Global Baby Foods and Infant Formula Market - Key Trends and Drivers Summarized

The baby foods and infant formula market plays a critical role in ensuring the nutritional needs and healthy development of infants and young children. This market includes a variety of products such as infant formula, baby cereals, purees, snacks, and ready-to-eat meals, all designed to provide essential nutrients during the early stages of life. Parents and caregivers are increasingly seeking products that not only meet nutritional standards but also align with their preferences for organic, non-GMO, and clean label ingredients. The demand for convenience has driven innovation in packaging and product formats, offering easy-to-use options like single-serve pouches and ready-to-drink bottles that cater to busy lifestyles. The market has seen significant advancements in formulations, with manufacturers focusing on mimicking the nutritional profile of breast milk and incorporating functional ingredients that support immunity and cognitive development.Technological advancements have greatly influenced the production and quality of baby foods and infant formula. Modern manufacturing processes ensure stringent safety and quality control, addressing concerns about contamination and nutritional adequacy. Innovations in food science have led to the development of advanced formulations that include prebiotics, probiotics, and DHA, which are crucial for gut health and brain development. Packaging technology has also evolved, with vacuum sealing and aseptic packaging extending shelf life while maintaining product integrity. Digital platforms and e-commerce have transformed the way parents shop for baby food, providing access to a wider range of products and enabling detailed product comparisons. Social media and online reviews have become vital tools for parents seeking trustworthy recommendations, significantly impacting purchasing decisions.

The growth in the baby foods and infant formula market is driven by several factors. Increasing awareness about infant nutrition and the importance of early childhood development has spurred demand for high-quality, nutrient-rich products. The rise in dual-income households and changing lifestyles has led to a greater need for convenient and ready-to-feed options. Technological advancements in food processing and packaging have enhanced product safety and extended shelf life, making it easier for manufacturers to meet the growing demand. Additionally, the trend towards organic and clean label products has expanded the market for premium baby foods, attracting health-conscious parents. The increasing prevalence of food allergies and intolerances has driven the development of specialized formulas and allergen-free products. Moreover, expanding urbanization and rising disposable incomes in emerging markets have provided significant growth opportunities, as more parents are willing to invest in premium nutrition for their children. These factors collectively contribute to the dynamic and evolving landscape of the baby foods and infant formula market, ensuring its sustained growth and innovation.

Report Scope

The report analyzes the Baby Foods and Infant Formula market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Segment (Milk Formula, Dried Baby Foods, Prepared Baby Foods, Other Product Segments).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Milk Formula segment, which is expected to reach US$64.9 Billion by 2030 with a CAGR of a 6.4%. The Dried Baby Foods segment is also set to grow at 6.7% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Baby Foods and Infant Formula Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Baby Foods and Infant Formula Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Baby Foods and Infant Formula Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories, Abbott Nutrition, Beingmate Group, Bellamy's Organic, Biostime Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Baby Foods and Infant Formula market report include:

- Abbott Laboratories

- Abbott Nutrition

- Beingmate Group

- Bellamy's Organic

- Biostime Inc.

- Dana Dairy Group

- Danone SA

- Fonterra Co-operative Group

- Gujarat Cooperative Milk Marketing Federation (AMUL)

- Hero Group

- HiPP UK Ltd.

- Mead Johnson Nutrition Company

- Meiji Co., Ltd.

- Morinaga Milk Industry Co. Ltd.

- Nestlé S.A.

- Perrigo Company plc

- Synlait Milk Ltd.

- The a2 Milk Company

- Wakodo Co. Ltd.

- Yashili International Holdings

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Abbott Nutrition

- Beingmate Group

- Bellamy's Organic

- Biostime Inc.

- Dana Dairy Group

- Danone SA

- Fonterra Co-operative Group

- Gujarat Cooperative Milk Marketing Federation (AMUL)

- Hero Group

- HiPP UK Ltd.

- Mead Johnson Nutrition Company

- Meiji Co., Ltd.

- Morinaga Milk Industry Co. Ltd.

- Nestlé S.A.

- Perrigo Company plc

- Synlait Milk Ltd.

- The a2 Milk Company

- Wakodo Co. Ltd.

- Yashili International Holdings

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | February 2026 |

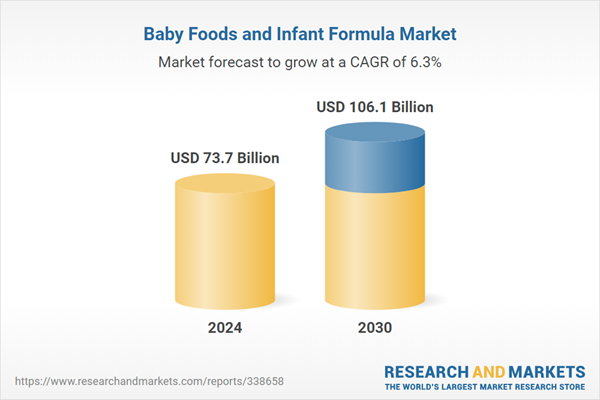

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 73.7 Billion |

| Forecasted Market Value ( USD | $ 106.1 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |