Building thermal insulation systems are expected to gain wide acceptance owing to its several benefits such as lightweight materials, improved external appearance, and acoustic performance of the buildings. Site-built homes qualify for the credit if they are certified to reduce energy consumption during heating and cooling by 50%, relative to the International Energy Conservation Code (IECC), 2006, and meet minimum efficiency standards set by the Department of Energy.

Increasing demand for energy-efficient buildings, owing to the stringent government regulations and rising awareness regarding environmental degradation, is anticipated to fuel the demand for thermal insulation for residential, non-residential, commercial, and industrial buildings. Favorable government policies coupled with increasing awareness among consumers are expected to remain the key driving factor for the growth of the building thermal insulation market in North America.

The government initiatives are inclusive of labor training and monetary aid are likely to propel the industry growth. Moreover, favorable building codes in the U.S. and Canada coupled with the establishment of energy certification agencies such as LEED and the U.S. Green Building Council are expected to have a positive influence on market growth.

Increasing investments in energy-efficient systems is projected to benefit the building thermal insulation system in North America over the forecast period. In addition, a rise in disposable income among consumers across the globe is projected to propel the expansion of the construction industry, thereby driving the building thermal insulation market.

The growing awareness related to energy conservation is projected to have a significant impact on the demand for energy-efficient buildings and is likely to benefit the industry growth in the forecast period. A rise in spending capacities among the people is projected to benefit the growth of the construction industry, thereby benefiting the building thermal insulation market.

The North America thermal insulation market is characterized by the presence of a large number of raw material suppliers that promotes price negotiation and quantity among the buyers. Additionally, the manufacturers and installers are dependent on the buyers due to the increase in infrastructural spending coupled with stringent government regulations with respect to energy efficiency. Moreover, the presence of multiple well-established and small-scale manufacturers is projected to allow buyers to bargain over the prices.

The presence of a large number of manufacturers in North America on the account of growing demand for building thermal insulation across the globe is estimated to intensify the market competition. Moreover, the expansion of the construction industry coupled with the implementation of energy-efficient codes is projected to further result in high competition.

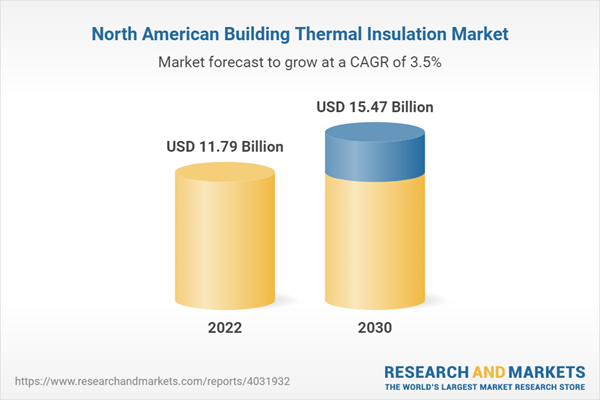

North America Building Thermal Insulation Market Report Highlights

- The U.S. accounted for the largest revenue share of 78.4% in 2022. The increased demand for energy-efficient construction solutions is driving the growth of thermal insulation products in the region

- On the basis of end-use, the residential sector accounted for the major revenue share of 53.13% of the building thermal insulation market in 2022. The growth in the number of single-family houses in developing economies and the rising disposable income of consumers are among the various factors projected to drive the residential construction activities

- On the basis of application, the wall segment is forecast to expand at a CAGR of 3.7% over the forecast period. This is attributed to the rise in investments in public infrastructure

- Based on products, glass wool dominated the building thermal insulation market with a revenue share of 39.6% and is expected to expand at a CAGR of 3.3%. This is because it helps to reduce energy consumption and fluctuation in temperature. Glass wool thermal insulation also provides extremely high-temperature tolerances, as the product itself is flame-resistant. In addition, it is cost-effective, versatile, and easily customizable thereby accounting for a notable demand in building insulation.

- The players in the North America building thermal insulation market focus on increasing their market share through organic growth, rather than mergers and acquisitions. Companies in the market are focusing on expanding their product portfolio by developing cost-effective insulation products with enhanced properties.

Table of Contents

Chapter 1. Methodology And Scope1.1. Market Segmentation & Scope

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. Internal Database

1.3.3. Secondary Sources

1.3.4. Third Party Perspective

1.3.5. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation And Data Visualization

1.6. List Of Data Sources

Chapter 2. Executive Summary

2.1. North America Building Thermal Insulation Market: Market Snapshot

Chapter 3. North America Building Thermal Insulation Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.2. North America Building Thermal Insulation Market - Value Chain Analysis

3.2.1. Raw Material Trends

3.2.2. Manufacturing Trends

3.2.3. Distribution Channel Analysis

3.3. North America Building Thermal Insulation Market - Market Dynamics

3.3.1. Market Driver Analysis

3.3.1.1. Growth Of Construction Industry In The U.S.

3.3.1.2. Favorable Government Regulations

3.3.2. Market Restraint Analysis

3.3.2.1. Growing Environmental Issues

3.3.3. Market Opportunity Analysis

3.3.4. Market Challenge Analysis

3.4. Regulatory Framework

3.5. North America Building Thermal Insulation Market - Business Environment Analysis

3.5.1. Pestle Analysis

3.5.1.1. Political

3.5.1.2. Economic

3.5.1.3. Social

3.5.1.4. Technological

3.5.1.5. Environmental

3.5.1.6. Legal

3.5.2. Porter’s Five Forces Analysis By Swot

3.5.2.1. Competitive Rivalry: High

3.5.2.2. Bargaining Power Of Buyers: Moderate To High

3.5.2.3. Bargaining Power Of Suppliers: Moderate

3.5.2.4. Threat Of Substitutes: Low

3.5.2.5. Threat Of New Entrants: Low

3.6. Market Disruption Analysis

Chapter 4. North America Building Thermal Insulation Market: Product Estimates & Trend Analysis

4.1. Key Takeaways

4.2. Product Market Share Analysis, 2022 & 2030

4.3. Market Estimates & Forecasts By Product, 2018 - 2030 (USD Million)

4.4. Glass Wool

4.4.1. North America Building Thermal Insulation Market Estimates And Forecasts, By Glass Wool, 2018 & 2030 (Kilotons) (USD Million)

4.5. Mineral Wool

4.5.1. North America Building Thermal Insulation Market Estimates And Forecasts, By Mineral Wool, 2018 & 2030 (Kilotons) (USD Million)

4.6. Eps

4.6.1. North America Building Thermal Insulation Market Estimates And Forecasts, By Eps, 2018 & 2030 (Kilotons) (USD Million)

4.7. Xps

4.7.1. North America Building Thermal Insulation Market Estimates And Forecasts, By Xps, 2018 & 2030 (Kilotons) (USD Million)

4.8. Cellulose

4.8.1. North America Building Thermal Insulation Market Estimates And Forecasts, By Cellulose, 2018 & 2030 (Kilotons) (USD Million)

4.9. PU Foam

4.9.1. North America Building Thermal Insulation Market Estimates And Forecasts, By Pu Foam, 2018 & 2030 (Kilotons) (USD Million)

4.10. PIR Foam

4.10.1. North America Building Thermal Insulation Market Estimates And Forecasts, By Pir Foam, 2018 & 2030 (Kilotons) (USD Million)

4.11. Others

4.11.1. North America Building Thermal Insulation Market Estimates And Forecasts, By Other Products, 2018 & 2030 (Kilotons) (USD Million)

Chapter 5. North America Building Thermal Insulation Market: Application Estimates & Trend Analysis

5.1. Key Takeaways

5.2. Application Market Share Analysis, 2022 & 2030

5.3. Market Estimates & Forecasts By Application, 2018 - 2030 (USD Million)

5.4. Roof

5.4.1. North America Building Thermal Insulation Market Estimates And Forecasts, In Roof, 2018 & 2030 (Kilotons) (USD Million)

5.5. Wall

5.5.1. North America Building Thermal Insulation Market Estimates And Forecasts, In Wall, 2018 & 2030 (Kilotons) (USD Million)

5.6. Floor

5.6.1. North America Building Thermal Insulation Market Estimates And Forecasts, In Floor, 2018 & 2030 (Kilotons) (USD Million)

Chapter 6. North America Building Thermal Insulation Market: End-Use Estimates & Trend Analysis

6.1. Key Takeaways

6.2. End-Use Market Share Analysis, 2022 & 2030

6.3. Market Estimates & Forecasts by End-Use, 2018 - 2030 (USD Million)

6.4. North America Building Thermal Insulation Market: End-Use Movement Analysis, 2022 & 2030

6.5. Residential

6.5.1. North America Building Thermal Insulation Market Estimates And Forecasts, In Residential, 2018 & 2030 (Kilotons) (USD Million)

6.6. Commercial

6.6.1. North America Building Thermal Insulation Market Estimates And Forecasts, In Commercial, 2018 & 2030 (Kilotons) (USD Million)

Chapter 7. North America Building Thermal Insulation Market: Regional Estimates & Trend Analysis

7.1. Key Takeaways

7.2. Regional Market Share Analysis, 2022 & 2030

7.3. Market Estimates & Forecasts by Region, 2018 - 2030 (USD Million)

7.4. North America

7.4.1. North America Building Thermal Insulation Market Estimates & Forecasts, 2018 & 2030 (Kilotons) (USD Million)

7.4.2. North America Building Thermal Insulation Market Estimates & Forecasts, By Product, 2018 & 2030 (Kilotons) (USD Million)

7.4.3. North America Building Thermal Insulation Market Estimates & Forecasts, By Application, 2018 & 2030 (Kilotons) (USD Million)

7.4.4. North America Building Thermal Insulation Market Estimates & Forecasts, By End-Use, 2018 & 2030 (Kilotons) (USD Million)

7.4.5. U.S.

7.4.5.1. U.S. Building Thermal Insulation Market Estimates & Forecasts, 2018 & 2030 (Kilotons) (USD Million)

7.4.5.2. U.S. building thermal insulation market estimates & forecasts, by product, 2018 & 2030 (Kilotons) (USD Million)

7.4.5.3. U.S. building thermal insulation market estimates & forecasts, by application, 2018 & 2030 (Kilotons) (USD Million)

7.4.5.4. U.S. building thermal insulation market estimates & forecasts, by end-use, 2018 & 2030 (Kilotons) (USD Million)

7.4.6. Canada

7.4.6.1. Canada Building Thermal Insulation Market Estimates & Forecasts, 2018 & 2030 (Kilotons) (USD Million)

7.4.6.2. Canada building thermal insulation market estimates & forecasts, by product, 2018 & 2030 (Kilotons) (USD Million)

7.4.6.3. Canada building thermal insulation market estimates & forecasts, by application, 2018 & 2030 (Kilotons) (USD Million)

7.4.6.4. Canada building thermal insulation market estimates & forecasts, by end-use, 2018 & 2030 (Kilotons) (USD Million)

7.4.7. Mexico

7.4.7.1. Mexico Building Thermal Insulation Market Estimates & Forecasts, 2018 & 2030 (Kilotons) (USD Million)

7.4.7.2. Mexico building thermal insulation market estimates & forecasts, by product, 2018 & 2030 (Kilotons) (USD Million)

7.4.7.3. Mexico building thermal insulation market estimates & forecasts, by application, 2018 & 2030 (Kilotons) (USD Million)

7.4.7.4. Mexico building thermal insulation market estimates & forecasts, by end-use, 2018 & 2030 (Kilotons) (USD Million)

Chapter 8. Competitive Analysis

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. North America Building Thermal Insulation Market: Vendor Landscape

8.3. Key Company Categorization

8.4. Competitive dashboard analysis

8.4.1. Information Regarding Production Facilities Of Major Xps Producers

8.4.1.1. Market Differentiators

8.4.2. List Of Emerging Companies

8.5. North America Building Thermal Insulation Market - Company Market Positioning

Chapter 9. Market Supplier Intelligence

9.1. Kraljic Matrix (Portfolio Analysis)

9.2. Engagement Model

9.3. Negotiation Strategies

9.4. Sourcing Best Practices

9.5. Vendor Selection Criteria

9.6. List of Raw Material Suppliers

9.7. List of Equipment Suppliers

9.8. List of End-user

Chapter 10. Company Profiles

10.1. Anco Products, Inc.

10.1.1. Company Overview

10.1.2. Product Benchmarking

10.2. Atlas Roofing Corporation

10.2.1. Company Overview

10.2.2. Financial Performance

10.2.3. Product Benchmarking

10.3. Cellofoam North America, Inc.

10.3.1. Company Overview

10.3.2. Financial Performance

10.3.3. Product Benchmarking

10.3.4. Strategic Initiatives

10.4. Certainteed Corporation

10.4.1. Company Overview

10.4.2. Financial Performance

10.4.3. Product Benchmarking

10.4.4. Strategic Initiatives

10.5. Gaf Material Corporation

10.5.1. Company Overview

10.5.2. Financial Performance

10.5.3. Product Benchmarking

10.5.4. Strategic Initiatives

10.6. Huntsman International Llc

10.6.1. Company Overview

10.6.2. Product Benchmarking

10.6.3. Strategic Initiatives

10.7. Johns Manville Corporation

10.7.1. Company Overview

10.7.2. Financial Performance

10.7.3. Product Benchmarking

10.7.4. Strategic Initiatives

10.8. Knauf Insulation

10.8.1. Company Overview

10.8.2. Product Benchmarking

10.8.3. Strategic Initiatives

10.9. Owens Corning

10.9.1. Company Overview

10.9.2. Financial Performance

10.9.3. Product Benchmarking

10.9.4. Strategic Initiatives

10.10. Rockwool Insulation A/S

10.10.1. Company Overview

10.10.2. Financial Performance

10.10.3. Product Benchmarking

10.10.4. Strategic Initiatives

10.11. Dow Inc.

10.11.1. Company Overview

10.11.2. Financial Performance

10.11.3. Product Benchmarking

10.12. Dupont

10.12.1. Company Overview

10.12.2. Financial Performance

10.12.3. Product Benchmarking

10.13. Kingspan Group

10.13.1. Company Overview

10.13.2. Financial Performance

10.13.3. Product Benchmarking

10.13.4. Strategic Initiatives

List of Tables

Table 1 North America building thermal insulation market estimates and forecasts, by glass wool, 2018 & 2030 (Kilotons) (USD Million)

Table 2 North America building thermal insulation market estimates and forecasts, by mineral wool, 2018 & 2030 (Kilotons) (USD Million)

Table 3 North America building thermal insulation market estimates and forecasts, by EPS, 2018 & 2030 (Kilotons) (USD Million)

Table 4 North America building thermal insulation market estimates and forecasts, by XPS, 2018 & 2030 (Kilotons) (USD Million)

Table 5 North America building thermal insulation market estimates and forecasts, by cellulose, 2018 & 2030 (Kilotons) (USD Million)

Table 6 North America building thermal insulation market estimates and forecasts, by PU foam, 2018 & 2030 (Kilotons) (USD Million)

Table 7 North America building thermal insulation market estimates and forecasts, by PIR foam, 2018 & 2030 (Kilotons) (USD Million)

Table 8 North America building thermal insulation market estimates and forecasts, by other products, 2018 & 2030 (Kilotons) (USD Million)

Table 9 North America building thermal insulation market estimates and forecasts, in roof, 2018 & 2030 (Kilotons) (USD Million)

Table 10 North America building thermal insulation market estimates and forecasts, in wall, 2018 & 2030 (Kilotons) (USD Million)

Table 11 North America building thermal insulation market estimates and forecasts, in floor, 2018 & 2030 (Kilotons) (USD Million)

Table 12 North America building thermal insulation market estimates and forecasts, in residential, 2018 & 2030 (Kilotons) (USD Million)

Table 13 North America building thermal insulation market estimates and forecasts, in commercial, 2018 & 2030 (Kilotons) (USD Million)

Table 14 North America building thermal insulation market estimates & forecasts, 2018 & 2030 (USD Million) (Kilotons)

Table 15 North America building thermal insulation market estimates & forecasts, by product, 2018 & 2030 (Kilotons)

Table 16 North America building thermal insulation market estimates & forecasts, by product, 2018 & 2030 (USD Million)

Table 17 North America building thermal insulation market estimates & forecasts, by application, 2018 & 2030 (Kilotons)

Table 18 North America building thermal insulation market estimates & forecasts, by application, 2018 & 2030 (USD Million)

Table 19 North America building thermal insulation market estimates & forecasts, by end-use, 2018 & 2030 (Kilotons)

Table 20 North America building thermal insulation market estimates & forecasts, by end-use, 2018 & 2030 (USD Million)

Table 21 U.S. building thermal insulation market estimates & forecasts, 2018 & 2030 (USD Million) (Kilotons)

Table 22 U.S. building thermal insulation market estimates & forecasts, by product, 2018 & 2030 (Kilotons)

Table 23 U.S. building thermal insulation market estimates & forecasts, by product, 2018 & 2030 (USD Million)

Table 24 U.S. building thermal insulation market estimates & forecasts, by application, 2018 & 2030 (Kilotons)

Table 25 U.S. building thermal insulation market estimates & forecasts, by application, 2018 & 2030 (USD Million)

Table 26 U.S. building thermal insulation market estimates & forecasts, by end-use, 2018 & 2030 (Kilotons)

Table 27 U.S. building thermal insulation market estimates & forecasts, by end-use, 2018 & 2030 (USD Million)

Table 28 Canada building thermal insulation market estimates & forecasts, 2018 & 2030 (USD Million) (Kilotons)

Table 29 Canada building thermal insulation market estimates & forecasts, by product, 2018 & 2030 (Kilotons)

Table 30 Canada building thermal insulation market estimates & forecasts, by product, 2018 & 2030 (USD Million)

Table 31 Canada building thermal insulation market estimates & forecasts, by application, 2018 & 2030 (Kilotons)

Table 32 Canada building thermal insulation market estimates & forecasts, by application, 2018 & 2030 (USD Million)

Table 33 Canada building thermal insulation market estimates & forecasts, by end-use, 2018 & 2030 (Kilotons)

Table 34 Canada building thermal insulation market estimates & forecasts, by end-use, 2018 & 2030 (USD Million)

Table 35 Mexico building thermal insulation market estimates & forecasts, 2018 & 2030 (USD Million) (Kilotons)

Table 36 Mexico building thermal insulation market estimates & forecasts, by product, 2018 & 2030 (Kilotons)

Table 37 Mexico building thermal insulation market estimates & forecasts, by product, 2018 & 2030 (USD Million)

Table 38 Mexico building thermal insulation market estimates & forecasts, by application, 2018 & 2030 (Kilotons)

Table 39 Mexico building thermal insulation market estimates & forecasts, by application, 2018 & 2030 (USD Million)

Table 40 Mexico building thermal insulation market volume, by end-use, 2018 & 2030 (Kilotons)

Table 41 Mexico building thermal insulation market revenue, by end-use, 2018 & 2030 (USD Million)

List of Figures

Fig. 1 North America building thermal insulation market - Market segmentation & scope

Fig. 2 Information procurement

Fig. 3 Primary research pattern

Fig. 4 Primary research process

Fig. 5 Primary research approaches

Fig. 6 North America building thermal insulation market - Penetration and growth prospect mapping

Fig. 7 North America building thermal insulation market - Value chain analysis

Fig. 8 North America building thermal insulation market - Market dynamics

Fig. 9 Market driver impact analysis

Fig. 10 Market restraint impact analysis

Fig. 11 Product Market Share Analysis, 2022 & 2030

Fig. 12 Application Market Share Analysis, 2022 & 2030

Fig. 13 End-Use Market Share Analysis, 2022 & 2030

Fig. 14 Regional Market Share Analysis, 2022 & 2030

Fig. 15 Key company categorization

Companies Mentioned

- Anco Products, Inc.

- Atlas Roofing Corporation

- Cellofoam North America, Inc.

- Certainteed Corporation

- Gaf Material Corporation

- Huntsman International Llc

- Johns Manville Corporation

- Knauf Insulation

- Owens Corning

- Rockwool Insulation A/S

- Dow Inc.

- Dupont

- Kingspan Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 109 |

| Published | February 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 11.79 Billion |

| Forecasted Market Value ( USD | $ 15.47 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | North America |

| No. of Companies Mentioned | 13 |