The global naphtha market is projected to register a CAGR of more than 4% during the forecast period.

The COVID-19 pandemic severely impacts the global naphtha market. The pandemic significantly affected the construction industry's growth. The lockdown imposed in response to the pandemic disrupted the construction materials supply chain. It also caused a significant shortage of workforce. Several major construction projects have been shut down for a considerable amount of time, which led to a decrease in demand for paints and coatings and their additives, thus, hindering the naphtha market growth rate. Similarly, the aerospace industry is severely affected by the COVID-19 pandemic. But, in the post-pandemic period, the opening of economies and government support to different industries led to increasing demand for naphtha and showing signs of recovery of market growth.

This product will be delivered within 2 business days.

The COVID-19 pandemic severely impacts the global naphtha market. The pandemic significantly affected the construction industry's growth. The lockdown imposed in response to the pandemic disrupted the construction materials supply chain. It also caused a significant shortage of workforce. Several major construction projects have been shut down for a considerable amount of time, which led to a decrease in demand for paints and coatings and their additives, thus, hindering the naphtha market growth rate. Similarly, the aerospace industry is severely affected by the COVID-19 pandemic. But, in the post-pandemic period, the opening of economies and government support to different industries led to increasing demand for naphtha and showing signs of recovery of market growth.

Key Highlights

- Over the medium term, the naphtha market growth is likely driven by the rising demand for naphtha as a feedstock in the petrochemical Industry. Additionally, the increasing need for fertilizers in India will likely boost the demand for naphtha.

- The primary driver of the market studied is the rising demand for fertilizers in India. Moreover, due to rapid industrialization and urbanization in countries, like China, India, and Japan, the transportation sector is growing, stimulating the gasoline demand and driving the need for the naphtha market.

- The demand for natural gas liquid in the United States is expected to hinder the growth of the naphtha market.

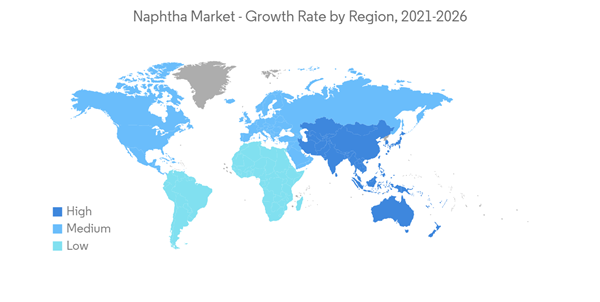

- With the increasing demand for naphtha from fast-developing countries like China, India, and Japan, the Asia-Pacific region is expected to dominate the global market.

Naphtha Market Trends

Rising Demand from Petrochemical Industry

- Naphtha is used in various industries as light naphtha and heavy naphtha. Naphtha is majorly used in the petrochemical industry as feedstock. Around 50% of the naphtha produced is being used in the petrochemical industry.

- In the petrochemical industry, naphtha is used for manufacturing aromatics and olefins, like benzene, butadiene, ethylene, toluene, and propylene. Continuous growth in the industry makes it proactive in maintaining the development of the naphtha market.

- Olefin-rich naphtha is mainly used as a feedstock for processing cost-effective high-octane diesel. Naphtha consumption increased in both emerging and industrialized economies due to the increasing demand for cost-effective fuel due to rapid urbanization and a growing global population.

- Naphtha consumption and production are growing in fast-developing economies such as India, China, and ASEAN. For instance, the Malaysian petrochemical industry is multiplying recently, with many FDIs flowing into the country. A Malaysian national oil and gas company, Petronas, along with Saudi Aramco, announced the establishment of two joint ventures for the Refinery and Petrochemicals Integrated Development (RAPID) project in Johor, worth USD 7 billion. The collaboration mentioned above resulted in a refinery construction with a capacity to process 300,000 barrels of crude oil per day and six petrochemical plants with a combined annual output of more than 3.5 million metric tons.

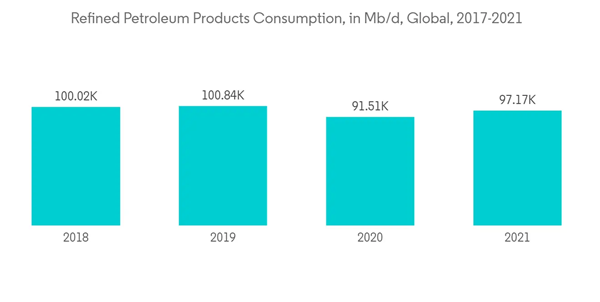

- As per data published by US Energy Information Administration, the global consumption of refined petroleum products increased significantly in the post-pandemic period.

- The United Kingdom is expected to lead the upcoming projects in the European region's oil and gas sector, accounting for 25% of the pipelined projects which are likely to commence by 2025. The country shall be boasting 111 oil and gas industry projects in the near term, out of which 83 will be upstream projects, 23 will be midstream, with refinery and petrochemical at three and two, respectively.

- As of September 2022, Ineos, a petrochemicals company, will develop an oil and gas field in Denmark, marking the country's first approval of such a project in years. INEOS will collaborate with Danoill and Nordsfonden to develop the Solsort West field in the North Sea, with the first oil and gas production expected in the fourth quarter of 2023.

- Hence, the above factors are likely to increase the demand for naphtha for various applications in the end-user industries. Thus, this is expected to drive the demand for naphtha during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia Pacific region dominated the global market share. Due to the growth in various end-user industries, such as petrochemical, fertilizers, paints, and coatings, the demand for naphtha is continuously rising in countries such as China, India, and Japan.

- The Japanese aerospace industry manufactures aircraft components for commercial and defense aircraft. Commercial aircraft production is increasing over the past couple of years owing to the increasing cargo demands.

- The South Korean Defense Acquisition Program Administration (DAPA) plans to work on light aircraft with an investment of USD 2.1 billion, which is expected to be operable in 2033. Hyundai Heavy Industries is involved in this manufacturing process with annual maintenance of USD 210 million.

- The Australian aerospace industry is one of the significant industries in the country, which contributes to around 2% of its GDP and manages about 10% of the world’s airspace. Moreover, Australia’s aerospace and defense industry includes approximately 1,000 firms and generates around USD 4 billion in annual revenue. Of this total revenue, 45% comes from exports to Europe, the United States, China, and ASEAN countries.

- The growth trend of the market is likely to remain the same in the next few years, which will drive its growth in the region.

Naphtha Market Competitor Analysis

The naphtha market is partially consolidated in nature. In terms of market share, few players currently dominate the market. Key players in the market include Reliance Industries Limited, Exxon Mobil Corporation, Saudi Arabian Oil Co. (Saudi Aramco), Formosa Petrochemical Corporation, and LG Chem(not in any particular order).Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET DYNAMICS

5 MARKET SEGMENTATION (Market Size in Volume)

6 COMPETITIVE LANDSCAPE

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AMOC (Alexandria Mineral Oils Co.)

- BP PLC

- Chevron Phillips Chemical Company LLC

- China National Petroleum Corporation (CNPC)

- China Petroleum & Chemical Corporation (SINOPEC)

- Exxon Mobil Corporation

- Formosa Petrochemical Corporation

- LG Chem

- MGTPetroil.com

- PetroChina Company Limited

- Petroleos Mexicanos

- Reliance Industries Limited

- Royal Dutch Shell PLC

- SASOL

- SABIC

- Saudi Arabian Oil Co. (Saudi Aramco)

Methodology

LOADING...