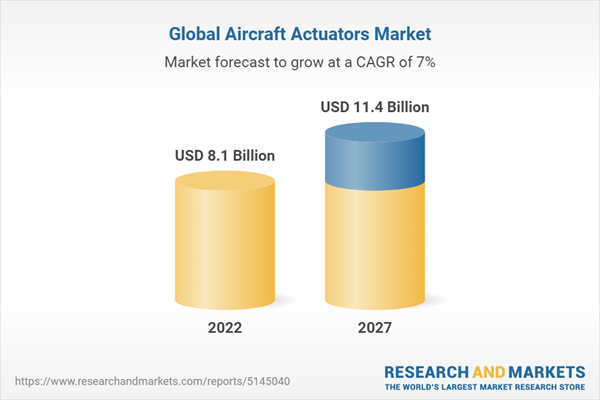

The Aircraft Actuators market size is projected to grow from USD 8.1 Billion in 2022 to USD 11.4 Billion by 2027, at a CAGR of 7.0% from 2022 to 2027. The anticipated rise in demand for commercial aircraft and the rising use of more electric aircraft concepts is driving the growth of the market. Although constraints limiting market expansion include the high-power consumption of electric actuators and associated design issues such heat dissipation.

The OEM segment is projected to dominate market share in the system segment during the forecast period

Based on Installation Type, the Original Equipment Manufacturer (OEM) segment is projected to dominate market share during the forecast period. The market is further segmented into Original Equipment Manufacturer (OEM) and Aftermarket. The demand is influenced by the rapidly increasing of the passenger travel is a growing number of deliveries to meet the need for it. The increasing regulations that attempt to enhance the safety features provided by aircraft and standardize the functions delivered by certain types of aircraft are anticipated to be the driving force behind the fleet modernization initiatives.

Flight Control System is expected to account for the largest share in 2022

Based on System, the flight control system segment is projected to lead the aircraft actuators market during the forecast period. Flight Control to dominate the market as fly-by-wire systems, which replace the physical linkages between the pilot controls and flight control surfaces with an electrical interface, are being introduced into aircraft platforms. Since landing and braking systems contribute to the safety of both the aircraft and onboard passengers and crew, they are essential to maintaining the fleet's airworthiness and will represent the largest segment of spending throughout the forecast period.

The Hydraulic segment is projected to dominate market share in the system segment during the forecast period

Based on system, the hydraulic segment is projected to dominate market share during the forecast period. The market is further segmented into hydraulic, electric hybrid, mechanical, pneumatic and full electric. The demand is due to intrinsic advantages such variable speed, high power output, stall condition, and overload protection, which are fueling market expansion. Because of this, they are suitable for high-force applications like landing gear. However, OEMs are attempting to include hybrid actuators as a prelude to integrating electric actuator aboard new forthcoming aircraft programs in the next generation of aircraft.

The Rotary segment projected to lead Aircraft Actuators market during the forecast period

Based on Type, the rotary segment is projected to lead the aircraft actuators market during the forecast period. Rotary actuators have intrinsic advantages that make them particularly useful in automation applications like gates and valves. For instance, the demand for their integration into contemporary aircraft platforms is driven by their high effectiveness, which ranges from 85% to 92% in single rack models and from 92% to 97% in double rack models.

Fixed-wing Aircraft is expected to account for the largest share in 2022

Based on Aircraft Type, the fixed-wing aircraft segment is projected to lead the aircraft actuators market during the forecast period. There is a concurrent need for aircraft actuators for integration into the various systems onboard the aircraft because of the rapidly increasing global passenger traffic, which is expected to increase demand for fixed-wing aircraft in the commercial and general aviation sectors.

North America is expected to account for the largest share in 2022

The aircraft actuators market industry has been studied for North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America accounted for the largest market share in 2022, and Latin America is projected to witness the highest CAGR during the forecast period. The increasing need for air travel in the area is expected to increase demand for commercial and general aviation. Additionally, the leading OEMs have increased their investments in R&D to develop higher performance electric actuators to satisfy future aviation industry demand.

Prominent companies include Raytheon Technologies Corporation (US), Curtiss-Wright Corporation (US), Honeywell International Inc. (US), Safran SA (France), Liebherr-International Duetschland GmbH (Germany), Moog Inc. (US), and Eaton Corporation plc (Ireland).

Research Coverage:

The report segments the aircraft actuators market based on Installation Type, System, Technology, Type, Platform, Aircraft type, and Region. Based on Installation Type, the market is segmented into, Original Equipment Manufacturer (OEM) and Retrofit. Based on System, the market is segmented into power generation system, flight control system, thrust reverser actuation system, fuel distribution system, landing & braking system, fuel storage system, cabin actuation system, payload management system. Based on Technology, the aircraft actuators market is segmented into hydraulic, eletric hybrid, mechanical, pneumatic and full eletric. Based on Type, the market is segmented into linear and rotary. Based on Platform, the market is segmented into commercial aviation, business & general aviation and military aviation. Based on aircraft type, the market is segmented into fixed wing and rotary wing. The aircraft actuators market has been studied for North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the aircraft actuators market. A detailed analysis of the key industry players has been done to provide insights into their business overviews; solutions and services; key strategies; Contracts, partnerships, agreements new product & service launches, mergers and acquisitions; and recent developments associated with the aircraft actuators market. Competitive analysis of upcoming startups in the aircraft actuators market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall aircraft actuators market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on aircraft actuators offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the aircraft actuators market

- Market Development: Comprehensive information about lucrative markets - the report analyses the aircraft actuators market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the aircraft actuators market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players in the aircraft actuators market

Table of Contents

Companies Mentioned

- Beaver Aerospace & Defense Inc.

- Parker Hannifin Corp.

- Arkwin Industries Inc.

- Safran Sa

- Ametek, Inc.

- Sitec Aerospace GmbH

- Saab Ab

- Itt Inc.

- Nabtesco Corporation

- Eaton Corporation plc

- Honeywell International Inc.

- Triumph Group

- Astronics Corporation

- Moog Inc.

- Nook Industries, Inc.

- Whippany Actuation Systems LLC

- Electromech Technologies

- Elektro-Metall Export

- Raytheon Technologies Corporation

- Woodward Inc.

- Pht Aerospace LLC

- Liebherr Group

- Pegasus Actuators GmbH

- Curtiss-Wright Corporation

- Meggitt plc

- Tamagawa Seiko Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 247 |

| Published | October 2022 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 8.1 Billion |

| Forecasted Market Value ( USD | $ 11.4 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |