Increasing Collaborations and Partnerships Among Key Players Drives Opportunities

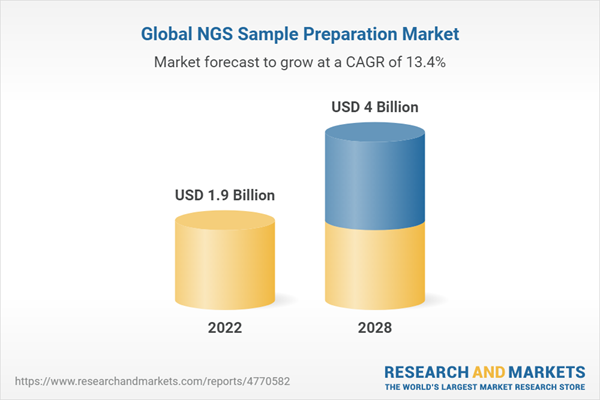

The global NGS sample preparation market is projected to reach USD 4 billion by 2028 from USD 1.9 billion in 2022, at a CAGR of 13.4% during the forecast period. The key factors driving the growth of the NGS sample preparation market are constant innovations in NGS platforms, and increased availability of advanced NGS systems at low costs. However, the presence of alternative technologies is expected to restrain market growth to a certain extent. The NGS sample preparation market has been segmented based on products & services, workflow, sample type, method, application, end-user, and region.

By application, the disease diagnostics accounted for the largest share of the NGS sample preparation market

Based on application, the NGS sample preparation market is categorized into disease diagnostics, drug discovery, agricultural & animal research, and others. The disease diagnostics segment dominated the market in 2022, owing to favorable reimbursement scenario for NGS-based tests and increasing focus of key players on developing NGS-based products & services for cancer and NIPT are the key factors driving the growth of the segment.

By end-user, the academic institutes & research centers accounted for the largest share

Based on end-user, the NGS sample preparation market is segmented into hospitals & clinics, academic institutes & research centers, pharmaceutical & biotechnology companies, and other end-users. In 2022, the academic institutes & research centers segment accounted for a larger share of the NGS sample preparation market. Growth in this market segment can be attributed to availability of financial support for genomics R&D across regions, and the development of cost-effective NGS products & services for researchers.

North America: the largest share of the NGS sample preparation market

North America accounted for the largest share of the NGS sample preparation market. Favorable initiatives by government and private bodies for the adoption of NGS technologies, advancements in NGS sample preparation products, the growing prevalence of target diseases, an increasing number of NGS-based research & clinical applications, growing research on cancer, the rising awareness of NGS services, and the presence of leading NGS service providers, such as Illumina (US), Thermo Fisher Scientific (US), and Agilent Technologies (US), are driving the growth of the NGS sample preparation market in North America.

Asia-Pacific: The fastest-growing region in the NGS sample preparation market

The Asia-Pacific NGS sample preparation market is projected to grow at the highest CAGR during the forecast period, mainly due to significant focus on R&D activities as a means of broadening the scope of NGS applications, the increasing adoption of NGS for diagnostics due to the decreasing cost of NGS products and services, and technological development in NGS data analysis. In addition, a number of domestic and international market players focus on strengthening their presence in the Asia-Pacific NGS market, while domestic players expand their international reach through partnerships, collaborations, agreements, and expansions.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply Side - 60% and Demand Side 40%

- By Designation: Executives - 40%, Research Scientists - 30%, and Managers - 30%

- By Country: North America - 22%, Europe - 42%, Asia-Pacific - 11%, Latin America - 20%, and MEA - 5%

Prominent Players

- Illumina, Inc. (US)

- Thermo Fisher Scientific Inc. (US)

- PerkinElmer Inc. (US)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Agilent Technologies, Inc. (US)

- Danaher (US)

- Becton, Dickinson and Company (US)

- Merck KGAA (Germany)

- QIAGEN (Germany)

- Bio-Rad Laboratories, Inc. (US)

- Promega Corporation (US)

- Eurofins Scientific (Luxembourg)

- BGI (China)

- 10x Genomics (US)

- Sysmex Corporation (US)

- Psomagen (US)

- Zymo Research Corporation (US)

- Takara Bio Inc. (Japan)

- Novogene Co. Ltd. (China)

- New England Biolabs (US)

- Tecan Trading AG (US)

- Oxford Nanopore Technologies PLC (UK)

- PacBio (US)

- Medgenome (US)

- Swift Biosciences Inc. (US)

Research Coverage

This report provides a detailed picture of the NGS sample preparation market. It aims at estimating the size and future growth potential of the market across different segments, such as the product & services, workflow, sample type, method, applications, end-user, and region. The report also includes an in-depth competitive analysis of the key market players, along with their company profiles, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report will help market leaders/new entrants by providing them with the closest approximations of the revenue numbers for the overall NGS sample preparation market and its segments. It will also help stakeholders better understand the competitive landscape and gain more insights to better position their business and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, trends, opportunities, and challenges.

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Study Scope

1.4 Years Considered

1.5 Currency Considered

1.6 Research Limitations

1.7 Stakeholders

2 Research Methodology

2.1 Research Data

Figure 1 Research Design

2.1.1 Secondary Data

2.1.2 Primary Data

Figure 2 Breakdown of Primaries

2.2 Market Estimation Methodology

Figure 3 Market Size Estimation: Approach 1 (Company Revenue Analysis), 2021

Figure 4 Market Size (USD Million)

Figure 5 Market: Final CAGR Projections (2023−2028)

Figure 6 Market: CAGR Projections from Analysis of Drivers, Restraints, Opportunities, and Challenges

2.3 Market Data Estimation and Triangulation

Figure 7 Data Triangulation Methodology

2.4 Industry Insights

2.5 Study Assumptions

2.6 Global Recession Impact: Market

Table 1 Global Inflation Rate Projections, 2021-2027 (% Growth)

Table 2 US Health Expenditure, 2019-2022 (USD Million)

Table 3 US Health Expenditure, 2023-2027 (USD Million)

3 Executive Summary

Figure 8 NGS Sample Preparation Market, by Product & Service, 2022 vs. 2028 (USD Million)

Figure 9 Market, by Workflow, 2022 vs. 2028 (USD Million)

Figure 10 Market, by Sample Type, 2022 vs. 2028 (USD Million)

Figure 11 Market, by Method, 2022 vs. 2028 (USD Million)

Figure 12 Market, by Application, 2022 vs. 2028 (USD Million)

Figure 13 Market, by End-user, 2022 vs. 2028 (USD Million)

Figure 14 Geographical Snapshot of Market

4 Premium Insights

4.1 Market Overview

Figure 15 Advancements in NGS Platforms to Drive Growth

4.2 North America: Market, by Product & Service and Country (2022)

Figure 16 Reagents & Consumables Accounted for Largest Market Share in 2022

4.3 Market, by Application, 2022 vs. 2028

Figure 17 Disease Diagnostics Segment to Dominate Market in 2028

4.4 Market: Geographic Growth Opportunities

Figure 18 China to Register Highest Growth During Forecast Period

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 19 NGS Sample Preparation Market: Drivers, Restraints, Opportunities, and Challenges

Table 4 Market: Impact Analysis

5.2.1 Drivers

5.2.1.1 Constant Innovations in NGS Platforms

5.2.1.2 Increased Availability of Advanced NGS Systems at Low Costs

Figure 20 Cost Per Human Genome, 2001-2021

5.2.1.3 Use of NGS as Substitute for PCR

5.2.1.4 Greater Efficiency of Genotyping and Preparation Protocols

5.2.2 Restraints

5.2.2.1 Presence of Alternative Technologies

5.2.2.2 Limited Expertise and Sequencing Capabilities of Individual Laboratories

5.2.3 Opportunities

5.2.3.1 Increasing Collaborations and Partnerships Among Key Players

5.2.4 Challenges

5.2.4.1 Ethical and Privacy Issues in Health Data

5.3 Technology Analysis

5.4 Trends/Disruptions Impacting Customers’ Businesses

Figure 21 Trends/Disruptions Impacting Customers’ Businesses

5.5 Supply and Value Chain Analysis

5.5.1 Supply Chain Analysis of Market

Figure 22 Market: Supply Chain Analysis

5.5.2 Value Chain Analysis of Market

Figure 23 Market: Value Chain Analysis

5.6 Ecosystem Analysis

Figure 24 Market: Ecosystem Analysis

5.7 Porter's Five Forces Analysis

Table 5 Market: Porter's Five Forces Analysis

5.7.1 Threat of New Entrants

5.7.2 Threat of Substitutes

5.7.3 Bargaining Power of Buyers

5.7.4 Bargaining Power of Suppliers

5.7.5 Intensity of Competitive Rivalry

5.8 Regulatory Analysis

5.8.1 FDA Approvals

5.8.2 Regulatory Bodies, Government Agencies, and Other Organizations

Table 6 North America: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 7 Europe: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 8 Asia-Pacific: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 9 Rest of the World: List of Regulatory Bodies, Government Agencies, and Other Organizations

5.9 Pricing Analysis

Table 10 Average Selling Price of Key Players, by Product

5.9.1 Average Selling Price Trend Analysis

5.10 Patent Analysis

Figure 25 Patent Filing Trends for Top 5 IPC Main Classes, 2018−2020

5.11 Key Conferences and Events in 2023

5.11.1 Conferences on NGS Sample Preparation in 2023

Table 11 Conferences on NGS Sample Preparation (2023)

5.12 Key Stakeholders and Buying Criteria

5.12.1 Key Stakeholders in Buying Process

Figure 26 Influence of Stakeholders on Buying Process in Market

5.12.2 Buying Criteria for Market

Figure 27 Key Buying Criteria for End-users

6 NGS Sample Preparation Market, by Product & Service

6.1 Introduction

Table 12 Market, by Product & Service, 2021-2028 (USD Million)

6.2 Workstations/Instruments

6.2.1 Increasing Demand for Automation of NGS to Propel Market

Table 13 Market for Workstations/Instruments, by Region, 2021-2028 (USD Million)

Table 14 North America: Market for Workstations/Instruments, by Country, 2021-2028 (USD Million)

Table 15 Europe: Market for Workstations/Instruments, by Country, 2021-2028 (USD Million)

Table 16 Asia-Pacific: Market for Workstations/Instruments, by Country, 2021-2028 (USD Million)

Table 17 Latin America: Market for Workstations/Instruments, by Country, 2021-2028 (USD Million)

6.3 Reagents & Consumables

6.3.1 Growing Use of Consumables for NGS Sample Preparation to Drive Market

Table 18 Market for Reagents & Consumables, by Region, 2021-2028 (USD Million)

Table 19 North America: Market for Reagents & Consumables, by Country, 2021-2028 (USD Million)

Table 20 Europe: Market for Reagents & Consumables, by Country, 2021-2028 (USD Million)

Table 21 Asia-Pacific: Market for Reagents & Consumables, by Country, 2021-2028 (USD Million)

Table 22 Latin America: Market for Reagents & Consumables, by Country, 2021-2028 (USD Million)

6.4 Services

6.4.1 Increasing Installation of NGS Platforms to Support Market

Table 23 Market for Services, by Region, 2021-2028 (USD Million)

Table 24 North America: Market for Services, by Country, 2021-2028 (USD Million)

Table 25 Europe: Market for Services, by Country, 2021-2028 (USD Million)

Table 26 Asia-Pacific: Market for Services, by Country, 2021-2028 (USD Million)

Table 27 Latin America: Market for Services, by Country, 2021-2028 (USD Million)

7 NGS Sample Preparation Market, by Workflow

7.1 Introduction

Table 28 Market, by Workflow, 2021-2028 (USD Million)

7.2 DNA Fragmentation & Library Preparation

7.2.1 Availability of Products from Various Players to Drive Market

Table 29 Market for DNA Fragmentation & Library Preparation, by Region, 2021-2028 (USD Million)

Table 30 North America: Market for DNA Fragmentation & Library Preparation, by Country, 2021-2028 (USD Million)

Table 31 Europe: Market for DNA Fragmentation & Library Preparation, by Country, 2021-2028 (USD Million)

Table 32 Asia-Pacific: Market for DNA Fragmentation & Library Preparation, by Country, 2021-2028 (USD Million)

Table 33 Latin America: Market for DNA Fragmentation & Library Preparation, by Country, 2021-2028 (USD Million)

7.3 Target Enrichment

7.3.1 Launch of Advanced Target Enrichment Solutions and Technologies to Drive Market

Table 34 Market for Target Enrichment, by Region, 2021-2028 (USD Million)

Table 35 North America: Market for Target Enrichment, by Country, 2021-2028 (USD Million)

Table 36 Europe: Market for Target Enrichment, by Country, 2021-2028 (USD Million)

Table 37 Asia-Pacific: Market for Target Enrichment, by Country, 2021-2028 (USD Million)

Table 38 Latin America: Market for Target Enrichment, by Country, 2021-2028 (USD Million)

7.4 Quality Control

7.4.1 Rising Number of Research Activities Requiring Quality-Assured Samples to Propel Market

Table 39 Market for Quality Control, by Region, 2021-2028 (USD Million)

Table 40 North America: Market for Quality Control, by Country, 2021-2028 (USD Million)

Table 41 Europe: Market for Quality Control, by Country, 2021-2028 (USD Million)

Table 42 Asia-Pacific: Market for Quality Control, by Country, 2021-2028 (USD Million)

Table 43 Latin America: Market for Quality Control, by Country, 2021-2028 (USD Million)

8 NGS Sample Preparation Market, by Sample Type

8.1 Introduction

Table 44 Market, by Sample Type, 2021-2028 (USD Million)

8.2 DNA

8.2.1 Rising Number of Cancer Cases and Growing R&D Investments for Studying DNA Samples to Drive Market

Table 45 Market for DNA, by Region, 2021-2028 (USD Million)

Table 46 North America: Market for DNA, by Country, 2021-2028 (USD Million)

Table 47 Europe: Market for DNA, by Country, 2021-2028 (USD Million)

Table 48 Asia-Pacific: Market for DNA, by Country, 2021-2028 (USD Million)

Table 49 Latin America: Market for DNA, by Country, 2021-2028 (USD Million)

8.3 RNA

8.3.1 Decreased Costs of Genome Sequencing to Augment Market

Table 50 Market for RNA, by Region, 2021-2028 (USD Million)

Table 51 North America: Market for RNA, by Country, 2021-2028 (USD Million)

Table 52 Europe: Market for RNA, by Country, 2021-2028 (USD Million)

Table 53 Asia-Pacific: Market for RNA, by Country, 2021-2028 (USD Million)

Table 54 Latin America: Market for RNA, by Country, 2021-2028 (USD Million)

9 NGS Sample Preparation Market, by Application

9.1 Introduction

Table 55 Market, by Application, 2021-2028 (USD Million)

9.2 Disease Diagnostics

Table 56 Market for Disease Diagnostics, by Type, 2021-2028 (USD Million)

Table 57 Market for Disease Diagnostics, by Region, 2021-2028 (USD Million)

Table 58 North America: Market for Disease Diagnostics, by Country, 2021-2028 (USD Million)

Table 59 Europe: Market for Disease Diagnostics, by Country, 2021-2028 (USD Million)

Table 60 Asia-Pacific: Market for Disease Diagnostics, by Country, 2021-2028 (USD Million)

Table 61 Latin America: Market for Disease Diagnostics, by Country, 2021-2028 (USD Million)

9.2.1 Cancer Diagnostics

9.2.1.1 Increase in Cancer Patients Globally and Launch of NGS-based Cancer Panels to Drive Market

Table 62 Cancer Diagnostics Market, by Region, 2021-2028 (USD Million)

Table 63 North America: Cancer Diagnostics Market, by Country, 2021-2028 (USD Million)

Table 64 Europe: Cancer Diagnostics Market, by Country, 2021-2028 (USD Million)

Table 65 Asia-Pacific: Cancer Diagnostics Market, by Country, 2021-2028 (USD Million)

Table 66 Latin America: Cancer Diagnostics Market, by Country, 2021-2028 (USD Million)

9.2.2 Reproductive Health Diagnostics

9.2.2.1 Increasing Awareness About Benefits of NIPT and Decreasing Costs of Sequencing to Propel Market

Table 67 Reproductive Health Diagnostics Market, by Region, 2021-2028 (USD Million)

Table 68 North America: Reproductive Health Diagnostics Market, by Country, 2021-2028 (USD Million)

Table 69 Europe: Reproductive Health Diagnostics Market, by Country, 2021-2028 (USD Million)

Table 70 Asia-Pacific: Reproductive Health Diagnostics Market, by Country, 2021-2028 (USD Million)

Table 71 Latin America: Reproductive Health Diagnostics Market, by Country, 2021-2028 (USD Million)

9.2.3 Infectious Disease Diagnostics

9.2.3.1 Growing Burden of Healthcare-Associated Infections to Aid Market

Table 72 Infectious Disease Diagnostics Market, by Region, 2021-2028 (USD Million)

Table 73 North America: Infectious Disease Diagnostics Market, by Country, 2021-2028 (USD Million)

Table 74 Europe: Infectious Disease Diagnostics Market, by Country, 2021-2028 (USD Million)

Table 75 Asia-Pacific: Infectious Disease Diagnostics Market, by Country, 2021-2028 (USD Million)

Table 76 Latin America: Infectious Disease Diagnostics Market, by Country, 2021-2028 (USD Million)

9.2.4 Other Disease Diagnostic Applications

Table 77 Other Disease Diagnostic Applications Market, by Region, 2021-2028 (USD Million)

Table 78 North America: Other Disease Diagnostic Applications Market, by Country, 2021-2028 (USD Million)

Table 79 Europe: Other Disease Diagnostic Applications Market, by Country, 2021-2028 (USD Million)

Table 80 Asia-Pacific: Other Disease Diagnostic Applications Market, by Country, 2021-2028 (USD Million)

Table 81 Latin America: Other Disease Diagnostic Applications Market, by Country, 2021-2028 (USD Million)

9.3 Drug Discovery

9.3.1 Increasing Use of NGS During Clinical Trials to Augment Market

Table 82 Market for Drug Discovery, by Region, 2021-2028 (USD Million)

Table 83 North America: Market for Drug Discovery, by Country, 2021-2028 (USD Million)

Table 84 Europe: Market for Drug Discovery, by Country, 2021-2028 (USD Million)

Table 85 Asia-Pacific: Market for Drug Discovery, by Country, 2021-2028 (USD Million)

Table 86 Latin America: Market for Drug Discovery, by Country, 2021-2028 (USD Million)

9.4 Agricultural & Animal Research

9.4.1 Increased Funding and Support for Animal and Plant Genomics Research to Fuel Adoption

Table 87 Market for Agricultural & Animal Research, by Region, 2021-2028 (USD Million)

Table 88 North America: Market for Agricultural & Animal Research, by Country, 2021-2028 (USD Million)

Table 89 Europe: Market for Agricultural & Animal Research, by Country, 2021-2028 (USD Million)

Table 90 Asia-Pacific: Market for Agricultural & Animal Research, by Country, 2021-2028 (USD Million)

Table 91 Latin America: Market for Agricultural & Animal Research, by Country, 2021-2028 (USD Million)

9.5 Other Applications

Table 92 Market for Other Applications, by Region, 2021-2028 (USD Million)

Table 93 North America: Market for Other Applications, by Country, 2021-2028 (USD Million)

Table 94 Europe: Market for Other Applications, by Country, 2021-2028 (USD Million)

Table 95 Asia-Pacific: Market for Other Applications, by Country, 2021-2028 (USD Million)

Table 96 Latin America: Market for Other Applications, by Country, 2021-2028 (USD Million)

10 NGS Sample Preparation Market, by Method

10.1 Introduction

Table 97 Market, by Method, 2021-2028 (USD Million)

10.2 Manual Sample Preparation

10.2.1 Errors Associated with NGS Manual Sample Preparation to Hinder Market

Table 98 Market for Manual Sample Preparation, by Region, 2021-2028 (USD Million)

Table 99 North America: Market for Manual Sample Preparation, by Country, 2021-2028 (USD Million)

Table 100 Europe: Market for Manual Sample Preparation, by Country, 2021-2028 (USD Million)

Table 101 Asia-Pacific: Market for Manual Sample Preparation, by Country, 2021-2028 (USD Million)

Table 102 Latin America: Market for Manual Sample Preparation, by Country, 2021-2028 (USD Million)

10.3 Microfluidic Sample Preparation

10.3.1 Growing Applications of Microfluidic Sample Preparation to Create Opportunities

Table 103 Market for Microfluidic Sample Preparation, by Region, 2021-2028 (USD Million)

Table 104 North America: Market for Microfluidic Sample Preparation, by Country, 2021-2028 (USD Million)

Table 105 Europe: Market for Microfluidic Sample Preparation, by Country, 2021-2028 (USD Million)

Table 106 Asia-Pacific: Market for Microfluidic Sample Preparation, by Country, 2021-2028 (USD Million)

Table 107 Latin America: Market for Microfluidic Sample Preparation, by Country, 2021-2028 (USD Million)

10.4 Automated Liquid Handling-based Sample Preparation

10.4.1 High Performance and Accuracy of Automated Liquid Handling-based Sample Preparation to Boost Growth

Table 108 Market for Automated Liquid Handling-based Sample Preparation, by Region, 2021-2028 (USD Million)

Table 109 North America: Market for Automated Liquid Handling-based Sample Preparation, by Country, 2021-2028 (USD Million)

Table 110 Europe: Market for Automated Liquid Handling-based Sample Preparation, by Country, 2021-2028 (USD Million)

Table 111 Asia-Pacific: Market for Automated Liquid Handling-based Sample Preparation, by Country, 2021-2028 (USD Million)

Table 112 Latin America: Market for Automated Liquid Handling-based Sample Preparation, by Country, 2021-2028 (USD Million)

11 NGS Sample Preparation Market, by End-user

11.1 Introduction

Table 113 Market, by End-user, 2021-2028 (USD Million)

11.2 Hospitals & Clinics

11.2.1 Advantages of NGS Technology for Disease Diagnosis Over Conventional Method to Fuel Adoption

Table 114 Market for Hospitals & Clinics, by Region, 2021-2028 (USD Million)

Table 115 North America: Market for Hospitals & Clinics, by Country, 2021-2028 (USD Million)

Table 116 Europe: Market for Hospitals & Clinics, by Country, 2021-2028 (USD Million)

Table 117 Asia-Pacific: Market for Hospitals & Clinics, by Country, 2021-2028 (USD Million)

Table 118 Latin America: Market for Hospitals & Clinics, by Country, 2021-2028 (USD Million)

11.3 Academic Institutes & Research Centers

11.3.1 Availability of Financial Support for Genomics Research to Support Segment

Table 119 Market for Academic Institutes & Research Centers, by Region, 2021-2028 (USD Million)

Table 120 North America: Market for Academic Institutes & Research Centers, by Country, 2021-2028 (USD Million)

Table 121 Europe: Market for Academic Institutes & Research Centers, by Country, 2021-2028 (USD Million)

Table 122 Asia-Pacific: Market for Academic Institutes & Research Centers, by Country, 2021-2028 (USD Million)

Table 123 Latin America: Market for Academic Institutes & Research Centers, by Country, 2021-2028 (USD Million)

11.4 Pharmaceutical & Biotechnology Companies

11.4.1 Growing Collaborations Between NGS Market Players and Pharmaceutical & Biotechnology Companies to Drive Growth

Table 124 Market for Pharmaceutical & Biotechnology Companies, by Region, 2021-2028 (USD Million)

Table 125 North America: Market for Pharmaceutical & Biotechnology Companies, by Country, 2021-2028 (USD Million)

Table 126 Europe: Market for Pharmaceutical & Biotechnology Companies, by Country, 2021-2028 (USD Million)

Table 127 Asia-Pacific: Market for Pharmaceutical & Biotechnology Companies, by Country, 2021-2028 (USD Million)

Table 128 Latin America: Market for Pharmaceutical & Biotechnology Companies, by Country, 2021-2028 (USD Million)

11.5 Other End-users

Table 129 Market for Other End-users, by Region, 2021-2028 (USD Million)

Table 130 North America: Market for Other End-users, by Country, 2021-2028 (USD Million)

Table 131 Europe: Market for Other End-users, by Country, 2021-2028 (USD Million)

Table 132 Asia-Pacific: Market for Other End-users, by Country, 2021-2028 (USD Million)

Table 133 Latin America: Market for Other End-users, by Country, 2021-2028 (USD Million)

12 NGS Sample Preparation Market, by Region

12.1 Introduction

Figure 28 Market, by Region, 2021 vs. 2028 (USD Million)

Table 134 Market, by Region, 2021-2028 (USD Million)

12.2 North America

Figure 29 North America: NGS Sample Preparation Market Snapshot

Table 135 North America: Market, by Country, 2021-2028 (USD Million)

Table 136 North America: Market, by Product & Service, 2021-2028 (USD Million)

Table 137 North America: Market, by Workflow, 2021-2028 (USD Million)

Table 138 North America: Market, by Sample Type, 2021-2028

Table 139 North America: Market, by Method, 2021-2028

Table 140 North America: Market, by Application, 2021-2028

Table 141 North America: Market for Disease Diagnostics, by Type, 2021-2028

Table 142 North America: Market, by End-user, 2021-2028

12.2.1 US

12.2.1.1 Favorable Regulatory and Reimbursement Scenarios to Drive Market

Table 143 US: NGS Sample Preparation Market, by Product & Service, 2021-2028 (USD Million)

Table 144 US: Market, by Workflow, 2021-2028 (USD Million)

Table 145 US: Market, by Sample Type, 2021-2028 (USD Million)

Table 146 US: Market, by Method, 2021-2028 (USD Million)

Table 147 US: Market, by Application, 2021-2028 (USD Million)

Table 148 US: Market for Disease Diagnostics, by Type, 2021-2028 (USD Million)

Table 149 US: Market by End-user, 2021-2028 (USD Million)

12.2.2 Canada

12.2.2.1 Favorable Government Funding to Boost Genomics Research

Table 150 Canada: NGS Sample Preparation Market, by Product & Service, 2021-2028 (USD Million)

Table 151 Canada: Market, by Workflow, 2021-2028 (USD Million)

Table 152 Canada: Market, by Sample Type, 2021-2028 (USD Million)

Table 153 Canada: Market, by Method, 2021-2028 (USD Million)

Table 154 Canada: Market, by Application, 2021-2028 (USD Million)

Table 155 Canada: Market for Disease Diagnostics, by Type, 2021-2028 (USD Million)

Table 156 Canada: Market, for End-user, 2021-2028 (USD Million)

12.2.3 North America: Impact of Recession

12.3 Europe

Table 157 Europe: NGS Sample Preparation Market, by Country, 2021-2028 (USD Million)

Table 158 Europe: Market, by Product & Service, 2021-2028 (USD Million)

Table 159 Europe: Market, by Workflow, 2021-2028 (USD Million)

Table 160 Europe: Market, by Sample Type, 2021-2028 (USD Million)

Table 161 Europe: Market, by Method, 2021-2028 (USD Million)

Table 162 Europe: Market, by Application, 2021-2028 (USD Million)

Table 163 Europe: Market for Disease Diagnostics, by Type, 2021-2028 (USD Million)

Table 164 Europe: Market, by End-user, 2021-2028 (USD Million)

12.3.1 Germany

12.3.1.1 Strong R&D Base and Presence of Several NGS Players to Support Market

Table 165 Germany: NGS Sample Preparation Market, by Product & Service, 2021-2028 (USD Million)

Table 166 Germany: Market, by Workflow, 2021-2028 (USD Million)

Table 167 Germany: Market, by Sample Type, 2021-2028 (USD Million)

Table 168 Germany: Market, by Method, 2021-2028 (USD Million)

Table 169 Germany: Market, by Application, 2021-2028 (USD Million)

Table 170 Germany: Market for Disease Diagnostics, by Type, 2021-2028 (USD Million)

Table 171 Germany: Market, by End-user, 2021-2028 (USD Million)

12.3.2 UK

12.3.2.1 Use of NGS-based Tests for Disease Diagnosis to Augment Market

Table 172 UK: NGS Sample Preparation Market, by Product & Service, 2021-2028 (USD Million)

Table 173 UK: Market, by Workflow, 2021-2028 (USD Million)

Table 174 UK Market, by Sample Type, 2021-2028 (USD Million)

Table 175 UK Market, by Method, 2021-2028 (USD Million)

Table 176 UK: Market, by Application, 2021-2028 (USD Million)

Table 177 UK: Market for Disease Diagnostics, by Type, 2021-2028 (USD Million)

Table 178 UK: Market, by End-user, 2021-2028 (USD Million)

12.3.3 France

12.3.3.1 Growing Government Support for Genomics Research to Propel Market

Table 179 France: NGS Sample Preparation Market, by Product & Service, 2021-2028 (USD Million)

Table 180 France: Market, by Workflow, 2021-2028 (USD Million)

Table 181 France: Market, by Sample Type, 2021-2028 (USD Million)

Table 182 France: Market, by Method, 2021-2028 (USD Million)

Table 183 France: Market, by Application, 2021-2028 (USD Million)

Table 184 France: Market by Disease Diagnostics, by Type, 2021-2028 (USD Million)

Table 185 France: Market, by End-user, 2021-2028 (USD Million)

12.3.4 Rest of Europe

Table 186 Rest of Europe NGS Sample Preparation Market, by Product & Service, 2021-2028 (USD Million)

Table 187 Rest of Europe: Market, by Workflow, 2021-2028 (USD Million)

Table 188 Rest of Europe: Market, by Sample Type, 2021-2028 (USD Million)

Table 189 Rest of Europe: Market, by Method, 2021-2028 (USD Million)

Table 190 Rest of Europe: Market, by Application, 2021-2028 (USD Million)

Table 191 Rest of Europe: Market for Disease Diagnostics, by Type, 2021-2028 (USD Million)

Table 192 Rest of Europe: Market, by End-user, 2021-2028 (USD Million)

12.3.5 Europe: Impact of Recession

12.4 Asia-Pacific

Figure 30 Asia-Pacific: NGS Sample Preparation Market Snapshot

Table 193 Asia-Pacific: Market, by Country, 2021-2028 (USD Million)

Table 194 Asia-Pacific: Market, by Product & Service, 2021-2028 (USD Million)

Table 195 Asia-Pacific: Market, by Workflow, 2021-2028 (USD Million)

Table 196 Asia-Pacific: Market, by Sample Type, 2021-2028 (USD Million)

Table 197 Asia-Pacific: Market, by Method, 2021-2028 (USD Million)

Table 198 Asia-Pacific: Market, by Application, 2021-2028 (USD Million)

Table 199 Asia-Pacific: Market for Disease Diagnostics, by Type, 2021-2028 (USD Million)

Table 200 Asia-Pacific: Market, by End-user, 2021-2028 (USD Million)

12.4.1 China

12.4.1.1 Favorable Government Initiatives for Advanced Life Science Research to Aid Market

Table 201 China: NGS Sample Preparation Market, by Product & Service, 2021-2028 (USD Million)

Table 202 China: Market, by Workflow, 2021-2028 (USD Million)

Table 203 China: Market, by Sample Type, 2021-2028 (USD Million)

Table 204 China: Market, by Method, 2021-2028 (USD Million)

Table 205 China: Market, by Application, 2021-2028 (USD Million)

Table 206 China: Market for Disease Diagnostics, by Type, 2021-2028 (USD Million)

Table 207 China: Market, by End-user, 2021-2028 (USD Million)

12.4.2 Japan

12.4.2.1 Increased Research Funding to Create Growth Opportunities for NGS-based Studies

Table 208 Japan: NGS Sample Preparation Market, by Product & Service, 2021-2028 (USD Million)

Table 209 Japan: Market, by Workflow, 2021-2028 (USD Million)

Table 210 Japan: Market, by Sample Type, 2021-2028 (USD Million)

Table 211 Japan: Market, by Method, 2021-2028 (USD Million)

Table 212 Japan: Market, by Application, 2021-2028 (USD Million)

Table 213 Japan: Market for Disease Diagnostics, by Type, 2021-2028 (USD Million)

Table 214 Japan: Market, by End-user, 2021-2028 (USD Million)

12.4.3 India

12.4.3.1 Decreasing Sequencing Costs and Growing Prevalence of Target Diseases to Support Market

Table 215 India: NGS Sample Preparation Market, by Product & Service, 2021-2028 (USD Million)

Table 216 India: Market, by Workflow, 2021-2028 (USD Million)

Table 217 India: Market, by Sample Type, 2021-2028 (USD Million)

Table 218 India: Market, by Method, 2021-2028 (USD Million)

Table 219 India: Market, by Application, 2021-2028 (USD Million)

Table 220 India: Market for Disease Diagnostics, by Type, 2021-2028 (USD Million)

Table 221 India: Market, by End-user, 2021-2028 (USD Million)

12.4.4 Australia

12.4.4.1 Increasing Use of NGS Platforms by Academic Institutes to Propel Market

Table 222 Australia: NGS Sample Preparation Market, by Product & Service, 2021-2028 (USD Million)

Table 223 Australia: Market, by Workflow, 2021-2028 (USD Million)

Table 224 Australia: Market, by Sample Type, 2021-2028 (USD Million)

Table 225 Australia: Market, by Method, 2021-2028 (USD Million)

Table 226 Australia: Market, by Application, 2021-2028 (USD Million)

Table 227 Australia: Market for Disease Diagnostics, by Type, 2021-2028 (USD Million)

Table 228 Australia: Market, by End-user, 2021-2028 (USD Million)

12.4.5 South Korea

12.4.5.1 Increasing Spending by Government on NGS Research to Augment Market

Table 229 South Korea: NGS Sample Preparation Market, by Product & Service, 2021-2028 (USD Million)

Table 230 South Korea: Market, by Workflow, 2021-2028 (USD Million)

Table 231 South Korea: Market, by Sample Type, 2021-2028 (USD Million)

Table 232 South Korea: Market, by Method, 2021-2028 (USD Million)

Table 233 South Korea: Market, by Application, 2021-2028 (USD Million)

Table 234 South Korea: Preparation Market for Disease Diagnostics, by Type, 2021-2028 (USD Million)

Table 235 South Korea: Market, by End-user, 2021-2028 (USD Million)

12.4.6 Rest of Asia-Pacific

Table 236 Rest of Asia-Pacific: NGS Sample Preparation Market, by Product & Service, 2021-2028 (USD Million)

Table 237 Rest of Asia-Pacific: Market, by Workflow, 2021-2028 (USD Million)

Table 238 Rest of Asia-Pacific: Market, by Sample Type, 2021-2028 (USD Million)

Table 239 Rest of Asia-Pacific: Market, by Method, 2021-2028 (USD Million)

Table 240 Rest of Asia-Pacific: Market, by Application, 2021-2028 (USD Million)

Table 241 Rest of Asia-Pacific: Market for Disease Diagnostics, by Type, 2021-2028 (USD Million)

Table 242 Rest of Asia-Pacific: Market, by End-user, 2021-2028 (USD Million)

12.4.7 Asia-Pacific: Impact of Recession

12.5 Latin America

Table 243 Latin America: NGS Sample Preparation Market, by Country, 2021-2028 (USD Million)

Table 244 Latin America: Market, by Product & Service, 2021-2028 (USD Million)

Table 245 Latin America: Market, by Workflow, 2021-2028 (USD Million)

Table 246 Latin America: Market, by Sample Type, 2021-2028 (USD Million)

Table 247 Latin America: Market, by Method, 2021-2028 (USD Million)

Table 248 Latin America: Market, by Application, 2021-2028 (USD Million)

Table 249 Latin America: Market for Disease Diagnostics, by Type, 2021-2028 (USD Million)

Table 250 Latin America: Market, by End-user, 2021-2028 (USD Million)

12.5.1 Brazil

12.5.1.1 Rising Focus on Clinical Genomics to Drive Demand for NGS

Table 251 Brazil: NGS Sample Preparation Market, by Product & Service, 2021-2028 (USD Million)

Table 252 Brazil: Market, by Workflow, 2021-2028 (USD Million)

Table 253 Brazil: Market, by Sample Type, 2021-2028 (USD Million)

Table 254 Brazil: Market, by Method, 2021-2028 (USD Million)

Table 255 Brazil: Market, by Application, 2021-2028 (USD Million)

Table 256 Brazil: Market for Disease Diagnostics, by Type, 2021-2028 (USD Million)

Table 257 Brazil: Market, by End-user, 2021-2028 (USD Million)

12.5.2 Mexico

12.5.2.1 Growing Biotechnology Infrastructure Development to Support Market

Table 258 Mexico: NGS Sample Preparation Market, by Product & Service, 2021-2028 (USD Million)

Table 259 Mexico: Market, by Workflow, 2021-2028 (USD Million)

Table 260 Mexico: Market, by Sample Type, 2021-2028 (USD Million)

Table 261 Mexico: Market, by Method, 2021-2028 (USD Million)

Table 262 Mexico: Market, by Application, 2021-2028 (USD Million)

Table 263 Mexico: Market for Disease Diagnostics, by Type, 2021-2028 (USD Million)

Table 264 Mexico: Market, by End-user, 2021-2028 (USD Million)

12.5.3 Rest of Latin America

Table 265 Rest of Latin America: NGS Sample Preparation Market, by Product & Service, 2021-2028 (USD Million)

Table 266 Rest of Latin America: Market, by Workflow, 2021-2028 (USD Million)

Table 267 Rest of Latin America: Market, by Sample Type, 2021-2028 (USD Million)

Table 268 Rest of Latin America: Market, by Method, 2021-2028 (USD Million)

Table 269 Rest of Latin America: Market, by Application, 2021-2028 (USD Million)

Table 270 Rest of Latin America: Market for Disease Diagnostics, by Type, 2021-2028 (USD Million)

Table 271 Rest of Latin America: Market, by End-user, 2021-2028 (USD Million)

12.5.4 Latin America: Impact of Recession

12.6 Middle East & Africa

12.6.1 Introduction of Cost-Effective and Portable NGS Technologies to Stimulate Market

Table 272 Middle East & Africa: NGS Sample Preparation Market, by Product & Service, 2021-2028 (USD Million)

Table 273 Middle East & Africa: Market, by Workflow, 2021-2028 (USD Million)

Table 274 Middle East & Africa: Market, by Sample Type, 2021-2028 (USD Million)

Table 275 Middle East & Africa: Market, by Method, 2021-2028 (USD Million)

Table 276 Middle East & Africa: Market, by Application, 2021-2028 (USD Million)

Table 277 Middle East & Africa: Market for Disease Diagnostics, by Type, 2021-2028 (USD Million)

Table 278 Middle East & Africa: Market, by End-user, 2021-2028 (USD Million)

13 Competitive Landscape

13.1 Introduction

13.2 Key Strategies Adopted by Market Players

Table 279 NGS Sample Preparation Market: Strategies Adopted by Key Players

13.3 Revenue Share Analysis (Top 5 Players)

Figure 31 Revenue Analysis for Top 5 Companies (2019−2021)

13.4 Market Share Analysis (2022)

Figure 32 Market: Market Share Analysis of Top 5 Players (2022)

13.5 Company Evaluation Quadrant

Figure 33 Market: Company Evaluation Matrix (2022)

13.5.1 Stars

13.5.2 Emerging Leaders

13.5.3 Pervasive Players

13.5.4 Participants

13.6 Company Evaluation Quadrant for Start-Ups/SMEs

13.6.1 Progressive Companies

13.6.2 Starting Blocks

13.6.3 Responsive Companies

13.6.4 Dynamic Companies

Figure 34 Market: Start-Ups/SMEs Evaluation Quadrant (2022)

13.7 Competitive Benchmarking

13.7.1 Detailed List of Start-Ups/SMEs

Table 280 Market: Detailed List of Start-Ups/SMEs

13.7.2 Competitive Benchmarking of Key Players [Start-Ups/SMEs)

Table 281 Market: Competitive Benchmarking of Key Players [Start-Ups/SMEs]

13.8 Competitive Scenario and Trends

13.8.1 Key Deals

Table 282 Market: Key Deals

13.8.2 Key Product Launches

Table 283 Market: Key Product Launches

13.8.3 Key Expansions

Table 284 Market: Key Expansions

14 Company Profiles

14.1 Key Players

(Business Overview, Products Offered, Recent Developments, and Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

14.1.1 Illumina, Inc.

Table 285 Illumina, Inc.: Company Overview

Figure 35 Illumina, Inc.: Company Snapshot (2021)

14.1.2 Thermo Fisher Scientific Inc.

Table 286 Thermo Fisher Scientific Inc.: Company Overview

14.1.3 F. Hoffmann-La Roche Ltd.

Table 287 F. Hoffmann-La Roche Ltd.: Company Overview

14.1.4 PerkinElmer Inc.

Table 288 PerkinElmer Inc.: Company Overview

Figure 38 PerkinElmer Inc.: Company Snapshot (2022)

14.1.5 Agilent Technologies, Inc.

Table 289 Agilent Technologies, Inc.: Company Overview

14.1.6 Danaher

Table 290 Danaher: Company Overview

14.1.7 Becton, Dickinson and Company

Table 291 Becton, Dickinson, and Company: Company Overview

Figure 41 Becton, Dickinson, and Company: Company Snapshot (2021)

14.1.8 Qiagen

Table 292 Qiagen: Company Overview

Figure 42 Qiagen: Company Snapshot (2021)

14.1.9 Merck KGaA

Table 293 Merck KGaA: Company Overview

Figure 43 Merck KGaA: Company Snapshot (2021)

14.1.10 Bio-Rad Laboratories, Inc.

Table 294 Bio-Rad Laboratories, Inc.: Company Overview

Figure 44 Bio-Rad Laboratories, Inc.: Company Snapshot (2021)

14.1.11 Promega Corporation

Table 295 Promega Corporation: Company Overview

14.1.12 Eurofins Scientific

Table 296 Eurofins Scientific: Company Overview

Figure 45 Eurofins Scientific: Company Snapshot (2021)

14.1.13 BGI

Table 297 BGI: Company Overview

14.1.14 10x Genomics

Table 298 10x Genomics: Company Overview

Figure 46 10x Genomics: Company Snapshot (2021)

14.1.15 Sysmex Corporation

Table 299 Sysmex Corporation: Company Overview

Figure 47 Sysmex Corporation: Company Snapshot (2022)

14.2 Other Players

14.2.1 Psomagen

14.2.2 Zymo Research Corporation

14.2.3 Takara Bio Inc.

14.2.4 Novogene Co. Ltd.

14.2.5 New England Biolabs

14.2.6 Tecan Trading AG

14.2.7 Oxford Nanopore Technologies PLC

14.2.8 PacBio

14.2.9 MedGenome

14.2.10 Swift Biosciences Inc.

*Details on Business Overview, Products Offered, Recent Developments, and Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) Might Not be Captured in Case of Unlisted Companies

15 Discussion Guide

15.1 Knowledgestore: The Subscription Portal

15.2 Customization Options

Executive Summary

Companies Mentioned

- 10x Genomics

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- BGI

- Bio-Rad Laboratories, Inc.

- Danaher

- Eurofins Scientific

- F. Hoffmann-La Roche Ltd.

- Illumina, Inc.

- MedGenome

- Merck KGaA

- New England Biolabs

- Novogene Co. Ltd.

- Oxford Nanopore Technologies PLC

- PacBio

- PerkinElmer Inc.

- Promega Corporation

- Psomagen

- Qiagen

- Swift Biosciences Inc.

- Sysmex Corporation

- Takara Bio Inc.

- Tecan Trading AG

- Thermo Fisher Scientific Inc.

- Zymo Research Corporation

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 289 |

| Published | March 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 1.9 Billion |

| Forecasted Market Value ( USD | $ 4 Billion |

| Compound Annual Growth Rate | 13.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |