Global Industrial Rubber Products Market - Key Trends & Drivers Summarized

What Constitutes Industrial Rubber Products and Their Role in Modern Industries?

Industrial rubber products encompass a broad category of items essential to numerous sectors such as automotive, construction, manufacturing, and aerospace. These products range from belts, hoses, gaskets, and seals to flooring and vibration control devices, all crafted from natural or synthetic rubber. The inherent properties of rubber such as flexibility, durability, resistance to abrasion, and the ability to absorb shock make it invaluable in applications that require sealing against moisture, protection from chemicals, reduction of vibration, and insulation against electricity. Rubber products are crucial in complex machinery and infrastructure, providing the functionality required to ensure safety, efficiency, and longevity in harsh industrial environments. This versatility has positioned rubber as a key material in advancing industrial innovation and operational reliability.How Technological Advancements Influence Rubber Product Manufacturing

The manufacturing of industrial rubber products has significantly evolved with technological advancements, enhancing both the materials used and the processes involved. Innovations in material science have led to the development of high-performance rubber composites that exhibit superior properties, such as increased resistance to heat, chemicals, and wear. These advancements extend the applications of rubber products into more demanding environments, such as high-temperature industrial processes or corrosive chemical exposures. Additionally, improvements in manufacturing technologies such as injection molding, extrusion, and robotic automation have streamlined production lines, improving precision, scalability, and cost-efficiency. Moreover, the integration of digital technologies like IoT sensors in rubber products enables real-time monitoring of their condition and performance, facilitating predictive maintenance and thereby reducing downtime in industrial operations.Emerging Trends Shaping the Industrial Rubber Products Market

Several emerging trends are significantly shaping the industrial rubber products market. Environmental sustainability has become a priority, driving the industry towards more eco-friendly practices, including the use of recycled rubber materials and the development of biodegradable rubber composites. The automotive industry's shift towards electric vehicles is another trend influencing demand, as this transition requires new types of rubber products that meet the specific needs of electric powertrains, such as better insulation properties and chemical resistance. Additionally, the rise in infrastructure development globally, particularly in emerging economies, fuels the demand for rubber products used in construction and public works. These trends not only reflect the growing diversification of applications for rubber products but also underscore the industry's adaptability to global economic and environmental changes.What Drives the Growth of the Industrial Rubber Products Market?

The growth in the industrial rubber products market is driven by several factors, including the expanding scope of rubber applications across various industries and the ongoing innovations in rubber technology. The robust demand from the automotive sector, particularly for specialized rubber components in both traditional and electric vehicles, plays a significant role in this growth. Additionally, the construction industry's recovery and expansion worldwide boost the demand for rubber products used in sealing and insulation applications. Technological advancements that lead to the production of superior rubber composites are also crucial, as they enhance the performance and durability of rubber products, making them suitable for a wider range of industrial applications. Furthermore, consumer behavior that increasingly prioritizes sustainability has spurred the development of green rubber manufacturing processes and products. Lastly, global economic growth, particularly in industrial and emerging markets, continues to drive the consumption and innovation of rubber products, ensuring their critical role in industrial advancement. These factors collectively contribute to the dynamic growth and evolution of the industrial rubber products market, reflecting its integral role in modern industrial ecosystems.Report Scope

The report analyzes the Industrial Rubber Products market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Segment (Mechanical Rubber Goods, Rubber Hose & Belting, Other Product Segments); Rubber Type (Natural, Styrene Butadiene, Polybutadiene, Ethylene-Propylene, Nitrile Butadiene, Other Rubber Types); End-Use (Automotive, Construction & Infrastructure, Energy, Aerospace, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Mechanical Rubber Goods segment, which is expected to reach US$72.8 Billion by 2030 with a CAGR of 6%. The Rubber Hose & Belting segment is also set to grow at 7.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $23.4 Billion in 2024, and China, forecasted to grow at an impressive 7.5% CAGR to reach $47.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Rubber Products Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Rubber Products Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Rubber Products Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Federal-Mogul Corporation, Bridgestone Corporation, Freudenberg SE, Amp Impex Private Limited, Caledonian Industries Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 321 companies featured in this Industrial Rubber Products market report include:

- Federal-Mogul Corporation

- Bridgestone Corporation

- Freudenberg SE

- Amp Impex Private Limited

- Caledonian Industries Ltd.

- Dayco Products LLC

- ABG Rubber & Plastics Ltd.

- ALFAGOMMA SpA

- American High Performance Seals, Inc.

- Bando Chemical Industries, Ltd. (Bando Group)

- Bangkok Synthetics Co., Ltd.

- Bohra Rubber Pvt., Ltd.

- Codan Rubber A/S

- Buchanan Rubber Ltd.

- As One Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Federal-Mogul Corporation

- Bridgestone Corporation

- Freudenberg SE

- Amp Impex Private Limited

- Caledonian Industries Ltd.

- Dayco Products LLC

- ABG Rubber & Plastics Ltd.

- ALFAGOMMA SpA

- American High Performance Seals, Inc.

- Bando Chemical Industries, Ltd. (Bando Group)

- Bangkok Synthetics Co., Ltd.

- Bohra Rubber Pvt., Ltd.

- Codan Rubber A/S

- Buchanan Rubber Ltd.

- As One Corporation

Table Information

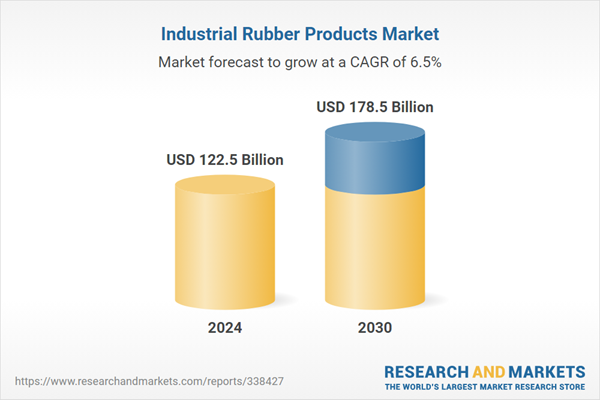

| Report Attribute | Details |

|---|---|

| No. of Pages | 706 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 122.5 Billion |

| Forecasted Market Value ( USD | $ 178.5 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |