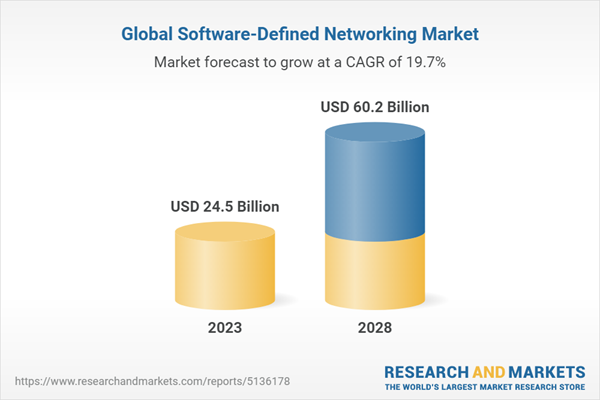

The global Software-Defined Networking market is expected to grow from USD 24.5 billion in 2023 to USD 60.2 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 19.7% during the forecast period. The exponential growth of data traffic and the proliferation of cloud-based services are driving the need for more agile and scalable network infrastructures. SDN offers a solution by enabling automated provisioning, efficient resource allocation, dynamic traffic management, enhancing network performance and adaptability.

Among offering, services segment to grow at the highest CAGR during the forecast period

As businesses increasingly rely on digital technologies and data-driven operations, the demand for SDN services continues to expand. The growing demand for expert guidance and integration services in the implementation of SDN solutions within existing infrastructures will also drive the market.

Among the SDN Type, the Open SDN segment holds the highest market share during the forecast period

The key driver for open SDN is vendor neutrality and interoperability. Open SDN solutions adhere to open standards, ensuring compatibility between various vendors’ hardware and software components. This vendor-agnostic approach gives businesses the freedom to choose the best-of-breed solutions without being locked into a single vendor. The emphasis on interoperability promotes healthy competition, fosters innovation, and prevents vendor monopolies, making it an attractive choice for industries seeking flexibility and innovation in their network infrastructure.

Among regions, Asia-Pacific is to hold a higher CAGR during the forecast period

Several global players of SDN have foreseen Asia-Pacific as a major strategy-impacting region due to its strong spending capabilities in the IT infrastructure. SDN is a significant paradigm shift in networking technology. There is a growing trend of SMEs adopting SDN technologies in Asia-Pacific, leading to economic benefits and driving prosperity.

Breakdown of Primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the smart water management market.

- By Company: Tier I: 60%, Tier II: 25%, and Tier III: 15%

- By Designation: C-Level Executives: 48%, Directors: 28%, and others: 24%

- By Region: North America: 35%, Europe: 28%, Asia-Pacific: 23%, and Rest of the World: 14%

The report includes studying key players offering SDN, solutions, and services. It profiles major vendors in the global SDN market. The major vendors in the global SDN market include Cisco (US), Huawei (China), VMWare (US), Dell EMC (US), Juniper Networks (US), IBM (US), Ericsson (Sweden), Ciena (US), HPE (US), Nokia (Finland), Arista Networks (US), Extreme Networks (US), Comcast (US), Citrix (US), NEC (Japan), Oracle (US), Palo Alto Networks (US), NVIDIA (US), Fortinet (US), Fujitsu (Japan), HiveIO (US), Lenovo (Hong Kong), Pica8 (US), Scale Computing (US), Canopus Networks (Australia), Zeetta Networks (UK), Trustgrid (US), and COSGrid Networks (India).

Research Coverage

The market study covers the SDN market across segments. It aims at estimating the market size and the growth potential across different segments, such as offering, SDN Type, application, end-user, vertical and region. It includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report would help the market leaders and new entrants in the following ways:

- It comprehensively segments the SDN market and provides the closest approximations of the revenue numbers for the overall market and its subsegments across different regions.

- It would help stakeholders understand the market’s pulse and provide information on the key market drivers, restraints, challenges, and opportunities.

- It would help stakeholders understand their competitors better and gain more insights to enhance their positions in the market. The competitive landscape includes a competitor ecosystem, new service developments, partnerships, and mergers and acquisitions.

The report provides insights on the following pointers:

- Analysis of key drivers (Need to simplify network management, need to optimize CAPEX and reduce OPEX, rising demand for cloud services, data centre consolidation, and server virtualization, increasing need for enterprise mobility to enhance productivity for field-based services) restraints (Increasing security concerns, lack of skilled workforce) opportunities (growing adoption of IoT, rising implementation of SDN for 5G, increasing demand for hybrid clouds) challenges (difficulties in transitioning from traditional network to SDN, reliability concerns for SDN network) influencing the growth of the SDN market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in SDN market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the SDN market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the SDN market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, offerings of leading Cisco (US), Huawei (China), VMWare (US), Dell EMC (US), Juniper Networks (US), IBM (US), Ericsson (Sweden), Ciena (US), HPE (US), Nokia (Finland), Arista Networks (US), Extreme Networks (US), Comcast (US), Citrix (US), NEC (Japan), Oracle (US), Palo Alto Networks (US), NVIDIA (US), Fortinet (US), Fujitsu (Japan), HiveIO (US), Lenovo (Hong Kong), Pica8 (US), Scale Computing (US), Canopus Networks (Australia), Zeetta Networks (UK), Trustgrid (US), and COSGrid Networks (India).

Table of Contents

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered

1.4 Currency Considered

1.4.1 USD Exchange Rates, 2020-2022

1.5 Inclusions and Exclusions

1.6 Stakeholders

1.7 Impact of Recession

1.8 Summary of Changes

Figure 1 Software-Defined Networking Market: Research Design

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

Figure 2 Data Triangulation

2.3 Market Size Estimation

Figure 3 Market Size Estimation Methodology - Approach 1 (Supply Side): Revenue of Offerings of Software-Defined Networking Market

Figure 4 Market Size Estimation Methodology - Approach 2 (Demand Side): Software-Defined Networking Market

2.3.1 Bottom-Up Approach

Figure 5 Bottom-Up Approach

Figure 6 Market Size Estimation Using Bottom-Up Approach

2.3.2 Top-Down Approach

Figure 7 Top-Down Approach

2.4 Market Forecast

Table 1 Factor Analysis

2.5 Research Assumptions

Table 2 Research Assumptions

2.6 Recession Impact on Software-Defined Networking Market

Figure 9 Implementation Segment to Dominate Market in 2023

Figure 10 SD-WAN Segment to Lead Market in 2023

Figure 11 BFSI Segment to Have Largest Market Size in 2023

Figure 12 North America to Account for Largest Market Share in 2023

Figure 13 Increasing Adoption of Cloud Services and Growth of Data Centers to Drive Market

4.2 Software-Defined Networking Market, by Vertical

Figure 14 BFSI Segment to Lead Market During Forecast Period

4.3 Software-Defined Networking Market, by Offering and Vertical

Figure 15 Software and BFSI Segments to Lead Market in 2023

4.4 Software-Defined Networking Market, by Region

Figure 16 North America to Dominate Market in 2023

Figure 17 Software-Defined Networking Market: Drivers, Restraints, Opportunities, and Challenges

5.1.1 Drivers

5.1.1.1 Need to Simplify Network Management

5.1.1.2 Need to Optimize CapEx and Reduce OpEx

5.1.1.3 Rising Demand for Cloud Services, Data Center Consolidation, and Server Virtualization

5.1.1.4 Increasing Need for Enterprise Mobility to Enhance Productivity for Field-based Services

5.1.2 Restraints

5.1.2.1 Increasing Security Concerns

5.1.2.2 Lack of Skilled Workforce

5.1.3 Opportunities

5.1.3.1 Growing Adoption of IoT

5.1.3.2 Rising Implementation of SDN for 5G

5.1.3.3 Increasing Demand for Hybrid Clouds

5.1.3.4 Development of Open-Source SDN

5.1.4 Challenges

5.1.4.1 Difficulties in Transitioning from Traditional Network to SDN

5.1.4.2 Reliability Concerns for SDN Network

5.2 Software-Defined Networking Market: Evolution

Figure 18 Evolution of Software-Defined Networking Market

5.3 Software-Defined Networking Market: Ecosystem Map

Figure 19 Software-Defined Networking Market: Ecosystem Map

Table 3 Software-Defined Networking Market: Ecosystem Map

5.4 Use Case Analysis

5.4.1 Use Case 1: Cisco Improved Network Segmentation for German Automotive Group

5.4.2 Use Case 2: Juniper Accelerated Activation of Ebay Classifieds Group's Business Platforms

5.4.3 Use Case 3: NEC Helped Kanazawa University Hospital Keep Pace with Rapid Developments Occurring in Clinical Medicine

5.4.4 Use Case 4: HPE Helped Deltion College Drive Growth and Comply with Changing Regulations

5.4.5 Use Case 5: Huawei Helped Lincoln University Increase Wired Access Bandwidth by Ten Times

5.5 Industry Standards

5.5.1 Open Networking Foundation

5.5.2 Internet Engineering Task Force

5.5.3 Opendaylight

5.5.4 International Telecommunication Union - Telecommunication Standardization Sector

5.5.5 Internet Research Task Force Software-Defined Networking Research Group

5.5.6 Open Virtualization Format

5.5.7 Organization for the Advancement of Structured Information Standards

5.5.8 European Telecommunications Standards Institute/ Industry Specification Group - Network Function Virtualization

5.6 Technology Analysis

5.6.1 Key Technologies

5.6.1.1 Artificial Intelligence (AI) and Machine Learning (ML)

5.6.1.2 5G

5.6.1.3 Edge Computing

5.6.2 Complementary Technologies

5.6.2.1 Software-Defined Wide Area Networking (SD-WAN)

5.6.2.2 Network Functions Virtualization (NFV)

5.6.3 Adjacent Technologies

5.6.3.1 Intent-based Networking (IBN)

5.6.3.2 Blockchain

5.6.3.3 Containerization and Microservices

5.7 Value Chain Analysis

Figure 20 Value Chain Analysis

5.8 Porter's Five Forces Analysis

Figure 21 Software-Defined Networking Market: Porter's Five Forces Analysis

Table 4 Software-Defined Networking Market: Porter's Five Forces Analysis

5.8.1 Intensity of Competitive Rivalry

5.8.2 Threat of New Entrants

5.8.3 Bargaining Power of Buyers

5.8.4 Bargaining Power of Suppliers

5.8.5 Threat of Substitutes

5.9 Pricing Analysis

5.9.1 Average Selling Price Trend of Key Players, by Offering

Figure 22 Average Selling Price Trend of Key Players, by Offering

5.9.2 Indicative Pricing of Key Offerings

Table 5 Pricing Analysis

5.10 Patent Analysis

5.10.1 Methodology

5.10.2 Document Type

Table 6 Patents Filed, 2013-2023

5.10.3 Innovations and Patent Applications

Figure 23 List of Major Patents for Software-Defined Networking Market

Table 7 List of Major Patents in Software-Defined Networking Market, 2021-2023

5.11 Trade Analysis

5.11.1 Export Scenario of Network Devices

Figure 24 Network Devices Export, by Key Country, 2015-2022 (USD Million)

5.11.2 Import Scenario of Network Devices

Figure 25 Network Devices Import, by Key Country, 2015-2022 (USD Million)

5.12 Key Conferences and Events

Table 8 Software-Defined Networking Market: List of Conferences and Events in 2023-2024

5.13 Tariff and Regulatory Landscape

5.13.1 Tariff Related to Network Devices

Table 9 Tariff Related to Network Devices

5.13.2 Regulatory Bodies, Government Agencies, and Other Organizations

Table 10 North America: Regulatory Bodies, Government Agencies, and Other Organizations

Table 11 Europe: Regulatory Bodies, Government Agencies, and Other Organizations

Table 12 Asia-Pacific: Regulatory Bodies, Government Agencies, and Other Organizations

Table 13 Rest of the World: Regulatory Bodies, Government Agencies, and Other Organizations

5.13.3 Regulations in Software-Defined Networking Market

5.13.3.1 North America

5.13.3.1.1 US

5.13.3.1.2 Canada

5.13.3.2 Europe

5.13.3.3 Asia-Pacific

5.13.3.3.1 South Korea

5.13.3.3.2 China

5.13.3.4 Middle East & Africa

5.13.3.4.1 UAE

5.13.3.4.2 Saudi Arabia

5.13.3.5 Latin America

5.13.3.5.1 Brazil

5.13.3.5.2 Mexico

5.14 Trends and Disruptions Impacting Customer Business

Figure 26 Software-Defined Networking Market: Trends and Disruptions Impacting Customer Business

5.15 Key Stakeholders and Buying Criteria

5.15.1 Key Stakeholders in Buying Process

Figure 27 Influence of Stakeholders on Buying Process for Top 3 Verticals

Table 14 Influence of Stakeholders on Buying Process for Top 3 Verticals (%)

5.15.2 Buying Criteria

Figure 28 Key Buying Criteria for Top 3 Verticals

Table 15 Key Buying Criteria for Top 3 Verticals

5.16 Best Practices in Software-Defined Networking Market

5.16.1 Comprehensive Network Assessment

5.16.2 Appropriate SDN Architecture

5.16.3 Open Standards and Interoperability

5.16.4 Network Segmentation and Virtualization

5.16.5 Automation and Orchestration

5.17 Technology Roadmap of Software-Defined Networking Market

Table 16 Technology Roadmap of Software-Defined Networking Market, 2023-2030

5.18 Business Models of Software-Defined Networking Market

Figure 29 Business Models of Software-Defined Networking Market

5.19 Pillars/Principles of Software-Defined Networking

5.19.1 Centralized Control and Programmability

5.19.2 Separation of Control Plane and Data Plane

5.19.3 Abstraction and Virtualization

5.19.4 Programmatic Network Configuration

5.19.5 Open Standards and APIs

5.19.6 Network Intelligence Through Analytics

5.19.7 Policy-Driven Management

5.19.8 Vendor-Neutrality and Interoperability

6.1.1 Offering: Software-Defined Networking Market Drivers

Figure 30 Software Segment to Account for Largest Market Size During Forecast Period

Table 17 Software-Defined Networking Market, by Offering, 2018-2022 (USD Million)

Table 18 Software-Defined Networking Market, by Offering, 2023-2028 (USD Million)

6.2 SDN Infrastructure

6.2.1 Need for Improved Network and Efficient Resource Utilization to Drive Market

6.2.2 Applications

6.2.3 Controllers

6.2.4 Networking Devices

Table 19 SDN Infrastructure: Software-Defined Networking Market, by Region, 2018-2022 (USD Million)

Table 20 SDN Infrastructure: Software-Defined Networking Market, by Region, 2023-2028 (USD Million)

6.3 Software

6.3.1 Need to Simplify Management of Complex Networks to Drive Market

Table 21 Software: Software-Defined Networking Market, by Region, 2018-2022 (USD Million)

Table 22 Software: Software-Defined Networking Market, by Region, 2023-2028 (USD Million)

6.4 Services

6.4.1 Need to Implement, Manage, and Optimize SDN-Enabled Networks to Drive Market

Table 23 Services: Software-Defined Networking Market, by Region, 2018-2022 (USD Million)

Table 24 Services: Software-Defined Networking Market, by Region, 2023-2028 (USD Million)

Table 25 Services: Software-Defined Networking Market, by Type, 2018-2022 (USD Million)

Table 26 Services: Software-Defined Networking Market, by Type, 2023-2028 (USD Million)

6.4.2 Consulting

Table 27 Consulting Market, by Region, 2018-2022 (USD Million)

Table 28 Consulting Market, by Region, 2023-2028 (USD Million)

6.4.3 Implementation

Table 29 Implementation Market, by Region, 2018-2022 (USD Million)

Table 30 Implementation Market, by Region, 2023-2028 (USD Million)

6.4.4 Training and Support

Table 31 Training and Support Market, by Region, 2018-2022 (USD Million)

Table 32 Training and Support Market, by Region, 2023-2028 (USD Million)

7.1.1 SDN Type: Software-Defined Networking Market Drivers

Figure 31 Hybrid SDN Segment to Register Highest CAGR During Forecast Period

Table 33 Software-Defined Networking Market, by SDN Type, 2018-2022 (USD Million)

Table 34 Software-Defined Networking Market, by SDN Type, 2023-2028 (USD Million)

7.2 Open SDN

7.2.1 Rising Popularity of Data Centers and Large-Scale Cloud Networks to Drive Market

Table 35 Open SDN: Software-Defined Networking Market, by Region, 2018-2022 (USD Million)

Table 36 Open SDN: Software-Defined Networking Market, by Region, 2023-2028 (USD Million)

7.3 SDN Via API

7.3.1 Growing Need to Automate Network Provisioning Processes to Drive Market

Table 37 SDN Via API: Software-Defined Networking Market, by Region, 2018-2022 (USD Million)

Table 38 SDN Via API: Software-Defined Networking Market, by Region, 2023-2028 (USD Million)

7.4 SDN Via Overlay

7.4.1 Increasing Demand for Greater Network Agility, Scalability, and Security to Drive Market

Table 39 SDN Via Overlay: Software-Defined Networking Market, by Region, 2018-2022 (USD Million)

Table 40 SDN Via Overlay: Software-Defined Networking Market, by Region, 2023-2028 (USD Million)

7.5 Hybrid SDN

7.5.1 Growing Need to Accommodate Legacy Systems and Manage Complex Networks to Drive Market

Table 41 Hybrid SDN: Software-Defined Networking Market, by Region, 2018-2022 (USD Million)

Table 42 Hybrid SDN: Software-Defined Networking Market, by Region, 2023-2028 (USD Million)

8.1.1 End-user: Software-Defined Networking Market Drivers

Figure 32 Enterprises Segment to Lead Market During Forecast Period

Table 43 Software-Defined Networking Market, by End-user, 2018-2022 (USD Million)

Table 44 Software-Defined Networking Market, by End-user, 2023-2028 (USD Million)

8.2 Telecommunication Service Providers

8.2.1 Rising Demand for High-Speed Internet, Mobile Connectivity, and Innovative Services to Drive Market

Table 45 Telecommunication Service Providers: Software-Defined Networking Market, by Region, 2018-2022 (USD Million)

Table 46 Telecommunication Service Providers: Software-Defined Networking Market, by Region, 2023-2028 (USD Million)

8.3 Cloud Service Providers

8.3.1 Increasing Need to Create Agile and Adaptive Network Infrastructures to Drive Market

Table 47 Cloud Service Providers: Software-Defined Networking Market, by Region, 2018-2022 (USD Million)

Table 48 Cloud Service Providers: Software-Defined Networking Market, by Region, 2023-2028 (USD Million)

8.4 Enterprises

8.4.1 Growing Demand for Robust and Secure Networks to Drive Market

Table 49 Enterprises: Software-Defined Networking Market, by Region, 2018-2022 (USD Million)

Table 50 Enterprises: Software-Defined Networking Market, by Region, 2023-2028 (USD Million)

9.1.1 Application: Software-Defined Networking Market Drivers

Figure 33 SD-WAN Segment to Lead Market During Forecast Period

Table 51 Software-Defined Networking Market, by Application, 2018-2022 (USD Million)

Table 52 Software-Defined Networking Market, by Application, 2023-2028 (USD Million)

9.2 Software-Defined Wide Area Networking (SD-WAN)

9.2.1 Increasing Need for Seamless Connectivity and Enhanced User Experience to Drive Market

Table 53 SD-WAN: Software-Defined Networking Market, by Region, 2018-2022 (USD Million)

Table 54 SD-WAN: Software-Defined Networking Market, by Region, 2023-2028 (USD Million)

9.3 Software-Defined Local Area Networking (SD-LAN)

9.3.1 Growing Demand from Businesses to Transform Lan Infrastructures into Agile and Responsive Networks to Drive Market

Table 55 SD-LAN: Software-Defined Networking Market, by Region, 2018-2022 (USD Million)

Table 56 SD-LAN: Software-Defined Networking Market, by Region, 2023-2028 (USD Million)

9.4 Security Applications

9.4.1 Rising Need to Enhance Network Security Through Intelligent and Dynamic Policies to Drive Market

Table 57 Security Applications: Software-Defined Networking Market, by Region, 2018-2022 (USD Million)

Table 58 Security Applications: Software-Defined Networking Market, by Region, 2023-2028 (USD Million)

9.5 Other Applications

Table 59 Other Applications: Software-Defined Networking Market, by Region, 2018-2022 (USD Million)

Table 60 Other Applications: Software-Defined Networking Market, by Region, 2023-2028 (USD Million)

10.1.1 Vertical: Software-Defined Networking Market Drivers

Figure 34 Banking, Financial Services, and Insurance Segment to Hold Largest Market Size During Forecast Period

Table 61 Software-Defined Networking Market, by Vertical, 2018-2022 (USD Million)

Table 62 Software-Defined Networking Market, by Vertical, 2023-2028 (USD Million)

10.2 Banking, Financial Services, and Insurance

10.2.1 Growing Demand for Enhanced User Experience and Simplified Network Operations for Diverse BFSI Services to Drive Market

10.2.2 Banking, Financial Services, and Insurance: Software-Defined Networking Market Use Cases

10.2.2.1 Network Security Enhancement

10.2.2.2 Fraud Detection and Prevention

10.2.2.3 High-Frequency Trading (HFT) Networks

10.2.2.4 Branch Network Optimization

10.2.2.5 Disaster Recovery and Business Continuity

10.2.2.6 Cloud Banking and Virtualization

10.2.2.7 ATM and Point of Sale (PoS) Networks

10.2.2.8 Customer Experience Optimization

10.2.2.9 Regulatory Compliance and Reporting

Table 63 Banking, Financial Services, and Insurance: Software-Defined Networking Market, by Region, 2018-2022 (USD Million)

Table 64 Banking, Financial Services, and Insurance: Software-Defined Networking Market, by Region, 2023-2028 (USD Million)

10.3 Healthcare

10.3.1 Rising Adoption of Disruptive and Patient-Centric Technologies to Drive Market

10.3.2 Healthcare: Software-Defined Networking Market Use Cases

10.3.2.1 Telemedicine and Remote Patient Monitoring

10.3.2.2 Unified Communications and Collaboration

10.3.2.3 Secure Access Control and Compliance

10.3.2.4 Medical IoT Device Management

10.3.2.5 Clinical Workflow Optimization

10.3.2.6 Disaster Recovery and Redundancy

10.3.2.7 Virtual Health Networks for Remote Locations

10.3.2.8 Hospital Campus Network Optimization

Table 65 Healthcare: Software-Defined Networking Market, by Region, 2018-2022 (USD Million)

Table 66 Healthcare: Software-Defined Networking Market, by Region, 2023-2028 (USD Million)

10.4 Retail & E-Commerce

10.4.1 Growing Demand for Optimized Network Traffic and Fast and Reliable Online Transactions to Drive Market

10.4.2 Retail & E-Commerce: Software-Defined Networking Market Use Cases

10.4.2.1 Dynamic Inventory Management

10.4.2.2 Optimized Supply Chain and Logistics

10.4.2.3 Enhanced In-Store Customer Experience

10.4.2.4 Secure Payment Processing

10.4.2.5 Virtual Queues and Customer Engagement

10.4.2.6 E-Commerce Website Scalability

10.4.2.7 Optimized Wi-Fi and In-Store Connectivity

10.4.2.8 Smart Warehousing and Fulfillment Centers

10.4.2.9 Multi-Cloud Management for E-Commerce Platforms

10.4.2.10 Augmented Reality (AR) Shopping Experiences

Table 67 Retail & E-Commerce: Software-Defined Networking Market, by Region, 2018-2022 (USD Million)

Table 68 Retail & E-Commerce: Software-Defined Networking Market, by Region, 2023-2028 (USD Million)

10.5 Manufacturing

10.5.1 Increasing Use of Industrial Internet of Things (IIoT) to Drive Market

10.5.2 Manufacturing: Software-Defined Networking Market Use Cases

10.5.2.1 Industrial IoT (IIoT) Connectivity and Data Management

10.5.2.2 Factory Automation and Robotics

10.5.2.3 Quality Control and Monitoring

10.5.2.4 Supply Chain Optimization

10.5.2.5 Secure Manufacturing Networks

Table 69 Manufacturing: Software-Defined Networking Market, by Region, 2018-2022 (USD Million)

Table 70 Manufacturing: Software-Defined Networking Market, by Region, 2023-2028 (USD Million)

10.6 Government & Defense

10.6.1 Increasing Demand for Upgrading Existing Network Infrastructures to Drive Market

10.6.2 Government & Defense: Software-Defined Networking Market Use Cases

10.6.2.1 Secure Communication Networks

10.6.2.2 Secure Remote Access and Mobile Connectivity

10.6.2.3 Disaster Recovery and Continuity of Operations (Coop)

Table 71 Government & Defense: Software-Defined Networking Market, by Region, 2018-2022 (USD Million)

Table 72 Government & Defense: Software-Defined Networking Market, by Region, 2023-2028 (USD Million)

10.7 Education

10.7.1 Growing Digital Transformation Across Education Sector to Drive Market

10.7.2 Education: Software-Defined Networking Market Use Cases

10.7.2.1 Enhanced Campus Network Management

10.7.2.2 Virtual Learning Environments

10.7.2.3 Scalable and Flexible Network Infrastructure

10.7.2.4 Secure Access Control and BYOD Policies

10.7.2.5 Optimized Content Delivery

10.7.2.6 Campus Safety and Emergency Response

Table 73 Education: Software-Defined Networking Market, by Region, 2018-2022 (USD Million)

Table 74 Education: Software-Defined Networking Market, by Region, 2023-2028 (USD Million)

10.8 Telecom

10.8.1 Need to Accelerate Deployment of Emerging Technologies to Drive Market

10.8.2 Telecom: Software-Defined Networking Market Use Cases

10.8.2.1 Network Functions Virtualization (NFV)

10.8.2.2 5G Network Slicing

10.8.2.3 Centralized Network Control

10.8.2.4 Dynamic Bandwidth Allocation

10.8.2.5 Traffic Engineering and Optimization

10.8.2.6 Virtual Customer Premises Equipment (VCPE)

Table 75 Telecom: Software-Defined Networking Market, by Region, 2018-2022 (USD Million)

Table 76 Telecom: Software-Defined Networking Market, by Region, 2023-2028 (USD Million)

10.9 Information Technology-Enabled Services

10.9.1 Growing Demand for Enhanced Network Security, Scalability, and Automation to Drive Market

10.9.2 ITeS: Software-Defined Networking Market Use Cases

10.9.2.1 Virtual Private Networks (VPNs) for Remote Teams

10.9.2.2 Multi-Tenant Environments

10.9.2.3 Cloud Connectivity and Hybrid Cloud Adoption

10.9.2.4 Quality of Service (QoS) for Multimedia Services

10.9.2.5 Dynamic Scalability for Peak Loads

10.9.2.6 Efficient Data Center Management

10.9.2.7 Cybersecurity and Threat Mitigation

10.9.2.8 Application Performance Optimization

10.9.2.9 Compliance and Data Governance

Table 77 Information Technology-Enabled Services: Software-Defined Networking Market, by Region, 2018-2022 (USD Million)

Table 78 Information Technology-Enabled Services: Software-Defined Networking Market, by Region, 2023-2028 (USD Million)

10.10 Other Verticals

Table 79 Other Verticals: Software-Defined Networking Market, by Region, 2018-2022 (USD Million)

Table 80 Other Verticals: Software-Defined Networking Market, by Region, 2023-2028 (USD Million)

Table 81 Software-Defined Networking Market, by Region, 2018-2022 (USD Million)

Table 82 Software-Defined Networking Market, by Region, 2023-2028 (USD Million)

Figure 35 Asia-Pacific to Exhibit Highest Growth Rate During Forecast Period

11.2 North America

11.2.1 North America: Recession Impact

11.2.2 North America: Software-Defined Networking Market Drivers

Figure 36 North America: Software-Defined Networking Market Snapshot

Table 83 North America: Software-Defined Networking Market, by Offering, 2018-2022 (USD Million)

Table 84 North America: Software-Defined Networking Market, by Offering, 2023-2028 (USD Million)

Table 85 North America: Software-Defined Networking Market for Services, by Type, 2018-2022 (USD Million)

Table 86 North America: Software-Defined Networking Market for Services, by Type, 2023-2028 (USD Million)

Table 87 North America: Software-Defined Networking Market, by SDN Type, 2018-2022 (USD Million)

Table 88 North America: Software-Defined Networking Market, by SDN Type, 2023-2028 (USD Million)

Table 89 North America: Software-Defined Networking Market, by End-user, 2018-2022 (USD Million)

Table 90 North America: Software-Defined Networking Market, by End-user, 2023-2028 (USD Million)

Table 91 North America: Software-Defined Networking Market, by Application, 2018-2022 (USD Million)

Table 92 North America: Software-Defined Networking Market, by Application, 2023-2028 (USD Million)

Table 93 North America: Software-Defined Networking Market, by Vertical, 2018-2022 (USD Million)

Table 94 North America: Software-Defined Networking Market, by Vertical, 2023-2028 (USD Million)

Table 95 North America: Software-Defined Networking Market, by Country, 2018-2022 (USD Million)

Table 96 North America: Software-Defined Networking Market, by Country, 2023-2028 (USD Million)

11.2.3 US

11.2.3.1 Increasing Government Initiatives Toward Infrastructure Development to Drive Market

Table 97 US: Software-Defined Networking Market, by Offering, 2018-2022 (USD Million)

Table 98 US: Software-Defined Networking Market, by Offering, 2023-2028 (USD Million)

Table 99 US: Software-Defined Networking Market for Services, by Type, 2018-2022 (USD Million)

Table 100 US: Software-Defined Networking Market for Services, by Type, 2023-2028 (USD Million)

Table 101 US: Software-Defined Networking Market, by SDN Type, 2018-2022 (USD Million)

Table 102 US: Software-Defined Networking Market, by SDN Type, 2023-2028 (USD Million)

Table 103 US: Software-Defined Networking Market, by End-user, 2018-2022 (USD Million)

Table 104 US: Software-Defined Networking Market, by End-user, 2023-2028 (USD Million)

Table 105 US: Software-Defined Networking Market, by Application, 2018-2022 (USD Million)

Table 106 US: Software-Defined Networking Market, by Application, 2023-2028 (USD Million)

11.2.4 Canada

11.2.4.1 Rising Need to Monitor Increasing Traffic to Drive Market

Table 107 Canada: Software-Defined Networking Market, by Offering, 2018-2022 (USD Million)

Table 108 Canada: Software-Defined Networking Market, by Offering, 2023-2028 (USD Million)

Table 109 Canada: Software-Defined Networking Market for Services, by Type, 2018-2022 (USD Million)

Table 110 Canada Software-Defined Networking Market for Services, by Type, 2023-2028 (USD Million)

Table 111 Canada: Software-Defined Networking Market, by SDN Type, 2018-2022 (USD Million)

Table 112 Canada: Software-Defined Networking Market, by SDN Type, 2023-2028 (USD Million)

Table 113 Canada: Software-Defined Networking Market, by End-user, 2018-2022 (USD Million)

Table 114 Canada: Software-Defined Networking Market, by End-user, 2023-2028 (USD Million)

Table 115 Canada: Software-Defined Networking Market, by Application, 2018-2022 (USD Million)

Table 116 Canada: Software-Defined Networking Market, by Application, 2023-2028 (USD Million)

11.3 Europe

11.3.1 Europe: Recession Impact

11.3.2 Europe: Software-Defined Networking Market Drivers

Table 117 Europe: Software-Defined Networking Market, by Offering, 2018-2022 (USD Million)

Table 118 Europe: Software-Defined Networking Market, by Offering, 2023-2028 (USD Million)

Table 119 Europe: Software-Defined Networking Market for Services, by Type, 2018-2022 (USD Million)

Table 120 Europe: Software-Defined Networking Market for Services, by Type, 2023-2028 (USD Million)

Table 121 Europe: Software-Defined Networking Market, by SDN Type, 2018-2022 (USD Million)

Table 122 Europe: Software-Defined Networking Market, by SDN Type, 2023-2028 (USD Million)

Table 123 Europe: Software-Defined Networking Market, by End-user, 2018-2022 (USD Million)

Table 124 Europe: Software-Defined Networking Market, by End-user, 2023-2028 (USD Million)

Table 125 Europe: Software-Defined Networking Market, by Application, 2018-2022 (USD Million)

Table 126 Europe: Software-Defined Networking Market, by Application, 2023-2028 (USD Million)

Table 127 Europe: Software-Defined Networking Market, by Vertical, 2018-2022 (USD Million)

Table 128 Europe: Software-Defined Networking Market, by Vertical, 2023-2028 (USD Million)

Table 129 Europe: Software-Defined Networking Market, by Country, 2018-2022 (USD Million)

Table 130 Europe: Software-Defined Networking Market, by Country, 2023-2028 (USD Million)

11.3.3 UK

11.3.3.1 Government Initiatives to Promote Regulatory Compliance to Drive Market

Table 131 UK: Software-Defined Networking Market, by Offering, 2018-2022 (USD Million)

Table 132 UK: Software-Defined Networking Market, by Offering, 2023-2028 (USD Million)

Table 133 UK: Software-Defined Networking Market for Services, by Type, 2018-2022 (USD Million)

Table 134 UK: Software-Defined Networking Market for Services, by Type, 2023-2028 (USD Million)

Table 135 UK: Software-Defined Networking Market, by SDN Type, 2018-2022 (USD Million)

Table 136 UK: Software-Defined Networking Market, by SDN Type, 2023-2028 (USD Million)

Table 137 UK: Software-Defined Networking Market, by End-user, 2018-2022 (USD Million)

Table 138 UK: Software-Defined Networking Market, by End-user 2023-2028 (USD Million)

Table 139 UK: Software-Defined Networking Market, by Application, 2018-2022 (USD Million)

Table 140 UK: Software-Defined Networking Market, by Application, 2023-2028 (USD Million)

11.3.4 Germany

11.3.4.1 Growth in Connectivity Domain to Drive Market

11.3.5 France

11.3.5.1 Growing IT and Telecommunications Sector to Drive Market

11.3.6 Italy

11.3.6.1 Developments in Telecom Infrastructure to Drive Market

11.3.7 Spain

11.3.7.1 Increasing Government Focus on Digitization to Drive Market

11.3.8 Nordic Countries

11.3.8.1 Increased Collaborations and Investments to Drive Market

11.3.9 Rest of Europe

11.4 Asia-Pacific

11.4.1 Asia-Pacific: Recession Impact

11.4.2 Asia-Pacific: Software-Defined Networking Market Drivers

Figure 37 Asia-Pacific: Software-Defined Networking Market Snapshot

Table 141 Asia-Pacific: Software-Defined Networking Market, by Offering, 2018-2022 (USD Million)

Table 142 Asia-Pacific: Software-Defined Networking Market, by Offering, 2023-2028 (USD Million)

Table 143 Asia-Pacific: Software-Defined Networking Market for Services, by Type, 2018-2022 (USD Million)

Table 144 Asia-Pacific: Software-Defined Networking Market for Services, by Type, 2023-2028 (USD Million)

Table 145 Asia-Pacific: Software-Defined Networking Market, by SDN Type, 2018-2022 (USD Million)

Table 146 Asia-Pacific: Software-Defined Networking Market, by SDN Type, 2023-2028 (USD Million)

Table 147 Asia-Pacific: Software-Defined Networking Market, by End-user, 2018-2022 (USD Million)

Table 148 Asia-Pacific: Software-Defined Networking Market, by End-user, 2023-2028 (USD Million)

Table 149 Asia-Pacific: Software-Defined Networking Market, by Application, 2018-2022 (USD Million)

Table 150 Asia-Pacific: Software-Defined Networking Market, by Application, 2023-2028 (USD Million)

Table 151 Asia-Pacific: Software-Defined Networking Market, by Vertical, 2018-2022 (USD Million)

Table 152 Asia-Pacific: Software-Defined Networking Market, by Vertical, 2023-2028 (USD Million)

Table 153 Asia-Pacific: Software-Defined Networking Market, by Country, 2018-2022 (USD Million)

Table 154 Asia-Pacific: Software-Defined Networking Market, by Country, 2023-2028 (USD Million)

11.4.3 China

11.4.3.1 Shift Toward IoT, Cloud, and AI Technologies to Drive Market

Table 155 China: Software-Defined Networking Market, by Offering, 2018-2022 (USD Million)

Table 156 China: Software-Defined Networking Market, by Offering, 2023-2028 (USD Million)

Table 157 China: Software-Defined Networking Market for Services, by Type, 2018-2022 (USD Million)

Table 158 China: Software-Defined Networking Market for Services, by Type, 2023-2028 (USD Million)

Table 159 China: Software-Defined Networking Market, by SDN Type, 2018-2022 (USD Million)

Table 160 China: Software-Defined Networking Market, by SDN Type, 2023-2028 (USD Million)

Table 161 China: Software-Defined Networking Market, by End-user, 2018-2022 (USD Million)

Table 162 China: Software-Defined Networking Market, by End-user, 2023-2028 (USD Million)

Table 163 China: Software-Defined Networking Market, by Application, 2018-2022 (USD Million)

Table 164 China: Software-Defined Networking Market, by Application, 2023-2028 (USD Million)

11.4.4 Japan

11.4.4.1 Transformative Developments in Networking Technology to Drive Market

11.4.5 Australia and New Zealand

11.4.5.1 Strong Focus on Simplification of Network and Reduction in Operational Expenses to Drive Market

11.4.6 India

11.4.6.1 Government Initiatives to Leverage Benefits of Disruptive Technologies to Drive Market

11.4.7 South Korea

11.4.7.1 Extensive Plans for Digital Transformation, Specifically in Public Services and Social Welfare Programs, to Drive Market

11.4.8 Southeast Asia

11.4.8.1 Rising Investment in Smart Network Infrastructure to Drive Market

11.4.9 Rest of Asia-Pacific

11.5 Middle East & Africa

11.5.1 Middle East & Africa: Recession Impact

11.5.2 Middle East & Africa: Software-Defined Networking Market Drivers

Table 165 Middle East & Africa: Software-Defined Networking Market, by Offering, 2018-2022 (USD Million)

Table 166 Middle East & Africa: Software-Defined Networking Market, by Offering, 2023-2028 (USD Million)

Table 167 Middle East & Africa: Software-Defined Networking Market for Services, by Type, 2018-2022 (USD Million)

Table 168 Middle East & Africa: Software-Defined Networking Market for Services, by Type, 2023-2028 (USD Million)

Table 169 Middle East & Africa: Software-Defined Networking Market, by SDN Type, 2018-2022 (USD Million)

Table 170 Middle East & Africa: Software-Defined Networking Market, by SDN Type, 2023-2028 (USD Million)

Table 171 Middle East & Africa: Software-Defined Networking Market, by End-user, 2018-2022 (USD Million)

Table 172 Middle East & Africa: Software-Defined Networking Market, by End-user, 2023-2028 (USD Million)

Table 173 Middle East & Africa: Software-Defined Networking Market, by Application, 2018-2022 (USD Million)

Table 174 Middle East & Africa: Software-Defined Networking Market, by Application, 2023-2028 (USD Million)

Table 175 Middle East & Africa: Software-Defined Networking Market, by Vertical, 2018-2022 (USD Million)

Table 176 Middle East & Africa: Software-Defined Networking Market, by Vertical, 2023-2028 (USD Million)

Table 177 Middle East & Africa: Software-Defined Networking Market, by Country, 2018-2022 (USD Million)

Table 178 Middle East & Africa: Software-Defined Networking Market, by Country, 2023-2028 (USD Million)

11.5.3 GCC Countries

11.5.3.1 Increasing Adoption of Cloud Services in UAE to Drive Market

Table 179 GCC Countries: Software-Defined Networking Market, by Country, 2018-2022 (USD Million)

Table 180 GCC Countries: Software-Defined Networking Market, by Country, 2023-2028 (USD Million)

11.5.3.2 Saudi Arabia

11.5.3.2.1 Rising Investment in IoT, Cloud, and Wireless Technology to Drive Market

11.5.3.3 UAE

11.5.3.3.1 Digital Transformation Across Energy and Utility Sectors to Drive Market

11.5.3.4 Qatar

11.5.3.4.1 Rising Investment by Telcos to Drive Market

11.5.3.5 Rest of GCC Countries

11.5.4 South Africa

11.5.4.1 Increasing Demand for Better Connectivity to Drive Market

11.5.5 Rest of Middle East & Africa

11.6 Latin America

11.6.1 Latin America: Recession Impact

11.6.2 Latin America: Software-Defined Networking Market Drivers

Table 181 Latin America: Software-Defined Networking Market, by Offering, 2018-2022 (USD Million)

Table 182 Latin America: Software-Defined Networking Market, by Offering, 2023-2028 (USD Million)

Table 183 Latin America: Software-Defined Networking Market for Services, by Type, 2018-2022 (USD Million)

Table 184 Latin America: Software-Defined Networking Market for Services, by Type, 2023-2028 (USD Million)

Table 185 Latin America: Software-Defined Networking Market, by SDN Type, 2018-2022 (USD Million)

Table 186 Latin America: Software-Defined Networking Market, by SDN Type, 2023-2028 (USD Million)

Table 187 Latin America: Software-Defined Networking Market, by End-user, 2018-2022 (USD Million)

Table 188 Latin America: Software-Defined Networking Market, by End-user, 2023-2028 (USD Million)

Table 189 Latin America: Software-Defined Networking Market, by Application, 2018-2022 (USD Million)

Table 190 Latin America: Software-Defined Networking Market, by Application, 2023-2028 (USD Million)

Table 191 Latin America: Software-Defined Networking Market, by Vertical, 2018-2022 (USD Million)

Table 192 Latin America: Software-Defined Networking Market, by Vertical, 2023-2028 (USD Million)

Table 193 Latin America: Software-Defined Networking Market, by Country, 2018-2022 (USD Million)

Table 194 Latin America: Software-Defined Networking Market, by Country, 2023-2028 (USD Million)

11.6.3 Brazil

11.6.3.1 Growth in IT Spending and Investment in Emerging Technologies to Drive Market

11.6.4 Mexico

11.6.4.1 Implementation of National Digital Strategy to Drive Market

11.6.5 Rest of Latin America

12.2 Key Player Strategies/ Right to Win

Table 195 Overview of Strategies Deployed by Key Players in Software-Defined Networking Market

12.3 Revenue Analysis of Key Players

Figure 38 Revenue Analysis of Top Players, 2018-2022 (USD Billion)

12.4 Market Share Analysis

Figure 39 Software-Defined Networking Market Share Analysis, 2022

Table 196 Software-Defined Networking Market: Degree of Competition

12.5 Company Evaluation Matrix

12.5.1 Stars

12.5.2 Emerging Leaders

12.5.3 Pervasive Players

12.5.4 Participants

Figure 40 Software-Defined Networking Market: Company Evaluation Matrix, 2022

12.5.5 Company Footprint

Table 197 Software-Defined Networking Market: Application Footprint of Key Players

Table 198 Software-Defined Networking Market: Vertical Footprint of Key Players

Table 199 Software-Defined Networking Market: Region Footprint of Key Players

Table 200 Software-Defined Networking Market: Company Footprint of Key Players

12.6 Start-Up/SME Evaluation Matrix

12.6.1 Progressive Companies

12.6.2 Responsive Companies

12.6.3 Dynamic Companies

12.6.4 Starting Blocks

Figure 41 Software-Defined Networking Market: Start-Up/SME Evaluation Matrix, 2022

12.6.5 Competitive Benchmarking

Table 201 Software-Defined Networking Market: List of Key Start-Ups/SMEs

Table 202 Software-Defined Networking Market: Competitive Benchmarking of Start-Ups/SMEs

12.7 Competitive Scenarios and Trends

12.7.1 Product Launches

Table 203 Product Launches, 2021-2023

12.7.2 Deals

Table 204 Deals, 2021-2023

12.8 Brand/Product Comparative Landscape

12.8.1 Software-Defined Networking Market: Trending Products/Brand Comparison

12.9 Valuation and Financial Matrix

Figure 42 Valuation and Financial Matrix of Software-Defined Networking Key Players

(Business Overview, Products/Solutions/Services Offered, Recent Developments, Analyst's View, Right to Win, Strategic Choices, and Weaknesses and Competitive Threats)*

13.1.1 Cisco

Table 205 Cisco: Company Overview

Figure 43 Cisco: Company Snapshot

Table 206 Cisco: Products/Solutions/Services Offered

Table 207 Cisco: Deals

13.1.2 Huawei

Table 208 Huawei: Company Overview

Figure 44 Huawei: Company Snapshot

Table 209 Huawei: Products/Solutions/Services Offered

Table 210 Huawei: Product Launches/Enhancements

Table 211 Huawei: Deals

13.1.3 VMware

Table 212 VMware: Company Overview

Figure 45 VMware: Company Snapshot

Table 213 VMware: Products/Solutions/Services Offered

Table 214 VMware: Deals

13.1.4 Dell EMC

Table 215 Dell EMC: Company Overview

Figure 46 Dell EMC: Company Snapshot

Table 216 Dell EMC: Products/Solutions/Services Offered

13.1.5 Juniper Networks

Table 217 Juniper Networks: Company Overview

Figure 47 Juniper Networks: Company Snapshot

Table 218 Juniper Networks: Products/Solutions/Services Offered

Table 219 Juniper Networks: Deals

13.1.6 IBM

Table 220 IBM: Company Overview

Figure 48 IBM: Company Snapshot

Table 221 IBM: Products/Solutions/Services Offered

Table 222 IBM: Deals

13.1.7 Ericsson

Table 223 Ericsson: Company Overview

Figure 49 Ericsson: Company Snapshot

Table 224 Ericsson: Products/Solutions/Services Offered

Table 225 Ericsson: Deals

13.1.8 Ciena

Table 226 Ciena: Company Overview

Figure 50 Ciena: Company Snapshot

Table 227 Ciena: Products/Solutions/Services Offered

13.1.9 HPE

Table 228 HPE: Company Overview

Figure 51 HPE: Company Snapshot

Table 229 HPE: Products/Solutions/Services Offered

Table 230 HPE: Deals

13.1.10 Nokia

Table 231 Nokia: Company Overview

Figure 52 Nokia: Company Snapshot

Table 232 Nokia: Products/Solutions/Services Offered

Table 233 Nokia: Deals

13.1.11 Arista Networks

Table 234 Arista Networks: Company Overview

Figure 53 Arista Networks: Company Snapshot

Table 235 Arista Networks: Products/Solutions/Services Offered

Table 236 Arista Networks: Deals

13.1.12 Extreme Networks

Table 237 Extreme Networks: Company Overview

Figure 54 Extreme Networks: Company Snapshot

Table 238 Extreme Networks: Products/Solutions/Services Offered

Table 239 Extreme Networks: Product Launches/Enhancements

Table 240 Extreme Networks: Deals

13.2 Other Players

13.2.1 Comcast

13.2.2 Citrix

13.2.3 NEC

13.2.4 Oracle

13.2.5 Palo Alto Networks

13.2.6 NVIDIA

13.2.7 Fortinet

13.2.8 Fujitsu

13.2.9 Hiveio

13.2.10 Lenovo

13.2.11 Pica8

13.2.12 Scale Computing

13.2.13 Canopus Networks

13.2.14 Zeetta Networks

13.2.15 Trustgrid

13.2.16 Cosgrid Networks

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, Analyst's View, Right to Win, Strategic Choices, and Weaknesses and Competitive Threats Might Not be Captured in Case of Unlisted Companies

14.1.1 Network Management System Market

14.1.1.1 Market Definition

14.1.1.2 Network Management System Market, by Component

Table 241 Network Management System Market, by Component, 2016-2021 (USD Million)

Table 242 Network Management System Market, by Component, 2022-2027 (USD Million)

14.1.1.3 Network Management System Market, by Solution

Table 243 Network Management System Market, by Solution, 2016-2021 (USD Million)

Table 244 Network Management System Market, by Solution, 2022-2027 (USD Million)

14.1.1.4 Network Management System Market, by Service

Table 245 Network Management System Market, by Service, 2016-2021 (USD Million)

Table 246 Network Management System Market, by Service, 2022-2027 (USD Million)

14.1.1.5 Network Management System Market, by Deployment Type

Table 247 Network Management System Market, by Deployment Type, 2016-2021 (USD Million)

Table 248 Network Management System Market, by Deployment Type, 2022-2027 (USD Million)

14.1.1.6 Network Management System Market, by Organization Size

Table 249 Network Management System Market, by Organization Size, 2016-2021 (USD Million)

Table 250 Network Management System Market, by Organization Size, 2022-2027 (USD Million)

14.1.1.7 Network Management System Market, by End-user

Table 251 Network Management System Market, by End-user, 2016-2021 (USD Million)

Table 252 Network Management System Market, by End-user, 2022-2027 (USD Million)

14.1.1.8 Network Management System Market, by Vertical

Table 253 Network Management System Market, by Vertical, 2016-2021 (USD Million)

Table 254 Network Management System Market, by Vertical, 2022-2027 (USD Million)

14.1.1.9 Network Management System Market, by Region

Table 255 Network Management System Market, by Region, 2016-2021 (USD Million)

Table 256 Network Management System Market, by Region, 2022-2027 (USD Million)

14.1.2 Software-Defined Perimeter Market

14.1.2.1 Market Definition

14.1.2.2 Software-Defined Perimeter Market, by Connectivity

14.1.2.2.1 Introduction

14.1.2.2.2 Connectivity: Software-Defined Perimeter Market Drivers

Table 257 Software-Defined Perimeter Market, by Connectivity, 2017-2024 (USD Million)

14.1.2.2.3 Controller

Table 258 Controller: Software-Defined Perimeter Market, by Region, 2017-2024 (USD Million)

14.1.2.2.4 Gateway

Table 259 Gateway: Software-Defined Perimeter Market, by Region, 2017-2024 (USD Million)

14.1.2.2.5 End Point

Table 260 End Point: Software-Defined Perimeter Market, by Region, 2017-2024 (USD Million)

14.1.2.3 Software-Defined Perimeter Market, by Deployment Mode

14.1.2.3.1 Introduction

Table 261 Software-Defined Perimeter Market, by Deployment Mode, 2017-2024 (USD Million)

14.1.2.3.2 On-Premises

14.1.2.3.3 On-Premises: Software-Defined Perimeter Market Drivers

Table 262 On-Premises: Software-Defined Perimeter Market, by Region, 2017-2024 (USD Million)

Table 263 North America: On-Premises Market, by Country, 2017-2024 (USD Million)

14.1.2.3.4 Cloud

14.1.2.3.5 Cloud: Software-Defined Perimeter Market Drivers

Table 264 Cloud: Software-Defined Perimeter Market, by Region, 2017-2024 (USD Million)

14.1.2.4 Software-Defined Perimeter Market, by Region

Table 265 North America: Software-Defined Perimeter Market, by Component, 2017-2024 (USD Million)

Table 266 North America: Software-Defined Perimeter Market, by Solution, 2017-2024 (USD Million)

Table 267 North America: Software-Defined Perimeter Market, by Service, 2017-2024 (USD Million)

Table 268 North America: Software-Defined Perimeter Market, by Connectivity, 2017-2024 (USD Million)

Table 269 North America: Software-Defined Perimeter Market Size, by Organization Size, 2017-2024 (USD Million)

Table 270 North America: Software-Defined Perimeter Market Size, by Deployment Mode, 2017-2024 (USD Million)

Table 271 North America: Software-Defined Perimeter Market, by User Type, 2017-2024 (USD Thousand)

Table 272 North America: Software-Defined Perimeter Market, by Country, 2017-2024 (USD Million)

14.1.2.4.1 US

Table 273 US: Software-Defined Perimeter Market, by Component, 2017-2024 (USD Million)

Table 274 US: Software-Defined Perimeter Market, by Solution, 2017-2024 (USD Thousand)

Table 275 US: Software-Defined Perimeter Market, by Service, 2017-2024 (USD Million)

Table 276 US: Software-Defined Perimeter Market, by Connectivity, 2017-2024 (USD Million)

Table 277 US: Software-Defined Perimeter Market, by Deployment Mode, 2017-2024 (USD Million)

Table 278 US: Software-Defined Perimeter Market, by Organization Size, 2017-2024 (USD Million)

Table 279 US: Software-Defined Perimeter Market, by User Type, 2017-2024 (USD Thousand)

14.1.2.4.2 Canada

Table 280 Canada: Software-Defined Perimeter Market, by Component, 2017-2024 (USD Million)

Table 281 Canada: Software-Defined Perimeter Market, by Solution, 2017-2024 (USD Thousand)

Table 282 Canada: Software-Defined Perimeter Market, by Service, 2017-2024 (USD Thousand)

Table 283 Canada: Software-Defined Perimeter Market, by Connectivity, 2017-2024 (USD Million)

Table 284 Canada: Software-Defined Perimeter Market, by Organization Size, 2017-2024 (USD Million)

Table 285 Canada: Software-Defined Perimeter Market, by Deployment Mode, 2017-2024 (USD Million)

Table 286 Canada: Software-Defined Perimeter Market, by User Type, 2017-2024 (USD Thousand)

Table 287 North America: Cloud Market, by Country, 2017-2024 (USD Million)

14.1.2.5 Software-Defined Perimeter Market, by Organization Size

14.1.2.5.1 Introduction

Table 288 Software-Defined Perimeter Market, by Organization Size, 2017-2024 (USD Million)

14.1.2.5.2 Large Enterprises

14.1.2.5.3 Large Enterprises: Software-Defined Perimeter Market Drivers

Table 289 Large Enterprises: Software-Defined Perimeter Market, by Region, 2017-2024 (USD Million)

Table 290 North America: Large Enterprises Market, by Country, 2017-2024 (USD Million)

14.1.2.5.4 Small and Medium-Sized Enterprises

14.1.2.5.5 Small and Medium-Sized Enterprises: Software-Defined Perimeter Market Drivers

Table 291 Small and Medium-Sized Enterprises: Software-Defined Perimeter Market, by Region, 2017-2024 (USD Million)

Table 292 North America: Small and Medium-Sized Enterprises Market, by Country, 2017-2024 (USD Million)

14.2 Discussion Guide

14.3 KnowledgeStore: The Subscription Portal

14.4 Customization Options

Companies Mentioned

- Arista Networks

- Canopus Networks

- Ciena

- Cisco

- Citrix

- Comcast

- Cosgrid Networks

- Dell EMC

- Ericsson

- Extreme Networks

- Fortinet

- Fujitsu

- Hiveio

- HPE

- Huawei

- IBM

- Juniper Networks

- Lenovo

- NEC

- Nokia

- NVIDIA

- Oracle

- Palo Alto Networks

- Pica8

- Scale Computing

- Trustgrid

- VMware

- Zeetta Networks

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 269 |

| Published | November 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 24.5 Billion |

| Forecasted Market Value ( USD | $ 60.2 Billion |

| Compound Annual Growth Rate | 19.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |