The proton pump inhibitors market is poised to grow at a CAGR of 4.5% during the forecast period of the study.

Many researchers have found that proton pump inhibitors have increased the risk of COVID-19 in patients taking these medications. An article published by PubMed Central in February 2022, reported that proton pump inhibitors (PPI) use was marginally associated with a nominal but statistically significant increase in the risk of COVID-19 infection, and PPI use also increased the risk of poor outcomes in patients with COVID-19. This factor affected the market growth as patients undergoing proton-pump inhibitor therapy was advised to consume fewer medications and avoid these medications unless it is an emergency. Thus, COVID-19 has a significant impact on the growth of the studied market. However, currently, as the pandemic subsided and fewer people are getting infected with the virus, the studied market is expected to have favorable growth during the forecast period of the study.

Proton pump inhibitors are the gold standard medication for gastroesophageal reflux disease (GERD), and the increasing prevalence of GERD and the rising acceptance of novel drug delivery systems are the two most prominent factors driving the growth of the market.

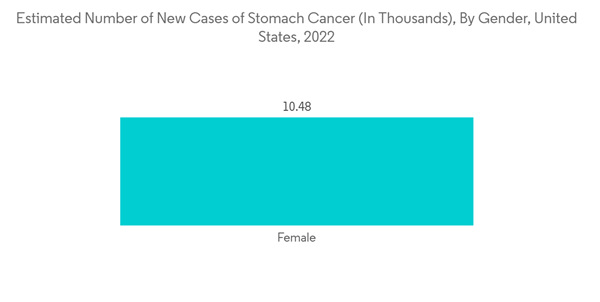

Additionally, the risk factors, such as aging, obesity, delayed stomach emptying, changing lifestyles associated with smoking, and consumption of alcohol, coffee, fatty, and fried foods are the major reasons for the occurrence of GERD. Furthermore, according to the data published by WHO in October 2022, it is estimated that by 2030 1 in 6 people in the world will be aged 60 years or over, and by 2050, the world’s population of people aged 60 years and older will double to 2.1 billion. With the increasing geriatric population, the usage of proton pump inhibitors is expected to increase as aging is a major risk factor for GERD. Hence, this factor is expected to enhance the market growth.

Furthermore, players in this market are developing novel products and coming up with new product launches to leverage market opportunities. For instance, in March 2021, Xiromed LLC, the New Jersey-based generic division of Insud Pharmaceuticals, launched Omeprazole Delayed-Release Capsules, 20mg, generic for Prilose. Such a launch of drugs is propelling the growth of the market.

Thus, the increasing prevalence of GERD, along with the growing risk factors are likely to increase the demand for proton pump inhibitors, which is expected to drive the market’s growth. Also, the increasing shift from prescription to OTC drugs is driving the growth of the proton pump inhibitor market. However, the increasing use of generic products in the market and the side effects associated with the drugs may hamper the market growth.

In addition, major market players are focused on research and development and market expansion activities to bring new and reliable formulations to the market. For instance, in August 2021, the Subject Matter Expert Committee (SEC) functioning under CDSCO recommended Sun Pharma conduct a phase 3 clinical trial of esomeprazole dual-release gastro-resistant tablets 80mg vs esomeprazole gastro-resistant tablets 40mg bids for the proposed indication.

Additionally, the strategic initiatives taken by the market players are propelling the growth of the segment. For instance, in March 2021, Daiichi Sankyo Co., Ltd. transferred the marketing and distribution rights for the proton pump inhibitor Nexium capsules 10 mg and 20 mg and Nexium granules for suspension 10 mg and 20 mg (esomeprazole magnesium) to AstraZeneca in Japan.

Thus, owing to all the above-mentioned factors, the Esomeprazole segment is expected to achieve high growth rates.

In the United States, proton pump inhibitors are one of the most widely prescribed drugs, and increased PPI use has been observed in United States ambulatory settings for the last few years. Furthermore, many firms are spending heavily on promoting their brands. The widespread use of PPIs has also gained the attention of the American Board of Internal Medicine; as a result, the board conducted a campaign to promote the appropriate use of PPIs.

Moreover, product launches in generic categories are also expected to impact the market. For instance, in February 2021, Dr. Reddy’s Laboratories Ltd. launched lansoprazole DR, orally disintegrating tablets, a therapeutic equivalent generic version of Prevacid soluTab delayed-release orally disintegrating tablets, 15 mg and 30 mg, approved by the United States Food and Drug Administration (USFDA). Such generic drug launches are also propelling the growth of the market.

Thus, owing to the abovementioned factors, the proton pump inhibitor market in the North American region is expected to project growth over the forecast period.

This product will be delivered within 2 business days.

Many researchers have found that proton pump inhibitors have increased the risk of COVID-19 in patients taking these medications. An article published by PubMed Central in February 2022, reported that proton pump inhibitors (PPI) use was marginally associated with a nominal but statistically significant increase in the risk of COVID-19 infection, and PPI use also increased the risk of poor outcomes in patients with COVID-19. This factor affected the market growth as patients undergoing proton-pump inhibitor therapy was advised to consume fewer medications and avoid these medications unless it is an emergency. Thus, COVID-19 has a significant impact on the growth of the studied market. However, currently, as the pandemic subsided and fewer people are getting infected with the virus, the studied market is expected to have favorable growth during the forecast period of the study.

Proton pump inhibitors are the gold standard medication for gastroesophageal reflux disease (GERD), and the increasing prevalence of GERD and the rising acceptance of novel drug delivery systems are the two most prominent factors driving the growth of the market.

Additionally, the risk factors, such as aging, obesity, delayed stomach emptying, changing lifestyles associated with smoking, and consumption of alcohol, coffee, fatty, and fried foods are the major reasons for the occurrence of GERD. Furthermore, according to the data published by WHO in October 2022, it is estimated that by 2030 1 in 6 people in the world will be aged 60 years or over, and by 2050, the world’s population of people aged 60 years and older will double to 2.1 billion. With the increasing geriatric population, the usage of proton pump inhibitors is expected to increase as aging is a major risk factor for GERD. Hence, this factor is expected to enhance the market growth.

Furthermore, players in this market are developing novel products and coming up with new product launches to leverage market opportunities. For instance, in March 2021, Xiromed LLC, the New Jersey-based generic division of Insud Pharmaceuticals, launched Omeprazole Delayed-Release Capsules, 20mg, generic for Prilose. Such a launch of drugs is propelling the growth of the market.

Thus, the increasing prevalence of GERD, along with the growing risk factors are likely to increase the demand for proton pump inhibitors, which is expected to drive the market’s growth. Also, the increasing shift from prescription to OTC drugs is driving the growth of the proton pump inhibitor market. However, the increasing use of generic products in the market and the side effects associated with the drugs may hamper the market growth.

Proton Pump Inhibitors Market Trends

The Esomeprazole Segment is Expected to Account for a Significant Share Over the Forecast Period

Esomeprazole is expected to have a significant share of the revenue as it is mostly indicated to treat the symptoms of GERD, heartburn, and other disorders involving excessive stomach acids. The shift from being a prescription-only drug to being sold as an over-the-counter (OTC) drug is likely to be a major driving force for the sales of the drug shortly.In addition, major market players are focused on research and development and market expansion activities to bring new and reliable formulations to the market. For instance, in August 2021, the Subject Matter Expert Committee (SEC) functioning under CDSCO recommended Sun Pharma conduct a phase 3 clinical trial of esomeprazole dual-release gastro-resistant tablets 80mg vs esomeprazole gastro-resistant tablets 40mg bids for the proposed indication.

Additionally, the strategic initiatives taken by the market players are propelling the growth of the segment. For instance, in March 2021, Daiichi Sankyo Co., Ltd. transferred the marketing and distribution rights for the proton pump inhibitor Nexium capsules 10 mg and 20 mg and Nexium granules for suspension 10 mg and 20 mg (esomeprazole magnesium) to AstraZeneca in Japan.

Thus, owing to all the above-mentioned factors, the Esomeprazole segment is expected to achieve high growth rates.

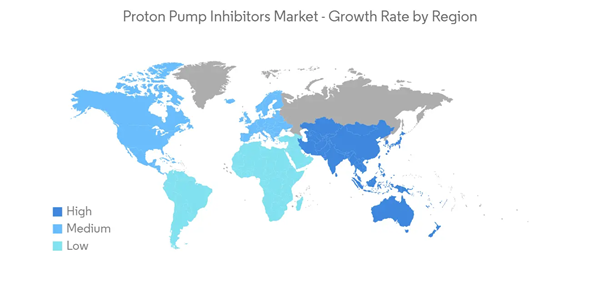

North America is Expected to Account for A Significant Share of the Market

North America currently dominates the proton pump inhibitors market and is anticipated to show a similar trend over the forecast period without significant fluctuations. There is a rising burden of GERD in the United States, Canada, and Mexico due to people’s shift toward unhealthy lifestyles. According to an article published by the journal of annals of esophagus in March 2022, it is estimated that 40% of the United States population experience GERD symptoms, and 10-20% of people are being affected on a weekly basis.In the United States, proton pump inhibitors are one of the most widely prescribed drugs, and increased PPI use has been observed in United States ambulatory settings for the last few years. Furthermore, many firms are spending heavily on promoting their brands. The widespread use of PPIs has also gained the attention of the American Board of Internal Medicine; as a result, the board conducted a campaign to promote the appropriate use of PPIs.

Moreover, product launches in generic categories are also expected to impact the market. For instance, in February 2021, Dr. Reddy’s Laboratories Ltd. launched lansoprazole DR, orally disintegrating tablets, a therapeutic equivalent generic version of Prevacid soluTab delayed-release orally disintegrating tablets, 15 mg and 30 mg, approved by the United States Food and Drug Administration (USFDA). Such generic drug launches are also propelling the growth of the market.

Thus, owing to the abovementioned factors, the proton pump inhibitor market in the North American region is expected to project growth over the forecast period.

Proton Pump Inhibitors Market Competitor Analysis

The proton pump inhibitors market is moderately fragmented, owing to the presence of various players in the market. The market players are focusing on acquiring market shares by focusing on aggressive advertisements and awareness programs among patients. The major key players in the market include AstraZeneca, Bayer AG, Cadila Pharmaceuticals, GlaxoSmithKline PLC, and Pfizer, among others.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET DYNAMICS

5 MARKET SEGMENTATION

6 COMPETITIVE LANDSCAPE

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AstraZeneca

- Bayer AG

- Cadila Pharmaceuticals

- Eisai Inc.

- GlaxoSmithKline PLC

- Pfizer Inc.

- Takeda Pharmaceuticals

- Sanofi SA

- Perrigo Company PLC

- Dr. Reddy's Laboratories

- Redhill Pharma Limited

- Cipla Limited

Methodology

LOADING...