The Global T-Cell Lymphoma Market size is estimated at USD 2.21 billion in 2024, and is expected to reach USD 3.05 billion by 2029, growing at a CAGR of 6.66% during the forecast period (2024-2029).

Due to the high transmission rate of COVID-19 and lack of treatment, many countries suffered, and they continue to bear a significant burden on their economies and healthcare systems. The COVID-19 outbreak may put patients with cutaneous lymphomas at additional risk of not receiving the necessary diagnostic procedures and treatment because they cannot access hospitals easily or due to healthcare resources limitations. Several guidelines for managing cutaneous lymphoma have been recently published to help dermatologists choose the right approach in the COVID-19 pandemic. However, these guidelines happen to be not applicable in countries that are still under a lockdown or do not have enough resources to implement the plan.

Moreover, the outbreak of COVID-19 impacted the cancer T-cell lymphoma market, as hospitals and healthcare services were significantly reduced due to social distancing measures enforced globally. The COVID-19 pandemic also affected the global economy and showed a huge impact on the general hospital care functioning for non-COVID-19 patients in hospitals across the world.

The growth of the T-cell lymphoma market is attributed to the rise in lymphoma cancer incidence due to radiations, an increase in the number of T-cell lymphoma-specific therapies, and the risk of lymphoma due to autoimmune disorders.

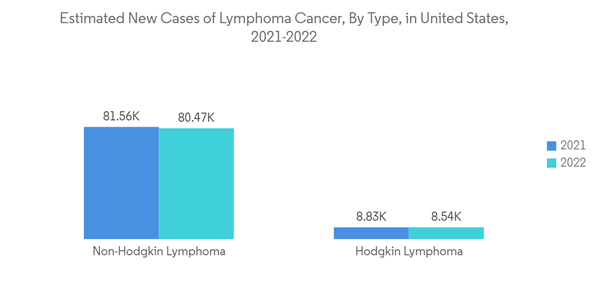

According to Leukemia & Lymphoma Society 2021, 186,400 people in the United States were diagnosed with leukemia and lymphoma in 2021. In addition, 825,651 people lived with lymphoma in the United States, 152,671 people lived with Hodgkin lymphoma, and 672,980 people lived with non-Hodgkin lymphoma. T-cell lymphoma is significantly contributing to non-Hodgkin lymphoma, which further boosts the overall market growth.

In addition, the growing uptake of premium-priced products such as Keytruda, Opdivo, and immune checkpoint inhibitors and the launch of several novel therapies with label extension of commercialized products are also boosting the overall market growth. However, the high cost associated with T-cell lymphoma treatment and the adverse side effects of therapies have been obstructing the overall market growth.

According to the European Society for Medical Oncology, the COVID-pandemic had generated a huge backlog in oncology care and research. In addition, cancer care was hit by the COVID-19 pandemic due to the halt in diagnostic procedures and surgical procedures. Moreover, as per many studies, cancer patients are more susceptible to coronavirus than individuals without cancer, as they are in an immunosuppressive state caused by the malignancy and anticancer treatment.

For instance, as per the American Society of Clinical Oncology, chemotherapy treatments and follow-ups were postponed during the COVID-19 pandemic. Even private clinics in major Indian cities reported a nearly 50% decrease in patients for cancer care. Overall cancer services declined by 50% in April and May 2020. As per a study titled 'Impact of nationwide lockdown on cancer care during COVID-19 pandemic: A retrospective analysis from western India' published in 2021, Chemotherapy was the most commonly received treatment (before lockdown 71.8% and during lockdown 45.9%).

Chemotherapy is used with surgery or radiation therapy, or both. In some cases, it is used in combination with other drugs, such as hormone therapy, targeted therapy, or immunotherapy. For example, chemo may be used to shrink a tumor before surgery or radiation therapy. Chemo used in this way is called neoadjuvant therapy or after surgery or radiation therapy to help kill any remaining cancer cells in the body. Chemo used in this way is called adjuvant therapy.

There are several types of chemotherapies given to T-cell lymphoma patients, including alkylating agents, plant alkaloids, antitumor antibiotics, antimetabolites, topoisomerase inhibitors, and miscellaneous antineoplastics.

Favorable reimbursement policies concerning these drugs, making them accessible and affordable, are expected to positively impact the market studied. For instance, Pralatrexate, a chemotherapy drug used to treat patients with relapsed/refractory peripheral T-cell lymphoma (PTCL), is listed under the PBS scheme by the Australian government.

Thus, with the rising awareness about the benefits of chemotherapy and favorable government policies, the market studied is expected to flourish during the forecast period.

The COVID-19 outbreak impacted the cancer T-cell lymphoma market, as hospitals and healthcare services were significantly reduced due to social distancing measures enforced in the North American region. Some biopharmaceutical companies, such as Merck & Co. Inc. and Eli Lilly and Company, announced clinical trial delays. For instance, the data from ClinicalTrials.gov showed that more than 200 interventional oncology studies were suspended in March and April 2020 as a result of the COVID-19 crisis. In addition, 60% of institutions in the United States are enrolling new patients at a lower rate.

According to the Globocan 2020 report, Canada had 8,506 cases of Non-Hodgkin lymphoma and 313 deaths caused due to it in 2020. This is expected to increase T-cell lymphoma incidence in the country. The increase in cases of Non-Hodgkin lymphoma is expected to boost the demand for treatment options, which is going to positively aid market development, as T-cell lymphomas are a type of Non-Hodgkin lymphoma.

Some of the major companies that operate in the oncology segment in the North American region are adopting several strategies, such as collaboration and acquisition, to strengthen their positions in the T-cell lymphoma market. For instance, in August 2020, BostonGene Corporation announced the collaboration with The Weinstock Laboratory, which is at Dana-Farber Cancer Institute Inc. The collaboration is focused on defining predictors of response to PI3 kinase inhibition in relapsed/refractory T-cell lymphomas. In addition, other companies, such as Amgen and Merck, have been working on developing cancer therapies for T-cell lymphomas. Hence the aforementioned factors are expected to fuel market growth in this region.

This product will be delivered within 2 business days.

Due to the high transmission rate of COVID-19 and lack of treatment, many countries suffered, and they continue to bear a significant burden on their economies and healthcare systems. The COVID-19 outbreak may put patients with cutaneous lymphomas at additional risk of not receiving the necessary diagnostic procedures and treatment because they cannot access hospitals easily or due to healthcare resources limitations. Several guidelines for managing cutaneous lymphoma have been recently published to help dermatologists choose the right approach in the COVID-19 pandemic. However, these guidelines happen to be not applicable in countries that are still under a lockdown or do not have enough resources to implement the plan.

Moreover, the outbreak of COVID-19 impacted the cancer T-cell lymphoma market, as hospitals and healthcare services were significantly reduced due to social distancing measures enforced globally. The COVID-19 pandemic also affected the global economy and showed a huge impact on the general hospital care functioning for non-COVID-19 patients in hospitals across the world.

The growth of the T-cell lymphoma market is attributed to the rise in lymphoma cancer incidence due to radiations, an increase in the number of T-cell lymphoma-specific therapies, and the risk of lymphoma due to autoimmune disorders.

According to Leukemia & Lymphoma Society 2021, 186,400 people in the United States were diagnosed with leukemia and lymphoma in 2021. In addition, 825,651 people lived with lymphoma in the United States, 152,671 people lived with Hodgkin lymphoma, and 672,980 people lived with non-Hodgkin lymphoma. T-cell lymphoma is significantly contributing to non-Hodgkin lymphoma, which further boosts the overall market growth.

In addition, the growing uptake of premium-priced products such as Keytruda, Opdivo, and immune checkpoint inhibitors and the launch of several novel therapies with label extension of commercialized products are also boosting the overall market growth. However, the high cost associated with T-cell lymphoma treatment and the adverse side effects of therapies have been obstructing the overall market growth.

T-Cell Lymphoma Market Trends

Chemotherapy is Expected to Hold Significant Market Share over the Forecast Period

Chemotherapy is a type of drug treatment often used to treat lymphoma. It works by stopping and slowing down the growth of cancer cells. Surgery and radiation therapy works by removing, killing, or damaging the cancer cells in a particular area, but chemotherapy works throughout the whole body. This means that chemotherapy can destroy and damage cancer cells that have spread to other parts of the body away from the original tumor.According to the European Society for Medical Oncology, the COVID-pandemic had generated a huge backlog in oncology care and research. In addition, cancer care was hit by the COVID-19 pandemic due to the halt in diagnostic procedures and surgical procedures. Moreover, as per many studies, cancer patients are more susceptible to coronavirus than individuals without cancer, as they are in an immunosuppressive state caused by the malignancy and anticancer treatment.

For instance, as per the American Society of Clinical Oncology, chemotherapy treatments and follow-ups were postponed during the COVID-19 pandemic. Even private clinics in major Indian cities reported a nearly 50% decrease in patients for cancer care. Overall cancer services declined by 50% in April and May 2020. As per a study titled 'Impact of nationwide lockdown on cancer care during COVID-19 pandemic: A retrospective analysis from western India' published in 2021, Chemotherapy was the most commonly received treatment (before lockdown 71.8% and during lockdown 45.9%).

Chemotherapy is used with surgery or radiation therapy, or both. In some cases, it is used in combination with other drugs, such as hormone therapy, targeted therapy, or immunotherapy. For example, chemo may be used to shrink a tumor before surgery or radiation therapy. Chemo used in this way is called neoadjuvant therapy or after surgery or radiation therapy to help kill any remaining cancer cells in the body. Chemo used in this way is called adjuvant therapy.

There are several types of chemotherapies given to T-cell lymphoma patients, including alkylating agents, plant alkaloids, antitumor antibiotics, antimetabolites, topoisomerase inhibitors, and miscellaneous antineoplastics.

Favorable reimbursement policies concerning these drugs, making them accessible and affordable, are expected to positively impact the market studied. For instance, Pralatrexate, a chemotherapy drug used to treat patients with relapsed/refractory peripheral T-cell lymphoma (PTCL), is listed under the PBS scheme by the Australian government.

Thus, with the rising awareness about the benefits of chemotherapy and favorable government policies, the market studied is expected to flourish during the forecast period.

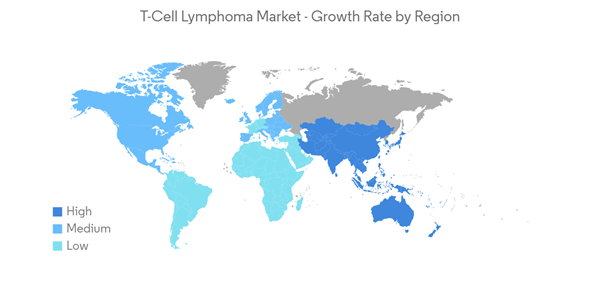

North America Dominates the Market, and it is Expected to do the Same over the Forecast Period

Some of the factors driving market growth in the North American region include the high prevalence of T-cell lymphoma, the presence of key market players, and increasing research and development activities.The COVID-19 outbreak impacted the cancer T-cell lymphoma market, as hospitals and healthcare services were significantly reduced due to social distancing measures enforced in the North American region. Some biopharmaceutical companies, such as Merck & Co. Inc. and Eli Lilly and Company, announced clinical trial delays. For instance, the data from ClinicalTrials.gov showed that more than 200 interventional oncology studies were suspended in March and April 2020 as a result of the COVID-19 crisis. In addition, 60% of institutions in the United States are enrolling new patients at a lower rate.

According to the Globocan 2020 report, Canada had 8,506 cases of Non-Hodgkin lymphoma and 313 deaths caused due to it in 2020. This is expected to increase T-cell lymphoma incidence in the country. The increase in cases of Non-Hodgkin lymphoma is expected to boost the demand for treatment options, which is going to positively aid market development, as T-cell lymphomas are a type of Non-Hodgkin lymphoma.

Some of the major companies that operate in the oncology segment in the North American region are adopting several strategies, such as collaboration and acquisition, to strengthen their positions in the T-cell lymphoma market. For instance, in August 2020, BostonGene Corporation announced the collaboration with The Weinstock Laboratory, which is at Dana-Farber Cancer Institute Inc. The collaboration is focused on defining predictors of response to PI3 kinase inhibition in relapsed/refractory T-cell lymphomas. In addition, other companies, such as Amgen and Merck, have been working on developing cancer therapies for T-cell lymphomas. Hence the aforementioned factors are expected to fuel market growth in this region.

T-Cell Lymphoma Industry Overview

The T-cell lymphoma market is highly competitive and consists of a few major players. Companies like Johnson & Johnson (Janssen Pharmaceuticals Inc.), Novartis AG, Bristol Myers Squibb Company, Merck & Co. Inc., and F. Hoffmann-La Roche Ltd hold a substantial share in the market.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET DYNAMICS

5 MARKET SEGMENTATION (Market Size by Value - USD million)

6 COMPETITIVE LANDSCAPE

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Mundipharma International

- Bristol-Myers Squibb Company

- Genmab AS

- Johnson & Johnson (Janssen Pharmaceuticals Inc.)

- Merck & Co. Inc.

- F. Hoffmann-La Roche Ltd

- Novartis AG

- Autolus Therapeutics PLC

- Acrotech Biopharma

- Macopharma

Methodology

LOADING...