1 Introduction

1.1 Study Objectives

1.2 Market Definition

Table 1 Automotive Paints Market Definition, by Paint Type

Table 2 Automotive Paints Market Definition, by Technology

Table 3 Automotive Paints Market Definition, by Resin Type

Table 4 Automotive Paints Market Definition, by Texture

Table 5 Automotive Paints Market Definition, by Content

Table 6 Automotive Paints Market Definition, by Painting Equipment Technique

Table 7 Automotive Paints Market Definition, by Vehicle Type

Table 8 Electric & Hybrid Vehicle Paints Market Definition, by Vehicle Type

Table 9 Automotive Refinish Paints Market Definition, by Resin Type

1.2.1 Inclusions and Exclusions

Table 10 Inclusions and Exclusions

1.3 Study Scope

Figure 1 Automotive Paints Market Segmentation

1.3.1 Regions Covered

1.3.2 Years Considered

1.4 Currency Considered

Table 11 Currency Exchange Rates

1.5 Unit Considered

1.6 Stakeholders

1.7 Summary of Changes

1.7.1 Recession Impact

2 Research Methodology

2.1 Research Data

Figure 2 Research Design

Figure 3 Research Design Model

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.1.2 Key Data from Secondary Sources

2.1.2 Primary Data

Figure 4 Breakdown of Primary Interviews

2.1.2.1 Primary Participants

2.1.3 Sampling Techniques and Data Collection Methods

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

Figure 5 Bottom-Up Approach

2.2.2 Top-Down Approach

Figure 6 Top-Down Approach

2.3 Data Triangulation

Figure 7 Data Triangulation

2.4 Factor Analysis

2.5 Research Assumptions

2.6 Research Limitations

2.7 Recession Impact Analysis

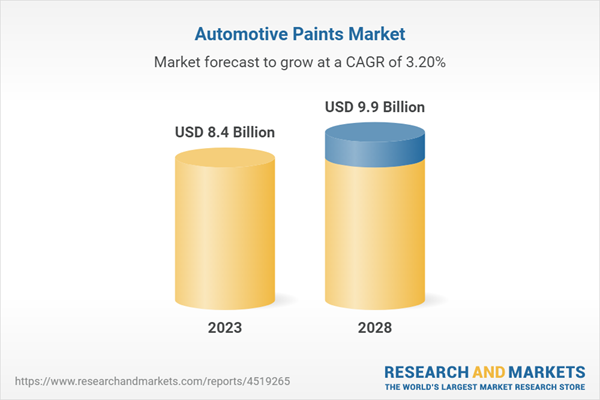

3 Executive Summary

Figure 8 Automotive Paints Market Outlook

Figure 9 Water-Borne Segment to Grow Rapidly During Forecast Period

Figure 10 Polyurethane to be Largest Segment During Forecast Period

Figure 11 Metallic to Surpass Other Segments During Forecast Period

4 Premium Insights

4.1 Attractive Opportunities for Players in Automotive Paints Market

Figure 12 Increase in Vehicle Production to Drive Growth

4.2 Automotive Paints Market, by Paint Type

Figure 13 Base Coat to Acquire Maximum Market Share by Value in 2028

4.3 Automotive Paints Market, by Technology

Figure 14 Solvent-Borne to be Largest Segment by Value During Forecast Period

4.4 Automotive Paints Market, by Resin Type

Figure 15 Polyurethane to Hold Largest Market Share by Value in 2028

4.5 Automotive Paints Market, by Texture

Figure 16 Metallic to be Largest Segment by Volume During Forecast Period

4.6 Automotive Paints Market, by Vehicle Type

Figure 17 Passenger Car to Secure Leading Market Position by Value During Forecast Period

4.7 Automotive Paints Market, by Content

Figure 18 Pigment & Colorant to Record Highest CAGR During Forecast Period

4.8 Electric & Hybrid Vehicle Paints Market, by Vehicle Type

Figure 19 Bev to Surpass Other Segments by Value During Forecast Period

4.9 Automotive Paints Market, by Region

Figure 20 Asia-Pacific to be Largest Market During Forecast Period

4.10 Automotive Refinish Paints Market, by Resin Type

Figure 21 Polyurethane to Secure Leading Market Position During Forecast Period

4.11 Automotive Paints Equipment Market, by Region

Figure 22 Asia-Pacific to be Largest Market for Electrostatic Spray Guns During Forecast Period

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 23 Automotive Paints Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Production of Sustainable Automotive Paints due to Stringent Emission Regulations

Table 12 Voc Content Limits in Automotive Coatings

5.2.1.2 Expansion of Established Players in Refinish Paints Market

5.2.2 Restraints

5.2.2.1 Reduced Number of Accidents and Refinish Jobs due to Advancements in Autonomous Technologies

Table 13 Safety Features Imposed by Key Countries

5.2.3 Opportunity

5.2.3.1 Emergence of Innovative Paint Technologies

Figure 24 Automotive Coat Process: Conventional Vs. Advanced

5.2.3.2 Growing Popularity of SUVs

Figure 25 Global Suv Production Data, 2018-2022

5.2.4 Challenges

5.2.4.1 Lack of Adequate Waste Management Infrastructure in Developing Countries

5.2.4.2 Rapidly Changing Consumer Preferences

5.2.4.3 Decline in Vehicle Sales

5.3 Trends and Disruptions Impacting Customers’ Businesses

Figure 26 Trends and Disruptions Impacting Customers’ Businesses

5.4 Technology Analysis

5.4.1 Nano-Ceramic Coatings

5.4.2 Smart Paints

5.4.3 Self-Cleaning Paints

5.4.4 Dress Up

5.4.5 Self-Healing Wraps

5.4.6 Paint Atomizers

5.4.7 Smart Automotive Paint Booths

5.4.8 Antimicrobial Coatings

5.4.9 Impact of Electric Vehicles on Automotive Paints Market

5.5 Case Studies

5.5.1 Mitsubishi Chemical Group

5.5.2 Popular Paints

5.5.3 Twin City Fan

5.6 Popularity of Automotive Colors Worldwide

5.6.1 Popular Automotive Colors

Figure 27 Colors Sold Globally

Figure 28 Colors Widely Used in Automobiles (%)

Figure 29 North America: Color Preferences, by Vehicle Type

Figure 30 Europe: Color Preferences, by Vehicle Type

5.6.2 Vehicle Depreciation Value Based on Colors

Table 14 Vehicle Depreciation Value Based on Colors

5.6.3 New Color Trends by Automakers

Table 15 New Vehicle Color Trends by Automakers

5.7 Patent Analysis

Table 16 Innovations and Patents, 2020-2023

5.8 Trade Analysis

5.8.1 Import Data

Table 17 US: Import, by Country (%)

Table 18 China: Import, by Country (%)

Table 19 Germany: Import, by Country (%)

Table 20 Belgium: Import, by Country (%)

Table 21 Netherlands: Import, by Country (%)

Table 22 Canada: Import, by Country (%)

5.8.2 Export Data

Table 23 Germany: Export, by Country (%)

Table 24 Japan: Export, by Country (%)

Table 25 US: Export, by Country (%)

Table 26 Belgium: Export, by Country (%)

Table 27 Netherlands: Export, by Country (%)

5.9 Supply Chain Analysis

Figure 31 Supply Chain Analysis

Table 28 Role of Companies in Supply Chain

5.10 Ecosystem Mapping

Figure 32 Ecosystem Mapping

5.11 Pricing Analysis

Table 29 Average Selling Price Trend of Automotive Paints, by Vehicle Type, 2022 (USD)

Table 30 Average Selling Price Trend of Automotive Paints, by Region, 2022 (USD)

5.12 Tariff and Regulatory Landscape

5.12.1 Tariff Related to Automotive Paints

Table 31 Tariff Related to Automotive Paints

5.12.2 Regulatory Bodies, Government Agencies, and Other Organizations

Table 32 Regulatory Bodies, Government Agencies, and Other Organizations

5.13 Key Stakeholders and Buying Criteria

5.13.1 Stakeholders in Buying Process

Table 33 Influence of Stakeholders on the Buying Process for Automotive Paints

5.13.2 Key Buying Criteria

Figure 33 Key Buying Criteria for Automotive Paints

Table 34 Key Buying Criteria for Automotive Paints

5.14 Key Conferences and Events, 2023-2024

Table 35 Key Conferences and Events, 2023-2024

6 Automotive Paints Market, by Paint Type

6.1 Introduction

6.1.1 Industry Insights

Figure 34 Average Thickness of Automotive Paints, by Layer (µm)

Figure 35 Automotive Refinish Paint Single Staging Process, by Layer (µm)

Figure 36 Automotive Paints Market, by Paint Type, 2023-2028 (USD Million)

Table 36 Automotive Paints Market, by Paint Type, 2019-2022 (Thousand Gallons)

Table 37 Automotive Paints Market, by Paint Type, 2023-2028 (Thousand Gallons)

Table 38 Automotive Paints Market, by Paint Type, 2019-2022 (USD Million)

Table 39 Automotive Paints Market, by Paint Type, 2023-2028 (USD Million)

6.2 Electrocoat

6.2.1 Focus on Reducing Voc Emissions to Drive Growth

Table 40 Electrocoat: Automotive Paints Market, by Region, 2019-2022 (Thousand Gallons)

Table 41 Electrocoat: Automotive Paints Market, by Region, 2023-2028 (Thousand Gallons)

Table 42 Electrocoat: Automotive Paints Market, by Region, 2019-2022 (USD Million)

Table 43 Electrocoat: Automotive Paints Market, by Region, 2023-2028 (USD Million)

6.3 Primer

6.3.1 Shift Toward Water-Borne Formulations to Drive Growth

Table 44 Primer: Automotive Paints Market, by Region, 2019-2022 (Thousand Gallons)

Table 45 Primer: Automotive Paints Market, by Region, 2023-2028 (Thousand Gallons)

Table 46 Primer: Automotive Paints Market, by Region, 2019-2022 (USD Million)

Table 47 Primer: Automotive Paints Market, by Region, 2023-2028 (USD Million)

6.4 Base Coat

6.4.1 Upcoming Innovative Technologies to Drive Growth

Table 48 Vehicles with Special Effect Finishes

Table 49 Base Coat: Automotive Paints Market, by Region, 2019-2022 (Thousand Gallons)

Table 50 Base Coat: Automotive Paints Market, by Region, 2023-2028 (Thousand Gallons)

Table 51 Base Coat: Automotive Paints Market, by Region, 2019-2022 (USD Million)

Table 52 Base Coat: Automotive Paints Market, by Region, 2023-2028 (USD Million)

6.5 Clear Coat

6.5.1 Increasing Use of Lightweight Materials to Drive Growth

Table 53 Clear Coat: Automotive Paints Market, by Region, 2019-2022 (Thousand Gallons)

Table 54 Clear Coat: Automotive Paints Market, by Region, 2023-2028 (Thousand Gallons)

Table 55 Clear Coat: Automotive Paints Market, by Region, 2019-2022 (USD Million)

Table 56 Clear Coat: Automotive Paints Market, by Region, 2023-2028 (USD Million)

7 Automotive Paints Market, by Technology

7.1 Introduction

Table 57 Comparison Between Automotive Paint Technologies

7.1.1 Industry Insights

Figure 37 Automotive Paints Market, by Technology, 2023-2028 (USD Million)

Table 58 Automotive Paints Market, by Technology, 2019-2022 (Thousand Gallons)

Table 59 Automotive Paints Market, by Technology, 2023-2028 (Thousand Gallons)

Table 60 Automotive Paints Market, by Technology, 2019-2022 (USD Million)

Table 61 Automotive Paints Market, by Technology, 2023-2028 (USD Million)

7.2 Solvent-Borne

7.2.1 Availability of Diverse Colors and Finishes to Drive Growth

Table 62 Solvent-Borne: Automotive Paints Market, by Region, 2019-2022 (Thousand Gallons)

Table 63 Solvent-Borne: Automotive Paints Market, by Region, 2023-2028 (Thousand Gallons)

Table 64 Solvent-Borne: Automotive Paints Market, by Region, 2019-2022 (USD Million)

Table 65 Solvent-Borne: Automotive Paints Market, by Region, 2023-2028 (USD Million)

7.3 Water-Borne

7.3.1 Rise in Environmental Concerns to Drive Growth

Table 66 Water-Borne: Automotive Paints Market, by Region, 2019-2022 (Thousand Gallons)

Table 67 Water-Borne: Automotive Paints Market, by Region, 2023-2028 (Thousand Gallons)

Table 68 Water-Borne: Automotive Paints Market, by Region, 2019-2022 (USD Million)

Table 69 Water-Borne: Automotive Paints Market, by Region, 2023-2028 (USD Million)

7.4 Powder Coating

7.4.1 Cost-Effectiveness and Less Maintenance Requirements to Drive Growth

Table 70 Powder Coating: Automotive Paints Market, by Region, 2019-2022 (Thousand Gallons)

Table 71 Powder Coating: Automotive Paints Market, by Region, 2023-2028 (Thousand Gallons)

Table 72 Powder Coating: Automotive Paints Market, by Region, 2019-2022 (USD Million)

Table 73 Powder Coating: Automotive Paints Market, by Region, 2023-2028 (USD Million)

8 Automotive Paints Market, by Resin Type

8.1 Introduction

Figure 38 Automotive Paints Market, by Resin Type, 2023-2028 (USD Million)

Table 74 Automotive Paints Market, by Resin Type, 2019-2022 (Million Gallons)

Table 75 Automotive Paints Market, by Resin Type, 2023-2028 (Million Gallons)

Table 76 Automotive Paints Market, by Resin Type, 2019-2022 (USD Million)

Table 77 Automotive Paints Market, by Resin Type, 2023-2028 (USD Million)

8.2 Polyurethane

8.2.1 Durability and Corrosion Resistance Properties to Drive Growth

Table 78 Polyurethane: Automotive Paints Market, by Region, 2019-2022 (Million Gallons)

Table 79 Polyurethane: Automotive Paints Market, by Region, 2023-2028 (Million Gallons)

Table 80 Polyurethane: Automotive Paints Market, by Region, 2019-2022 (USD Million)

Table 81 Polyurethane: Automotive Paints Market, by Region, 2023-2028 (USD Million)

8.3 Epoxy

8.3.1 Extensive Use in Vehicle Refinishing to Drive Growth

Table 82 Epoxy: Automotive Paints Market, by Region, 2019-2022 (Million Gallons)

Table 83 Epoxy: Automotive Paints Market, by Region, 2023-2028 (Million Gallons)

Table 84 Epoxy: Automotive Paints Market, by Region, 2019-2022 (USD Million)

Table 85 Epoxy: Automotive Paints Market, by Region, 2023-2028 (USD Million)

8.4 Acrylic

8.4.1 Increasing Demand for Water-Borne Coatings to Drive Growth

Table 86 Acrylic: Automotive Paints Market, by Region, 2019-2022 (Million Gallons)

Table 87 Acrylic: Automotive Paints Market, by Region, 2023-2028 (Million Gallons)

Table 88 Acrylic: Automotive Paints Market, by Region, 2019-2022 (USD Million)

Table 89 Acrylic: Automotive Paints Market, by Region, 2023-2028 (USD Million)

8.5 Other Resins

Table 90 Other Resins: Automotive Paints Market, by Region, 2019-2022 (Million Gallons)

Table 91 Other Resins: Automotive Paints Market, by Region, 2023-2028 (Million Gallons)

Table 92 Other Resins: Automotive Paints Market, by Region, 2019-2022 (USD Million)

Table 93 Other Resins: Automotive Paints Market, by Region, 2023-2028 (USD Million)

9 Automotive Paints Market, by Texture

9.1 Introduction

9.1.1 Industry Insights

Figure 39 Automotive Paints Market, by Texture, 2023-2028 (Thousand Units)

Table 94 Automotive Paints Market, by Texture, 2019-2022 (Thousand Units)

Table 95 Automotive Paints Market, by Texture, 2023-2028 (Thousand Units)

9.2 Solid

9.2.1 Development of New Pigment Technologies to Drive Growth

Table 96 Vehicles with Solid Texture, 2023

Table 97 Solid: Automotive Paints Market, by Region, 2019-2022 (Thousand Units)

Table 98 Solid: Automotive Paints Market, by Region, 2023-2028 (Thousand Units)

9.3 Metallic

9.3.1 Rising Premium Car Sales to Drive Growth

Table 99 Vehicles with Metallic Texture, 2023

Table 100 Metallic: Automotive Paints Market, by Region, 2019-2022 (Thousand Units)

Table 101 Metallic: Automotive Paints Market, by Region, 2023-2028 (Thousand Units)

9.4 Matte Finish

9.4.1 Consumer Preference for Limited-Edition Vehicles to Drive Growth

Table 102 Vehicles with Matte Finish Texture, 2023

Table 103 Matte Finish: Automotive Paints Market, by Region, 2019-2022 (Thousand Units)

Table 104 Matte Finish: Automotive Paints Market, by Region, 2023-2028 (Thousand Units)

9.5 Pearlescent

9.5.1 Personalization Trend in High-Performance Vehicles to Drive Growth

Table 105 Pearlescent: Automotive Paints Market, by Region, 2019-2022 (Thousand Units)

Table 106 Pearlescent: Automotive Paints Market, by Region, 2023-2028 (Thousand Units)

9.6 Solar Reflective

9.6.1 Innovations for Solar Heat Reduction in Automotive Paints to Drive Growth

Table 107 Solar Reflective: Automotive Paints Market, by Region, 2019-2022 (Thousand Units)

Table 108 Solar Reflective: Automotive Paints Market, by Region, 2023-2028 (Thousand Units)

10 Automotive Paints Market, by Content

10.1 Introduction

10.2 Electrocoat, by Content

Figure 40 Automotive Electrocoat Market, by Content, 2023-2028 (Thousand Gallons)

Table 109 Automotive Electrocoat Market, by Content, 2019-2022 (Thousand Gallons)

Table 110 Automotive Electrocoat Market, by Content, 2023-2028 (Thousand Gallons)

10.3 Solvent-Borne Paint, by Content

Figure 41 Automotive Solvent-Borne Base Coat Market, by Content, 2023-2028 (Thousand Gallons)

Table 111 Automotive Solvent-Borne Base Coat Market, by Content, 2019-2022 (Thousand Gallons)

Table 112 Automotive Solvent-Borne Base Coat Market, by Content, 2023-2028 (Thousand Gallons)

Figure 42 Automotive Solvent-Borne Clear Coat Market, by Content, 2023-2028 (Thousand Gallons)

Table 113 Automotive Solvent-Borne Clear Coat Market, by Content, 2019-2022 (Thousand Gallons)

Table 114 Automotive Solvent-Borne Clear Coat Market, by Content, 2023-2028 (Thousand Gallons)

10.4 Water-Borne Paint, by Content

Figure 43 Automotive Water-Borne Base Coat Market, by Content, 2023-2028 (Thousand Gallons)

Table 115 Automotive Water-Borne Base Coat Market, by Content, 2019-2022 (Thousand Gallons)

Table 116 Automotive Water-Borne Base Coat Market, by Content, 2023-2028 (Thousand Gallons)

Figure 44 Automotive Water-Borne Clear Coat Market, by Content, 2023-2028 (Thousand Gallons)

Table 117 Automotive Water-Borne Clear Coat Market, by Content, 2019-2022 (Thousand Gallons)

Table 118 Automotive Water-Borne Clear Coat Market, by Content, 2023-2028 (Thousand Gallons)

11 Automotive Paints Market, by Painting Equipment Technique

11.1 Introduction

11.1.1 Industry Insights

Figure 45 Automotive Paints Equipment Market, by Region, 2023-2028 (Units)

Table 119 Automotive Paints Equipment Market, by Region, 2019-2022 (Units)

Table 120 Automotive Paints Equipment Market, by Region, 2023-2028 (Units)

11.2 Airless Spray Gun

11.2.1 Growing Popularity of Water-Borne Paints to Drive Growth

Table 121 Airless Spray Gun: Automotive Paints Equipment Market, by Region, 2019-2022 (Units)

Table 122 Airless Spray Gun: Automotive Paints Equipment Market, by Region, 2023-2028 (Units)

11.3 Electrostatic Spray Gun

11.3.1 Strict Environmental Regulations to Drive Growth

Table 123 Electrostatic Spray Gun: Automotive Paints Equipment Market, by Region, 2019-2022 (Units)

Table 124 Electrostatic Spray Gun: Automotive Paints Equipment Market, by Region, 2023-2028 (Units)

12 Automotive Paints Market, by Vehicle Type

12.1 Introduction

12.1.1 Industry Insights

Figure 46 Automotive Paints Market, by Vehicle Type, 2023-2028 (USD Million)

Table 125 Automotive Paints Market, by Vehicle Type, 2019-2022 (Million Gallons)

Table 126 Automotive Paints Market, by Vehicle Type, 2023-2028 (Million Gallons)

Table 127 Automotive Paints Market, by Vehicle Type, 2019-2022 (USD Million)

Table 128 Automotive Paints Market, by Vehicle Type, 2023-2028 (USD Million)

12.2 Passenger Car

12.2.1 Rise in Demand for Compact and Mid-Sized SUVs to Drive Growth

Table 129 Passenger Car: Automotive Paints Market, by Region, 2019-2022 (Thousand Gallons)

Table 130 Passenger Car: Automotive Paints Market, by Region, 2023-2028 (Thousand Gallons)

Table 131 Passenger Car: Automotive Paints Market, by Region, 2019-2022 (USD Million)

Table 132 Passenger Car: Automotive Paints Market, by Region, 2023-2028 (USD Million)

12.3 Light Commercial Vehicle (Lcv)

12.3.1 Booming E-Commerce and Logistics Industries to Drive Growth

Table 133 Light Commercial Vehicle: Automotive Paints Market, by Region, 2019-2022 (Thousand Gallons)

Table 134 Light Commercial Vehicle: Automotive Paints Market, by Region, 2023-2028 (Thousand Gallons)

Table 135 Light Commercial Vehicle: Automotive Paints Market, by Region 2019-2022 (USD Million)

Table 136 Light Commercial Vehicle: Automotive Paints Market, by Region, 2023-2028 (USD Million)

12.4 Truck

12.4.1 Increase in Vehicle Sales and Maintenance Services to Drive Growth

Table 137 Truck: Automotive Paints Market, by Region, 2019-2022 (Thousand Gallons)

Table 138 Truck: Automotive Paints Market, by Region, 2023-2028 (Thousand Gallons)

Table 139 Truck: Automotive Paints Market, by Region, 2019-2022 (USD Million)

Table 140 Truck: Automotive Paints Market, by Region, 2023-2028 (USD Million)

12.5 Bus

12.5.1 Expanding Tourism Industry to Drive Growth

Table 141 Bus: Automotive Paints Market, by Region, 2019-2022 (Thousand Gallons)

Table 142 Bus: Automotive Paints Market, by Region, 2023-2028 (Thousand Gallons)

Table 143 Bus: Automotive Paints Market, by Region, 2019-2022 (USD Million)

Table 144 Bus: Automotive Paints Market, by Region, 2023-2028 (USD Million)

13 Electric & Hybrid Vehicle Paints Market, by Vehicle Type

13.1 Introduction

13.1.1 Industry Insights

Figure 47 Electric & Hybrid Vehicle Paints Market, by Vehicle Type, 2023-2028 (USD Billion)

Table 145 Electric & Hybrid Vehicle Paints Market, by Vehicle Type, 2019-2022 (Thousand Units)

Table 146 Electric & Hybrid Vehicle Paints Market, by Vehicle Type, 2023-2028 (Thousand Units)

Table 147 Electric & Hybrid Vehicle Paints Market, by Vehicle Type, 2019-2022 (USD Million)

Table 148 Electric & Hybrid Vehicle Paints Market, by Vehicle Type, 2023-2028 (USD Million)

13.2 Battery Electric Vehicle (Bev)

13.2.1 Government Incentives and Policies to Drive Growth

Table 149 Bev: Electric & Hybrid Vehicle Paints Market, by Region, 2019-2022 (Thousand Units)

Table 150 Bev: Electric & Hybrid Vehicle Paints Market, by Region, 2023-2028 (Thousand Units)

Table 151 Bev: Electric & Hybrid Vehicle Paints Market, by Region, 2019-2022 (USD Million)

Table 152 Bev: Electric & Hybrid Vehicle Paints Market, by Region, 2023-2028 (USD Million)

13.3 Fuel Cell Electric Vehicle (FCEV)

13.3.1 Hydrogen Fuel Infrastructure Development to Drive Growth

Table 153 Fcev: Electric & Hybrid Vehicle Paints Market, by Region, 2019-2022 (Thousand Unit)

Table 154 Fcev: Electric & Hybrid Vehicle Paints Market, by Region, 2023-2028 (Thousand Unit)

Table 155 Fcev: Electric & Hybrid Vehicle Paints Market, by Region, 2019-2022 (USD Million)

Table 156 Fcev: Electric & Hybrid Vehicle Paints Market, by Region, 2023-2028 (USD Million)

13.4 Plug-In Hybrid Vehicle (PHEV)

13.4.1 Changing Customer Preferences to Drive Growth

Table 157 Phev: Electric & Hybrid Vehicle Paints Market, by Region, 2019-2022 (Thousand Units)

Table 158 Phev: Electric & Hybrid Vehicle Paints Market, by Region, 2023-2028 (Thousand Units)

Table 159 Phev: Electric & Hybrid Vehicle Paints Market, by Region, 2019-2022 (USD Million)

Table 160 Phev: Electric & Hybrid Vehicle Paints Market, by Region, 2023-2028 (USD Million)

14 Automotive Refinish Paints Market, by Resin Type

14.1 Introduction

Figure 48 Automotive Refinish Paints Market, by Resin Type, 2023-2028 (USD Million)

Table 161 Automotive Refinish Paints Market, by Resin Type, 2019-2022 (Million Gallons)

Table 162 Automotive Refinish Paints Market, by Resin Type, 2023-2028 (Million Gallons)

Table 163 Automotive Refinish Paints Market, by Resin Type, 2019-2022 (USD Million)

Table 164 Automotive Refinish Paints Market, by Resin Type, 2023-2028 (USD Million)

14.2 Polyurethane

14.2.1 Diy Car Care Trend to Drive Growth

Table 165 Polyurethane: Automotive Refinish Paints Market, by Region, 2019-2022 (Million Gallons)

Table 166 Polyurethane: Automotive Refinish Paints Market, by Region, 2023-2028 (Million Gallons)

Table 167 Polyurethane: Automotive Refinish Paints Market, by Region, 2019-2022 (USD Million)

Table 168 Polyurethane: Automotive Refinish Paints Market, by Region, 2023-2028 (USD Million)

14.3 Epoxy

14.3.1 Restoration of Classic Cars and Special Performance Vehicles to Drive Growth

Table 169 Epoxy: Automotive Refinish Paints Market, by Region, 2019-2022 (Million Gallons)

Table 170 Epoxy: Automotive Refinish Paints Market, by Region, 2023-2028 (Million Gallons)

Table 171 Epoxy: Automotive Refinish Paints Market, by Region, 2019-2022 (USD Million)

Table 172 Epoxy: Automotive Refinish Paints Market, by Region, 2023-2028 (USD Million)

14.4 Acrylic

14.4.1 Regulatory Compliance to Lower Demand

Table 173 Acrylic: Automotive Refinish Paints Market, by Region, 2019-2022 (Million Gallons)

Table 174 Acrylic: Automotive Refinish Paints Market, by Region, 2023-2028 (Million Gallons)

Table 175 Acrylic: Automotive Refinish Paints Market, by Region, 2019-2022 (USD Million)

Table 176 Acrylic: Automotive Refinish Paints Market, by Region, 2023-2028 (USD Million)

14.5 Other Resins

Table 177 Other Resins: Automotive Refinish Paints Market, by Region, 2019-2022 (Million Gallons)

Table 178 Other Resins: Automotive Refinish Paints Market, by Region, 2023-2028 (Million Gallons)

Table 179 Other Resins: Automotive Refinish Paints Market, by Region, 2019-2022 (USD Million)

Table 180 Other Resins: Automotive Refinish Paints Market, by Region, 2023-2028 (USD Million)

15 Automotive Paints Market, by Region

15.1 Introduction

15.1.1 Industry Insights

Figure 49 Automotive Paints Market, by Region, 2023-2028 (USD Million)

Table 181 Automotive Paints Market, by Region, 2019-2022 (Million Gallons)

Table 182 Automotive Paints Market, by Region, 2023-2028 (Million Gallons)

Table 183 Automotive Paints Market, by Region, 2019-2022 (USD Million)

Table 184 Automotive Paints Market, by Region, 2023-2028 (USD Million)

15.2 North America

Figure 50 North America: Automotive Paints Market Snapshot

Table 185 North America: Automotive Paints Market, by Country, 2019-2022 (Thousand Gallons)

Table 186 North America: Automotive Paints Market, by Country, 2023-2028 (Thousand Gallons)

Table 187 North America: Automotive Paints Market, by Country, 2019-2022 (USD Million)

Table 188 North America: Automotive Paints Market, by Country, 2023-2028 (USD Million)

15.2.1 US

15.2.1.1 Rise of Electric and Autonomous Vehicles to Drive Growth

Table 189 US: Automotive Paints Market, by Vehicle Type, 2019-2022 (Thousand Gallons)

Table 190 US: Automotive Paints Market, by Vehicle Type, 2023-2028 (Thousand Gallons)

Table 191 US: Automotive Paints Market, by Vehicle Type, 2019-2022 (USD Million)

Table 192 US: Automotive Paints Market, by Vehicle Type, 2023-2028 (USD Million)

15.2.2 Mexico

15.2.2.1 Robust Automotive Manufacturing Base to Drive Growth

Table 193 Mexico: Automotive Paints Market, by Vehicle Type, 2019-2022 (Million Gallons)

Table 194 Mexico: Automotive Paints Market, by Vehicle Type, 2023-2028 (Million Gallons)

Table 195 Mexico: Automotive Paints Market, by Vehicle Type, 2019-2022 (USD Million)

Table 196 Mexico: Automotive Paints Market, by Vehicle Type, 2023-2028 (USD Million)

15.2.3 Canada

15.2.3.1 Extreme Climatic Conditions to Drive Growth

Table 197 Canada: Automotive Paints Market, by Vehicle Type, 2019-2022 (Million Gallons)

Table 198 Canada: Automotive Paints Market, by Vehicle Type, 2023-2028 (Million Gallons)

Table 199 Canada: Automotive Paints Market, by Vehicle Type, 2019-2022 (USD Million)

Table 200 Canada: Automotive Paints Market, by Vehicle Type, 2023-2028 (USD Million)

15.3 Asia-Pacific

Figure 51 Asia-Pacific: Automotive Paints Market Snapshot

Table 201 Asia-Pacific: Automotive Paints Market, by Country, 2019-2022 (Thousand Gallons)

Table 202 Asia-Pacific: Automotive Paints Market, by Country, 2023-2028 (Thousand Gallons)

Table 203 Asia-Pacific: Automotive Paints Market, by Country, 2019-2022 (USD Million)

Table 204 Asia-Pacific: Automotive Paints Market, by Country, 2023-2028 (USD Million)

15.3.1 China

15.3.1.1 Large-Scale Vehicle Production to Drive Growth

Table 205 China: Automotive Paints Market, by Vehicle Type, 2019-2022 (Million Gallons)

Table 206 China: Automotive Paints Market, by Vehicle Type, 2023-2028 (Million Gallons)

Table 207 China: Automotive Paints Market, by Vehicle Type, 2019-2022 (USD Million)

Table 208 China: Automotive Paints Market, by Vehicle Type, 2023-2028 (USD Million)

15.3.2 Japan

15.3.2.1 Rising Popularity of Kei Cars to Drive Growth

Table 209 Japan: Automotive Paints Market, by Vehicle Type, 2019-2022 (Thousand Gallons)

Table 210 Japan: Automotive Paints Market, by Vehicle Type, 2023-2028 (Thousand Gallons)

Table 211 Japan: Automotive Paints Market, by Vehicle Type, 2019-2022 (USD Million)

Table 212 Japan: Automotive Paints Market, by Vehicle Type, 2023-2028 (USD Million)

15.3.3 South Korea

15.3.3.1 Presence of Prominent Automotive Paint Manufacturers to Drive Growth

Table 213 South Korea: Automotive Paints Market, by Vehicle Type, 2019-2022 (Thousand Gallons)

Table 214 South Korea: Automotive Paints Market, by Vehicle Type, 2023-2028 (Thousand Gallons)

Table 215 South Korea: Automotive Paints Market, by Vehicle Type, 2019-2022 (USD Million)

Table 216 South Korea: Automotive Paints Market, by Vehicle Type, 2023-2028 (USD Million)

15.3.4 India

15.3.4.1 Vehicle Scrappage Policy to Drive Growth

Table 217 India: Automotive Paints Market, by Vehicle Type, 2019-2022 (Thousand Gallons)

Table 218 India: Automotive Paints Market, by Vehicle Type, 2023-2028 (Thousand Gallons)

Table 219 India: Automotive Paints Market, by Vehicle Type, 2019-2022 (USD Million)

Table 220 India: Automotive Paints Market, by Vehicle Type, 2023-2028 (USD Million)

15.3.5 Rest of Asia-Pacific

Table 221 Rest of Asia-Pacific: Automotive Paints Market, by Vehicle Type, 2019-2022 (Thousand Gallons)

Table 222 Rest of Asia-Pacific: Automotive Paints Market, by Vehicle Type, 2023-2028 (Thousand Gallons)

Table 223 Rest of Asia-Pacific: Automotive Paints Market, by Vehicle Type, 2019-2022 (USD Million)

Table 224 Rest of Asia-Pacific: Automotive Paints Market, by Vehicle Type, 2023-2028 (USD Million)

15.4 Europe

Table 225 Europe: Automotive Paints Market, by Country, 2019-2022 (Thousand Gallons)

Table 226 Europe: Automotive Paints Market, by Country, 2023-2028 (Thousand Gallons)

Table 227 Europe: Automotive Paints Market, by Country, 2019-2022 (USD Million)

Table 228 Europe: Automotive Paints Market, by Country, 2023-2028 (USD Million)

15.4.1 Germany

15.4.1.1 Rising Production of Premium Cars to Drive Growth

Table 229 Germany: Automotive Paints Market, by Vehicle Type, 2019-2022 (Thousand Gallons)

Table 230 Germany: Automotive Paints Market, by Vehicle Type, 2023-2028 (Thousand Gallons)

Table 231 Germany: Automotive Paints Market, by Vehicle Type, 2019-2022 (USD Million)

Table 232 Germany: Automotive Paints Market, by Vehicle Type, 2023-2028 (USD Million)

15.4.2 France

15.4.2.1 Favorable Government Policies for Electric Vehicles to Drive Growth

Table 233 France: Automotive Paints Market, by Vehicle Type, 2019-2022 (Thousand Gallons)

Table 234 France: Automotive Paints Market, by Vehicle Type, 2023-2028 (Thousand Gallons)

Table 235 France: Automotive Paints Market, by Vehicle Type, 2019-2022 (USD Million)

Table 236 France: Automotive Paints Market, by Vehicle Type, 2023-2028 (USD Million)

15.4.3 UK

15.4.3.1 Zero Emission Vehicle Mandate to Drive Growth

Table 237 UK: Automotive Paints Market, by Vehicle Type, 2019-2022 (Thousand Gallons)

Table 238 UK: Automotive Paints Market, by Vehicle Type, 2023-2028 (Thousand Gallons)

Table 239 UK: Automotive Paints Market, by Vehicle Type, 2019-2022 (USD Million)

Table 240 UK: Automotive Paints Market, by Vehicle Type, 2023-2028 (USD Million)

15.4.4 Italy

15.4.4.1 Aging Fleet Renewal to Drive Growth

Table 241 Italy: Automotive Paints Market, by Vehicle Type, 2019-2022 (Thousand Gallons)

Table 242 Italy: Automotive Paints Market, by Vehicle Type, 2023-2028 (Thousand Gallons)

Table 243 Italy: Automotive Paints Market, by Vehicle Type, 2019-2022 (USD Million)

Table 244 Italy: Automotive Paints Market, by Vehicle Type, 2023-2028 (USD Million)

15.4.5 Spain

15.4.5.1 Tourism and Recreational Activities to Drive Growth

Table 245 Spain: Automotive Paints Market, by Vehicle Type, 2019-2022 (Thousand Gallons)

Table 246 Spain: Automotive Paints Market, by Vehicle Type, 2023-2028 (Thousand Gallons)

Table 247 Spain: Automotive Paints Market, by Vehicle Type, 2019-2022 (USD Million)

Table 248 Spain: Automotive Paints Market, by Vehicle Type, 2023-2028 (USD Million)

15.4.6 Russia

15.4.6.1 Robust Automobile Manufacturing Industry to Drive Growth

Table 249 Russia: Automotive Paints Market, by Vehicle Type, 2019-2022 (Thousand Gallons)

Table 250 Russia: Automotive Paints Market, by Vehicle Type, 2023-2028 (Thousand Gallons)

Table 251 Russia: Automotive Paints Market, by Vehicle Type, 2019-2022 (USD Million)

Table 252 Russia: Automotive Paints Market, by Vehicle Type, 2023-2028 (USD Million)

15.4.7 Rest of Europe

Table 253 Rest of Europe: Automotive Paints Market, by Vehicle Type, 2019-2022 (Thousand Gallons)

Table 254 Rest of Europe: Automotive Paints Market, by Vehicle Type, 2023-2028 (Thousand Gallons)

Table 255 Rest of Europe: Automotive Paints Market, by Vehicle Type, 2019-2022 (USD Million)

Table 256 Rest of Europe: Automotive Paints Market, by Vehicle Type, 2023-2028 (USD Million)

15.5 Rest of the World (Row)

Table 257 Rest of the World: Automotive Paints Market, by Country, 2019-2022 (Thousand Gallons)

Table 258 Rest of the World: Automotive Paints Market, by Country, 2023-2028 (Thousand Gallons)

Table 259 Rest of the World: Automotive Paints Market, by Country, 2019-2022 (USD Million)

Table 260 Rest of the World: Automotive Paints Market, by Country, 2023-2028 (USD Million)

15.5.1 Brazil

15.5.1.1 Increasing Sales of Ethanol-Based Vehicles to Drive Growth

Table 261 Brazil: Automotive Paints Market, by Vehicle Type, 2019-2022 (Thousand Gallons)

Table 262 Brazil: Automotive Paints Market, by Vehicle Type, 2023-2028 (Thousand Gallons)

Table 263 Brazil: Automotive Paints Market, by Vehicle Type, 2019-2022 (USD Million)

Table 264 Brazil: Automotive Paints Market, by Vehicle Type, 2023-2028 (USD Million)

15.5.2 South Africa

15.5.2.1 Emergence of Digital Design Tools and Customization Services to Drive Growth

Table 265 South Africa: Automotive Paints Market, by Vehicle Type, 2019-2022 (Thousand Gallons)

Table 266 South Africa: Automotive Paints Market, by Vehicle Type, 2023-2028 (Thousand Gallons)

Table 267 South Africa: Automotive Paints Market, by Vehicle Type, 2019-2022 (USD Million)

Table 268 South Africa: Automotive Paints Market, by Vehicle Type, 2023-2028 (USD Million)

15.5.3 Others

Table 269 Others: Automotive Paints Market, by Vehicle Type, 2019-2022 (Thousand Gallons)

Table 270 Others: Automotive Paints Market, by Vehicle Type, 2023-2028 (Thousand Gallons)

Table 271 Others: Automotive Paints Market, by Vehicle Type, 2019-2022 (USD Million)

Table 272 Others: Automotive Paints Market, by Vehicle Type, 2023-2028 (USD Million)

16 Competitive Landscape

16.1 Overview

16.2 Market Share Analysis, 2022

Figure 52 Market Share of Key Players, 2022

16.3 Revenue Analysis, 2020 Vs. 2022

Figure 53 Revenue Analysis of Key Players, 2020 Vs. 2022

16.4 Automotive Paints Market: Company Evaluation Matrix, 2022

16.4.1 Stars

16.4.2 Emerging Leaders

16.4.3 Pervasive Players

16.4.4 Participants

Figure 54 Automotive Paints Market: Company Evaluation Matrix, 2022

16.5 Company Footprint

Table 273 Automotive Paints Market: Company Footprint, 2022

Table 274 Automotive Paints Market: Technology Footprint, 2022

Table 275 Automotive Paints Market: Region Footprint, 2022

16.6 Automotive Refinish Paints Market: Company Evaluation Matrix, 2022

16.6.1 Stars

16.6.2 Emerging Leaders

16.6.3 Pervasive Players

16.6.4 Participants

Figure 55 Automotive Refinish Paints Market: Company Evaluation Matrix, 2022

16.7 Company Footprint

Table 276 Automotive Refinish Paints Market: Company Footprint, 2022

Table 277 Automotive Refinish Paints Market: Technology Footprint, 2022

Table 278 Automotive Refinish Paints Market: Region Footprint, 2022

16.8 Competitive Scenario

16.8.1 Product Developments, 2022-2023

Table 279 Product Developments, 2022-2023

16.8.2 Deals, 2022-2023

Table 280 Deals, 2022-2023

16.8.3 Others, 2022-2023

Table 281 Others, 2022-2023

16.9 Right to Win, 2022-2023

Table 282 Right to Win, 2022-2023

17 Company Profiles

(Business Overview, Products Offered, Recent Developments, and Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

17.1 Key Players

17.1.1 Ppg Industries, Inc.

Table 283 Ppg Industries, Inc.: Company Overview

Figure 56 Ppg Industries, Inc.: Company Snapshot

Table 284 Ppg Industries, Inc.: Products Offered

Table 285 Ppg Industries, Inc.: Product Developments

Table 286 Ppg Industries, Inc.: Deals

Table 287 Ppg Industries, Inc.: Others

17.1.2 Basf Se

Table 288 Basf Se: Company Overview

Figure 57 Basf Se: Company Snapshot

Table 289 Basf Se: Products Offered

Table 290 Basf Se: Product Developments

Table 291 Basf Se: Deals

Table 292 Basf Se: Others

17.1.3 Axalta Coating Systems, LLC

Table 293 Axalta Coating Systems, LLC: Company Overview

Figure 58 Axalta Coating Systems, LLC: Company Snapshot

Table 294 Axalta Coating Systems, LLC: Products Offered

Table 295 Axalta Coating Systems, LLC: Product Developments

Table 296 Axalta Coating Systems, LLC: Deals

Table 297 Axalta Coating Systems, LLC: Others

17.1.4 Akzo Nobel N.V.

Table 298 Akzo Nobel N.V.: Company Overview

Figure 59 Akzo Nobel N.V.: Company Snapshot

Table 299 Akzo Nobel N.V.: Products Offered

Table 300 Akzo Nobel N.V.: Product Developments

Table 301 Akzo Nobel N.V.: Deals

Table 302 Akzo Nobel N.V.: Others

17.1.5 The Sherwin-Williams Company

Table 303 The Sherwin-Williams Company: Company Overview

Figure 60 The Sherwin-Williams Company: Company Snapshot

Table 304 The Sherwin-Williams Company: Products Offered

Table 305 The Sherwin-Williams Company: Product Developments

Table 306 The Sherwin-Williams Company: Deals

Table 307 The Sherwin-Williams Company: Others

17.1.6 Kansai Paint Co., Ltd.

Table 308 Kansai Paint Co., Ltd.: Company Overview

Figure 61 Kansai Paint Co., Ltd.: Company Snapshot

Table 309 Kansai Paint Co., Ltd.: Products Offered

Table 310 Kansai Paint Co., Ltd.: Deals

17.1.7 Solvay

Table 311 Solvay: Company Overview

Figure 62 Solvay: Company Snapshot

Table 312 Solvay: Products Offered

Table 313 Solvay: Product Developments

Table 314 Solvay: Others

17.1.8 Nippon Paint Holdings Co., Ltd.

Table 315 Nippon Paint Holdings Co., Ltd.: Company Overview

Figure 63 Nippon Paint Holdings Co., Ltd.: Company Snapshot

Table 316 Nippon Paint Holdings Co., Ltd.: Products Offered

Table 317 Nippon Paint Holdings Co., Ltd.: Product Developments

Table 318 Nippon Paint Holdings Co., Ltd.: Deals

17.1.9 Covestro Ag

Table 319 Covestro Ag: Company Overview

Figure 64 Covestro Ag: Company Snapshot

Table 320 Covestro Ag: Products Offered

Table 321 Covestro Ag: Product Developments

Table 322 Covestro Ag: Others

17.1.10 Clariant

Table 323 Clariant: Company Overview

Figure 65 Clariant: Company Snapshot

Table 324 Clariant: Products Offered

Table 325 Clariant: Product Developments

17.2 Other Players

17.2.1 Jotun

Table 326 Jotun: Company Overview

17.2.2 Skshu Paint Co., Ltd.

Table 327 Skshu Paint Co., Ltd.: Company Overview

17.2.3 Kcc Corporation

Table 328 Kcc Corporation: Company Overview

17.2.4 Donglai Coating Technology (Shanghai) Co., Ltd.

Table 329 Donglai Coating Technology (Shanghai) Co., Ltd.: Company Overview

17.2.5 Dupont

Table 330 Dupont: Company Overview

17.2.6 Standox

Table 331 Standox: Company Overview

17.2.7 Nexa Autocolor

Table 332 Nexa Autocolor: Company Overview

17.2.8 3M

Table 333 3M: Company Overview

17.2.9 Wacker Chemie Ag

Table 334 Wacker Chemie Ag: Company Overview

17.2.10 Ppg Asianpaints

Table 335 Ppg Asianpaints: Company Overview

*Details on Business Overview, Products Offered, Recent Developments, and Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) Might Not be Captured in Case of Unlisted Companies.

18 Analyst's Recommendations

18.1 Asia-Pacific to be Major Market for Automotive Paints

18.2 Environment Friendliness and Better Strength-To-Weight Ratio to Drive Polyurethane Segment

18.3 Conclusion

19 Appendix

19.1 Insights from Industry Experts

19.2 Discussion Guide

19.3 Knowledgestore: The Subscription Portal

19.4 Customization Options

19.4.1 Additional Company Profiles

19.4.2 Electric & Hybrid Vehicle Paints Market, by Vehicle Type, at Country Level

19.4.2.1 Bev

19.4.2.2 Fcev

19.4.2.3 Phev