Speak directly to the analyst to clarify any post sales queries you may have.

KEY HIGHLIGHTS

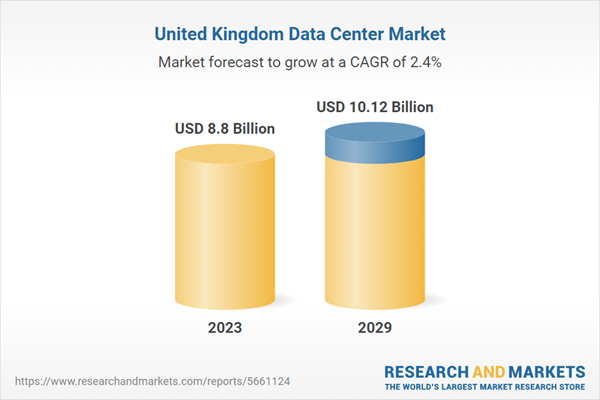

- The UK data center market is thriving due to the widespread adoption of digital platforms, expanding 5G connectivity, rising internet users, increasing data traffic, government initiatives, and integrating advanced technologies like IoT, big data, and AI. These factors collectively contribute to the heightened demand for data centers.

- The UK benefits from a robust network of internet exchange points, including LINX London, LINX Manchester, and others, which facilitate inland connectivity and support seamless data exchange within the country.

- The UK boasts 56 submarine cables connecting it to key regions globally, facilitating robust connectivity and supporting initiatives like 5G rollout and cloud service expansion. Upcoming cables like 2Africa, Amitie, and BT North Sea strengthen the UK's global connectivity.

- The UK government is actively promoting digital infrastructure through projects like the Wireless Infrastructure Strategy, aimed at increasing wireless connectivity by 2030, and the Digital Strategy, outlining comprehensive digital policy across critical domains.

- In November 2023, the UK government partnered with IBM to grant access to advanced quantum computers via the cloud. CGG established a 100 petaflops HPC Hub powered by renewable energy, highlighting investments in AI and high-performance computing infrastructure.

- By 2040, it's projected that one million UK businesses will integrate AI-driven technologies, reflecting AI's continued growth trajectory and importance in shaping the digital landscape.

WHY SHOULD YOU BUY THIS RESEARCH?

- Market size is available in the investment, area, power capacity, and UK colocation market revenue.

- An assessment of the data center investment in the UK by colocation and enterprise operators.

- Investments in the area (square feet) and power capacity (MW) across locations in the country.

- A detailed study of the existing UK data center market landscape, an in-depth market analysis, and insightful predictions about market size during the forecast period.

- Snapshot of existing and upcoming third-party data center facilities in the UK

- Data Center Colocation Market in the UK

- The UK data center market investments are classified into IT, power, cooling, and general construction services with sizing and forecast.

- A comprehensive analysis of the latest trends, growth rate, potential opportunities, growth restraints, and prospects for the industry.

- Business overview and product offerings of prominent IT infrastructure providers, construction contractors, support infrastructure providers, and investors operating in the industry.

- A transparent research methodology and the analysis of the demand and supply aspects of the industry.

VENDOR LANDSCAPE

- Some of the key investors in the UK data center market include Amazon Web Services (AWS), Ark Data Centres, China Mobile International (CMI), Colt Data Centre Services, Custodian Data Centres, CyrusOne, Cyxtera Technologies, Corscale Data Centers, Digital Realty, Data Datacentres, Equinix, Echelon Data Centres, Global Switch, Iron Mountain, Ionos, Infinity SDC, Keppel Data Centres, Kao Data, NTT Global Data Centers, Lumen Technologies, Microsoft, Proximity Data Centres, Serverfarm, Sungard Availability Services, Telehouse, Vantage Data Centers, Virtus Data Centres (ST Telemedia Global Data Centres), Yondr, among others.

- The UK data center market also witnessed the entry of colocation operators such as CloudHQ, Digital Reef, EdgeCore Digital Infrastructure, Google, Global Technical Realty, and Stratus DC Management.

IT Infrastructure Providers

- Arista Networks

- Atos

- Broadcom

- Cisco Systems

- Dell Technologies

- Fujitsu

- Hewlett Packard Enterprise

- Huawei Technologies

- IBM

- Juniper Networks

- Lenovo

- NetApp

Data Center Construction Contractors & Sub-Contractors

- 2bm

- AECOM

- Arup

- ARC: MC

- Atkins

- BladeRoom Data Centres

- Bouygues Construction

- Deerns

- Future-tech

- HDR Architecture

- INFINITI

- ISG

- JCA Engineering

- Kirby Engineering Group

- KMG Partnership

- Mace

- Mercury Engineering

- MiCiM

- studioNWA

- Oakmont Construction

- Sweet Projects

- RED

- SPIE UK

- Skanska

- STO Building Group

- Sudlows

- TTSP

- Waldeck

Support Infrastructure Providers

- ABB

- Airedale International Air Conditioning

- Caterpillar

- Cummins

- Delta Electronics

- Eaton

- Kohler SDMO

- Legrand

- Mitsubishi Electric

- Piller Power Systems

- Rolls Royce

- Riello Elettronica (Riello UPS)

- Rittal

- Schneider Electric

- Socomec

- Siemens

- STULZ

- Vertiv

Data Center Investors

- Amazon Web Services (AWS)

- Ark Data Centres

- China Mobile International (CMI)

- Colt Data Centre Services

- Custodian Data Centres

- CyrusOne

- Cyxtera Technologies

- Corscale Data Centers

- Digital Realty

- Data Datacentres

- Equinix

- Echelon Data Centres

- Global Switch

- Iron Mountain

- Ionos

- Infinity SDC

- Keppel Data Centres

- Kao Data

- NTT Global Data Centers

- Lumen Technologies

- Microsoft

- Proximity Data Centres

- Serverfarm

- Sungard Availability Services

- Telehouse

- Vantage Data Centers

- Virtus Data Centres (ST Telemedia Global Data Centres)

- Yondr

New Entrants

- CloudHQ

- Digital Reef

- EdgeCore Digital Infrastructure

- Global Technical Realty

- Stratus DC Management

EXISTING VS. UPCOMING DATA CENTERS

- Existing Facilities in the Region (Area and Power Capacity)

- Greater London

- Berkshire

- Greater Manchester

- Other Counties

- List of Upcoming Facilities in the Region (Area and Power Capacity)

REPORT COVERAGE

This report analyses the UK data center market share. It elaboratively analyses the existing and upcoming facilities and investments in IT, electrical, mechanical infrastructure, general construction, and tier standards. It discusses market sizing and investment estimation for different segments. The segmentation includes:- IT Infrastructure

- Servers

- Storage Systems

- Network Infrastructure

- Electrical Infrastructure

- UPS Systems

- Generators

- Transfer Switches & Switchgears

- PDUs

- Other Electrical Infrastructure

- Mechanical Infrastructure

- Cooling Systems

- Racks

- Other Mechanical Infrastructure

- Cooling Systems

- CRAC & CRAH Units

- Chiller Units

- Cooling Towers, Condensers & Dry Coolers

- Economizers & Evaporative Coolers

- Other Cooling Units

- General Construction

- Core & Shell Development

- Installation & Commissioning Services

- Engineering & Building Design

- Fire Detection & Suppression Systems

- Physical Security

- Data Center Infrastructure Management (DCIM)

- Tier Standard

- Tier I & Tier II

- Tier III

- Tier IV

- Geography

- Greater London

- Other Counties

KEY QUESTIONS ANSWERED

1. How much is the UK data center market investment expected to grow?2. How many data centers have been identified in the UK?

3. What is the growth rate of the UK data center market?

4. What are the driving factors for the UK data center market?

5. Who are the new entrants in the UK data center market?

Table of Contents

Companies Mentioned

- Arista Networks

- Atos

- Broadcom

- Cisco Systems

- Dell Technologies

- Fujitsu

- Hewlett Packard Enterprise

- Huawei Technologies

- IBM

- Juniper Networks

- Lenovo

- NetApp

- 2bm

- AECOM

- Arup

- ARC: MC

- Atkins

- BladeRoom Data Centres

- Bouygues Construction

- Deerns

- Future-tech

- HDR Architecture

- INFINITI

- ISG

- JCA Engineering

- Kirby Engineering Group

- KMG Partnership

- Mace

- Mercury Engineering

- MiCiM

- studioNWA

- Oakmont Construction

- Sweet Projects

- RED

- SPIE UK

- Skanska

- STO Building Group

- Sudlows

- TTSP

- Waldeck

- ABB

- Airedale International Air Conditioning

- Caterpillar

- Cummins

- Delta Electronics

- Eaton

- Kohler SDMO

- Legrand

- Mitsubishi Electric

- Piller Power Systems

- Rolls Royce

- Riello Elettronica (Riello UPS)

- Rittal

- Schneider Electric

- Socomec

- Siemens

- STULZ

- Vertiv

- Amazon Web Services (AWS)

- Ark Data Centres

- China Mobile International (CMI)

- Colt Data Centre Services

- Custodian Data Centres

- CyrusOne

- Cyxtera Technologies

- Corscale Data Centers

- Digital Realty

- Data Datacentres

- Equinix

- Echelon Data Centres

- Global Switch

- Iron Mountain

- Ionos

- Infinity SDC

- Keppel Data Centres

- Kao Data

- NTT Global Data Centers

- Lumen Technologies

- Microsoft

- Proximity Data Centres

- Serverfarm

- Sungard Availability Services

- Telehouse

- Vantage Data Centers

- Virtus Data Centres (ST Telemedia Global Data Centres)

- Yondr

- CloudHQ

- Digital Reef

- EdgeCore Digital Infrastructure

- Global Technical Realty

- Stratus DC Management

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 152 |

| Published | April 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 8.8 Billion |

| Forecasted Market Value ( USD | $ 10.12 Billion |

| Compound Annual Growth Rate | 2.3% |

| Regions Covered | United Kingdom |

| No. of Companies Mentioned | 92 |