The Soybean Meal Market size is estimated at USD 106.91 billion in 2024, and is expected to reach USD 133.24 billion by 2029, growing at a CAGR of 4.5% during the forecast period (2024-2029).

The COVID-19 pandemic positively impacted the market due to the increased usage of soybean meal in the food and beverage industry and in the manufacturing of healthcare products. However, the decline in the meat demand around the world and the closure of animal feed manufacturing units have slightly hindered the demand for soybean meal from the feed industry.

An increase in demand for high-quality protein in soybean will continue to drive higher demand for soybean meal, mainly from the animal feed industry, over the forecast period. There is an increase in the global requirement for biodiesel as a major alternative to petrol and diesel. Biodiesel is produced using soybean; therefore, this may fuel the growth of the soybean meal market during the forecast period.

The global need for soybean meal has been increasing rapidly in recent years. An increasing number of farm animals and pet animals in the region of North America and Asia-Pacific is prompting the higher consumption and production of soybean meal products. This is boosting the opportunities for soybean meal manufacturers and the overall market.

The main reasons behind the increasing demand for protein-enriched foods are its health benefits and the number of livestock, cattle, ruminants, and other animals that are fed soybean meal. The other reason for the increase in demand is the restrictions placed on slaughterhouse byproducts, which in turn, has increased the market for soybean meal.

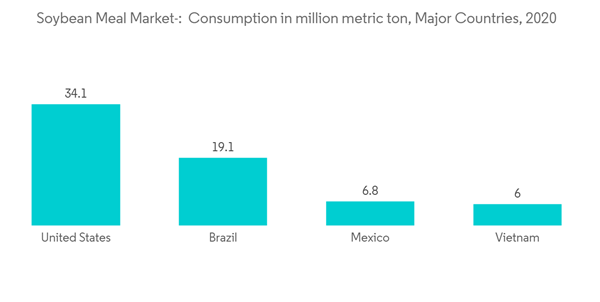

China was the largest soybean meal-producing country, with a capacity of 78.4 million metric ton, followed by the United States with 46.9 million metric ton, in 2020. The major importers of soybean meal are Vietnam, Belgium, Spain, and other countries. The major exporters are the United States, Italy, India, and other countries. Owing to the large numbers of swine, poultry, and aquaculture in these countries, they demand quality protein ingredients to formulate feeds, which supports the commercial production of meat, milk, and eggs.

Higher feed production is expected for the remainder of the calendar year 2021 and into 2022 as changes in the livestock and poultry industry drive moderate growth of soybean meal (SBM) use. As China imports large quantities of beans to crush at home to meet its increasing demand for protein meal, in the near future, it is set to become the world's largest producer of soybean meal. Argentina is the biggest soybean meal exporter, followed by Brazil, the United States, and India.

This product will be delivered within 2 business days.

The COVID-19 pandemic positively impacted the market due to the increased usage of soybean meal in the food and beverage industry and in the manufacturing of healthcare products. However, the decline in the meat demand around the world and the closure of animal feed manufacturing units have slightly hindered the demand for soybean meal from the feed industry.

An increase in demand for high-quality protein in soybean will continue to drive higher demand for soybean meal, mainly from the animal feed industry, over the forecast period. There is an increase in the global requirement for biodiesel as a major alternative to petrol and diesel. Biodiesel is produced using soybean; therefore, this may fuel the growth of the soybean meal market during the forecast period.

The global need for soybean meal has been increasing rapidly in recent years. An increasing number of farm animals and pet animals in the region of North America and Asia-Pacific is prompting the higher consumption and production of soybean meal products. This is boosting the opportunities for soybean meal manufacturers and the overall market.

Soybean Meal Market Trends

Increasing Demand for Protein-enriched Food for Humans and Animals

Soybean meal has a unique composition of amino acids and can be used as an alternative to cereal proteins. Soybean meal is used in both animal feed and human food industries. The main reasons behind the increasing demand for soybean meal include the health benefits associated with this protein-enriched food and the increasing population of livestock, cattle, ruminants, and other animals that are fed soybean meal. The other reason for the increase in demand is the restrictions placed on slaughterhouse byproducts, which in turn, has increased the market for soybean meal. This is further expected to enhance the market for soybean meals during the forecast period.The main reasons behind the increasing demand for protein-enriched foods are its health benefits and the number of livestock, cattle, ruminants, and other animals that are fed soybean meal. The other reason for the increase in demand is the restrictions placed on slaughterhouse byproducts, which in turn, has increased the market for soybean meal.

China was the largest soybean meal-producing country, with a capacity of 78.4 million metric ton, followed by the United States with 46.9 million metric ton, in 2020. The major importers of soybean meal are Vietnam, Belgium, Spain, and other countries. The major exporters are the United States, Italy, India, and other countries. Owing to the large numbers of swine, poultry, and aquaculture in these countries, they demand quality protein ingredients to formulate feeds, which supports the commercial production of meat, milk, and eggs.

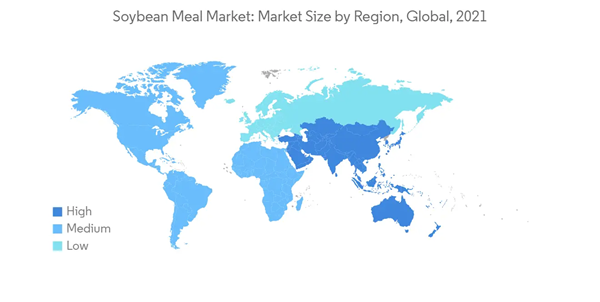

Asia-Pacific Dominates the Market

Asia-Pacific is the dominant region in the soybean meal market, holding the major share of the market. China, India, Bangladesh, Thailand, Pakistan, and Japan are the major producers of soybean meal in the region. According to the USDA, soybean meal production increased from 69.69 million metric ton and 7.2 million metric ton in 2016-2017 to 78.41 million metric ton and 7.6 million metric ton in 2020-2021 in China and India, respectively. Soybean meal is majorly consumed by the animal feed industry in the region. Soybean meal is widely used in the larger varieties of products like bakery products, health food, cosmetics, and in the manufacturing of antibiotics.Higher feed production is expected for the remainder of the calendar year 2021 and into 2022 as changes in the livestock and poultry industry drive moderate growth of soybean meal (SBM) use. As China imports large quantities of beans to crush at home to meet its increasing demand for protein meal, in the near future, it is set to become the world's largest producer of soybean meal. Argentina is the biggest soybean meal exporter, followed by Brazil, the United States, and India.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET DYNAMICS

5 MARKET SEGMENTATION

Methodology

LOADING...