Free Webex Call

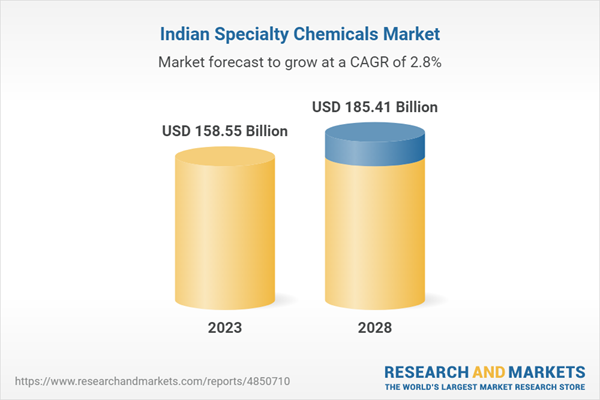

India Specialty Chemicals Market has reached reach USD 158.55 billion by 2023 and is anticipated to project robust growth in the forecast period with a CAGR of 2.78% through 2029. The Indian chemical industry is poised for significant and rapid growth, with specialty chemicals anticipated to emerge as the most lucrative segment. This growth can be attributed to the escalating demand from a diverse range of end-use industries, including pharmaceuticals, textiles, and personal care products. India's robust domestic demand, coupled with its export potential, further reinforces the expansion of this sector. Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Moreover, India is rapidly establishing itself as a preferred manufacturing hub for specialty chemicals, catering to both domestic and export markets. Notably, approximately 20% of the total exports from the Indian chemical industry comprise specialty chemicals. This growth trajectory has been further bolstered by substantial investments in infrastructure and research and development, elevating the industry's competitiveness on a global scale.

Furthermore, the specialty chemicals sector is witnessing an upsurge in investor interest, fueled by its strong performance and promising prospects. This influx of investments serves as an additional catalyst for the sector's growth.

In conclusion, the specialty chemicals market in India is on an upward trajectory, driven by the increasing domestic and global demand, strategic investments, and a supportive regulatory environment. As the sector continues to expand and innovate, India is poised to solidify its position as a global leader in the specialty chemicals market, ushering in new opportunities and driving economic growth.

Key Market Drivers

Growing Demand of Specialty Chemicals in Agriculture Industry

The specialty chemicals market in India is experiencing a significant surge, majorly driven by the escalating demand from the agriculture industry. Specialty chemicals, including agrochemicals such as fertilizers, pesticides, and herbicides, play a crucial role in enhancing crop yield and protecting crops from pests and diseases.India, being an agrarian economy, heavily relies on farming. The growing population raises the demand for agricultural products, thus requiring more efficient farming practices. Specialty chemicals come into play here, increasing productivity by improving soil fertility and combating harmful pests. Moreover, these chemicals also contribute to the effective management of weeds and diseases, ensuring the overall health and well-being of the crops.

Research and development (R&D) in the specialty chemicals sector have introduced innovative agrochemical solutions that are more effective and eco-friendlier. These innovations cater to the shifting focus towards sustainable farming practices, further driving the demand for specialty chemicals in agriculture. For instance, advancements in biopesticides and biofertilizers provide environmentally friendly alternatives to conventional agrochemicals, aligning with the growing emphasis on organic and sustainable farming.

The Indian government's initiatives to boost agricultural productivity have also played a significant role. Policies encouraging the use of modern farming techniques and agrochemicals have resulted in increased adoption of specialty chemicals. In addition to that, the government has been actively promoting the concept of integrated pest management (IPM), which emphasizes the judicious use of agrochemicals in combination with other pest control methods, ensuring minimal environmental impact.

The rising demand for agrochemicals presents lucrative investment opportunities. Investors are showing keen interest, leading to increased funding for innovation, production capacity expansion, and marketing efforts in the specialty chemicals sector. This not only drives the growth of the specialty chemicals market but also fosters technological advancements and the development of new and improved products for sustainable agriculture.

The growing demand for specialty chemicals in the agriculture industry is a key driver of India's specialty chemicals market. As India continues to modernize its agriculture sector and focus on sustainable farming practices, the need for specialty chemicals is expected to increase further. This trend, coupled with supportive government policies and investment opportunities, signifies a promising future for India's specialty chemicals market, contributing to the overall growth and development of the agricultural sector in the country.

Growing Demand of Specialty Chemicals in Pharmaceutical Industry

The specialty chemicals market in India is experiencing remarkable growth, propelled by the surging demand from the pharmaceutical industry. Specialty chemicals, encompassing active pharmaceutical ingredients (APIs), intermediates, and excipients, play a vital role in the development and manufacturing of drugs, ensuring their efficacy and safety.Specialty chemicals, particularly APIs, serve as the foundation of drug production, conferring therapeutic effects to medicines. Intermediates, on the other hand, are instrumental in the synthesis of APIs, while excipients facilitate drug delivery, ensuring optimal absorption and bioavailability.

Given the dynamic nature of the pharmaceutical industry, continuous innovation in specialty chemicals is imperative. Extensive research and development (R&D) efforts are focused on creating more efficient and high-quality APIs and excipients, as well as developing sustainable and eco-friendly production processes.

The Indian government's steadfast commitment to promoting self-reliance in API production has further bolstered the growth of the specialty chemicals market. To reduce reliance on imports, particularly from China, the government has implemented policies and initiatives to encourage domestic production of APIs. This proactive approach has resulted in a surge in demand for specialty chemicals within the country.

The escalating demand for specialty chemicals in the pharmaceutical industry serves as a key driver of growth in India's specialty chemicals market. As the pharmaceutical industry continues to expand and embrace innovation, the need for specialized chemical solutions is poised to increase further. In conjunction with favorable government policies and abundant investment opportunities, this upward trend promises a prosperous and promising future for the specialty chemicals market in India.

Key Market Challenges

Raw Material Availability and Pricing

The specialty chemicals industry heavily relies on imports for its raw materials, with major suppliers located in countries like China and the Middle East. This dependence exposes the Indian specialty chemicals sector to various vulnerabilities, including supply disruptions and price fluctuations. These vulnerabilities can be triggered by factors such as geopolitical tensions, trade policies, or global market dynamics.Moreover, price volatility of raw materials poses another significant challenge for the industry. Changes in crude oil prices, exchange rates, and demand-supply dynamics in the international market have a substantial impact on the cost of raw materials. The resulting price volatility creates uncertainty in production costs, which in turn affects the profitability and competitiveness of companies operating in the specialty chemicals market.

Additionally, stricter environmental regulations, particularly in China, have led to a tightening of the global supply chain for certain raw materials. This has resulted in increased prices and limited availability of these materials. While this situation has opened up opportunities for Indian companies to fill the supply gap, it also poses a challenge in terms of sourcing raw materials.

Overall, the specialty chemicals industry faces a complex landscape, influenced by various factors that require careful consideration and strategic planning to ensure sustainable growth and competitiveness.

Key Market Trends

Growing Demand of Advanced Materials and Polymers

The specialty chemicals market in India is currently undergoing a significant transformation, driven by the surging demand for advanced materials and polymers. These cutting-edge products play a pivotal role in driving innovation across various sectors, including automotive, construction, electronics, and consumer goods.Advanced materials and polymers, which fall under the category of specialty chemicals, are renowned for their exceptional properties such as remarkable durability, lightweight nature, and remarkable resistance to heat and chemicals. These properties make them increasingly popular as they have the potential to enhance product performance and improve overall efficiency. There are several factors fueling the growing demand for these specialty chemicals. Firstly, the rapid pace of industrialization and urbanization in India has led to an increased need for advanced materials in construction and infrastructure projects.

Secondly, the evolving consumer preferences for high-quality, durable, and lightweight products have significantly boosted the demand in the automotive and consumer goods sectors. The transition towards advanced materials and polymers has spurred a wave of innovation and research and development (R&D) in the specialty chemicals sector. Companies are making significant investments in R&D to develop new materials with enhanced properties and to improve manufacturing processes. The escalating demand for advanced materials and polymers represents a key trend that is shaping India's specialty chemicals market.

As industries continue to innovate and evolve, the demand for these specialty chemicals is expected to witness further growth. This trend, coupled with the support of favorable government policies and a strong focus on R&D, points towards a promising and prosperous future for the specialty chemicals market in India.

Growing Focus on Green and Sustainable Solutions

The chemical industry, including the specialty chemicals sector, has traditionally been associated with high energy consumption and environmental pollution. However, in recent years, there has been a growing realization that sustainability is not just good for the environment, but also for business. As a result, companies have started to shift their focus towards developing 'green' specialty chemicals that have a significantly reduced environmental impact. These green chemicals are designed to minimize energy consumption, reduce emissions, and promote the efficient use of resources.Several drivers are fueling this trend towards green specialty chemicals. One of the key factors is the increasing pressure from regulatory bodies. Governments around the world, including in India, are implementing stricter environmental regulations to combat pollution and promote sustainable practices. This has compelled companies in the chemical industry to explore greener alternatives to meet these regulations and reduce their environmental footprint.

Another important driver is the changing consumer preferences. There is a growing demand for products that are made with eco-friendly and sustainable materials. Consumers are becoming more conscious of the environmental impact of the products they use and are actively seeking out greener alternatives. This shift in consumer behavior has had a significant impact on industries such as textiles, cosmetics, and food, which are now actively seeking green specialty chemicals to meet the demands of environmentally conscious consumers.

The growing focus on green and sustainable solutions is not just a global trend, but it is also significantly shaping the specialty chemicals market in India. As the Indian government implements supportive policies and regulations to promote sustainable practices, companies in the specialty chemicals sector are being incentivized to invest in research and development of green solutions. This has led to a surge in innovation, creating new opportunities for growth and contributing to the overall development of the sector.

In conclusion, the future of India's specialty chemicals market looks not only prosperous but also green and sustainable. The industry's focus on developing and adopting green specialty chemicals, driven by regulatory pressures, and changing consumer preferences, is transforming the sector, and paving the way for a more sustainable future.

Segmental Insights

Product Type Insights

Based on the category of product type, the pharmaceutical segment emerged as the dominant player in the Indian market for specialty chemicals in 2023. The prime factors attributed to the prominent segment growth are the large number of applications in the pharmaceutical industry. These applications include drugs manufacturing for various skin disorders, cardiovascular diseases, and Hughes syndrome. These applications typically involve active ingredients that are found in medical products. Pharmaceutical ingredients are manufactured in large reactors using basic chemical compounds. After the processing of a chemical compound or base, it transforms into an intermediate that eventually forms the pharmaceutical ingredient. Depending on the number of intermediates involved, a specific type of pharmaceutical ingredient is manufactured. The number of intermediates in the process can vary from 1 to 10, highlighting the complexity of the pharmaceutical manufacturing process.Furthermore, the increasing population, coupled with the rising demand for good quality food, is a major driver for the agrochemicals market. With the need to meet the growing food demand, crop protection and high yield products have emerged as significant trends in the agrochemicals market. Farmers are becoming more aware of the benefits of applying agrochemicals in their farms, which is predicted to further fuel the market growth for agrochemicals in the near future. Furthermore, the rapid pace of industrialization and urbanization has led to the degradation and decrease of agricultural land. Despite this, the demand for food continues to increase. As a result, there is a growing need for agrochemicals to enhance crop yield production per acre of land, thereby accelerating the market growth of specialty chemicals during the forecast period.

Regional Insights

West India emerged as the dominant player in the India Specialty Chemicals Market in 2023, holding the largest market share in terms of value. West India, particularly Gujarat, boasts a robust and diversified industrial base, encompassing sectors such as textiles, petrochemicals, pharmaceuticals, and more. This strong foundation has been a key driving force behind the remarkable growth of the specialty chemicals industry in the region. With a well-established chemical industry, Gujarat has emerged as a hub for the production of colorants, paints, coatings, and other specialty chemicals, contributing significantly to India's thriving $20 billion market.One of the advantages of West India's strategic location is its proximity to major domestic and international markets. The region's accessibility to ports facilitates seamless export of specialty chemicals to various destinations, making it an appealing choice for manufacturers looking to expand their global reach. This advantageous geographical position enables efficient supply chain management and enhances the competitiveness of the specialty chemicals industry in the region.

The government's pro-industry policies and initiatives have been pivotal in nurturing the growth of Gujarat's chemical industry. The state's favorable policies, designed to promote investment and industrial development, have attracted both domestic and international players to set up manufacturing facilities in the region. This proactive approach by the government has not only accelerated the economic growth of Gujarat but also contributed significantly to India's overall industrial progress.

With its strong industrial base, strategic location, and supportive government policies, West India, especially Gujarat, continues to shape the landscape of the specialty chemicals industry, fostering innovation, employment, and economic prosperity.

Report Scope:

In this report, the India Specialty Chemicals Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Specialty Chemicals Market, By Product Type:

- Pharmaceuticals

- Colorant

- Paints

- Agrochemicals

- Surfactants

- Textile Chemicals

- Personal Care

- Others

India Specialty Chemicals Market, By Region:

- North India

- East India

- West India

- South India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Specialty Chemicals Market.Available Customizations:

India Specialty Chemicals Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

1. Product Overview

2. Research Methodology

3. Executive Summary

4. India Specialty Chemicals Market Outlook

5. North India Specialty Chemicals Market Outlook

6. South India Specialty Chemicals Market Outlook

7. West India Specialty Chemicals Market Outlook

8. East India Specialty Chemicals Market Outlook

9. Market Dynamics

10. Market Trends & Developments

13. Competitive Landscape

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- SRF Limited

- Aarti Industries Limited

- Galaxy Surfactants Ltd

- Solvay Pharma India Limited

- Himadri Speciality Chemical Ltd

- Bodal Chemicals Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | October 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 158.55 Billion |

| Forecasted Market Value ( USD | $ 185.41 Billion |

| Compound Annual Growth Rate | 2.7% |

| Regions Covered | India |