Oats are a cereal grain widely cultivated for their edible seeds and are predominantly used as a nutritious breakfast cereal in the form of oatmeal or rolled oats. They are a rich source of different essential nutrients, providing a balanced mix of carbohydrates, proteins, and fats, along with vitamins and minerals. They consist of beta-glucan, which is essential for reducing low-density lipoprotein (LDL) cholesterol levels, helping maintain cardiovascular health. They possess anti-inflammatory properties, making them beneficial for soothing and relieving various skin conditions, such as eczema and sunburn. They promote a feeling of fullness, aiding in weight management by reducing overall calorie intake.

At present, the increasing demand for oats, as they support healthy digestion and help prevent constipation, is impelling the growth of the market. Besides this, rising advancements in the farming procedure to improve the quality of oats and enhance their fiber content are contributing to the growth of the market. In addition, the growing utilization of oats in producing various breakfast cereals, granola bars, muesli, and snacks is offering a favorable market outlook. Apart from this, the increasing consumption of oat milk among vegans and lactose-intolerant individuals as an alternative to dairy-based milk is supporting the growth of the market. Additionally, the rising awareness about the beneficial aspects of consuming oats among the masses is propelling the growth of the market. Moreover, the increasing demand for organic oats manufactured without the involvement of harmful chemicals and fertilizers is bolstering the growth of the market.

Oats Market Trends/Drivers:

Rising health awareness among the masses

At present, the increasing health awareness among the masses is positively influencing the growth of the global oats market. Oats are perceived as nutritious and wholesome food, rich in dietary fiber, vitamins, minerals, and antioxidants. As people become more health-conscious and seek healthier food choices, oats are gaining popularity due to their various health benefits, such as lowering cholesterol levels, supporting weight management, and promoting digestive health. The rising prevalence of lifestyle-related diseases, including cardiovascular issues and diabetes, is also propelling the demand for oats as a part of preventive health measures. Furthermore, the global trend towards clean eating, which promotes the consumption of less processed, more natural foods, is bolstering the demand for oats.Increasing consumption of gluten-free and plant-based diets

The increasing consumption of gluten-free and plant-based diets is positively influencing the growth of the oats market. The shift toward these dietary trends is a result of growing health awareness, environmental concerns, and changing consumer preferences. Gluten-free diets are becoming highly popular due to a surge in diagnoses of gluten-related disorders, such as celiac disease and non-celiac gluten sensitivity, along with a wider public perception that gluten-free diets contribute to overall health and well-being. Moreover, there is an increase in the popularity of plant-based diets, driven by a combination of health, ethical, and environmental motivations. As consumers increasingly turn to plant-derived proteins and fibers, the demand for oats is growing significantly.Growing demand for convenient and ready-to-eat (RTE) food products

At present, there is an increase in the demand for convenient and ready-to-eat (RTE) food products among the masses as they eliminate the hassle of cooking. The fast-paced society, characterized by busy lifestyles, dual-income families, and urbanization, is leading consumers to seek out foods that are nutritious and quick, and easy to prepare. Oats are considered a nutritious grain that can be prepared in various methods effortlessly and within a short period. Oats are also a popular ingredient in snack foods due to their high satiety value and energy-boosting properties. Oat-based snack bars are non-perishable and can be eaten without preparation, making them an ideal solution for consumers seeking nutritious snacks that can be eaten on the go.Oats Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global oats market report, along with forecasts at the global and country levels from 2025-2033. Our report has categorized the market based on product type and application.Breakup by Product Type:

- Flakes

- Flour

- Bran

- Others

Flakes dominate the market

The report has provided a detailed breakup and analysis of the market based on the product type. This includes flakes, flour, bran, and others. According to the report, flakes represented the largest segment. Oat flakes, also known as rolled oats or oatmeal, are a type of whole-grain cereal made from oats. They are cleaned, hulled, and toasted, then rolled into flat flakes to make them easier to cook and consume. Oat flakes come in various thicknesses, including thick, medium, and thin varieties, depending on the processing method. They are a popular choice for making warm and nutritious breakfast cereal. They add texture, flavor, and a nutritional boost to baked goods. Oat flakes can be blended into smoothies to increase their fiber content and provide a thicker texture. They are also used in various baking recipes, such as oatmeal cookies, muffins, granola bars, and bread.Breakup by Application:

- Food use

- Feed use

Feed use holds the largest share of the market

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food use and feed use. According to the report, feed use accounted for the largest market share. Oats are a versatile and nutritious cereal grain and are rich in manganese, phosphorus, magnesium, and iron, which play vital roles in maintaining bone health, energy production, and blood circulation. Moreover, oats are a notable source of vitamin B, including thiamine and pantothenic acid, which support metabolism and overall vitality. The nutritious composition of oats makes them an excellent source of sustenance for various farm animals. Oats are easily digestible for animals, making them an ideal choice for both young and adult livestock. The digestibility of oats ensures that the animals can efficiently extract nutrients from the feed. Oats can be used as feed for horses, cattle, sheep, and poultry as a supplemental feed or a primary component of their diet, ensuring optimal health and performance.Breakup by Region:

- Russia

- Canada

- Australia

- United States

- Chile

- China

- Ukraine

- Others

Russia exhibits a clear dominance, accounting for the largest oats market share

The report has also provided a comprehensive analysis of all the major regional markets, which include Russia, Canada, Australia, the United States, Chile, China, Ukraine, and others. According to the report, Russia accounted for the largest market share.Russia held the biggest market share due to rising advancements in the food processing industry to improve operational efficiency and production rates. Besides this, the rising demand for oat milk among the masses is propelling the growth of the market. Apart from this, the increasing utilization of oats in preparing various local desserts and baked items is strengthening the growth of the market. Additionally, the growing awareness about gluten intolerance among the masses is offering a favorable market outlook in the region.

The United States is estimated to expand further in this domain due to rising health awareness among the masses. Besides this, the increasing trend of consuming smoothies and shakes containing oats among fitness enthusiasts and gymgoers is bolstering the growth of the market in the region.

Competitive Landscape:

Key market players are planning to introduce new oat-based products to cater to changing consumer preferences. They are manufacturing digestive biscuits containing oats which can be consumed as a healthy snack. Top companies are adopting effective marketing strategies to promote the health benefits of oats. They are also focusing on sourcing oats from sustainable and organic farms to create a positive brand image. Leading companies are actively promoting and selling their products through online platforms to reach a wider audience and capitalize on the convenience and accessibility of online shopping. They are also diversifying their portfolio by introducing various innovative food products and beverages, such as oat-based yogurt, ice cream, pasta, and baking mixes.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Avena Foods Limited

- B&G Foods, Inc.

- Bagrrys India Limited

- Blue Lake Milling Pty Ltd. (CBH Group)

- Bob’s Red Mill Natural Foods

- Grain Millers, Inc.

- Kellogg Company

- Marico Limited

- Morning Foods Ltd.

- Nature's Path Foods

- PepsiCo, Inc.

- Post Holdings, Inc.

Key Questions Answered in This Report

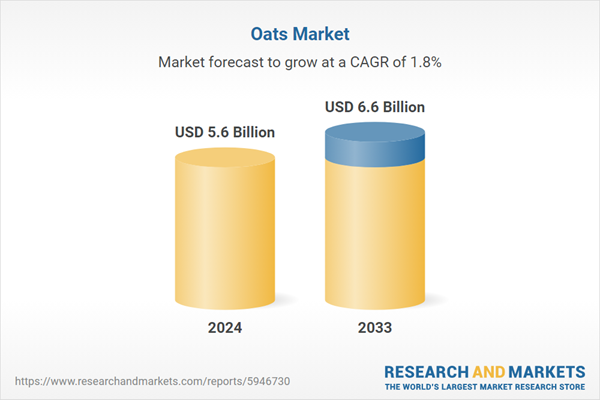

1. What was the size of the global oats market in 2024?2. What is the expected growth rate of the global oats market during 2025-2033?

3. What are the key factors driving the global oats market?

4. What has been the impact of COVID-19 on the global oats market?

5. What is the breakup of the global oats market based on the product type?

6. What is the breakup of the global oats market based on the application?

7. What are the key regions in the global oats market?

Table of Contents

Companies Mentioned

- Avena Foods Limited

- B&G Foods Inc.

- Bagrrys India Limited

- Blue Lake Milling Pty Ltd. (CBH Group)

- Bob’s Red Mill Natural Foods

- Grain Millers Inc.

- Kellogg Company

- Marico Limited

- Morning Foods Ltd.

- Nature's Path Foods

- PepsiCo Inc.

- Post Holdings Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 141 |

| Published | January 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 5.6 Billion |

| Forecasted Market Value ( USD | $ 6.6 Billion |

| Compound Annual Growth Rate | 1.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |