The adult malignant glioma therapeutics market is projected to register a CAGR of 9.6% during the forecast period.

The COVID-19 pandemic has caused widespread disruption in cancer care, including delays in treatment as well as the suspension of clinical trials. For instance, according to an article published in June 2021, the provision of oncology services was considerably reduced during the COVID pandemic. COVID-19 also had an adverse impact on people with malignant brain tumors. For instance, an article published in Acta Medica in July 2022 stated that due to immunodepression related to tumor disease and anti-cancer treatments, cancer patients were more vulnerable to COVID-19 and had a higher risk of severe complications requiring intensive care. However, the market recovered in the past few years since the restrictions were lifted and trials for the development of glioma therapeutics resumed. COVID-19 has a negligible impact on the adult malignant glioma therapeutics market in the current scenario and is expected to show a stable growth rate during the forecast period.

The high burden of brain cancer and malignant gliomas globally is expected to propel market growth. For instance, according to the Canadian Cancer Society 2022 update, 3,200 Canadians were estimated to be diagnosed with brain and spinal cord cancer in 2022. Also, as per the Australian Institute of Health and Welfare 2022 report, the estimated age-standardized incidence rate for brain cancer was 6.4 cases per 100,000 persons (8.1 for males and 4.8 for females) in 2022.

Furthermore, the rising funding and engagement of government organizations to expedite the malignant gliomas therapeutics research and development (R&D) is also contributing significantly to the market growth. For instance, in October 2022, the Australian Government provided more than USD 5.4 million to support brain cancer research. The funding is from the Medical Research Future Fund (MRFF). Also, in September 2021, the NCI-funded Glioblastoma Therapeutics Network (GTN) reported working collaboratively to develop new treatments for malignant gliomas. The rising funding and partnership for the development of innovative therapeutics are expected to propel market growth.

The strategic initiatives by market players, such as product approvals, launches, and partnerships to expand adult malignant gliomas therapeutics, are expected to augment the market growth. For instance, in December 2021, Sapience Therapeutics, Inc. was granted Fast Track Designation to its lead program investigating ST101 for treating recurrent glioblastoma (GBM) by the United States Food and Drug Administration (FDA). The fast-track designation expedites the review of a drug for treating serious conditions, thereby propelling the market growth.

Therefore, owing to the factors such as the high burden of brain cancer, rising R&D spending, and product approvals and launches by market players, the studied market is anticipated to witness growth over the analysis period. However, the diminishing preference for chemotherapy and low approval rates for novel therapeutics for glioma is estimated to restrain the market growth.

The increasing clinical trial developments by government organizations and various market players are significantly contributing to the segment’s growth. For instance, as per clinicaltrials.org, 144 trials are ongoing for adult glioblastoma multiforme with the status recruiting, active, not recruiting, enrolling by invitation as of 17th February 2023. The high number of trials for Glioblastoma multiforme of the brain is expected to propel the segment growth during the forecast period.

The rising approvals of innovative therapeutics for the treatment of glioblastoma multiforme are expected to propel the market growth. For instance, in December 2022, the FDA granted Fast Track designation to WP1122 for the treatment of glioblastoma multiforme. The drug is developed by Moleculin Biotech, Inc., which is currently examining collaboration opportunities for the clinical development of WP1122. According to preclinical studies, WP1122 (2-deoxy-D-glucose, or 2-DG) has been shown to increase cellular uptake of 2-DG, increase drug half-life, and increase the ability to cross the blood-brain barrier leading to higher uptake in the brain.

Additionally, in April 2022, CNS Pharmaceuticals, Inc., received approval from the National Agency for the Safety of Medicine and Health Products (ANSM) Competent Authority and from the People Protection Ethics Committee (EC) SUD-EST III (CPP Sud-Est III) in France for the Company's potentially pivotal study of Berubicin for the treatment of recurrent glioblastoma multiforme (GBM). These approvals and launches of advanced therapeutics are expected to propel the segment’s growth during the forecast period.

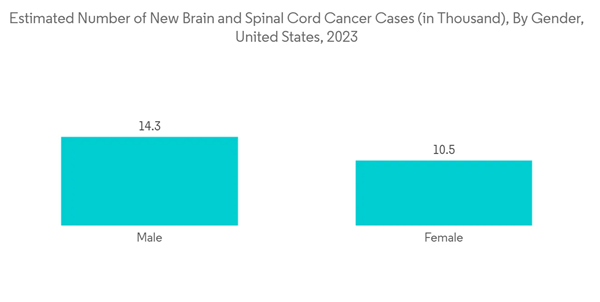

According to the American Cancer Society (ACS) 2023 update, the estimated number of brain and spinal cord tumors in the United States, including both adults and children, is 24.8 thousand (14,280 in males and 10,530 in females) in 2023. The most prevalent and malignant brain tumors originating from glial cells are called glioblastomas (GBM). Also, according to the Brain Tumour Registry of Canada 2022 update, the incidence of glioblastoma (GB) is 4 per 100,000 people in Canada. Therefore, the high burden of malignant tumors of the brain or spinal cord in the United States is expected to increase adult glioma incidence, which is further expected to propel the market growth during the forecast period.

Furthermore, according to the National Institute of Health, Estimates of Funding for Various Research, Condition, and Disease Categories (RCDC), May 2022 update, the spending on R&D in the United States for brain cancer was USD 415 million in 2021 and USD 435 million in 2022. The grant provided by the government for the research of brain cancer is expected to develop innovative therapeutics that are further expected to propel market growth in the upcoming years.

Additionally, the rising funding by government and non-government organizations for investigating adult malignant gliomas is expected to propel market growth in the region. For instance, in November 2021, a team of scientists and researchers at the Yale School of Public Health was awarded a USD 13 million grant to study the molecular evolution of lower-grade gliomas, which are slow-growing but malignant brain tumors that primarily affect young adults. These initiatives are expected to develop advanced therapeutics for adult gliomas, thereby propelling the market growth.

Therefore, the factors such as the high burden of malignant brain tumors and funding provided by organizations for R&D are expected to accelerate the market growth in the region during the forecast period.

This product will be delivered within 2 business days.

The COVID-19 pandemic has caused widespread disruption in cancer care, including delays in treatment as well as the suspension of clinical trials. For instance, according to an article published in June 2021, the provision of oncology services was considerably reduced during the COVID pandemic. COVID-19 also had an adverse impact on people with malignant brain tumors. For instance, an article published in Acta Medica in July 2022 stated that due to immunodepression related to tumor disease and anti-cancer treatments, cancer patients were more vulnerable to COVID-19 and had a higher risk of severe complications requiring intensive care. However, the market recovered in the past few years since the restrictions were lifted and trials for the development of glioma therapeutics resumed. COVID-19 has a negligible impact on the adult malignant glioma therapeutics market in the current scenario and is expected to show a stable growth rate during the forecast period.

The high burden of brain cancer and malignant gliomas globally is expected to propel market growth. For instance, according to the Canadian Cancer Society 2022 update, 3,200 Canadians were estimated to be diagnosed with brain and spinal cord cancer in 2022. Also, as per the Australian Institute of Health and Welfare 2022 report, the estimated age-standardized incidence rate for brain cancer was 6.4 cases per 100,000 persons (8.1 for males and 4.8 for females) in 2022.

Furthermore, the rising funding and engagement of government organizations to expedite the malignant gliomas therapeutics research and development (R&D) is also contributing significantly to the market growth. For instance, in October 2022, the Australian Government provided more than USD 5.4 million to support brain cancer research. The funding is from the Medical Research Future Fund (MRFF). Also, in September 2021, the NCI-funded Glioblastoma Therapeutics Network (GTN) reported working collaboratively to develop new treatments for malignant gliomas. The rising funding and partnership for the development of innovative therapeutics are expected to propel market growth.

The strategic initiatives by market players, such as product approvals, launches, and partnerships to expand adult malignant gliomas therapeutics, are expected to augment the market growth. For instance, in December 2021, Sapience Therapeutics, Inc. was granted Fast Track Designation to its lead program investigating ST101 for treating recurrent glioblastoma (GBM) by the United States Food and Drug Administration (FDA). The fast-track designation expedites the review of a drug for treating serious conditions, thereby propelling the market growth.

Therefore, owing to the factors such as the high burden of brain cancer, rising R&D spending, and product approvals and launches by market players, the studied market is anticipated to witness growth over the analysis period. However, the diminishing preference for chemotherapy and low approval rates for novel therapeutics for glioma is estimated to restrain the market growth.

Adult Malignant Glioma Therapeutics Market Trends

The Glioblastoma Multiforme Segment is Expected to Hold a Significant Growth Over The Forecast Period

Glioblastoma Multiforme (GBM) is one of the most aggressive types of brain cancer. The segment is expected to grow during the forecast period owing to the rising number of clinical trial developments and increasing approvals of innovative therapeutics by market players.The increasing clinical trial developments by government organizations and various market players are significantly contributing to the segment’s growth. For instance, as per clinicaltrials.org, 144 trials are ongoing for adult glioblastoma multiforme with the status recruiting, active, not recruiting, enrolling by invitation as of 17th February 2023. The high number of trials for Glioblastoma multiforme of the brain is expected to propel the segment growth during the forecast period.

The rising approvals of innovative therapeutics for the treatment of glioblastoma multiforme are expected to propel the market growth. For instance, in December 2022, the FDA granted Fast Track designation to WP1122 for the treatment of glioblastoma multiforme. The drug is developed by Moleculin Biotech, Inc., which is currently examining collaboration opportunities for the clinical development of WP1122. According to preclinical studies, WP1122 (2-deoxy-D-glucose, or 2-DG) has been shown to increase cellular uptake of 2-DG, increase drug half-life, and increase the ability to cross the blood-brain barrier leading to higher uptake in the brain.

Additionally, in April 2022, CNS Pharmaceuticals, Inc., received approval from the National Agency for the Safety of Medicine and Health Products (ANSM) Competent Authority and from the People Protection Ethics Committee (EC) SUD-EST III (CPP Sud-Est III) in France for the Company's potentially pivotal study of Berubicin for the treatment of recurrent glioblastoma multiforme (GBM). These approvals and launches of advanced therapeutics are expected to propel the segment’s growth during the forecast period.

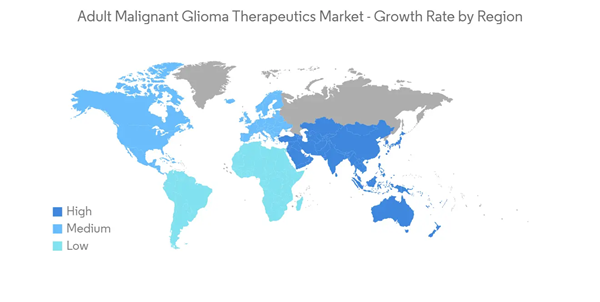

North America is Expected to Hold a Maximum Market Share Over The Forecast Period

North America is expected to dominate the market owing to factors such as the high prevalence of adult malignant glioma, the presence of high funding, and, thereby, ongoing research, along with the high concentration of market players in the region.According to the American Cancer Society (ACS) 2023 update, the estimated number of brain and spinal cord tumors in the United States, including both adults and children, is 24.8 thousand (14,280 in males and 10,530 in females) in 2023. The most prevalent and malignant brain tumors originating from glial cells are called glioblastomas (GBM). Also, according to the Brain Tumour Registry of Canada 2022 update, the incidence of glioblastoma (GB) is 4 per 100,000 people in Canada. Therefore, the high burden of malignant tumors of the brain or spinal cord in the United States is expected to increase adult glioma incidence, which is further expected to propel the market growth during the forecast period.

Furthermore, according to the National Institute of Health, Estimates of Funding for Various Research, Condition, and Disease Categories (RCDC), May 2022 update, the spending on R&D in the United States for brain cancer was USD 415 million in 2021 and USD 435 million in 2022. The grant provided by the government for the research of brain cancer is expected to develop innovative therapeutics that are further expected to propel market growth in the upcoming years.

Additionally, the rising funding by government and non-government organizations for investigating adult malignant gliomas is expected to propel market growth in the region. For instance, in November 2021, a team of scientists and researchers at the Yale School of Public Health was awarded a USD 13 million grant to study the molecular evolution of lower-grade gliomas, which are slow-growing but malignant brain tumors that primarily affect young adults. These initiatives are expected to develop advanced therapeutics for adult gliomas, thereby propelling the market growth.

Therefore, the factors such as the high burden of malignant brain tumors and funding provided by organizations for R&D are expected to accelerate the market growth in the region during the forecast period.

Adult Malignant Glioma Therapeutics Industry Overview

The adult malignant glioma therapeutics market is moderately competitive in nature due to the presence of various market players. The competitive landscape includes an analysis of a few international as well as local companies which hold major or significant market shares. The key players operating in the market include Merck & Co. Inc., F. Hoffmann-La Roche Ltd, Bio-Rad Laboratories, Azurity Pharmaceuticals, Inc., and Bristol-Myers Squibb Company.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET DYNAMICS

5 MARKET SEGMENTATION (Market Size by Value- USD million)

6 COMPETITIVE LANDSCAPE

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AbbVie, Inc.

- Amgen, Inc.

- Arbor Pharmaceuticals

- Bio Rad Laboratories

- Bristol-Myers Squibb Company

- F. Hoffmann-La Roche Ltd

- Pfizer, Inc.

- Sun Pharmaceuticals Ltd

- Merck & Co. Inc.

Methodology

LOADING...