The COVID-19 pandemic had a swift and negative impact on the globally integrated automotive industry. Automobile engine and component manufacturing plants have been shut down, and consumer footfalls in showrooms have fallen sharply because of lockdowns and travel restrictions worldwide.

However, the automotive engine market is expected to witness significant growth during the forecast period, as manufacturers are focusing on new technologies like the replacement of engine control units to increase the average life of vehicles, thereby improving the lifecycle of engines. The growing demand for fuel-efficient and lightweight vehicles will likely create lucrative opportunities for players in the market during the forecast period.

Moreover, with the rising electrification of the fleet, OEMs are seen closing down their respective production bases. For instance, In November 2022, Stellantis announced the closure of its Fiat Powertrain Technologies (FPT) engine plant in Campo Largo, Brazil. It came after the company aimed to achieve zero emissions by 2038.

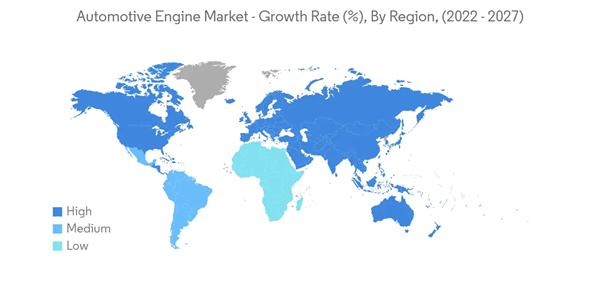

The Asia-Pacific region is anticipated to continue as a significant market for automotive engines throughout the forecasted period. Both North America and Asia-Pacific regions dominate the global automotive engine market as several environmental norms are employed in North America, Europe, and Asia-Pacific.

Automotive Engine Market Trends

Increasing Investment and Vehicle Sales to Provide Momentum

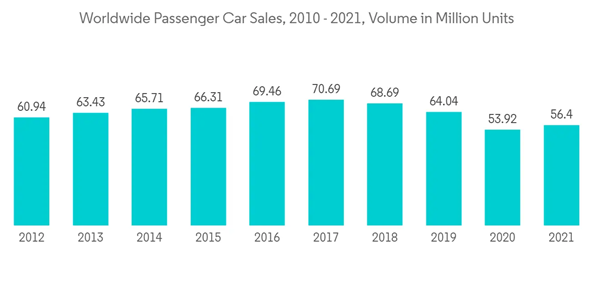

A key factor driving the growth of the automotive engine market is the development of new engine technologies, such as variable displacement engines (VDEs) and hybrids. Automotive manufacturers are developing new types of motors, such as hybrid and variable displacement engines (VDEs), to deliver high performance and fuel efficiency.Car manufacturers try to stay ahead of the competition by building the most compact engines that are lightweight, have greater power output, and have a higher fuel economy. OEMs downsize vehicle engines to decrease the overall curb weight of the vehicle and reduce emissions. Rising vehicle sales have predominately improved engine demand. For instance:

- In the UK, during October 2022 compared to last year in the same month, diesel-engine car sales fell by 9.7% to 6,347 units. In contrast, gasoline-engine car sales rose by 17.8% to 56,994 units, diesel mild hybrid electric vehicles by 21.4% to 5,466 units, gasoline mild hybrid electric vehicles by 59.5% to 20,993 units, electric vehicles by 23.4% to 19,933 units and plug-in hybrid electric vehicle sales rose by 6.2% to 8,899 units.

- In 2021, gasoline-powered vehicles in Germany accounted for 37.1% market share with 972,588 units, whereas hybrid cars accounted for 28.8% market share with 754,588 units. On similar lines, electric vehicles had a 13.6% market share with 355,961 units, and diesel vehicles had a 20.0% market share with 524,446 units. It is poised for strong growth in demand for gasoline and diesel engine shortly.

Engine manufacturers are expanding their business potential to meet the rising demand for gasoline and diesel vehicle sales across the geography. For instance:

- In November 2022, French automotive giant Renault Groupe discussed its plans to focus on producing IC engines during its longer-term vision. The company have signed a non-binding framework agreement with GeelyHoldings for establishing production units, supply power trains, and IC engines for upcoming mild hybrid and IC engine vehicles.

- In April 2022, Toyota announced an investment of USD 383 million in four of its US manufacturing plants to support the production of its four-cylinder engines, including hybrid electric vehicles. In addition, Toyota Alabama in Huntsville plant received USD 222 million to expand 114,000 sq ft and install a new four-cylinder production line to produce engines for both combustion and hybrid electric powertrains.

After considering these factors and development, demand for automotive engines is anticipated to continue during the forecast period, owing to a rise in vehicle sales.

The Asia-Pacific Region is Expected to Lead the Market

The Asia-Pacific region is expected to dominate the automotive engine market, followed by Europe and North America during the forecast period. The developments in the field of engine technology are increasing significantly, along with rising emission norms across the globe. A large amount of OEMs' profit will likely come from developing economies like India and China.The Asia-Pacific region is likely to attract major players in the market, as customers' preference toward electric vehicles is increasing significantly. However, as switching to electric mobility is associated with high cost, electrification and adopting electric vehicles at the local level will maintain the relevance of IC engines. Many electric vehicles are hybrid electric vehicles. IC engines will be produced until the electric car market sees full electrification of vehicles.

Europe and North America are expected to be active regions in the market after Asia-Pacific due to the presence of long-established original equipment manufacturers. It provides a strong base for the robust development and growth of the automotive engine market in the region.

The region is witnessing impressive vehicle sales, which have taken overall engine demand on the positive side. For instance:

- China dominates in the Asia-Pacific region regarding auto industry throughput and engine production. Region houses leading OEM, auto suppliers, and engine manufacturers maintain steady global supply. The total number of vehicles produced and sold in October was 2.599 million, up 11.1% from the same period of the previous year.

- In November 2022, India passenger vehicle sales registered 276,231 units, representing a net increase of 28.1% compared to November 2021 sales. Maruti-Suzuki, Tata Motors, and Mahindra lead the registered units.

- According to the Japan Automotive Dealers Association and Japan Light Motor Vehicle and Motorcycle Association, sales in Japan in October 2022 increased by 28.6% to 359,159 units compared with October 2021. Sales with engine displacements above 660cc rose from 19.7% to 211,542 units, and those with engine displacements below 660cc increased from 43.9% to 147,617 units. Total sales from January to October decreased by 7.4% to 3,479,877 units compared to October 2021.

OEMs have been focusing on developing technologically advanced powered engines to gain high torque and performance. The emergence of multi-fuel engine technology is expected to provide lucrative opportunities to the active market players in the automotive engine market. For example, the Volvo multi-fuel car have a 2 l engine that runs on five fuels: hythane, methane, bioethane, CNG, and petrol.

Automotive Engine Market Competitor Analysis

The automotive engine market is fragmented due to the numerous players in the market. The companies are launching more technologically advanced products to gain a competitive edge over other players. For instance:- In November 2021, Dongfeng Motor Company Limited announced that it had signed a cooperation agreement with Dongfeng Cummins Engine Co. Ltd. on a heavy-duty engine R&D and manufacturing project in Xiangyang National Hi-tech Industry Development Zone in Hubei Province.

Some of the key players in the market include Cummins Inc., Toyota Motor Corporation, Fiat Automobiles SpA, Volkswagen AG, MAN Energy Solutions, and General Motors.

Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Mercedes-Benz

- Cummins Inc.

- Toyota Motor Corporation

- BMW

- General Motors

- Honda Motor Company Ltd

- Hyundai Motor Company

- Scania AB

- Suzuki Motor Corporation

- Mazda Motor Corporation

- Volkswagen AG

- Eicher Motors Limited

- Yamaha Corporation

- Fiat Automobiles SpA

Methodology

LOADING...