Hydrocolloids Market, by Application, 2018-2022 (USD Million)

Table 168 Australia & New Zealand: Hydrocolloids Market, by Application, 2023-2028 (USD Million)

12.4.5 India

12.4.5.1 Increase in Demand for Healthy Processed Food Products to Increase Demand for Hydrocolloids

Table 169 India: Hydrocolloids Market, by Application, 2018-2022 (USD Million)

Table 170 India: Hydrocolloids Market, by Application, 2023-2028 (USD Million)

12.4.6 Rest of Asia-Pacific

Table 171 Rest of Asia-Pacific: Hydrocolloids Market, by Application, 2018-2022 (USD Million)

Table 172 Rest of Asia-Pacific: Hydrocolloids Market, by Application, 2023-2028 (USD Million)

12.5 Rest of the World (RoW)

Figure 39 RoW: Hydrocolloids Market Snapshot

12.5.1 Recession Impact Analysis

Figure 40 RoW Hydrocolloids Market: Recession Impact Analysis

Table 173 RoW: Hydrocolloids Market, by Sub-Region, 2018-2022 (USD Million)

Table 174 RoW: Hydrocolloids Market, by Region, 2023-2028 (USD Million)

Table 175 RoW: Hydrocolloids Market, by Type, 2018-2022 (USD Million)

Table 176 RoW Hydrocolloids Market, by Type, 2023-2028 (USD Million)

Table 177 RoW: Hydrocolloids Market, by Type, 2018-2022 (Kt)

Table 178 RoW: Hydrocolloids Market, by Type, 2023-2028 (Kt)

Table 179 RoW: Hydrocolloids Market, by Application, 2018-2022 (USD Million)

Table 180 RoW: Hydrocolloids Market, by Application, 2023-2028 (USD Million)

Table 181 RoW: Hydrocolloids Market, by Source, 2018-2022 (USD Million)

Table 182 RoW: Hydrocolloids Market, by Source, 2023-2028 (USD Million)

Table 183 RoW: Hydrocolloids Market, by Function, 2018-2022 (USD Million)

Table 184 RoW: Hydrocolloids Market, by Function, 2023-2028 (USD Million)

12.5.2 Middle East & Africa

12.5.2.1 Rising Demand for Nutritional Labeling to Increase Demand for Natural Hydrocolloids

Table 185 Middle East & Africa: Hydrocolloids Market, by Application, 2018-2022 (USD Million)

Table 186 Middle East & Africa: Hydrocolloids Market, by Application, 2023-2028 (USD Million)

12.5.3 South America

12.5.3.1 Gradual Increase in Purchasing Power of Argentinians and Brazilians to Increase Consumption of Convenience Food

Table 187 South America: Hydrocolloids Market, by Application, 2018-2022 (USD Million)

Table 188 South America: Hydrocolloids Market, by Application, 2023-2028 (USD Million)

13 Competitive Landscape

13.1 Overview

13.2 Strategies Adopted by Key Players

Table 189 Strategies Adopted by Key Players in Hydrocolloids Market

13.3 Market Share Analysis

Table 190 Global Hydrocolloids Market: Degree of Competition

13.4 Revenue Share Analysis of Key Players

Figure 41 Revenue Analysis of Key Players, 2019-2021 (USD Billion)

13.5 Company Evaluation Quadrant (Key Players)

13.5.1 Stars

13.5.2 Emerging Leaders

13.5.3 Pervasive Players

13.5.4 Participants

Figure 42 Hydrocolloids Market: Company Evaluation Quadrant, 2021 (Key Players)

13.6 Product Footprint

Table 191 Company Product Footprint, by Application

Table 192 Company Product Footprint, by Region

Table 193 Overall Company Product Footprint

13.7 Startup/SME Evaluation Quadrant (Other Players)

13.7.1 Progressive Companies

13.7.2 Starting Blocks

13.7.3 Responsive Companies

13.7.4 Dynamic Companies

Figure 43 Hydrocolloids Market: Company Evaluation Quadrant, 2021 (Other Players)

13.7.5 Competitive Benchmarking of Other Players

Table 194 Detailed List of Other Players

Table 195 Competitive Benchmarking (Other Players), 2021

13.8 Competitive Scenario

13.8.1 Product Launches

Table 196 Hydrocolloids Market: New Product Launches, 2018-2022

13.8.2 Deals

Table 197 Hydrocolloids Market: Deals, 2018-2022

13.8.3 Others

Table 198 Hydrocolloids Market: Others, 2018-2022

14 Company Profiles

Business Overview, Products/Solutions/Services Offered, Recent Developments, Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, Weakness/Competitive Threats

14.1 Key Players

14.1.1 International Flavors & Fragrances Inc.

Table 199 International Flavors & Fragrances Inc.- Business Overview

Figure 44 International Flavors & Fragrances Inc.: Company Snapshot

Table 200 International Flavors & Fragrances Inc.: Product Launches

Table 201 International Flavors & Fragrances Inc.: Deals

Table 202 International Flavors & Fragrances Inc.: Others

14.1.2 Ingredion

Table 203 Ingredion: Business Overview

Figure 45 Ingredion: Company Snapshot

Table 204 Ingredion: Product Launches

14.1.3 Cargill, Incorporated

Table 205 Cargill, Incorporated: Business Overview

Figure 46 Cargill, Incorporated: Company Snapshot

Table 206 Cargill, Incorporated: Others

14.1.4 Kerry Group PLC

Table 207 Kerry Group PLC: Business Overview

Figure 47 Kerry Group PLC: Company Snapshot

Table 208 Kerry Group PLC: Others

14.1.5 Archer Daniels Midland Company (Adm)

Table 209 Archer Daniels Midland Company - Business Overview

Figure 48 Archer Daniels Midland Company: Company Snapshot

Table 210 Archer Daniels Midland Company: Deals

Table 211 Archer Daniels Midland Company: Others

14.1.6 Darling Ingredients Inc.

Table 212 Darling Ingredients Inc.: Business Overview

Figure 49 Darling Ingredients Inc.: Company Snapshot

Table 213 Darling Ingredients Inc.: New Product Launches

14.1.7 DSM

Table 214 DSM: Business Overview

Figure 50 DSM: Company Snapshot

Table 215 DSM: Product Launches

Table 216 DSM: Others

14.1.8 Ashland

Table 217 Ashland - Business Overview

Figure 51 Ashland: Company Snapshot

14.1.9 Tate & Lyle

Table 218 Tate & Lyle: Business Overview

Figure 52 Tate & Lyle: Company Snapshot

Table 219 Tate & Lyle: Others

14.1.10 Fufeng Group

Table 220 Fufeng Group - Business Overview

Figure 53 Fufeng Group: Company Snapshot

14.1.11 Palsgaard A/S

Table 221 Palsgaard A/S: Business Overview

Table 222 Palsgaard A/S: Deals

Table 223 Palsgaard: Others

14.1.12 Cp Kelco U.S. Inc.

Table 224 Cp Kelco U.S. Inc. - Business Overview

Table 225 Cp Kelco U.S. Inc.: Product Launches

Table 226 Cp Kelco U.S. Inc.: Deals

Table 227 Cp Kelco U.S. Inc.: Others

14.1.13 Nexira

Table 228 Nexira - Business Overview

Table 229 Nexira: Product Launches

Table 230 Nexira: Deals

14.1.14 Deosen Biochemical (Ordos) Ltd.

Table 231 Deosen Biochemical (Ordos) Ltd. - Business Overview

14.1.15 BASF SE

Table 232 BASF SE: Business Overview

Figure 54 BASF SE: Company Snapshot

14.2 Other Players

14.2.1 Est-Agar As

Table 233 Est-Agar as - Business Overview

14.2.2 Exandal Usa Corp.

Table 234 Exandal Usa Corp.- Business Overview

14.2.3 Indian Hydrocolloids

Table 235 Indian Hydrocolloids - Business Overview

14.2.4 Lucid Colloids Ltd.

Table 236 Lucid Colloids Ltd - Business Overview

14.2.5 Sunita Hydrocolloids Pvt Ltd.

Table 237 Sunita Hydrocolloids Pvt Ltd - Business Overview

14.2.6 Bhansali International

14.2.7 B & V Srl

14.2.8 Altrafine Gums

14.2.9 Agarmex

14.2.10 Agar Del Pacifico SA

Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, Weakness/Competitive Threats)* Might Not be Captured in Case of Unlisted Companies.

15 Adjacent and Related Markets

15.1 Introduction

Table 238 Adjacent Markets to Hydrocolloids Market

15.2 Study Limitations

15.3 Food Emulsifiers Market

15.3.1 Market Definition

15.3.2 Market Overview

Table 239 Food Emulsifiers Market Size, by Application, 2020-2025 (USD Million)

15.4 Pectin Market

15.4.1 Market Definition

15.4.2 Market Overview

Table 240 Pectin Market Size, by Type, 2017-2025 (USD Million)

16 Appendix

16.1 Discussion Guide

16.2 Knowledgestore: The Subscription Portal

16.3 Customization Options

Companies Mentioned

- Agar Del Pacifico SA

- Agarmex

- Altrafine Gums

- Archer Daniels Midland Company (Adm)

- Ashland

- B & V Srl

- BASF SE

- Bhansali International

- Cargill, Incorporated

- Cp Kelco U.S. Inc.

- Darling Ingredients Inc.

- Deosen Biochemical (Ordos) Ltd.

- DSM

- Est-Agar As

- Exandal Usa Corp.

- Fufeng Group

- Indian Hydrocolloids

- Ingredion

- International Flavors & Fragrances Inc.

- Kerry Group PLC

- Lucid Colloids Ltd.

- Nexira

- Palsgaard A/S

- Sunita Hydrocolloids Pvt Ltd.

- Tate & Lyle

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 259 |

| Published | March 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 11.2 Billion |

| Forecasted Market Value ( USD | $ 14.5 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |