Global Amino Acids Market - Key Trends & Drivers Summarized

Amino acids are organic compounds that play a critical role in various biological processes, serving as the building blocks of proteins, which are essential for the structure, function, and regulation of the body's tissues and organs. There are 20 standard amino acids, each with unique properties that contribute to protein synthesis and various metabolic pathways. They are categorized into essential and non-essential amino acids; essential amino acids cannot be synthesized by the body and must be obtained through diet, while non-essential amino acids can be produced internally. Sources of essential amino acids include meat, dairy products, and legumes, making them vital components of a balanced diet. Amino acids are not only crucial for muscle development and repair but also play significant roles in immune function, hormone production, and neurotransmission.The application of amino acids extends beyond nutrition and health into various industrial sectors. In the pharmaceutical industry, amino acids are used in the formulation of drugs, nutritional supplements, and therapeutic agents. For instance, the amino acid L-glutamine is often used to support recovery in patients with severe injuries or illnesses. In the food and beverage industry, amino acids are employed as flavor enhancers, preservatives, and nutritional additives. Monosodium glutamate (MSG), derived from glutamic acid, is a common flavor enhancer that amplifies umami taste. The cosmetics industry also leverages amino acids for their hydrating and anti-aging properties in skincare products. Furthermore, amino acids play a pivotal role in animal nutrition, where they are added to animal feed to ensure adequate growth, health, and productivity of livestock.

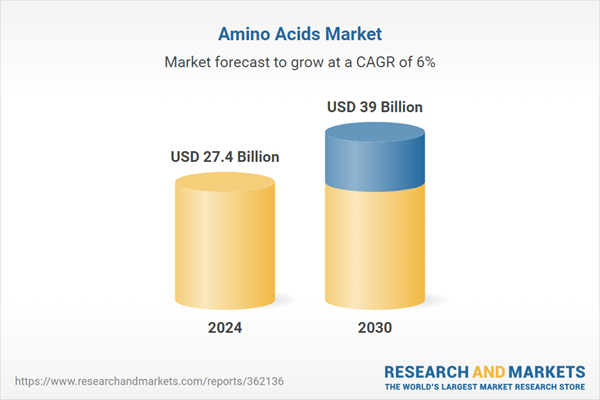

The growth in the amino acids market is driven by several factors, including advancements in production technologies, increasing health awareness, and the rising demand for protein-rich diets. Technological advancements such as microbial fermentation and enzymatic synthesis have enhanced the efficiency and scalability of amino acid production, making them more accessible and affordable. Increasing health awareness among consumers has led to a higher demand for dietary supplements and functional foods that contain amino acids to support overall health and wellness. Additionally, the growing popularity of protein-rich diets, driven by trends such as fitness and bodybuilding, has boosted the demand for amino acids, particularly branched-chain amino acids (BCAAs) like leucine, isoleucine, and valine, which are known to aid muscle recovery and growth. The expanding pharmaceutical and nutraceutical sectors also contribute significantly to the market, as amino acids are integral in developing new therapeutic and nutritional products. The increasing acceptance of meat as a major source of protein, as well as the increasing intake of nutraceuticals for a healthy lifestyle are driving demand for both feed grade and food grade amino acids. The continuous growth of the animal feed industry, driven by the need for high-quality livestock products, further propels the demand for amino acids. Another factor driving growth in the global amino acids market is the rising demand for food and dietary supplements due primarily to the improving health standards and the increased demand from elderly population. These drivers collectively support the robust expansion of the amino acids market, ensuring its continued evolution and relevance across various applications.

Report Scope

The report analyzes the Amino Acids market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Segment (Glutamic Acid, Methionine, Lysine, Threonine, Phenylalanine, Other Product Segments); Source (Plant-based, Animal-based); End-Use (Animal Feed, Food & Beverage, Pharma & Healthcare, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Glutamic Acid segment, which is expected to reach US$13.6 Billion by 2030 with a CAGR of 5.7%. The Methionine segment is also set to grow at 5.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.8 Billion in 2024, and China, forecasted to grow at an impressive 6.5% CAGR to reach $10.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Amino Acids Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Amino Acids Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Amino Acids Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ajinomoto Co., Inc., AnaSpec, Inc., Akorn, Inc., Brenntag AG, AMCO Proteins and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 113 companies featured in this Amino Acids market report include:

- Ajinomoto Co., Inc.

- AnaSpec, Inc.

- Akorn, Inc.

- Brenntag AG

- AMCO Proteins

- Albert David Ltd.

- AF Biochem

- Avanscure Lifesciences Private Limited

- Cargill, Inc.

- Evonik Industries AG

- Novus International, Inc.

- Titan Biotech Limited

- Worthington Biochemical Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ajinomoto Co., Inc.

- AnaSpec, Inc.

- Akorn, Inc.

- Brenntag AG

- AMCO Proteins

- Albert David Ltd.

- AF Biochem

- Avanscure Lifesciences Private Limited

- Cargill, Inc.

- Evonik Industries AG

- Novus International, Inc.

- Titan Biotech Limited

- Worthington Biochemical Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 557 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 27.4 Billion |

| Forecasted Market Value ( USD | $ 39 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |