The oil and gas pipeline fabrication and construction market is projected to register a CAGR of over 3.5% during the forecast period.

The market was negatively impacted by the COVID-19 pandemic. However, the market has now reached pre-pandemic levels.

The natural gas pipeline network is expected to grow parallel to the increasing natural gas demand, which is expected to boost the global oil and gas pipeline fabrication and construction market's growth during the forecast period.

However, delay in pipeline projects due to land and border disputes across several countries is anticipated to hinder the market's growth during the forecast period.

Nevertheless, pipeline expansion projects and new gas pipeline projects are expected to create tremendous business opportunities for the oil and gas pipeline fabrication and construction market in the coming years.

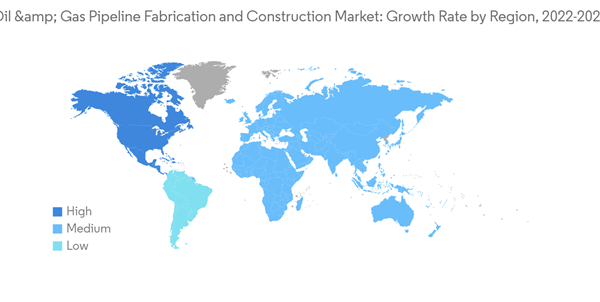

North America is one of the major demand centers for the oil and gas pipeline fabrication and construction market, with the United States being the major hotspot.

China has the most significant number of operational gas pipelines worldwide. As of January 2022, the Chinese gas network comprised 226 functional pipelines, with 159 proposed or already under construction. The total number of operational gas pipelines worldwide is 1,608.

Traditionally, the world has depended more on oil for its primary energy needs. However, the growing concern over emissions has increased natural gas consumption in the past few years. This has resulted in heavy investment in the natural gas pipeline network. According to the International Energy Agency, the global natural gas demand is expected to reach 4,370 billion cubic meters annually by 2025, or an average growth rate of 1.5% year-on-year (Y-o-Y) for 2019-25.

The growth of natural gas demand globally, in line with the increasing share of natural gas in the energy mix, is anticipated to be a primary driver for the maturation of the oil and gas pipeline fabrication and construction market. LNG trade has also shown strong growth over the past years because of the increasing dependency on natural gas for energy requirements, leading to an increase in LNG infrastructure investment, such as liquefaction and regasification terminals, and a growth in demand for oil and gas pipeline fabrication and construction.

In the first quarter of 2022, the Federal Energy Regulatory Commission (FERC) sanctioned three projects to increase United States natural gas exports via pipeline and LNG. FERC approved two projects that connect to LNG terminals in Louisiana. The Evangeline Pass Expansion Project is a 1.1 billion cubic feet project owned by the Tennessee Gas Pipeline Company. The project includes 13.1 miles of new pipeline and two new compressor stations that will deliver natural gas to the proposed Plaquemines LNG Project in Plaquemines Parish, Louisiana.

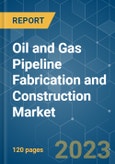

Global natural gas production amounted to about 4.14 trillion cubic meters in 2021, registering a growth of 5.8% compared to the previous year. The global natural gas share of energy sources is expected to increase. Russia, the United States, and Iran are some of the world's largest natural gas producers.

In October 2022, the Nigerian National Petroleum Company Limited (NNPC) anticipates an investment decision on the proposed USD 25 billion gas pipeline from Nigeria to Morocco in 2023. The pipeline is planned to run for 3,840 miles (5,600 kilometers) from Nigeria along the West African coast to Morocco before connecting with pipelines in Italy and Spain and potentially delivering more non-Russian gas to Europe. In July 2022, the government of India planned to set a target to raise the share of natural gas in the energy mix from 6.3% to 15% by 2030. In India, the percentage of natural gas in the primary energy mix has increased from 6.3% to 6.7% from 2020 to 2021. To expand the domestic natural gas pipeline infrastructure, in July 2022, the Minister of State for Petroleum and Natural Gas announced various initiatives, including the expansion of the National Gas Grid pipeline infrastructure from the current 21,715 km to about 33,500 km, the development of city gas distribution (CGD) grid, and setting up liquefied natural gas terminals.

The oil and gas pipeline market is expected to witness subdued growth due to an increasing share of natural gas in the global energy mix and rising investments in natural gas pipeline infrastructure.

During the last decade, the oil and gas infrastructure development in North America has been relatively robust compared to other regions because gas pipelines have a relatively larger share of new developments. The United States, Canada, and Mexico are the major countries in the region’s oil and gas industry.

In 2021, North America was one of the largest gas producers, with a global share of about 28%, and the second largest oil producer, with a share of about 29%. In 2021, the region showcased modest growth of about 1.5% in natural gas production compared to 2020. On the other hand, natural gas consumption in North America reached about 1034.1 billion cubic meters (bcm) in 2021, witnessing a slight growth of around 2.2% compared to 2020.

The region is also witnessing a shift toward natural gas as it is a cleaner fuel than oil, which aligns with the global trend of adopting measures for reducing emissions and achieving a carbon-neutral future. This scenario has been reflected in the region’s interest in developing gas pipelines over oil pipelines, indicating the growth of natural gas pipelines in the region.

As of October 2022, the United States has around 88.2 (for nine completed projects) miles of interstate transmission pipelines with an additional capacity of 3,097 MMcf/d. The country has 812.4 (for 15 construction projects) miles of interstate and intrastate transmission pipelines with an additional capacity of 8,323 MMcf/d. According to the United States EIA, 7.44 billion cubic feet per day (Bcf/d) of interstate natural gas pipeline capacity was added in the United States in 2021. Hence, such a growing interest in natural gas pipelines is expected to create positive demand for the oil and gas pipeline fabrication and construction market during the forecast period. For instance, in September 2022, a leading US LNG exporter Cheniere Energy Inc. planned to form a joint venture with units of Whistler Pipeline LLC to construct the natural gas pipeline. The 42-inch pipeline is planned to extend about 43 miles from Whistler’s terminus to Cheniere’s Corpus Christi liquefaction facility in Texas. The pipeline can transport up to 1.7 billion cubic feet per day (Bcf/d) of natural gas and is expected to be in service in 2024.

North America is expected to become one of the major demand centers for the oil and gas pipeline fabrication and construction market during the forecast period.

This product will be delivered within 2 business days.

The market was negatively impacted by the COVID-19 pandemic. However, the market has now reached pre-pandemic levels.

The natural gas pipeline network is expected to grow parallel to the increasing natural gas demand, which is expected to boost the global oil and gas pipeline fabrication and construction market's growth during the forecast period.

However, delay in pipeline projects due to land and border disputes across several countries is anticipated to hinder the market's growth during the forecast period.

Nevertheless, pipeline expansion projects and new gas pipeline projects are expected to create tremendous business opportunities for the oil and gas pipeline fabrication and construction market in the coming years.

North America is one of the major demand centers for the oil and gas pipeline fabrication and construction market, with the United States being the major hotspot.

Oil & Gas Pipeline Fabrication & Construction Market Trends

Gas Segment to Record Significant Growth

Pipeline transportation moves gaseous or liquid products from their production or extraction site to refineries and ultimate-end consumers. Pipelines used for transporting pressurized natural gas are made from carbon steel.China has the most significant number of operational gas pipelines worldwide. As of January 2022, the Chinese gas network comprised 226 functional pipelines, with 159 proposed or already under construction. The total number of operational gas pipelines worldwide is 1,608.

Traditionally, the world has depended more on oil for its primary energy needs. However, the growing concern over emissions has increased natural gas consumption in the past few years. This has resulted in heavy investment in the natural gas pipeline network. According to the International Energy Agency, the global natural gas demand is expected to reach 4,370 billion cubic meters annually by 2025, or an average growth rate of 1.5% year-on-year (Y-o-Y) for 2019-25.

The growth of natural gas demand globally, in line with the increasing share of natural gas in the energy mix, is anticipated to be a primary driver for the maturation of the oil and gas pipeline fabrication and construction market. LNG trade has also shown strong growth over the past years because of the increasing dependency on natural gas for energy requirements, leading to an increase in LNG infrastructure investment, such as liquefaction and regasification terminals, and a growth in demand for oil and gas pipeline fabrication and construction.

In the first quarter of 2022, the Federal Energy Regulatory Commission (FERC) sanctioned three projects to increase United States natural gas exports via pipeline and LNG. FERC approved two projects that connect to LNG terminals in Louisiana. The Evangeline Pass Expansion Project is a 1.1 billion cubic feet project owned by the Tennessee Gas Pipeline Company. The project includes 13.1 miles of new pipeline and two new compressor stations that will deliver natural gas to the proposed Plaquemines LNG Project in Plaquemines Parish, Louisiana.

Global natural gas production amounted to about 4.14 trillion cubic meters in 2021, registering a growth of 5.8% compared to the previous year. The global natural gas share of energy sources is expected to increase. Russia, the United States, and Iran are some of the world's largest natural gas producers.

In October 2022, the Nigerian National Petroleum Company Limited (NNPC) anticipates an investment decision on the proposed USD 25 billion gas pipeline from Nigeria to Morocco in 2023. The pipeline is planned to run for 3,840 miles (5,600 kilometers) from Nigeria along the West African coast to Morocco before connecting with pipelines in Italy and Spain and potentially delivering more non-Russian gas to Europe. In July 2022, the government of India planned to set a target to raise the share of natural gas in the energy mix from 6.3% to 15% by 2030. In India, the percentage of natural gas in the primary energy mix has increased from 6.3% to 6.7% from 2020 to 2021. To expand the domestic natural gas pipeline infrastructure, in July 2022, the Minister of State for Petroleum and Natural Gas announced various initiatives, including the expansion of the National Gas Grid pipeline infrastructure from the current 21,715 km to about 33,500 km, the development of city gas distribution (CGD) grid, and setting up liquefied natural gas terminals.

The oil and gas pipeline market is expected to witness subdued growth due to an increasing share of natural gas in the global energy mix and rising investments in natural gas pipeline infrastructure.

North America is Expected to Dominate the Market

North America is one of the significant markets for oil and gas pipeline fabrication and construction. The region is one of the largest oil and gas markets in the world and is also a net exporter of oil and gas, which indicates the involvement of huge midstream infrastructure.During the last decade, the oil and gas infrastructure development in North America has been relatively robust compared to other regions because gas pipelines have a relatively larger share of new developments. The United States, Canada, and Mexico are the major countries in the region’s oil and gas industry.

In 2021, North America was one of the largest gas producers, with a global share of about 28%, and the second largest oil producer, with a share of about 29%. In 2021, the region showcased modest growth of about 1.5% in natural gas production compared to 2020. On the other hand, natural gas consumption in North America reached about 1034.1 billion cubic meters (bcm) in 2021, witnessing a slight growth of around 2.2% compared to 2020.

The region is also witnessing a shift toward natural gas as it is a cleaner fuel than oil, which aligns with the global trend of adopting measures for reducing emissions and achieving a carbon-neutral future. This scenario has been reflected in the region’s interest in developing gas pipelines over oil pipelines, indicating the growth of natural gas pipelines in the region.

As of October 2022, the United States has around 88.2 (for nine completed projects) miles of interstate transmission pipelines with an additional capacity of 3,097 MMcf/d. The country has 812.4 (for 15 construction projects) miles of interstate and intrastate transmission pipelines with an additional capacity of 8,323 MMcf/d. According to the United States EIA, 7.44 billion cubic feet per day (Bcf/d) of interstate natural gas pipeline capacity was added in the United States in 2021. Hence, such a growing interest in natural gas pipelines is expected to create positive demand for the oil and gas pipeline fabrication and construction market during the forecast period. For instance, in September 2022, a leading US LNG exporter Cheniere Energy Inc. planned to form a joint venture with units of Whistler Pipeline LLC to construct the natural gas pipeline. The 42-inch pipeline is planned to extend about 43 miles from Whistler’s terminus to Cheniere’s Corpus Christi liquefaction facility in Texas. The pipeline can transport up to 1.7 billion cubic feet per day (Bcf/d) of natural gas and is expected to be in service in 2024.

North America is expected to become one of the major demand centers for the oil and gas pipeline fabrication and construction market during the forecast period.

Oil & Gas Pipeline Fabrication & Construction Market Competitor Analysis

The oil and gas pipeline fabrication and construction market is fragmented. The key companies (in no particular order) include Snelson Companies Inc., Bechtel Corporation, Pumpco Inc., Larsen & Toubro Limited, and Barnard Construction Company Inc., among others.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET OVERVIEW

5 MARKET SEGMENTATION

6 COMPETITIVE LANDSCAPE

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Snelson Companies Inc.

- Bechtel Corporation

- Pumpco Inc.

- Barnard Construction Company Inc.

- Tenaris SA

- Sunland Construction Inc.

- Shengli Oil & Gas Pipe Holdings Limited

- Gateway Pipeline LLC

- Ledcor Group

- Larsen & Toubro Limited

Methodology

LOADING...