Global Prebiotics Market - Key Trends & Drivers Summarized

Prebiotics are non-digestible food components that beneficially affect the host by selectively stimulating the growth and/or activity of beneficial bacteria in the gut. These compounds, typically found in dietary fibers, pass through the upper part of the gastrointestinal tract undigested and serve as food for probiotics, the beneficial bacteria in the colon. Common prebiotics include inulin, fructooligosaccharides (FOS), and galactooligosaccharides (GOS), which are found in foods like chicory root, garlic, onions, bananas, and whole grains. By promoting the growth of healthy gut flora, prebiotics contribute to improved digestion, enhanced immune function, and better absorption of minerals like calcium and magnesium.The growth in the prebiotics market is driven by several factors. The increasing consumer awareness of gut health and its impact on overall well-being is a major driver, as more people seek natural ways to improve their digestive health. The rising prevalence of digestive disorders and the growing recognition of the importance of the gut microbiome in preventing chronic diseases have also boosted demand for prebiotics. Technological advancements in the food and beverage industry, which enable the incorporation of prebiotics into a wide range of products, further fuel market growth. Additionally, regulatory support and endorsements from health organizations promoting the benefits of dietary fibers and prebiotics have encouraged the development and marketing of prebiotic products. The expanding research into personalized nutrition and the role of the microbiome in health and disease continue to open new opportunities for the prebiotics market, highlighting its dynamic growth and potential.

Technological advancements and scientific research have significantly expanded our understanding and application of prebiotics. Innovations in food processing and biotechnology have led to the development of prebiotic-enriched food products and supplements, making it easier for consumers to incorporate these beneficial compounds into their diets. Recent research has focused on identifying new sources of prebiotics and understanding their specific effects on different strains of gut bacteria. Additionally, the synergy between prebiotics and probiotics, known as synbiotics, has gained attention for its potential to enhance the overall health benefits of both components. Advances in analytical techniques have also improved our ability to measure and validate the effectiveness of prebiotics, ensuring that products on the market deliver the promised health benefits.

Report Scope

The report analyzes the Prebiotics market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Ingredient (Inulin, Galacto-Oligosaccharides (GOS), Fructo-Oligosaccharides (FOS), Mannan-Oligosaccharides (MOS), Other Ingredients); Application (Food & Beverage, Dietary Supplements, Animal Feed).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Inulin segment, which is expected to reach US$5 Billion by 2030 with a CAGR of 9.7%. The Galacto-Oligosaccharides (GOS) segment is also set to grow at 12.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $712.5 Million in 2024, and China, forecasted to grow at an impressive 13.5% CAGR to reach $2.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Prebiotics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Prebiotics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Prebiotics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

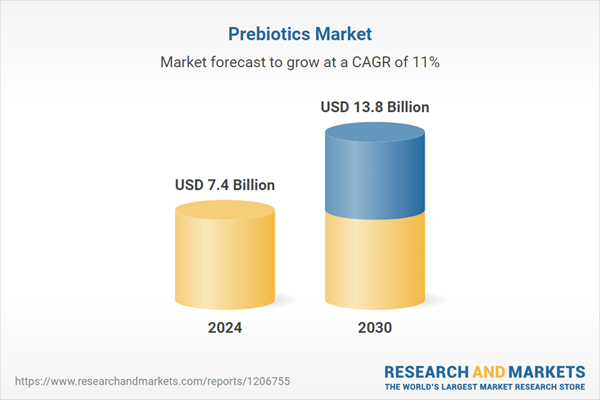

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Nutrition, BENEO-Orafti SA, Cargill, Incorporated, Clasado Biosciences Ltd., Coöperatie Koninklijke Cosun U.A. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 107 companies featured in this Prebiotics market report include:

- Abbott Nutrition

- BENEO-Orafti SA

- Cargill, Incorporated

- Clasado Biosciences Ltd.

- Coöperatie Koninklijke Cosun U.A.

- Sensus

- Cosucra Groupe Warcoing SA

- Danone SA

- Fonterra Co-operative Group Limited

- Ingredion Incorporated

- International Flavors & Fragrances Inc.

- Jarrow Formulas, Inc.

- Kerry Group plc

- Kirkman Group, Inc.

- Nestlé S.A.

- Nestlé Nutrition

- Nexira SAS

- Roquette America, Inc.

- Royal FrieslandCampina N.V.

- FrieslandCampina Domo

- Weetabix Limited

- Yakult Pharmaceutical Industry Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Nutrition

- BENEO-Orafti SA

- Cargill, Incorporated

- Clasado Biosciences Ltd.

- Coöperatie Koninklijke Cosun U.A.

- Sensus

- Cosucra Groupe Warcoing SA

- Danone SA

- Fonterra Co-operative Group Limited

- Ingredion Incorporated

- International Flavors & Fragrances Inc.

- Jarrow Formulas, Inc.

- Kerry Group plc

- Kirkman Group, Inc.

- Nestlé S.A.

- Nestlé Nutrition

- Nexira SAS

- Roquette America, Inc.

- Royal FrieslandCampina N.V.

- FrieslandCampina Domo

- Weetabix Limited

- Yakult Pharmaceutical Industry Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 562 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.4 Billion |

| Forecasted Market Value ( USD | $ 13.8 Billion |

| Compound Annual Growth Rate | 11.0% |

| Regions Covered | Global |