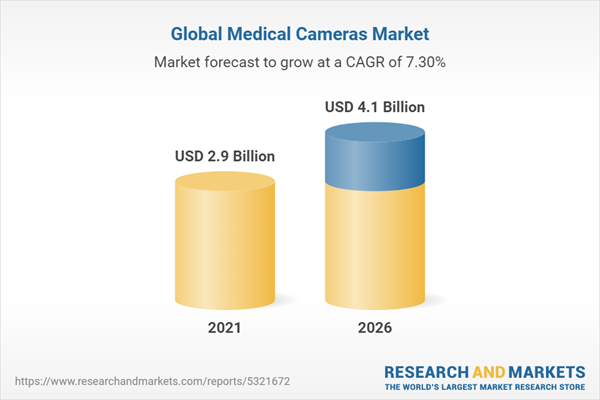

The medical cameras market is projected to reach USD 4.1 billion by 2026 from USD 2.9 billion in 2021, at a CAGR of 7.3% during the forecast period. Market growth is largely driven by the increasing number of surgical procedures, growing demand for endoscopic procedures, technological advancements, and increasing investments in endoscopy and laparoscopy facilities. However, the high cost of medical cameras is a major restraint for market growth. Product discontinuations, a shortage of trained medical professionals, and the availability of refurbished products are also major challenges limiting market growth to a certain extent.

The surgical microscopy cameras segment accounted for the highest growth rate in the medical cameras market, by type, during the forecast period.

Based on type, the medical cameras market is segmented into surgical microscopy cameras, endoscopy cameras, dermatology cameras, ophthalmology cameras, dental cameras, and other medical cameras. The surgical microscopy cameras segment accounted for the highest growth rate in the medical cameras market in 2020. This can be attributed to the increasing number of surgical procedures and the introduction of technologically advanced products.

CMOS Sensor segment accounted for the highest CAGR.

Based on the sensor, the medical cameras market is segmented into CMOS Sensor and CCD Sensor. In 2020, CMOS sensors accounted for the highest growth rate. The major factors driving the growth of this is the observable shift in the preference for CMOS sensors over CCD sensors due to its various advantages over CCD sensors.

High-definition (HD) cameras segment accounted for the highest CAGR.

Based on the resolution, the medical cameras market is segmented into standard-definition (SD) cameras and high-definition (HD) cameras. High-definition (HD) cameras registered the highest growth rate during the forecast period. This can be attributed to the introduction of technologically advanced products in this segment by players in the medical cameras market.

Hospitals & ambulatory surgery centres segment accounted for the highest CAGR.

Based on end-users, the global medical cameras market is segmented into hospitals & ambulatory surgery centres and speciality clinics. In 2020, the hospitals & ambulatory surgery centers segment accounted for the highest growth rate. This can be attributed to the rising number of hospitals coupled with a large patient pool for target diseases, and increasing healthcare expenditure.

Asia Pacific: The fastest-growing region in the Medical cameras market.

The medical cameras market is segmented into North America, Europe, Asia Pacific, and the Rest of the World. Asia Pacific is projected to register the highest CAGR during the forecast period. This can primarily be attributed to the growing patient population and increasing healthcare expenditure in emerging Asian countries.

The primary interviews conducted for this report can be categorized as follows:

- By Company Type: Tier 1 - 42%, Tier 2 - 28%, and Tier 3 - 30%

- By Designation: C-level - 30%, D-level - 34%, and Others - 36%

- By Region: North America- 46%, Europe- 25%, Asia Pacific - 18%, RoW - 11%

Lists of Companies Profiled in the Report:

- Olympus Corporation (Japan)

- Richard Wolf GmbH (Germany)

- TOPCON CORPORATION (Japan)

- Sony Corporation (Japan)

- Stryker (US)

- Danaher (US)

- Canon Inc. (Japan)

- Carl Zeiss AG (Germany)

- Smith & Nephew (UK)

- Carestream Dental LLC. (US)

- Basler AG (Germany)

- ATMOS MedizinTechnik GmbH & Co. KG. (Germany)

- IMPERX, Inc (US)

- IDS Imaging Development Systems GmbH (Germany)

- Optomed Plc (Finland)

- HAAG-STREIT GROUP (Switzerland)

- CYMO B.V. (Netherland)

- Diaspective Vision GmbH (Germany)

- Dage-MTI (US)

- Fude Technology Group Limited (China)

- Healthtech Engineers Private Limited (India)

- SCHÖLLY FIBEROPTIC GMBH (Germany)

- Medicam (India)

- ESC Medicams (India)

- Tonglu Kanger Medical Instrument Co., Ltd (China).

Research Coverage:

This report provides a detailed picture of the medical cameras market. It aims at estimating the size and future growth potential of the market across different segments, such as type, sensor, resolution, end-user, and region. The report also includes an in-depth competitive analysis of the key market players, along with their company profiles, recent developments, and key market strategies.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants by providing them with the closest approximations of the revenue numbers for the overall medical cameras market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to better position their business and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, opportunities, and challenges.

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Inclusions & Exclusions

1.3 Market Scope

1.3.1 Market Covered

Figure 1 Global Medical Cameras Market Segmentation

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

1.7 Summary of Changes

2 Research Methodology

2.1 Research Data

Figure 2 Research Design

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

Figure 3 Primary Sources

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

Figure 4 Breakdown of Primary Interviews: by Company Type, Designation, and Region

2.2 Market Size Estimation

Figure 5 Bottom-Up Approach

Figure 6 CAGR Projections: Supply-Side Analysis

Figure 7 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

Figure 8 Data Triangulation Methodology

2.4 Market Share Analysis

2.5 Assumptions for the Study

2.6 COVID-19 Economic Assessment

2.7 Assessment of the Impact of COVID-19 on the Economic Scenario

Figure 9 Criteria Impacting the Global Economy

Figure 10 Recovery Scenario of the Global Economy

3 Executive Summary

Figure 11 Medical Cameras Market, by Type, 2021 Vs. 2026 (USD Million)

Figure 12 Medical Cameras Market, by Sensor, 2021 Vs. 2026 (USD Million)

Figure 13 Medical Cameras Market, by Resolution, 2021 Vs. 2026 (USD Million)

Figure 14 Medical Cameras Market, by End-user, 2021 Vs. 2026 (USD Million)

Figure 15 Geographic Snapshot of the Medical Cameras Market

4 Premium Insights

4.1 Medical Cameras Market Overview

Figure 16 Increasing Number of Surgical Procedures to Drive Market Growth

4.2 Asia-Pacific: Medical Cameras Market, by End-user & Country (2020)

Figure 17 Hospitals & Ambulatory Surgery Centers Accounted for the Largest Share of the APAC Medical Cameras Market in 2020

4.3 Medical Cameras Market: Geographic Growth Opportunities

Figure 18 China to Register the Highest Growth During the Forecast Period

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 19 Medical Cameras Market: Drivers, Restraints, Opportunities, and Challenges

5.2.1 Drivers

5.2.1.1 The Increasing Number of Surgical Procedures

Table 1 Number of Surgical Procedures Performed in the United States Every Year

5.2.1.2 The Growing Demand for Endoscopic Procedures

5.2.1.3 Technological Advancements in Medical Cameras

5.2.1.4 Increasing Investments in Endoscopy and Laparoscopy Facilities

5.2.2 Restraints

5.2.2.1 High Costs of Medical Cameras

5.2.3 Opportunities

5.2.3.1 Emerging Countries in the Asia-Pacific Market

5.2.4 Challenges

5.2.4.1 Product Discontinuation

5.2.4.2 The Shortage of Trained Medical Professionals

5.2.4.3 Availability of Refurbished Products

5.3 COVID-19 Impact Analysis

5.4 Value Chain Analysis

Figure 20 Major Value is Added During the Manufacturing and Assembly Phase

5.5 Supply Chain Analysis

Figure 21 Direct Distribution - Strategy Preferred by Prominent Companies

5.6 Ecosystem Analysis of the Medical Cameras Market.

Figure 22 Ecosystem Analysis of the Medical Cameras Market

6 Medical Cameras Market, by Type

6.1 Introduction

Table 2 Global Medical Cameras Market, by Type, 2016-2019 (USD Million)

Table 3 Global Medical Cameras Market, by Type, 2020-2026 (USD Million)

6.2 Endoscopy Cameras

6.2.1 Rising Number of Endoscopic Procedures to Propel the Market Growth for Endoscopy Cameras

Table 4 Types of Endoscopic Procedures

Table 5 Number of Diagnostic Bronchoscopy Procedures Performed (With or Without Biopsy), by Country, 2014-2018

Table 6 Number of Colonoscopy Procedures Performed (With or Without Biopsy), by Country, 2014-2018

Table 7 Number of Laparoscopic Colectomy Procedures Performed, by Country, 2014-2018

Table 8 Number of Laparoscopic Appendectomy Procedures Performed, by Country, 2014-2018

Table 9 Number of Laparoscopic Cholecystectomy Procedures Performed, by Country, 2014-2018

Table 10 Number of Laparoscopic Inguinal Hernia Repair Procedures Performed, by Country, 2014-2018

Table 11 Number of Laparoscopic Hysterectomy Procedures Performed, by Country, 2014-2018

Table 12 Endoscopy Cameras Market, by Region, 2016-2019 (USD Million)

Table 13 Endoscopy Cameras Market, by Region, 2020-2026 (USD Million)

6.3 Surgical Microscopy Cameras

6.3.1 Increasing Number of Surgical Procedures and Technological Advancements to Support Market Growth

Table 14 Surgical Microscopy Cameras Market, by Region, 2016-2019 (USD Million)

Table 15 Surgical Microscopy Cameras Market, by Region, 2020-2026 (USD Million)

6.4 Ophthalmology Cameras

6.4.1 Rising Prevalence of Eye Diseases to Support the Growth of the Ophthalmology Cameras Market

Table 16 Number of Glaucoma Patients, by Country and Type, 2013 Vs. 2020 Vs. 2040 (Million)

Table 17 Population with Ocular Conditions in the Us, 2000 Vs. 2010 Vs. 2020 (Million Individuals)

Table 18 Projected Disability-Adjusted Life Years Across Various Regions, by Disease, 2015 Vs. 2030 (Million Years)

Table 19 Ophthalmology Cameras Market, by Region, 2016-2019 (USD Million)

Table 20 Ophthalmology Cameras Market, by Region, 2020-2026 (USD Million)

6.5 Dermatology Cameras

6.5.1 Rising Number of Dermatological Procedures to Boost the Dermatology Cameras Market

Table 21 Number of Surgical Procedures Performed by Plastic Surgeons Globally, 2015 Vs. 2018 Vs. 2019

Table 22 Number of Non-Surgical Procedures Performed Globally by Plastic Surgeons, 2015 Vs. 2018 Vs. 2019

Table 23 Dermatology Cameras Market, by Region, 2016-2019 (USD Million)

Table 24 Dermatology Cameras Market, by Region, 2020-2026 (USD Million)

6.6 Dental Cameras

6.6.1 Increasing Incidence of Oral Diseases to Support the Dental Cameras Market Growth

Table 25 Dental Cameras Market, by Region, 2016-2019 (USD Million)

Table 26 Dental Cameras Market, by Region, 2020-2026 (USD Million)

6.7 Other Medical Cameras

Table 27 Other Medical Cameras Market, by Region, 2016-2019 (USD Million)

Table 28 Other Medical Cameras Market, by Region, 2020-2026 (USD Million)

7 Medical Cameras Market, by Sensor

7.1 Introduction

Table 29 Cmos Sensors Vs. Ccd Sensors in Medical Cameras

Table 30 Medical Cameras Market, by Sensor, 2016-2019 (USD Million)

Table 31 Medical Cameras Market, by Sensor, 2020-2026 (USD Million)

7.2 Cmos Sensors

7.2.1 Cmos Sensors to Lead the Medical Cameras Market During the Forecast Period

Table 32 Cmos Sensor-Based Medical Cameras Market, by Region, 2016-2019 (USD Million)

Table 33 Cmos Sensor-Based Medical Cameras Market, by Region, 2020-2026 (USD Million)

7.3 Ccd Sensors

7.3.1 Discontinuation of Ccd Sensors by Players in the Market Can Hamper the Market Growth

Table 34 Ccd Sensor-Based Medical Cameras Market, by Region, 2016-2019 (USD Million)

Table 35 Ccd Sensor-Based Medical Cameras Market, by Region, 2020-2026 (USD Million)

8 Medical Cameras Market, by Resolution

8.1 Introduction

Table 36 Medical Cameras Market, by Resolution, 2016-2019 (USD Million)

Table 37 Medical Cameras Market, by Resolution, 2020-2026 (USD Million)

8.2 High-Definition Cameras

8.2.1 Technological Advancements in High-Definition Cameras to Support Market Growth

Table 38 High-Definition Medical Cameras Market, by Region, 2016-2019 (USD Million)

Table 39 High-Definition Medical Cameras Market, by Region, 2020-2026 (USD Million)

8.3 Standard-Definition Cameras

8.3.1 Standard-Definition Cameras May Become Obsolete due to the Availability of Better-Resolution Cameras in the Market

Table 40 Standard-Definition Medical Cameras Market, by Region, 2016-2019 (USD Million)

Table 41 Standard-Definition Medical Cameras Market, by Region, 2020-2026 (USD Million)

9 Medical Camera Market, by End-user

9.1 Introduction

Table 42 Medical Cameras Market, by End-user, 2016-2019 (USD Million)

Table 43 Medical Cameras Market, by End-user, 2020-2026 (USD Million)

9.2 Hospitals & Ambulatory Surgery Centers

9.2.1 Large Pool of Patients and Rising Number of Hospitals to Drive Market Growth

Table 44 Medical Cameras Market for Hospitals & Ambulatory Surgery Centers, by Region, 2016-2019 (USD Million)

Table 45 Medical Cameras Market for Hospitals & Ambulatory Surgery Centers, by Region, 2020-2026 (USD Million)

9.3 Specialty Clinics

9.3.1 Shorter Waiting Periods and the Increasing Number of Specialty Clinics to Support Market Growth

Table 46 Medical Cameras Market for Specialty Clinics, by Region, 2016-2019 (USD Million)

Table 47 Medical Cameras Market for Specialty Clinics, by Region, 2020-2026 (USD Million)

10 Medical Cameras Market, by Region

10.1 Introduction

Table 48 Medical Cameras Market, by Region, 2016-2019 (USD Million)

Table 49 Medical Cameras Market, by Region, 2020-2026 (USD Million)

10.2 North America

Figure 23 North America: Medical Cameras Market Snapshot

Table 50 North America: Medical Cameras Market, by Country, 2016-2019 (USD Million)

Table 51 North America: Medical Cameras Market, by Country, 2020-2026 (USD Million)

Table 52 North America: Medical Cameras Market, by Type, 2016-2019 (USD Million)

Table 53 North America: Medical Cameras Market, by Type, 2020-2026 (USD Million)

Table 54 North America: Medical Cameras Market, by Sensor, 2016-2019 (USD Million)

Table 55 North America: Medical Cameras Market, by Sensor, 2020-2026 (USD Million)

Table 56 North America: Medical Cameras Market, by Resolution, 2016-2019 (USD Million)

Table 57 North America: Medical Cameras Market, by Resolution, 2020-2026 (USD Million)

Table 58 North America: Medical Cameras Market, by End-user, 2016-2019 (USD Million)

Table 59 North America: Medical Cameras Market, by End-user, 2020-2026 (USD Million)

10.2.1 US

10.2.1.1 The Us Dominates the North American Medical Cameras Market

Table 60 US: Medical Cameras Market, by Type, 2016-2019 (USD Million)

Table 61 US: Medical Cameras Market, by Type, 2020-2026 (USD Million)

Table 62 US: Medical Cameras Market, by Sensor, 2016-2019 (USD Million)

Table 63 US: Medical Cameras Market, by Sensor, 2020-2026 (USD Million)

Table 64 US: Medical Cameras Market, by End-user, 2016-2019 (USD Million)

Table 65 US: Medical Cameras Market, by End-user, 2020-2026 (USD Million)

10.2.2 Canada

10.2.2.1 Rising Prevalence of Chronic Diseases to Drive Market Growth in Canada

Table 66 Canada: Medical Cameras Market, by Type, 2016-2019 (USD Million)

Table 67 Canada: Medical Cameras Market, by Type, 2020-2026 (USD Million)

Table 68 Canada: Medical Cameras Market, by Sensor, 2016-2019 (USD Million)

Table 69 Canada: Medical Cameras Market, by Sensor, 2020-2026 (USD Million)

Table 70 Canada: Medical Cameras Market, by End-user, 2016-2019 (USD Million)

Table 71 Canada: Medical Cameras Market, by End-user, 2020-2026 (USD Million)

10.3 Europe

Table 72 Europe: Medical Cameras Market, by Country, 2016-2019 (USD Million)

Table 73 Europe: Medical Cameras Market, by Country, 2020-2026 (USD Million)

Table 74 Europe: Medical Cameras Market, by Type, 2016-2019 (USD Million)

Table 75 Europe: Medical Cameras Market, by Type, 2020-2026 (USD Million)

Table 76 Europe: Medical Cameras Market, by Sensor, 2016-2019 (USD Million)

Table 77 Europe: Medical Cameras Market, by Sensor, 2020-2026 (USD Million)

Table 78 Europe: Medical Cameras Market, by Resolution, 2016-2019 (USD Million)

Table 79 Europe: Medical Cameras Market, by Resolution, 2020-2026 (USD Million)

Table 80 Europe: Medical Cameras Market, by End-user, 2016-2019 (USD Million)

Table 81 Europe: Medical Cameras Market, by End-user, 2020-2026 (USD Million)

10.3.1 Germany

10.3.1.1 Germany to Dominate the European Medical Cameras Market During the Forecast Period

Table 82 Germany: Medical Cameras Market, by Type, 2016-2019 (USD Million)

Table 83 Germany: Medical Cameras Market, by Type, 2020-2026 (USD Million)

Table 84 Germany: Medical Cameras Market, by Sensor, 2016-2019 (USD Million)

Table 85 Germany: Medical Cameras Market, by Sensor, 2020-2026 (USD Million)

Table 86 Germany: Medical Cameras Market, by End-user, 2016-2019 (USD Million)

Table 87 Germany: Medical Cameras Market, by End-user, 2020-2026 (USD Million)

10.3.2 UK

10.3.2.1 Rising Prevalence of Chronic Diseases Along with Favorable Government Policies Supporting Market Growth

Table 88 UK: Medical Cameras Market, by Type, 2016-2019 (USD Million)

Table 89 UK: Medical Cameras Market, by Type, 2020-2026 (USD Million)

Table 90 UK: Medical Cameras Market, by Sensor, 2016-2019 (USD Million)

Table 91 UK: Medical Cameras Market, by Sensor, 2020-2026 (USD Million)

Table 92 UK: Medical Cameras Market, by End-user, 2016-2019 (USD Million)

Table 93 UK: Medical Cameras Market, by End-user, 2020-2026 (USD Million)

10.3.3 France

10.3.3.1 Favorable Government Initiatives to Support Market Growth in France

Table 94 France: Medical Cameras Market, by Type, 2016-2019 (USD Million)

Table 95 France: Medical Cameras Market, by Type, 2020-2026 (USD Million)

Table 96 France: Medical Cameras Market, by Sensor, 2016-2019 (USD Million)

Table 97 France: Medical Cameras Market, by Sensor, 2020-2026 (USD Million)

Table 98 France: Medical Cameras Market, by End-user, 2016-2019 (USD Million)

Table 99 France: Medical Cameras Market, by End-user, 2020-2026 (USD Million)

10.3.4 Italy

10.3.4.1 Rising Geriatric Population to Propel Market Growth in Italy

Table 100 Italy: Medical Cameras Market, by Type, 2016-2019 (USD Million)

Table 101 Italy: Medical Cameras Market, by Type, 2020-2026 (USD Million)

Table 102 Italy: Medical Cameras Market, by Sensor, 2016-2019 (USD Million)

Table 103 Italy: Medical Cameras Market, by Sensor, 2020-2026 (USD Million)

Table 104 Italy: Medical Cameras Market, by End-user, 2016-2019 (USD Million)

Table 105 Italy: Medical Cameras Market, by End-user, 2020-2026 (USD Million)

10.3.5 Spain

10.3.5.1 High Efficiency in the Healthcare Industry and Low-Cost Advantage Make Spain a Prominent Medical Tourism Destination

Table 106 Spain: Medical Cameras Market, by Type, 2016-2019 (USD Million)

Table 107 Spain: Medical Cameras Market, by Type, 2020-2026 (USD Million)

Table 108 Spain: Medical Cameras Market, by Sensor, 2016-2019 (USD Million)

Table 109 Spain: Medical Cameras Market, by Sensor, 2020-2026 (USD Million)

Table 110 Spain: Medical Cameras Market, by End-user, 2016-2019 (USD Million)

Table 111 Spain: Medical Cameras Market, by End-user, 2020-2026 (USD Million)

10.3.6 Rest of Europe (Roe)

Table 112 Cancer Incidence in Roe Countries, 2018 Vs. 2025

Table 113 Roe: Medical Cameras Market, by Type, 2016-2019 (USD Million)

Table 114 Roe: Medical Cameras Market, by Type, 2020-2026 (USD Million)

Table 115 Roe: Medical Cameras Market, by Sensor, 2016-2019 (USD Million)

Table 116 Roe: Medical Cameras Market, by Sensor, 2020-2026 (USD Million)

Table 117 Roe: Medical Cameras Market, by End-user, 2016-2019 (USD Million)

Table 118 Roe: Medical Cameras Market, by End-user, 2020-2026 (USD Million)

10.4 Asia-Pacific

Figure 24 Asia-Pacific: Medical Cameras Market Snapshot

Table 119 Asia-Pacific: Medical Cameras Market, by Country, 2016-2019 (USD Million)

Table 120 Asia-Pacific: Medical Cameras Market, by Country, 2020-2026 (USD Million)

Table 121 Asia-Pacific: Medical Cameras Market, by Type, 2016-2019 (USD Million)

Table 122 Asia-Pacific: Medical Cameras Market, by Type, 2020-2026 (USD Million)

Table 123 Asia-Pacific: Medical Cameras Market, by Sensor, 2016-2019 (USD Million)

Table 124 Asia-Pacific: Medical Cameras Market, by Sensor, 2020-2026 (USD Million)

Table 125 Asia-Pacific: Medical Cameras Market, by Resolution, 2016-2019 (USD Million)

Table 126 Asia-Pacific: Medical Cameras Market, by Resolution, 2020-2026 (USD Million)

Table 127 Asia-Pacific: Medical Cameras Market, by End-user, 2016-2019 (USD Million)

Table 128 Asia-Pacific: Medical Cameras Market, by End-user, 2020-2026 (USD Million)

10.4.1 Japan

10.4.1.1 Japan is the Largest Market for Medical Cameras in the APAC

Table 129 Japan: Medical Cameras Market, by Type, 2016-2019 (USD Million)

Table 130 Japan: Medical Cameras Market, by Type, 2020-2026 (USD Million)

Table 131 Japan: Medical Cameras Market, by Sensor, 2016-2019 (USD Million)

Table 132 Japan: Medical Cameras Market, by Sensor, 2020-2026 (USD Million)

Table 133 Japan: Medical Cameras Market, by End-user, 2016-2019 (USD Million)

Table 134 Japan: Medical Cameras Market, by End-user, 2020-2026 (USD Million)

10.4.2 China

10.4.2.1 China to Register Highest Growth Rate During the Forecast Period

Table 135 China: Medical Cameras Market, by Type, 2016-2019 (USD Million)

Table 136 China: Medical Cameras Market, by Type, 2020-2026 (USD Million)

Table 137 China: Medical Cameras Market, by Sensor, 2016-2019 (USD Million)

Table 138 China: Medical Cameras Market, by Sensor, 2020-2026 (USD Million)

Table 139 China: Medical Cameras Market, by End-user, 2016-2019 (USD Million)

Table 140 China: Medical Cameras Market, by End-user, 2020-2026 (USD Million)

10.4.3 India

10.4.3.1 Healthcare Infrastructure Improvements and Implementation of Favorable Government Initiatives to Support Market Growth in India

Table 141 India: Medical Cameras Market, by Type, 2016-2019 (USD Million)

Table 142 India: Medical Cameras Market, by Type, 2020-2026 (USD Million)

Table 143 India: Medical Cameras Market, by Sensor, 2016-2019 (USD Million)

Table 144 India: Medical Cameras Market, by Sensor, 2020-2026 (USD Million)

Table 145 India: Medical Cameras Market, by End-user, 2016-2019 (USD Million)

Table 146 India: Medical Cameras Market, by End-user, 2020-2026 (USD Million)

10.4.4 Roapac

Table 147 Roapac: Medical Cameras Market, by Type, 2016-2019 (USD Million)

Table 148 Roapac: Medical Cameras Market, by Type, 2020-2026 (USD Million)

Table 149 Roapac: Medical Cameras Market, by Sensor, 2016-2019 (USD Million)

Table 150 Roapac: Medical Cameras Market, by Sensor, 2020-2026 (USD Million)

Table 151 Roapac: Medical Cameras Market, by End-user, 2016-2019 (USD Million)

Table 152 Roapac: Medical Cameras Market, by End-user, 2020-2026 (USD Million)

10.5 Rest of the World

Table 153 RoW: Medical Cameras Market, by Type, 2016-2019 (USD Million)

Table 154 RoW: Medical Cameras Market, by Type, 2020-2026 (USD Million)

Table 155 RoW: Medical Cameras Market, by Sensor, 2016-2019 (USD Million)

Table 156 RoW: Medical Cameras Market, by Sensor, 2020-2026 (USD Million)

Table 157 RoW: Medical Cameras Market, by Resolution, 2016-2019 (USD Million)

Table 158 RoW: Medical Cameras Market, by Resolution, 2020-2026 (USD Million)

Table 159 RoW: Medical Cameras Market, by End-user, 2016-2019 (USD Million)

Table 160 RoW: Medical Cameras Market, by End-user, 2020-2026 (USD Million)

11 Competitive Landscape

11.1 Overview

Figure 25 Key Developments in the Medical Cameras Market, January 2018-April 2021

11.2 Market Share Analysis

Table 161 Medical Cameras Market Share, by Key Player (2020)

11.3 Competitive Scenario

Figure 26 Market Evaluation Framework, 2018-2021

11.3.1 Product Launches & Approvals

Table 162 Product Launches & Approvals

11.3.2 Agreements and Collaborations

Table 163 Agreements and Collaborations

11.3.3 Acquisitions

Table 164 Acquisitions

11.3.4 Expansions

Table 165 Expansions

11.3.5 Other Developments

Table 166 Other Developments

11.4 Company Evaluation Matrix

11.4.1 Stars

11.4.2 Emerging Leaders

11.4.3 Pervasive Players

11.4.4 Participants

Figure 27 Medical Cameras Market: Vendor Dive Matrix, 2020

11.5 Competitive Leadership Mapping (SMEs/Start-Ups)

11.5.1 Progressive Companies

11.5.2 Starting Blocks

11.5.3 Responsive Companies

11.5.4 Dynamic Companies

Figure 28 Medical Cameras Market: Vendor Dive Matrix for SMEs & Start-Ups, 2020

12 Company Profiles

12.1 Olympus Corporation

Figure 29 Olympus Corporation: Company Snapshot (2020)

12.2 Richard Wolf GmbH

12.3 Topcon Corporation

Figure 30 Topcon Corporation: Company Snapshot (2020)

12.4 Sony Corporation

Figure 31 Sony Corporation: Company Snapshot (2020)

12.5 Stryker Corporation

Figure 32 Stryker Corporation: Company Snapshot (2020)

12.6 Danaher

Figure 33 Danaher: Company Snapshot (2020)

12.7 Canon Inc.

Figure 34 Canon Inc.: Company Snapshot (2020)

12.8 Carl Zeiss Ag

Figure 35 Carl Zeiss Ag: Company Snapshot (2020)

12.9 Smith & Nephew

Figure 36 Smith & Nephew plc: Company Snapshot (2020)

12.10 Carestream Dental LLC

12.11 Basler Ag

Figure 37 Basler Ag: Company Snapshot (2020)

12.12 Atmos Medizintechnik GmbH & Co. Kg

12.13 Imperx, Inc

12.14 Ids Imaging Development Systems GmbH

12.15 Optomed plc

Figure 38 Optomed: Company Snapshot (2020)

12.16 Haag-Streit Group

12.17 Cymo B.V.

12.18 Diaspective Vision

12.19 Dage-Mti

12.2 Fude Technology Group Limited

12.21 Healthtech Engineers Private Limited

12.22 Schölly Fiberoptic GmbH

12.23 Medicam

12.24 Esc Medicams

12.25 Tonglu Kanger Medical Instrument Co., Ltd

13 Appendix

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: The Subscription Portal

13.4 Available Customizations

Companies Mentioned

- Atmos Medizintechnik GmbH & Co. Kg

- Basler Ag

- Canon Inc.

- Carestream Dental LLC

- Carl Zeiss Ag

- Cymo B.V.

- Dage-Mti

- Danaher

- Diaspective Vision

- Esc Medicams

- Fude Technology Group Limited

- Haag-Streit Group

- Healthtech Engineers Private Limited

- IDS Imaging Development Systems GmbH

- Imperx, Inc

- Medicam

- Olympus Corporation

- Optomed plc

- Richard Wolf GmbH

- Schölly Fiberoptic GmbH

- Smith & Nephew

- Sony Corporation

- Stryker Corporation

- Tonglu Kanger Medical Instrument Co., Ltd

- Topcon Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | May 2021 |

| Forecast Period | 2021 - 2026 |

| Estimated Market Value ( USD | $ 2.9 Billion |

| Forecasted Market Value ( USD | $ 4.1 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |