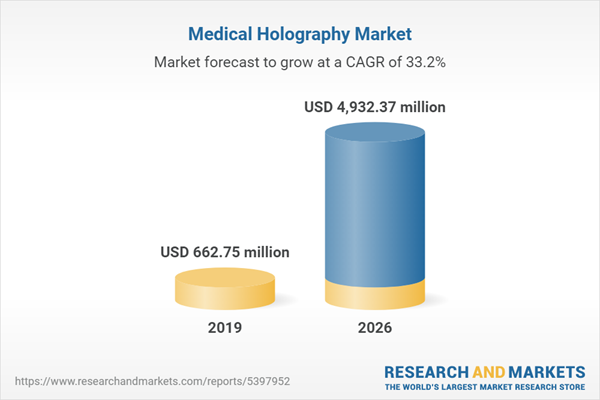

The medical holography market is evaluated at US$662.752 million for the year 2019 and is estimated to grow at a CAGR of 33.21% to reach US$4,932.372 million in 2026.

Holography is a method of creating a 3D image of an object by recording a split beam of light from a laser that is reflected from the object. It is then combined with the film with light from a reference beam which enables the viewer to see a 3D image. An aging population and growing instances of chronic diseases have augmented the demand for holography technology in diagnostic imaging. Furthermore, the rising adoption of holography products in medical education, biomedical research, and other clinical applications for gaining deep insights into the disease is also bolstering the global medical holography market growth. However, the requirement of high capital investment and the cost of the technology will hinder the growth of this market during the forecast period.

Rising adoption in medical education and research and other clinical applications to drive the market.

Holography has arisen as perhaps the most encouraging device for the medical sector. Holographic methods have expanded their applications in life sciences and medical education just as clinical research. The utilization of holographic imaging and projection has brought about colossal changes in the field of biomedical examination and clinical schooling and preparing. Along with medical imaging and research, holographic display technology and digital holograms are widely utilized in the education sector and emergency clinic training. 3D perception through holography items makes an intriguing and intelligent learning environment as holography holds more data contrasted with other learning strategies. With a developing spotlight on underlying science in clinical schools, different market players are zeroing in on creating holographic prints and holography programming to be utilized for clinical educating and preparing applications. Organizations have fostered a 3D unit for clinical understudies and specialists that will help them practice medical procedures and analyses without requiring real bodies and organs.

GIGXR, Inc., a US-based company providing extended reality GIG Immersive Learning System for instructor-led teaching and training, announced in October 2020, the launch of HoloPatient Remote and GIG Mobile for medical and nursing schools. Developed for online and hybrid learning ecosystems, these programs together ensure safe and socially distanced standardized patient simulation tutoring while incorporating real-time association, participation, and clinical evaluation between students and instructors.

Growing penetration of chronic diseases to augment the market demand.

Growing penetration of chronic diseases has propelled the demand for holography technology in diagnostic imaging. As reported by US National Center for Biotechnology Information, one in every three adults lives with more than one chronic condition, or multiple chronic conditions and procure an excessive health and cost burden. The mentioned figure is near to three out of four in older adults residing in developed economies and is estimated to incline drastically with the proportion of patients with more than four diseases almost doubling between 2015 and 2035 in the UK. Additionally, according to the World Health Organization, annually worldwide, more than 3600 million diagnostic radiology examinations are performed.

Technological advancement and increased investment open the door for opportunities.

The holography market in the health sector is rising due to increased investment in medical facilities, technological developments in surgical rooms, and a developing necessity for tailored personalized drugs. With the rise of high-yield investments, the market offers various opportunities. During a presentation at the VR/AR Global Summit on June 4th, 2021, Xenco Medical presented HoloMedX, the first glasses-free holographic surgical simulation platform. The revolutionary platform allows users to replicate a complete spine operation in holographic space without the use of headgear or glasses, and it quickly modifies the holographic environment to allow for glasses-free holographic viewing and interaction by several users at the same time.

Impact on COVID-19 pandemic.

A significant impact on the medical holography sector was witnessed during COVID-19. Several countries have implemented lockdown precautions, halted several economic activities, imposed border controls, and other measures in response to the high risk of exposure, resulting in supply chain disruptions and a shortage of inventory in many dispensaries, as well as new device deployments in diagnostic centers and hospitals. However, there is a rising demand for medical imaging combined with holographic technology for the diagnosis of diseases. For example, New York University scientists created a new model based on their holographic video microscopy experiment, which employs laser beams to capture holograms of their test beads, in October 2020. Scientists can identify both viruses and antibodies in COVID-19 patients using this holographic imaging technique, which can help with medical diagnosis.

Geographically, North America held the largest share of the global medical holography market in 2019 owing to high funding for R&D activities and the early adoption of holography technology and products by the healthcare sector. The Asia Pacific is also poised to grow at a considerable growth rate due to factors such as rising healthcare spending, improving healthcare infrastructure in developing economies such as China, India, and South Korea, and growing awareness regarding the usage of holography products in medical applications.

Holography is a method of creating a 3D image of an object by recording a split beam of light from a laser that is reflected from the object. It is then combined with the film with light from a reference beam which enables the viewer to see a 3D image. An aging population and growing instances of chronic diseases have augmented the demand for holography technology in diagnostic imaging. Furthermore, the rising adoption of holography products in medical education, biomedical research, and other clinical applications for gaining deep insights into the disease is also bolstering the global medical holography market growth. However, the requirement of high capital investment and the cost of the technology will hinder the growth of this market during the forecast period.

Rising adoption in medical education and research and other clinical applications to drive the market.

Holography has arisen as perhaps the most encouraging device for the medical sector. Holographic methods have expanded their applications in life sciences and medical education just as clinical research. The utilization of holographic imaging and projection has brought about colossal changes in the field of biomedical examination and clinical schooling and preparing. Along with medical imaging and research, holographic display technology and digital holograms are widely utilized in the education sector and emergency clinic training. 3D perception through holography items makes an intriguing and intelligent learning environment as holography holds more data contrasted with other learning strategies. With a developing spotlight on underlying science in clinical schools, different market players are zeroing in on creating holographic prints and holography programming to be utilized for clinical educating and preparing applications. Organizations have fostered a 3D unit for clinical understudies and specialists that will help them practice medical procedures and analyses without requiring real bodies and organs.

GIGXR, Inc., a US-based company providing extended reality GIG Immersive Learning System for instructor-led teaching and training, announced in October 2020, the launch of HoloPatient Remote and GIG Mobile for medical and nursing schools. Developed for online and hybrid learning ecosystems, these programs together ensure safe and socially distanced standardized patient simulation tutoring while incorporating real-time association, participation, and clinical evaluation between students and instructors.

Growing penetration of chronic diseases to augment the market demand.

Growing penetration of chronic diseases has propelled the demand for holography technology in diagnostic imaging. As reported by US National Center for Biotechnology Information, one in every three adults lives with more than one chronic condition, or multiple chronic conditions and procure an excessive health and cost burden. The mentioned figure is near to three out of four in older adults residing in developed economies and is estimated to incline drastically with the proportion of patients with more than four diseases almost doubling between 2015 and 2035 in the UK. Additionally, according to the World Health Organization, annually worldwide, more than 3600 million diagnostic radiology examinations are performed.

Technological advancement and increased investment open the door for opportunities.

The holography market in the health sector is rising due to increased investment in medical facilities, technological developments in surgical rooms, and a developing necessity for tailored personalized drugs. With the rise of high-yield investments, the market offers various opportunities. During a presentation at the VR/AR Global Summit on June 4th, 2021, Xenco Medical presented HoloMedX, the first glasses-free holographic surgical simulation platform. The revolutionary platform allows users to replicate a complete spine operation in holographic space without the use of headgear or glasses, and it quickly modifies the holographic environment to allow for glasses-free holographic viewing and interaction by several users at the same time.

Impact on COVID-19 pandemic.

A significant impact on the medical holography sector was witnessed during COVID-19. Several countries have implemented lockdown precautions, halted several economic activities, imposed border controls, and other measures in response to the high risk of exposure, resulting in supply chain disruptions and a shortage of inventory in many dispensaries, as well as new device deployments in diagnostic centers and hospitals. However, there is a rising demand for medical imaging combined with holographic technology for the diagnosis of diseases. For example, New York University scientists created a new model based on their holographic video microscopy experiment, which employs laser beams to capture holograms of their test beads, in October 2020. Scientists can identify both viruses and antibodies in COVID-19 patients using this holographic imaging technique, which can help with medical diagnosis.

Geographically, North America held the largest share of the global medical holography market in 2019 owing to high funding for R&D activities and the early adoption of holography technology and products by the healthcare sector. The Asia Pacific is also poised to grow at a considerable growth rate due to factors such as rising healthcare spending, improving healthcare infrastructure in developing economies such as China, India, and South Korea, and growing awareness regarding the usage of holography products in medical applications.

Market Segmentation:

By Product Type

- Holographic Prints

- Holographic Microscopes

- Holographic Software

- Holographic Displays

- Others

By Application

- Medical Education

- Biomedical Research

- Medical Imaging

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

Table of Contents

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

5. Medical Holography Market, by Type

6. Medical Holographic Market, by Solution

7. Medical Holographic Market, by Geography

8. Competitive Environment and Analysis

9. Company Profiles

Companies Mentioned

- NanoLive

- Mach7

- Holoxica

- EchoPixel

- RealView Imaging Ltd.

- zSpace Inc

- Eon Reality

- Lyncee Tec

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 110 |

| Published | July 2021 |

| Forecast Period | 2019 - 2026 |

| Estimated Market Value ( USD | $ 662.75 million |

| Forecasted Market Value ( USD | $ 4932.37 million |

| Compound Annual Growth Rate | 33.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |