Saudi Arabia fuel station market is expected to register a CAGR of 7.31% during the forecast period, thus witnessing a demand of 709 thousand barrels per day by 2027 from 455 thousand barrels per day in 2020. The COVID-19 outbreak negatively impacted the consumption of refined petroleum products, such as diesel, as most commercial and residential spaces in the country rely on diesel generators for power supply. The restriction imposed limited the movement of vehicles that directly impacted the market. Major factors such as increasing adoption of the compact fuel station concept, expansion of existing fuel station infrastructure, and increased investment in the downstream sector by government and multinational corporations are expected to drive the market during the forecast period. However, fluctuating fuel prices and stringent regulations by fuel station industries are expected to restrain the Saudi Arabian fuel station market.

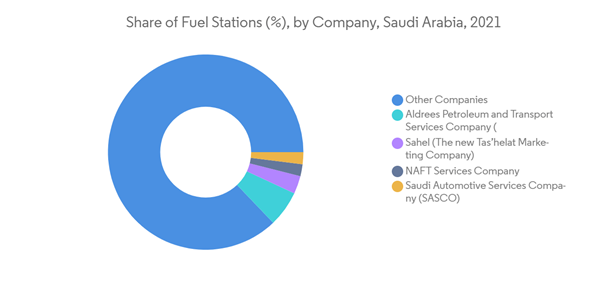

The fuel station market in Saudi Arabia is moderately fragmented. Some leading market players include Tas’helat Marketing Company, Aldrees Petroleum and Transport Services Company, ADNOC Distribution, ENOC, and Saudi Aramco Oil Co.

This product will be delivered within 2 business days.

Key Highlights

- Factors such as the expansion of existing fuel station infrastructure and increasing investment in the sector by the national firms and foreign players are expected to drive the fuel station market in the Kingdom during the forecast period.

- As per the 2020 budget, the Saudi government plans to invest more in the construction business, including new cities and shopping complexes. The new construction will boost the real state business and increase the need for a new fuel station in the constructed areas. Thus, this factor is expected to provide a great opportunity for the market.

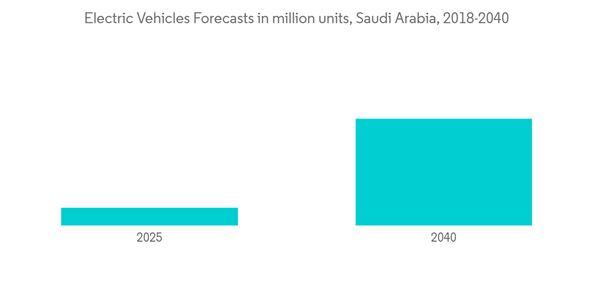

- However, factors such as the increasing adoption of electric vehicles and a lack of government surveillance and regulations to oversee the fuel station industry are expected to hinder the growth of the fuel station market in Saudi Arabia in the coming years.

Key Market Trends

Increasing Investment for Infrastructure Development to Drive the Market

- The Kingdom of Saudi Arabia is looking for investment in the fuel infrastructure and establishing fuel stations to provide country-wide connectivity, especially for the rural parts of the country. A huge number of foreign players showed interest in investing in the fuel stations across the country, which is expected to drive the fuel station market's growth.

- Saudi Arabia plans to expand the existing fuel station infrastructure by providing numerous amenities such as convenience stores, car care services, electric vehicle charging ports, and increasing investment in the sector by both the national firms and foreign players.

- In June 2020, Saudi Automotive Services Company (SASCO) signed an Islamic facility agreement for USD 66.64 million with the Arab National Bank (ANB). This agreement involves buying new locations, building new fuel stations, and developing the existing stations, which is expected to drive the fuel station market's growth during the forecast period.

- In April 2021, the Saudi Automotive Services Company (SASCO) opened eight new fuel stations in Saudi Arabia. The eight sites include convenience stores, branded restaurants, coffee shops, and ATM services. The three fuel stations are in Madinah and one in the Kingdom's southern region, with a total investment of about USD 5.6 million financed through banking facilities with local banks. The other four stations were renovations spread across the Kingdom's southern, central, and western provinces. The company increased its network over the last few years, and as of 2021, it operates over 200 stations in Saudi Arabia.

- In May 2021, Saudi Arabia's General Authority for Competition issued a no-objection certificate for Abu Dhabi National Oil Company for Distribution (ADNOC Distribution) to acquire 15 service stations in the Eastern Province of Saudi Arabia. The 15 service stations are owned by First Mazaya Company, one of the leading companies in Saudi Arabia that manage and operate fuel stations.

- In October 2021, Saudi Aramco and TotalEnergies launched the first two service stations of their joint retail network in Riyad. It is a part of a joint venture (JV) agreement between Aramco and TotalEnergies in 2019, with plans to upgrade a network of 270 service stations and expand the range of quality retail services available across Saudi Arabia.

- Moreover, with increasing government emphasis and growing foreign investment, the number of fuel stations is expected to witness huge growth during the forecast period.

Increasing Adoption of Alternate Vehicles to Restrain the Market

- Under the Saudi Vision 2030, the Saudi government is looking forward to reducing its dependency on oil. As the automobile sector accounts for almost a quarter of oil consumption in the country, the government plans to ensure a sustainable future by executing several reforms in the country, such as promoting a shift toward cleaner fuel-based automobiles. Like the global trend, Saudi Arabia is drafting policies to adopt hydrogen-based engines and electric vehicles. Traditional vehicles also account for a large amount of greenhouse gas emissions in the country. The promotion of these vehicles is expected to result in the reduction of GHGs in the country.

- In June 2019, Saudi Arabia inaugurated its first auto hydrogen fuel station. The station is a joint venture between Saudi Arabian Oil Company (Aramco) and Air Products and was opened at the Dhahran Techno Valley Science Park. This pilot project represents an exciting opportunity for Saudi Aramco and Air Products to demonstrate the potential of hydrogen in the transport sector and its viability as a sustainable fuel for the future.

- Owing to climate change, most of the major companies in the country are paying attention to the adoption of renewables in the country’s energy mix, thus investing in the business of electric vehicles. In a bid to move toward the Saudi 2030 Vision, in January 2018, the Saudi Electricity Company signed an agreement with Japanese firms, Tokyo Electric Power Company, Tecaoca Coco Energy Solutions Company, and Nissan Motor Company, to implement an electric vehicle pilot project. Under the agreement, fast-charger stations are expected to be developed to charge EVs in 30 minutes.

- In 2019, Saudi Arabia installed its first commercial charging station for EVs in Riyadh. More charging stations are expected to come online during the forecast period, which is expected to curtail the demand for fuels in the transportation sector.

- In April 2020, Schneider Electric Saudi Arabia and GREENER by IHCC signed a partnership agreement to develop e-mobility infrastructure in Saudi Arabia’s emerging and fast-growing electric vehicle (EV) sector. Schneider, French energy management and automation solutions company, and GREENER, a sustainability and energy efficiency services provider, will work on a strategy to boost the number of EV charging facilities in the Kingdom. This partnership is in line with the recently announced Saudi Green and Middle East Green initiatives, which aim to reduce carbon emissions, combat pollution and land degradation, and preserve nature.

- The declining cost of associated equipment, such as batteries, is expected to reduce the cost of electric vehicles and increase their uptake in Saudi Arabia during the forecast period.

Competitive Landscape

The fuel station market in Saudi Arabia is moderately fragmented. Some leading market players include Tas’helat Marketing Company, Aldrees Petroleum and Transport Services Company, ADNOC Distribution, ENOC, and Saudi Aramco Oil Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET OVERVIEW

4.7 Fuel Stations Expansion Targets by Companies/Government

5 COMPETITIVE LANDSCAPE

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- TotalEnergies SE

- Aldrees Petroleum and Transport Services Company (APTSCO)

- Wafi Energy Co.

- Petromin Corporation

- Oman Oil Marketing Company (OOMCO)

- ADNOC Distribution

- Emirates National Oil Co. Ltd LLC (ENOC)

- NAFT Services Co. Ltd

- Saudi Arabian Oil Company (Saudi Aramco)

Methodology

LOADING...