1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.3 Inclusions and Exclusions

1.3.1 Transformer Monitoring Market, by Component: Inclusions and Exclusions

1.3.2 Market, by Type: Inclusions and Exclusions

1.3.3 Market, by Services: Inclusions and Exclusions

1.3.4 Market, by Voltage: Inclusions and Exclusions

1.3.5 Market, by Application: Inclusions and Exclusions

1.4 Market Scope

1.4.1 Markets Covered

1.4.2 Regional Scope

1.4.3 Years Considered

1.4.4 Currency Considered

1.5 Limitations

1.6 Stakeholders

1.7 Summary of Changes

1.8 Recession Impact

2 Research Methodology

2.1 Research Data

Figure 1 Transformer Monitoring Market: Research Design

2.2 Market Breakdown and Data Triangulation

Figure 2 Data Triangulation

2.2.1 Secondary Data

2.2.1.1 Key Data from Secondary Sources

2.2.2 Primary Data

2.2.2.1 Key Industry Insights

2.2.2.2 Breakdown of Primaries

2.3 Scope

Figure 3 Main Metrics Considered to Analyze and Assess Demand for Transformer Monitoring Systems

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

2.4.2 Top-Down Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

2.4.3 Demand-Side Analysis

2.4.3.1 Regional Analysis

2.4.3.2 Country-Level Analysis

2.4.3.3 Assumptions for Demand-Side Analysis

2.4.3.4 Calculations for Demand-Side Analysis

2.4.4 Supply-Side Analysis

Figure 6 Key Steps Considered to Assess Supply of Transformer Monitoring Systems

Figure 7 Transformers Monitoring Market: Supply-Side Analysis

2.4.4.1 Calculations for Supply-Side Analysis

2.4.4.2 Assumptions for Supply-Side Analysis

Figure 8 Industry Concentration, 2022

2.4.5 Forecast

2.5 Risk Assessment

2.6 Impact of Recession

3 Executive Summary

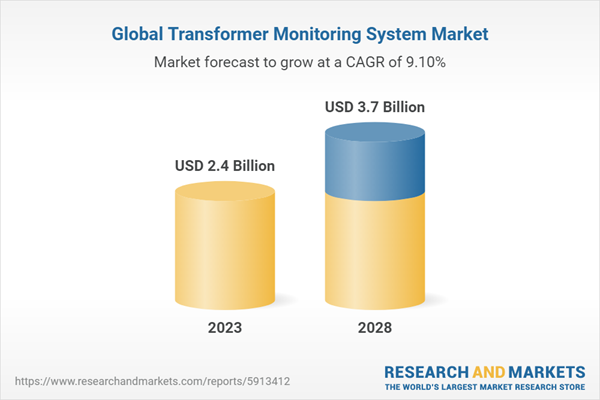

Table 1 Transformer Monitoring Market Snapshot

Figure 9 Asia-Pacific to Register Highest CAGR in Transformers Monitoring Market During Forecast Period

Figure 10 Hardware Solutions Segment to Lead Market During Forecast Period

Figure 11 Oil-Immersed Segment to Dominate Market During Forecast Period

Figure 12 Power Transformers Segment to Lead Transformer Monitoring Market During Forecast Period

Figure 13 High and Extra High Voltage Segment to Lead Market During Forecast Period

Figure 14 Oil Monitoring Segment to Lead Transformers Monitoring Market During Forecast Period

4 Premium Insights

4.1 Attractive Opportunities for Players in the Transformer Monitoring Market

Figure 15 Rising Adoption of Efficient Power Distribution Systems

4.2 Transformer Monitoring Market, by Region

Figure 16 Asia-Pacific to Register Highest CAGR During Forecast Period

4.3 Asia-Pacific Market, by Services and Country, 2022

Figure 17 Oil Monitoring Segment and China Held Largest Shares of Asia-Pacific Market in 2022

4.4 Transformers Monitoring Market, by Component

Figure 18 Hardware Solutions Segment to Dominate Market in 2028

4.5 Transformers Monitoring Market, by Type

Figure 19 Oil-Immersed Segment to Account for Largest Share of Market in 2028

4.6 Transformer Monitoring Market, by Application

Figure 20 Power Transformers Segment to Account for Largest Share of Transformers Monitoring Market in 2028

4.7 Transformers Monitoring Market, by Voltage

Figure 21 High and Extra High Voltage Segment to Account for Largest Share of Transformers Monitoring Market in 2028

4.8 Transformer Monitoring Market, by Services

Figure 22 Oil Monitoring Segment to Account for Largest Share of Transformers Monitoring Market in 2028

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 23 Transformer Monitoring Market: Drivers, Restraints, Opportunities, and Challenges

5.2.1 Drivers

5.2.1.1 Increasing Focus on Digitalization of Utilities

Table 2 Projects by Different Countries for Energy Transition

Figure 24 Investments in Digitalization of Transformers, 2015-2022 (USD Billion)

5.2.1.2 Increased Investments in Renewable and Clean Energy Generation

Figure 25 Global Clean Energy Investments, 2015-2023 (USD Billion)

Figure 26 Energy Transition Investments, by Top 10 Countries, 2021 (%)

Figure 27 Energy Transition Investments, by Sector, 2021 (USD Billion)

5.2.1.3 Growing Use of Monitoring Systems for Transformers

Figure 28 Electricity Consumption, by Country, 2022 (Twh)

5.2.2 Restraints

5.2.2.1 High Hardware, Software, and Installation Costs

5.2.3 Opportunities

5.2.3.1 Growing Use of Big Data Analytics in Energy Industry

5.2.3.2 Increased Investments in Offshore Wind Farms

Figure 29 New Offshore Installations, 2016-2022 (Mw)

5.2.4 Challenges

5.2.4.1 Low Acceptance Among End-users

5.3 Trends/Disruptions Impacting Customers’ Businesses

Figure 30 Trends/Disruptions Impacting Customers’ Businesses

5.4 Ecosystem Mapping

Table 3 Companies and Their Role in Transformer Monitoring Ecosystem

Figure 31 Transformers Monitoring Market: Ecosystem Mapping

5.5 Value Chain Analysis

Figure 32 Transformers Monitoring Market: Value Chain Analysis

5.5.1 Raw Material Providers/Suppliers/Component Manufacturers

5.5.2 Transformer Monitoring System Manufacturers/Assemblers

5.5.3 Distributors/Resellers

5.5.4 End-users

5.5.5 Maintenance/Service Providers

5.6 Technology Analysis

5.6.1 Sensors and Internet of Things (IoT)

5.6.2 Data Analytics and Artificial Intelligence (AI)

5.6.3 Digital Twins and Simulation

5.6.4 Cloud-Based and Mobile Solutions

5.7 Patent Analysis

Figure 33 Market: Patent Registrations, 2012-2022

Table 4 Market: Innovations and Patent Registrations, 2019-2023

5.8 Trade Analysis

5.8.1 Import Scenario for Hs Code 850423-Compliant Products

Table 5 Import Data for Hs Code 850423-Compliant Products, by Country, 2020-2022 (USD Thousand)

Figure 34 Import Data for Hs Code 850423-Compliant Products, by Top Five Countries, 2020-2022 (USD Thousand)

5.8.2 Export Scenario for Hs Code 850423-Compliant Products

Table 6 Export Data for Hs Code 850423-Compliant Products, by Country, 2020-2022 (USD Thousand)

Figure 35 Export Data for Hs Code 850423-Compliant Products, by Top Five Countries, 2020-2022 (USD Thousand)

5.8.3 Import Scenario for Hs Code 850421-Compliant Products

Table 7 Import Data for Hs Code 850421-Compliant Products, by Country, 2020-2022 (USD Thousand)

Figure 36 Import Scenario for Hs Code 850421-Compliant Products, by Top Five Countries, 2020-2022 (USD Thousand)

5.8.4 Export Scenario for Hs Code 850421-Compliant Products

Table 8 Export Data for Hs Code 850421-Compliant Products, by Country, 2020-2022 (USD Thousand)

Figure 37 Export Data for Hs Code 850421-Compliant Products, by Top Five Countries, 2020-2022 (USD Thousand)

5.9 Pricing Analysis

Figure 38 Average Selling Price (ASP) of Transformer Monitoring Systems, by Application, 2021, 2022, 2023, and 2028 (USD/Unit)

Table 9 Average Selling Price (ASP) of Transformer Monitoring Systems, by Application, 2021, 2022, 2023, and 2028 (USD/Unit)

Table 10 Average Selling Price (ASP) Trend, by Region, 2020, 2021, 2022, and 2030 (Usd/Unit)

Figure 39 Average Selling Price (ASP) Trend, by Region, 2020, 2021, 2022, and 2030 (Usd/Unit)

5.10 Tariff Analysis

Table 11 Tariff Levied on Transformer Monitoring Systems (Hs Code 850423), 2022

Table 12 Tariff Levied on Transformer Monitoring Systems (Hs Code 850421), 2022

5.11 Standards and Regulatory Landscape

5.11.1 Standards Related to Transformer Monitoring Systems

Table 13 Transformer Monitoring Market: North American Standards

Table 14 Market: European Standards

Table 15 Market: Asia-Pacific Standards

Table 16 Market: International Standards

5.11.2 Regulatory Bodies, Government Agencies, and Other Organizations

Table 17 North America: Regulatory Bodies, Government Agencies, and Other Organizations

Table 18 Europe: Regulatory Bodies, Government Agencies, and Other Organizations

Table 19 Asia-Pacific: Regulatory Bodies, Government Agencies, and Other Organizations

Table 20 RoW: Regulatory Bodies, Government Agencies, and Other Organizations

5.12 Porter's Five Forces Analysis

Figure 40 Transformer Monitoring Market: Porter's Five Forces Analysis

Table 21 Market: Porter's Five Forces Analysis

5.12.1 Threat of Substitutes

5.12.2 Bargaining Power of Suppliers

5.12.3 Bargaining Power of Buyers

5.12.4 Threat of New Entrants

5.12.5 Intensity of Competitive Rivalry

5.13 Case Study Analysis

5.13.1 Early Detection of Temperature, Oil Quality, Gas Levels, and Electrical Characteristics in Transformers by Condition Monitoring

5.13.1.1 Problem Statement

5.13.1.2 Solution

5.13.2 Gujarat Power Research & Development (Gprd) Deployed System Level Solutions (SLS)'s Real-Time Transformer Monitoring System (TMS) for Real-Time Transformer Monitoring

5.13.2.1 Problem Statement

5.13.2.2 Solution

5.13.3 Omicron Electronics GmbH Was Contracted by Substation Based in Austria to Rectify Partial Discharge and Ensure Operational Safety and Reliability

5.13.3.1 Problem Statement

5.13.3.2 Solution

5.14 Key Stakeholders and Buying Criteria

5.14.1 Key Stakeholders in the Buying Process

Figure 41 Influence of Key Stakeholders on the Buying Process for Top Three Services

Table 22 Influence of Key Stakeholders on the Buying Process for Top Three Services

5.14.2 Buying Criteria

Figure 42 Key Buying Criteria for Top Three Services

Table 23 Key Buying Criteria for Top Three Services

5.15 Key Conferences and Events, 2023-2024

Table 24 Transformers Monitoring Market: List of Key Conferences and Events, 2023-2024

6 Transformer Monitoring Market, by Voltage

6.1 Introduction

Figure 43 Market, by Voltage, 2022

Table 25 Transformer Monitoring Market, by Voltage, 2021-2028 (USD Million)

6.2 Low Voltage

6.2.1 Highly Used to Power Devices and Systems Requiring Lower Voltage

Table 26 Low Voltage: Transformer Monitoring Market, by Region, 2021-2028 (USD Million)

6.3 Medium Voltage

6.3.1 Used to Step Down Higher Voltages Supplied by Grid to Levels Appropriate for Industrial Operations, Ensuring Safe and Manageable Electricity Distribution

Table 27 Medium Voltage: Transformers Monitoring Market, by Region, 2021-2028 (USD Million)

6.4 High and Extra High Voltage

6.4.1 Facilitates Early Fault Detection, Compliance Adherence, and Remote Oversight

Table 28 High Voltage: Transformers Monitoring Market, by Region, 2021-2028 (USD Million)

7 Transformer Monitoring Market, by Services

7.1 Introduction

Figure 44 Market, by Services, 2022

Table 29 Transformer Monitoring Market, by Services, 2021-2028 (USD Million)

7.2 Oil Monitoring

7.2.1 Helps Detect Issues Early and Extend Operational Life of Transformers

Table 30 Oil Monitoring: Transformer Monitoring Market, by Region, 2021-2028 (USD Million)

7.3 Bushing Monitoring

7.3.1 Ensures Integrity and Prevents Crippling of Transformer, Circuit Breaker, or Shunt Reactor Bushing Failure

Table 31 Bushing Monitoring: Transformers Monitoring Market, by Region, 2021-2028 (USD Million)

7.4 Partial Discharge (Pd) Monitoring

7.4.1 Enables Early Problem Identification and Preventative Maintenance

Table 32 Partial Discharge (Pd) Monitoring: Transformers Monitoring Market, by Region, 2021-2028 (USD Million)

7.5 On-Load Tap Changer (Oltc) Monitoring

7.5.1 Ensures Proper Functioning by Modifying Turn Ratio of Transformers and Adjusting Voltage Under Various Load Situations

Table 33 On-Load Tap Changer (Oltc) Monitoring: Transformers Monitoring Market, by Region, 2021-2028 (USD Million)

7.6 Other Services

Table 34 Other Services: Market, by Region, 2021-2028 (USD Million)

8 Transformer Monitoring Market, by Component

8.1 Introduction

Figure 45 Market, by Component, 2022

Table 35 Transformer Monitoring Market, by Component, 2021-2028 (USD Million)

8.2 Hardware Solutions

8.2.1 Increased Efforts to Improve Efficiency, Reliability, and Longevity of Power Transformers to Drive Demand

Table 36 Hardware Solutions: Transformers Monitoring Market, by Region, 2021-2028 (USD Million)

8.3 Software Solutions

8.3.1 Growing Adoption for Preventative Maintenance, Improving Power Transformer Performance, and Transforming Raw Data into Usable Insights to Drive Market

Table 37 Software Solutions: Transformers Monitoring Market, by Region, 2021-2028 (USD Million)

9 Transformer Monitoring Market, by Application

9.1 Introduction

Figure 46 Market, by Application, 2022

Table 38 Transformer Monitoring Market, by Application, 2021-2028 (USD Million)

Table 39 Market, by Application, 2021-2028 (Units)

9.2 Power Transformers

9.2.1 Capability to Detect Anomalies for Informed Decision-Making to Drive Demand

Table 40 Power Transformers: Transformer Monitoring Market, by Region, 2021-2028 (USD Million)

Table 41 Power Transformers: Market, by Region, 2021-2028 (Units)

9.3 Distribution Transformers

9.3.1 Ability to Remotely Monitor and Control Power Distribution to Fuel Demand

Table 42 Distribution Transformers: Transformer Monitoring Market, by Region, 2021-2028 (USD Million)

Table 43 Distribution Transformers: Market, by Region, 2021-2028 (Units)

9.4 Other Applications

Table 44 Other Applications: Transformers Monitoring Market, by Region, 2021-2028 (USD Million)

Table 45 Other Applications: Market, by Region, 2021-2028 (Units)

10 Transformer Monitoring Market, by Type

10.1 Introduction

Figure 47 Market, by Type, 2022

Table 46 Transformer Monitoring Market, by Type, 2021-2028 (USD Million)

10.2 Oil-Immersed

10.2.1 Used in Utilities to Handle Possible Faults, Reduce Unplanned Outages, and Optimize Transformer Performance

Table 47 Oil-Immersed: Transformers Monitoring Market, by Region, 2021-2028 (USD Million)

10.3 Cast-Resin

10.3.1 Ideal for Real-Time Assessment of Solid Insulation Condition

Table 48 Cast-Resin: Transformers Monitoring Market, by Region, 2021-2028 (USD Million)

10.4 Other Types

Table 49 Other Types: Market, by Region, 2021-2028 (USD Million)

11 Transformer Monitoring Market, by Region

11.1 Introduction

Figure 48 Market, by Region, 2022 (%)

Figure 49 Asia-Pacific to Register Highest CAGR During Forecast Period

Table 50 Transformer Monitoring Market, by Region, 2021-2028 (USD Million)

Table 51 Market, by Component, 2021-2028 (USD Million)

Table 52 Market, by Services, 2021-2028 (USD Million)

Table 53 Market, by Type, 2021-2028 (USD Million)

Table 54 Market, by Voltage, 2021-2028 (USD Million)

Table 55 Market, by Application, 2021-2028 (USD Million)

11.2 North America

11.2.1 North American Market: Recession Impact

Figure 50 North America: Market Snapshot

Table 56 North America: Transformer Monitoring Market, by Country, 2021-2028 (USD Million)

Table 57 North America: Market, by Component, 2021-2028 (USD Million)

Table 58 North America: Market, by Services, 2021-2028 (USD Million)

Table 59 North America: Market, by Type, 2021-2028 (USD Million)

Table 60 North America: Market, by Voltage, 2021-2028 (USD Million)

Table 61 North America: Market, by Application, 2021-2028 (USD Million)

11.2.2 US

11.2.2.1 Growing Electricity Demand and Need for Reliable and Efficient Operation of Power Utilities

Table 62 US: Transformer Monitoring Market, by Services, 2021-2028 (USD Million)

11.2.3 Canada

11.2.3.1 Rising Use to Reduce Operational Risks and Ensure Reliability of Power Transformers in Technologically Evolving Landscape

Table 63 Canada: Market, by Services, 2021-2028 (USD Million)

11.2.4 Mexico

11.2.4.1 Increasing Use of Renewable Energy and Growing Emphasis on Sustainability and Grid Resilience

Table 64 Mexico: Market, by Services, 2021-2028 (USD Million)

11.3 Europe

Figure 51 Europe: Market Snapshot

11.3.1 European Market: Recession Impact

Table 65 Europe: Transformer Monitoring Market, by Country, 2021-2028 (USD Million)

Table 66 Europe: Market, by Component, 2021-2028 (USD Million)

Table 67 Europe: Market, by Services, 2021-2028 (USD Million)

Table 68 Europe: Market, by Type, 2021-2028 (USD Million)

Table 69 Europe: Market, by Voltage, 2021-2028 (USD Million)

Table 70 Europe: Market, by Application, 2021-2028 (USD Million)

11.3.2 UK

11.3.2.1 Growing Adoption of Innovative Monitoring Systems

Table 71 UK: Transformer Monitoring Market, by Services, 2021-2028 (USD Million)

11.3.3 Germany

11.3.3.1 Expansion of T&D Network with Shift from Nuclear and Fossil Fuels to Renewable Energy

Table 72 Germany: Transformers Monitoring Market, by Services, 2021-2028 (USD Million)

11.3.4 France

11.3.4.1 Decommissioning of Aging Nuclear Plants and Growing Importance of Reliable and Efficient Power Infrastructure

Table 73 France: Transformers Monitoring Market, by Services, 2021-2028 (USD Million)

11.3.5 Italy

11.3.5.1 Increased Power Consumption and Use of Renewable Energy Sources

Table 74 Italy: Transformers Monitoring Market, by Services, 2021-2028 (USD Million)

11.3.6 Russia

11.3.6.1 Rising Government-Led Investments in Modernization of Power Grids

Table 75 Russia: Transformers Monitoring Market, by Services, 2021-2028 (USD Million)

11.3.7 Rest of Europe

Table 76 Rest of Europe: Market, by Services, 2021-2028 (USD Million)

11.4 Asia-Pacific

Figure 52 Asia-Pacific: Market Snapshot

11.4.1 Asia-Pacific Market: Recession Impact

Table 77 Asia-Pacific: Transformer Monitoring Market, by Country, 2021-2028 (USD Million)

Table 78 Asia-Pacific: Market, by Component, 2021-2028 (USD Million)

Table 79 Asia-Pacific: Market, by Services, 2021-2028 (USD Million)

Table 80 Asia-Pacific: Market, by Type, 2021-2028 (USD Million)

Table 81 Asia-Pacific: Market, by Voltage, 2021-2028 (USD Million)

Table 82 Asia-Pacific: Market, by Application, 2021-2028 (USD Million)

11.4.2 China

11.4.2.1 Rising Focus on Grid Stability and Sustainability

Table 83 China: Market, by Services, 2021-2028 (USD Million)

11.4.3 Japan

11.4.3.1 Increasing Need for Modernized and Resilient Power Grids

Table 84 Japan: Transformer Monitoring Market, by Services, 2021-2028 (USD Million)

11.4.4 India

11.4.4.1 Growing Need for Dependable and Efficient Power Supply and Aging Transformer Infrastructure

Table 85 India: Market, by Services, 2021-2028 (USD Million)

11.4.5 South Korea

11.4.5.1 Increased Power Consumption and Adoption of Renewable Sources for Electricity Production

Table 86 South Korea: Transformer Monitoring Market, by Services, 2021-2028 (USD Million)

11.4.6 Australia

11.4.6.1 Increasing Electricity Demand, Growing Share of Renewable Energy Sources, and Rising Adoption of Distributed Generation

Table 87 Australia: Transformers Monitoring Market, by Services, 2021-2028 (USD Million)

11.4.7 Rest of Asia-Pacific

Table 88 Rest of Asia-Pacific: Market, by Services, 2021-2028 (USD Million)

11.5 South America

11.5.1 South American Market: Recession Impact

Table 89 South America: Transformer Monitoring Market, by Country, 2021-2028 (USD Million)

Table 90 South America: Market, by Component, 2021-2028 (USD Million)

Table 91 South America: Market, by Services, 2021-2028 (USD Million)

Table 92 South America: Market, by Type, 2021-2028 (USD Million)

Table 93 South America: Market, by Voltage, 2021-2028 (USD Million)

Table 94 South America: Market, by Application, 2021-2028 (USD Million)

11.5.2 Brazil

11.5.2.1 Growing Solar Power Generation

Table 95 Brazil: Transformer Monitoring Market, by Services, 2021-2028 (USD Million)

11.5.3 Argentina

11.5.3.1 Increased Hydroelectricity Generation

Table 96 Argentina: Transformers Monitoring Market, by Services, 2021-2028 (USD Million)

11.5.4 Venezuela

11.5.4.1 Presence of Aging and Underinvested Power Grids

Table 97 Venezuela: Transformers Monitoring Market, by Services, 2021-2028 (USD Million)

11.5.5 Rest of South America

Table 98 Rest of South America: Market, by Services, 2021-2028 (USD Million)

11.6 Middle East & Africa

11.6.1 Middle Eastern & African Market: Recession Impact

Table 99 Middle East & Africa: Transformer Monitoring Market, by Country, 2021-2028 (USD Million)

Table 100 Middle East & Africa: Market, by Component, 2021-2028 (USD Million)

Table 101 Middle East & Africa: Market, by Services, 2021-2028 (USD Million)

Table 102 Middle East & Africa: Market, by Type, 2021-2028 (USD Million)

Table 103 Middle East & Africa: Market, by Voltage, 2021-2028 (USD Million)

Table 104 Middle East & Africa: Market, by Application, 2021-2028 (USD Million)

11.6.2 GCC Countries

11.6.2.1 High Electricity Demand in Residential Sector

Table 105 UAE: Transformer Monitoring Market, by Country, 2021-2028 (USD Million)

Table 106 UAE: Market, by Services, 2021-2028 (USD Million)

11.6.2.2 UAE

11.6.2.2.1 Rising Investments in Solar Energy Generation

Table 107 UAE: Market, by Services, 2021-2028 (USD Million)

11.6.2.3 Saudi Arabia

11.6.2.3.1 Expansion of Grids and Energy Diversification

Table 108 Saudi Arabia: Market, by Services, 2021-2028 (USD Million)

11.6.2.4 Qatar

11.6.2.4.1 Increased Electricity Generation Capacity Year-On-Year

Table 109 Qatar: Market, by Services, 2021-2028 (USD Million)

11.6.2.5 Rest of GCC Countries

Table 110 Rest of GCC Countries: Market, by Services, 2021-2028 (USD Million)

11.6.3 Iran

11.6.3.1 Growing Use of Renewable Energy Sources and Aging Transformer Infrastructure

Table 111 Iran: Market, by Services, 2021-2028 (USD Million)

11.6.4 Algeria

11.6.4.1 Growing Deployment in Power Grids and Oil & Gas Fields

Table 112 Algeria: Transformers Monitoring Market, by Services, 2021-2028 (USD Million)

11.6.5 South Africa

11.6.5.1 Increased Power Generation Using Coal and Growing Use to Improve Transformer Dependability and Longevity by Giving Real-Time Data on Performance and Potential Defects

Table 113 South Africa: Transformers Monitoring Market, by Services, 2021-2028 (USD Million)

11.6.6 Rest of Middle East & Africa

Table 114 Rest of Middle East & Africa: Transformers Monitoring Market, by Services, 2021-2028 (USD Million)

12 Competitive Landscape

12.1 Overview

12.2 Major Strategies Adopted by Key Players

Figure 53 Market: Major Strategies Adopted by Key Players, 2018-2023

12.3 Market Share Analysis, 2022

Figure 54 Market Share Analysis, 2022

12.4 Revenue Analysis of Five Key Players, 2018-2022

Figure 55 Market: Annual Revenue Analysis of Five Key Players, 2018-2022

12.5 Competitive Scenarios and Trends

12.5.1 Deals

Table 116 Market: Deals, 2018-2023

12.5.2 Others

Table 117 Market: Others, 2018-2023

12.6 Company Evaluation Matrix, 2022

Figure 56 Market: Company Evaluation Matrix, 2022

12.6.1 Stars

12.6.2 Emerging Leaders

12.6.3 Pervasive Players

12.6.4 Participants

12.6.5 Company Footprint

Table 118 Component: Company Footprint

Table 119 Type: Company Footprint

Table 120 Services: Company Footprint

Table 121 Voltage: Company Footprint

Table 122 Application: Company Footprint

Table 123 Region: Company Footprint

Table 124 Company Overall Footprint

12.7 Startups/Small and Medium-Sized Enterprises (SMEs) Evaluation Matrix, 2022

Figure 57 Market: Startups/Small and Medium-Sized Enterprises (SMEs) Evaluation Matrix, 2022

12.7.1 Progressive Companies

12.7.2 Responsive Companies

12.7.3 Dynamic Companies

12.7.4 Starting Blocks

12.7.5 Competitive Benchmarking

Table 125 Transformer Monitoring Market: List of Key Startups/SMEs

Table 126 Competitive Benchmarking of Key Startups/SMEs, by Component

Table 127 Competitive Benchmarking of Key Startups/SMEs, by Type

Table 128 Competitive Benchmarking of Key Startups/SMEs, by Services

Table 129 Competitive Benchmarking of Key Startups/SMEs, by Voltage

Table 130 Competitive Benchmarking of Key Startups/SMEs, by Region

Table 131 Key Startups/SMEs Overall Footprint

13 Company Profiles

(Business Overview, Products/Services/Solutions Offered, Recent Developments, Analyst's View)*

13.1 Key Players

13.1.1 Siemens Energy Ag

Table 132 Siemens Energy Ag: Company Overview

Figure 58 Siemens Energy Ag: Company Snapshot

Table 133 Siemens Energy Ag: Products/Solutions/Services Offered

Table 134 Siemens Energy Ag: Product Launches

13.1.2 Abb

Table 135 Abb: Company Overview

Figure 59 Abb: Company Snapshot

Table 136 Abb: Products/Solutions/Services Offered

Table 137 Abb: Product Launches

13.1.3 Ge

Table 138 Ge: Company Overview

Figure 60 Ge: Company Snapshot

Table 139 Ge: Products/Solutions/Services Offered

Table 140 Ge: Deals

13.1.4 Schneider Electric

Table 141 Schneider Electric: Company Overview

Figure 61 Schneider Electric: Company Snapshot

Table 142 Schneider Electric: Products/Solutions/Services Offered

Table 143 Schneider Electric: Product Launches

Table 144 Schneider Electric: Deals

Table 145 Schneider Electric: Others

13.1.5 Eaton

Table 146 Eaton: Company Overview

Figure 62 Eaton: Company Snapshot

Table 147 Eaton: Products/Solutions/Services Offered

Table 148 Eaton: Others

13.1.6 Mistras Group

Table 149 Mistras Group: Company Overview

Figure 63 Mistras Group: Company Snapshot

Table 150 Mistras Group: Products/Solutions/Services Offered

13.1.7 Mitsubishi Electric Corporation

Table 151 Mitsubishi Electrical Corporation: Company Overview

Figure 64 Mitsubishi Electrical Corporation: Company Snapshot

Table 152 Mitsubishi Electrical Corporation: Products/Solutions/Services Offered

Table 153 Mitsubishi Electrical Corporation: Deals

13.1.8 Vaisala

Table 154 Vaisala: Company Overview

Figure 65 Vaisala: Company Snapshot

Table 155 Vaisala: Products/Solutions/Services Offered

13.1.9 Hitachi Energy Ltd

Table 156 Hitachi Energy Ltd: Company Overview

Table 157 Hitachi Energy Ltd: Products/Solutions/Services Offered

13.1.10 Kj Dynatech, Inc.

Table 158 Kj Dynatech, Inc.: Company Overview

Table 159 Kj Dynatech, Inc.: Products/Solutions/Services Offered

13.1.11 Maschinenfabrik Reinhausen GmbH

Table 160 Maschinenfabrik Reinhausen GmbH: Company Overview

Table 161 Maschinenfabrik Reinhausen GmbH: Products/Solutions/Services Offered

Table 162 Maschinenfabrik Reinhausen GmbH: Deals

Table 163 Maschinenfabrik Reinhausen GmbH: Others

13.1.12 Qualitrol

Table 164 Qualitrol: Company Overview

Table 165 Qualitrol: Products/Solutions/Services Offered

Table 166 Qualitrol: Product Launches

13.1.13 Gasera

Table 167 Gasera: Company Overview

Table 168 Gasera: Products/Solutions/Services Offered

13.1.14 Doble Engineering Company

Table 169 Doble Engineering Company: Company Overview

Table 170 Doble Engineering Company: Products/Solutions/Services Offered

Table 171 Doble Engineering Company: Product Launches

Table 172 Doble Engineering Company: Deals

13.1.15 Wilson Transformers

Table 173 Wilson Transformers: Company Overview

Table 174 Wilson Transformers: Products/Solutions/Services Offered

13.2 Other Players

13.2.1 Saielectrical

13.2.2 Camlin Ltd

13.2.3 Treetech

13.2.4 Emco Electronics

13.2.5 Advanced Power Technologies LLC

13.2.6 Koncar - Electrical Engineering Institute Ltd.

13.2.7 Cmsgp

13.2.8 Ubicquia, Inc

13.2.9 Avl India Private Ltd

*Details on Business Overview, Products/Services/Solutions Offered, Recent Developments, Analyst's View Might Not be Captured in the Case of Unlisted Companies.

14 Appendix

14.1 Insights from Industry Experts

14.2 Discussion Guide

14.3 Knowledgestore: Subscription Portal

14.4 Customization Options