The Military Aircraft Avionics Market size is estimated at USD 38.24 billion in 2024, and is expected to reach USD 47.32 billion by 2029, growing at a CAGR of 4.35% during the forecast period (2024-2029).

In 2020, military aircraft deliveries decreased significantly due to the impact of the COVID-19 pandemic on the supply chain of certain aircraft programs. Nevertheless, the situation improved in 2021 for several military aircraft manufacturers worldwide. On the other hand, no visible impact was noted on the orders placed by various armed forces worldwide.

With the growth in defense spending by several nations across the globe, the industry has witnessed procurement and development activities for military aircraft in the last few years. This factor is currently driving the growth of the associated avionics market.

The development of new and advanced avionics is generating the need to replace old avionics systems in older military aircraft. These new avionics suites support the aircraft to meet the newer generation battlefield requirements like long-distance target detection and tracking, stealth, and electronic warfare defense. Therefore, to stay abreast of adversaries and allied military forces are devising modernization plans to upgrade the avionics suites in the military aircraft.

Furthermore, several countries are developing and procuring next-generation military aircraft to modernize and expand their fleets. This is also expected to drive the investments toward next-generation avionics and mission computers.

This product will be delivered within 2 business days.

In 2020, military aircraft deliveries decreased significantly due to the impact of the COVID-19 pandemic on the supply chain of certain aircraft programs. Nevertheless, the situation improved in 2021 for several military aircraft manufacturers worldwide. On the other hand, no visible impact was noted on the orders placed by various armed forces worldwide.

With the growth in defense spending by several nations across the globe, the industry has witnessed procurement and development activities for military aircraft in the last few years. This factor is currently driving the growth of the associated avionics market.

The development of new and advanced avionics is generating the need to replace old avionics systems in older military aircraft. These new avionics suites support the aircraft to meet the newer generation battlefield requirements like long-distance target detection and tracking, stealth, and electronic warfare defense. Therefore, to stay abreast of adversaries and allied military forces are devising modernization plans to upgrade the avionics suites in the military aircraft.

Furthermore, several countries are developing and procuring next-generation military aircraft to modernize and expand their fleets. This is also expected to drive the investments toward next-generation avionics and mission computers.

Military Aircraft Avionics Market Trends

Flight Control System is Expected to Register Highest Growth During Forecast Period

The military aircraft's flight control systems (FCS) include hardware and software systems for primary and secondary cockpit flight controls such as autopilot, data acquisition systems, flight recorders, aircraft management computers, active inceptor systems, and Electrohydrostatic Actuation (EHA) systems, among others. All military aircraft flight control systems are currently developed based on the Fly-by-Wire (FBW) technology. The aircraft OEMs are partnering with the avionics manufacturers to develop and integrate advanced flight control systems onboard the new-generation aircraft, which are planned to be inducted into service in the coming years. Also, companies are currently focusing on integrating advanced technologies like artificial intelligence (AI) and big data into computers to enhance the autonomous operations of human-crewed and uncrewed aircraft. For instance, in June 2019, Airbus Defense and Space partnered with Ansys to develop a new flight-control solution with sophisticated artificial intelligence (AI) for the Future Combat Air System (FCAS). The OEM plans to introduce autonomous flight capabilities onboard the aircraft by 2030. Such partnerships further enhance aircraft capabilities and are expected to accelerate the market's growth in the coming years.North America Accounts for Major Market Share in 2021

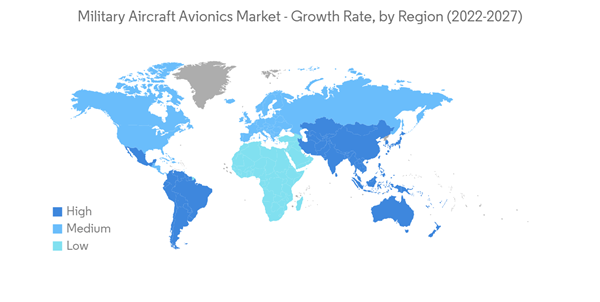

North America is dominating the military aircraft avionics market in terms of revenue in 2021, owing to the large-scale procurement of military aircraft by the United States. The United States is the largest military spender in the world, with USD 801 billion in military expenditure in 2021. The US Air Force has spent the past four years improving the fleet mission-capable rates, reaching its lowest point (below 70%) in 2018. However, the rate is still around 72% as of December 2021. This has raised concerns and pushed the government to fill the gaps through new aircraft procurement and upgrade mission-related systems in the existing fleet. The US Air Force operates one of the oldest aircraft fleets compared to Russia and China's adversaries. Fielding of new aircraft has slowed the increase in fleet age, but the US Air Force is not buying enough new aircraft to sustain its force structure at its current size. The average age of some fleets is high, at 45 years for bombers, 49 years for tankers, and 29 years for fighter/attack aircraft. Also, the US armed forces are upgrading its existing fleet with advanced avionics to support a wide range of missions. For instance, In February 2022, the USAF finally announced its plan to upgrade its 608 F-16 Block 40 and 50 in one of the largest modernization initiatives in history. The F-16 Fighter jets will get up to 22 modifications that will increase the aircraft's lethality and ensure that the fourth-generation fighter can confront current and future threats. The 22 modifications include an Active Electronically Scanned Array radar, new cockpit displays, a mission computer, and a new database. Such investments of the countries in North America to enhance their aerial capabilities are anticipated to propel the growth of the market.Military Aircraft Avionics Industry Overview

Some prominent players in the military aircraft avionics market are Raytheon Technologies Corporation, Lockheed Martin Corporation, Thales Group, BAE Systems plc, and Northrop Grumman Corporation. The players above have long-term contracts with various aircraft OEMs to provide avionic systems to their major aircraft programs. For instance, Thales Group is a prominent head-up display (HUD) provider that supports rotary-wing aircraft programs such as AH-1Z Viper, NH90, T129, Tiger, UH-1Y Venom, and Rooivalk helicopters. Similarly, BAE Systems provides an electronic warfare suite, active inceptor systems, vehicle management computer, and electronic components for communication, identification, and navigation systems onboard F-35 Lightning II fighter aircraft. To further enhance their presence in the market, the companies and adopting innovation as a key strategy that will allow them to capture new contracts with aircraft OEMs. For instance, Honeywell demonstrated various alternative navigation technologies for military aircraft in GPS-denied locations in April 2021, including information like position, velocity, and heading of the aircraft. These technologies include Vision-Aided Navigation, Celestial-Aided Navigation, and Magnetic Anomaly-Aided Navigation. The prototypes of alternative navigation technologies are expected to be available in 2022, and initial deliveries are planned to begin in 2023. Such innovations are anticipated to help the companies increase their market share.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET DYNAMICS

5 MARKET SEGMENTATION

6 COMPETITIVE LANDSCAPE

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- L3 Harris Technologies, Inc.

- Raytheon Technologies Corporation

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Thales Group

- BAE Systems Plc.

- Honeywell Internatonal, Inc.

- Elbit Systems Ltd

- Genesys Aero systems

- Cobham PLC

- Garmin Ltd.

- Moog Inc.

Methodology

LOADING...