The Body Temperature Monitoring Market size is estimated at USD 1.69 billion in 2024, and is expected to reach USD 2.16 billion by 2029, growing at a CAGR of 5.04% during the forecast period (2024-2029).

The body temperature monitoring devices were significantly impacted during the COVID-19 pandemic. For instance, an article published by Cambridge University in September 2022 reported that the major symptoms of acute COVID-19 infection were high peak body temperature. The increased body temperature due to COVID-19 led to fever and increased demand for body temperature monitoring devices. However, in the current scenario, with the substantial decrease in COVID-19 cases, the demand for temperature control devices may get stabilized compared to the beginning of the pandemic, but with the presence of various infectious microbes in the environment leading to fever and chills, the demand for body temperature control devices may keep on increasing over the forecast period.

The increasing prevalence of infectious diseases such as swine flu, Ebola, and others is leading to high body temperature due to fever and thus increasing the demand for body temperature monitoring devices. For instance, in July 2022, the World Health Organization (WHO) reported that WHO Global Influenza Surveillance and Response System (GISRS) laboratories tested more than 317,198 specimens obtained from laboratories in 99 countries from 27 December 2021 to 09 January 2022. Of these many sample tests, 16,862 people were positive for influenza viruses, of which 10,744 (63.7%) were typed as influenza A and 6,118 (36.3%) as influenza B. Feverish/chills were the most common symptoms associated with influenza and the high cases of influenza may lead to an increase in body temperature monitoring products and thus expected to drive the growth of the studied market.

Moreover, the increasing pediatric population is expected to drive the growth of this segment. For instance, an article published by NCBI in March 2022 reported that a survey conducted in the year 2021 among 14,767 participants aged between (0-65) years in a hospital in China reported the population among the age group (0-15) years was more sensitive, and the high cases of fever were reported among this age group. Since the pediatric population is continuously growing, the demand for body temperature monitoring devices is expected to increase over the forecast period.

Furthermore, new product launches are driving the growth of this market. For instance, in July 2021, Hicks launched the Hicks DT-12 Digital Thermometer, which comes with extraordinary features like memory, a beeper, and an automatic shut-off facility. Thus, such product launches are driving the growth of the market. Thus, due to the increasing prevalence of infectious diseases, rising cases of fever in the pediatric population, and new products, the market is expected to witness significant growth over the forecast period. However, issues related to rectal thermometers and concerns about the use of infrared thermometers may slow down the growth of the studied market.

The increasing pediatric population is also driving the growth of this segment. The pediatric population is more sensitive to various infections and viruses that may lead to fever, and their increasing pediatric population may increase the demand for body temperature monitoring devices. For instance, in July 2022, United Nations Projections reported that a 2.3 billion pediatric (0-17) years population was reported globally in the year 2022, and the pediatric population is expected to reach 2.5 billion by the end of 2040. Since it's easy to monitor the temperature by oral route for the pediatric population. Thus, the increasing pediatric population is driving the growth of the studied market.

Moreover, an article published by Emory University in September 2022 reported that after the COVID-19 pandemic, people have become more conscious about maintaining their body temperature, and the demand for oral thermometers has increased significantly, thereby contributing to this segment's growth. Furthermore, the accessibility an article published by the MSD manual in November 2022 reported that oral thermometers are more compatible with a population aged between 6 months - 5 years, and the high number of children present in this age group is significantly increasing the demand for oral thermometers, thereby driving the growth of this segment. Thus, the increasing pediatric population and the accessibility of devices used to maintain the temperature of the oral cavity are expected to drive the growth of this segment over the forecast period.

The United States holds the majority of the market in the North American region due to the rising cases of flu. For instance, according to the Centers for Disease Control and Prevention 2021, from September 28, 2020, to May 22, 2021, in the United States, 1,675 (0.2%) of 818,939 respiratory specimens tested by US clinical laboratories were positive for influenza virus. Thus, the increase in viral infections in North American countries is increasing the risk for fever, which in turn is demanding temperature control devices and thus controlling the growth of the studied market.

Also, the increasing pediatric (0-17) years population in North American countries is driving the demand for body temperature monitoring devices, as this population is more prevalent to diseases like fever, sour throat and cold, and cough. This disorder increases the demand for thermometers and propels the growth of the studied market in the region. For instance, in July 2022, the United Nations report stated that 37.7 million population in Mexico pediatric population was present in the year 2022, and this number is expected to increase to 32.4 million by 2040. The source also reported that a 1.8 million pediatric population was present in Canada in the year 2022, and the number is expected to increase by 7.3 million by 2040. Thus, the increasing pediatric population is increasing the demand for body temperature monitoring devices and thus contributing to the market's growth in the region.

Furthermore, researchers for the development of novel thermometers are expected to drive the growth of this market in the region. For instance, in April 2022, an article published by Frontiers in Medicine reported that a study was conducted to measure the accuracy and precision of a novel non-invasive Zero-Heat-Flux Thermometer (SpotOn) in a cohort of patients undergoing targeted temperature management (TTM) post-cardiac arrest in a hospital of Canada. The article reported that SpotOn is an accurate method that may enable non-invasive monitoring of core body temperature during TTM. Thus, such research is driving the growth of the studied market in the region. Thus, due to the increasing cases of infectious diseases and rising pediatric population, novel research in the region is expected to drive the growth of the studied market in the region.

This product will be delivered within 2 business days.

The body temperature monitoring devices were significantly impacted during the COVID-19 pandemic. For instance, an article published by Cambridge University in September 2022 reported that the major symptoms of acute COVID-19 infection were high peak body temperature. The increased body temperature due to COVID-19 led to fever and increased demand for body temperature monitoring devices. However, in the current scenario, with the substantial decrease in COVID-19 cases, the demand for temperature control devices may get stabilized compared to the beginning of the pandemic, but with the presence of various infectious microbes in the environment leading to fever and chills, the demand for body temperature control devices may keep on increasing over the forecast period.

The increasing prevalence of infectious diseases such as swine flu, Ebola, and others is leading to high body temperature due to fever and thus increasing the demand for body temperature monitoring devices. For instance, in July 2022, the World Health Organization (WHO) reported that WHO Global Influenza Surveillance and Response System (GISRS) laboratories tested more than 317,198 specimens obtained from laboratories in 99 countries from 27 December 2021 to 09 January 2022. Of these many sample tests, 16,862 people were positive for influenza viruses, of which 10,744 (63.7%) were typed as influenza A and 6,118 (36.3%) as influenza B. Feverish/chills were the most common symptoms associated with influenza and the high cases of influenza may lead to an increase in body temperature monitoring products and thus expected to drive the growth of the studied market.

Moreover, the increasing pediatric population is expected to drive the growth of this segment. For instance, an article published by NCBI in March 2022 reported that a survey conducted in the year 2021 among 14,767 participants aged between (0-65) years in a hospital in China reported the population among the age group (0-15) years was more sensitive, and the high cases of fever were reported among this age group. Since the pediatric population is continuously growing, the demand for body temperature monitoring devices is expected to increase over the forecast period.

Furthermore, new product launches are driving the growth of this market. For instance, in July 2021, Hicks launched the Hicks DT-12 Digital Thermometer, which comes with extraordinary features like memory, a beeper, and an automatic shut-off facility. Thus, such product launches are driving the growth of the market. Thus, due to the increasing prevalence of infectious diseases, rising cases of fever in the pediatric population, and new products, the market is expected to witness significant growth over the forecast period. However, issues related to rectal thermometers and concerns about the use of infrared thermometers may slow down the growth of the studied market.

Body Temperature Monitoring Market Trends

Oral Cavity Segment is Expected to Witness Significant Growth Over the Forecast Period.

The oral cavity segment is found to be the most accessible and is highly believed to provide the best estimation of the core body temperature. Hence, it is the most common site for measuring body temperature using local sensors. The convenience offered by the oral cavity is considered to be the advantage in measuring body temperature and is expected to drive the growth of this segment over the forecast period.The increasing pediatric population is also driving the growth of this segment. The pediatric population is more sensitive to various infections and viruses that may lead to fever, and their increasing pediatric population may increase the demand for body temperature monitoring devices. For instance, in July 2022, United Nations Projections reported that a 2.3 billion pediatric (0-17) years population was reported globally in the year 2022, and the pediatric population is expected to reach 2.5 billion by the end of 2040. Since it's easy to monitor the temperature by oral route for the pediatric population. Thus, the increasing pediatric population is driving the growth of the studied market.

Moreover, an article published by Emory University in September 2022 reported that after the COVID-19 pandemic, people have become more conscious about maintaining their body temperature, and the demand for oral thermometers has increased significantly, thereby contributing to this segment's growth. Furthermore, the accessibility an article published by the MSD manual in November 2022 reported that oral thermometers are more compatible with a population aged between 6 months - 5 years, and the high number of children present in this age group is significantly increasing the demand for oral thermometers, thereby driving the growth of this segment. Thus, the increasing pediatric population and the accessibility of devices used to maintain the temperature of the oral cavity are expected to drive the growth of this segment over the forecast period.

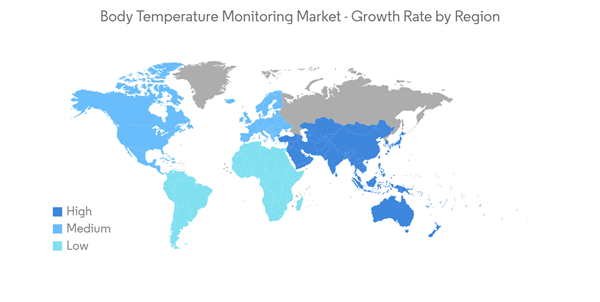

North America is Expected to Witness a Significant Growth Over the Forecast Period.

North America is expected to witness significant growth over the forecast period owing to the continuous research that is leading to the development of new and advanced body temperature monitoring devices. Also, due to the presence of a rising pediatric population and the presence of infectious diseases, the region is expected to witness significant growth over the forecast period.The United States holds the majority of the market in the North American region due to the rising cases of flu. For instance, according to the Centers for Disease Control and Prevention 2021, from September 28, 2020, to May 22, 2021, in the United States, 1,675 (0.2%) of 818,939 respiratory specimens tested by US clinical laboratories were positive for influenza virus. Thus, the increase in viral infections in North American countries is increasing the risk for fever, which in turn is demanding temperature control devices and thus controlling the growth of the studied market.

Also, the increasing pediatric (0-17) years population in North American countries is driving the demand for body temperature monitoring devices, as this population is more prevalent to diseases like fever, sour throat and cold, and cough. This disorder increases the demand for thermometers and propels the growth of the studied market in the region. For instance, in July 2022, the United Nations report stated that 37.7 million population in Mexico pediatric population was present in the year 2022, and this number is expected to increase to 32.4 million by 2040. The source also reported that a 1.8 million pediatric population was present in Canada in the year 2022, and the number is expected to increase by 7.3 million by 2040. Thus, the increasing pediatric population is increasing the demand for body temperature monitoring devices and thus contributing to the market's growth in the region.

Furthermore, researchers for the development of novel thermometers are expected to drive the growth of this market in the region. For instance, in April 2022, an article published by Frontiers in Medicine reported that a study was conducted to measure the accuracy and precision of a novel non-invasive Zero-Heat-Flux Thermometer (SpotOn) in a cohort of patients undergoing targeted temperature management (TTM) post-cardiac arrest in a hospital of Canada. The article reported that SpotOn is an accurate method that may enable non-invasive monitoring of core body temperature during TTM. Thus, such research is driving the growth of the studied market in the region. Thus, due to the increasing cases of infectious diseases and rising pediatric population, novel research in the region is expected to drive the growth of the studied market in the region.

Body Temperature Monitoring Industry Overview

The body temperature monitoring market is highly competitive and consists of several major players, indicating a fragmented market scenario. Some leading players that are working in this market segment are 3M Company, A&D Medical Technologies Sarl, Easywell Biomedicals, Inc., American Diagnostic Corporation Limited, Hicks Thermometers India Limited, Helen of Troy Limited (Kaz USA Inc.), Baxter International Inc., Cardinal Health Inc., Omron Corporation, Midas Investment Company Limited (Microlife Corporation), Terumo Corporation, Briggs Healthcare, and Hartmann AG.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET DYNAMICS

5 MARKET SEGMENTATION (Market Size by Value - USD million)

6 COMPETITIVE LANDSCAPE

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- A&D Medical Technologies Sarl

- Easywell Biomedicals, Inc.

- American Diagnostic Corporation Limited

- Hicks Thermometers India Limited

- Helen of Troy Limited (Kaz USA Inc.)

- Baxter International Inc.

- Cardinal Health Inc.

- Omron Corporation

- Midas Investment Company Limited (Microlife Corporation)

- Terumo Corporation

- Briggs Healthcare

- Hartmann AG

Methodology

LOADING...