Chapter 2 Summary and Highlights

Chapter 3 Market and Technology Overview

- Nuclear Fusion History

- Nuclear Fusion Regulations by Country

- U.S.

- U.K.

- France

- Germany

- Russia

- China

- South Korea

- Analysis of the Abovementioned Regulations

- Value Chain Analysis of the Nuclear Fusion Industry

- Research & Development

- Component and Fuel Suppliers

- System Integrators/Nuclear Fusion Companies

- Potential Industry Applications

- Patent Analysis

Chapter 4 Market Dynamics

- Market Drivers

- Increased Funding by Top Venture Capitalist and Other Private Investors

- Increase in Government Funded Projects

- Growing Number of Start-ups in Nuclear Fusion

- Growing Need for Additional Amount of Energy and Zero Carbon Energy

- Market Opportunities

- Alternative Energy Investments Opportunities in the Oil & Gas Industry

- Growth Potential for Space Industry

- Integration of Artificial intelligence (AI) and Machine Learning (ML) Technologies for Nuclear Fusion

- Market Challenges

- High Capital Costs for Constructing and Commissioning of Nuclear Fusion Facilities

- Issues Faced by Plasma Heating, Confinement, and Stability

- Low Availability of Tritium

- Regulation and Licensing of Commercial Fusion Energy Facilities

Chapter 5 Market Breakdown by Technology

- Overview

- Magnetic Confinement Fusion

- Inertial Confinement Fusion

- Magneto Inertial Fusion

Chapter 6 Market Breakdown by Application

- Overview

- Electricity Generation

- Space Propulsion

- Others (Marine Propulsion, Medical, Off-Grid Energy, Hydrogen and/or Clean Fuels, Industrial Heating)

Chapter 7 Market Breakdown by Region

- Overview

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Rest of Europe

- APAC

- China

- Japan

- India

- Thailand

- Rest of APAC

- Rest of the World

Chapter 8 Competitive Landscape

- Strategic Analysis

- Recent Key Developments

- Competitive Analysis

- Analysis on Alternative Power Generation Technologies

- Time by Proof-of-Concept to Early Commercialization for Energy Technologies

- Is Small Modular Reactor (SMR) a Threat for Nuclear Fusion?

Chapter 9 Company Profiles

- AVALANCHE ENERGY DESIGNS LLC

- COMMONWEALTH FUSION SYSTEMS (CFS)

- CTFUSION

- EX-FUSION INC.

- FOCUSED ENERGY

- FIRST LIGHT FUSION LTD

- GENERAL FUSION INC.

- HB11 ENERGY HOLDINGS PTY LTD

- HELION ENERGYINC.

- MARVEL FUSION GMBH

- MAGNETO-INERTIAL FUSION TECHNOLOGIES INC. (MIFTI)

- PRINCETON FUSION SYSTEMS INC.

- TAE TECHNOLOGIES INC.

- TOKAMAK ENERGY LTD.

- ZAP ENERGY INC.

List of Tables

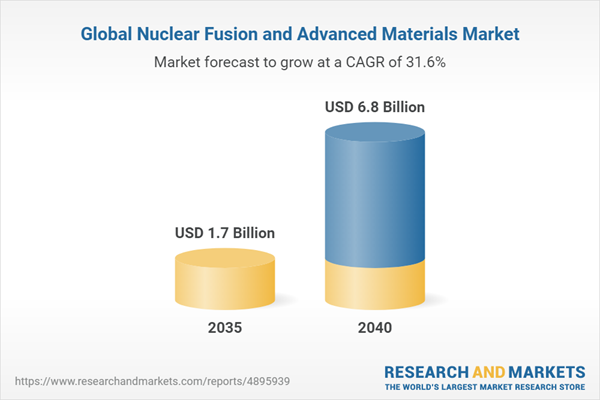

Summary Table: Global Market for Nuclear Fusion Technologies, by Region, Through 2040

Table 1: Notable Developments in the Timeline of Nuclear Fusion, 1950-2022

Table 2: Principal Regulations Currently Applicable to Fusion R&D in the U.K.

Table 3: Principal Regulations Currently Applicable to Fusion R&D in France

Table 4: Principal Regulations Currently Applicable to Fusion in China

Table 5: List of Component Manufacturer and Headquarters

Table 6: Global Market for Nuclear Fusion Technologies, by Type, Through 2040

Table 7: Three Key Technologies of Fusion and Their Challenges

Table 8: Global Market for Nuclear Fusion Technologies, by Application, Through 2040

Table 9: Global Projections of Electricity Consumption, by Energy Source, 2025-2050

Table 10: Global Market for Electricity Generation by Nuclear Fusion, by Region, Through 2040

Table 11: Global Market for Nuclear Fusion Space Propulsion Systems, by Region, Through 2040

Table 12: Global Market for Other Applications of Nuclear Fusion Technologies, by Region, Through 2040

Table 13: Global Nuclear Fusion Expected Commercialisation and Capacity, by Country

Table 14: Global Market for Nuclear Fusion Technologies, by Region, Through 2040

Table 15: U.S. Nuclear Fusion Device Status and Design Stage, by Device and Organization

Table 16: Canadian Nuclear Fusion Device Status and Design Stage, by Device and Organization

Table 17: Summary of Personnel and Institutions in Canada for Nuclear Research

Table 18: North American Market for Nuclear Fusion Technologies, by Application, Through 2040

Table 19: North American Market for Nuclear Fusion Technologies, by Country, Through 2040

Table 20: German Nuclear Fusion Device Status and Design Stage, by Device and Organization

Table 21: U.K. Nuclear Fusion Device Status and Design Stage, by Device and Organization

Table 22: French Nuclear Fusion Device Status and Design Stage, by Device and Organization

Table 23: Italian Nuclear Fusion Device Status and Design Stage, by Device and Organization

Table 24: Spanish Nuclear Fusion Device Status and Design Stage, by Device and Organization

Table 25: Rest of European Nuclear Fusion Device Status and Design Stage, by Device and Organization

Table 26: European Market for Nuclear Fusion Technologies, by Application, Through 2040

Table 27: European Market for Nuclear Fusion Technologies, by Country, Through 2040

Table 28: Chinese Nuclear Fusion Device Status and Design Stage, by Device and Organization

Table 29: Japanese Nuclear Fusion Device Status and Design Stage, by Device and Organization

Table 30: Indian Nuclear Fusion Device Status and Design Stage, by Device and Organization

Table 31: Thai Nuclear Fusion Device Status and Design Stage, by Device and Organization

Table 32: Rest of APAC Nuclear Fusion Device Status and Design Stage, by Device and Organization

Table 33: APAC Market for Nuclear Fusion Technologies, by Application, Through 2040

Table 34: APAC Market for Nuclear Fusion Technologies, by Country, Through 2040

Table 35: South American Nuclear Fusion Device Status and Design Stage, by Device and Organization

Table 36: RoW Market for Nuclear Fusion Technologies, by Application, Through 2040

Table 37: Recent Key Developments, 2022 and 2023*

Table 38: Nuclear Fusion Companies Expected Capacity Generation

Table 39: Avalanche Energy Designs LLC: Company Snapshot

Table 40: Commonwealth Fusion Systems: Company Snapshot

Table 41: Commonwealth Fusion Systems: Recent Developments

Table 42: CTFusion: Company Snapshot

Table 43: EX-Fusion Inc.: Company Snapshot

Table 44: EX-Fusion Inc.: Recent Developments

Table 45: Focused Energy: Company Snapshot

Table 46: Focused Energy: Recent Developments

Table 47: First Light Fusion Ltd: Company Snapshot

Table 48: First Light Fusion Ltd: Recent Developments

Table 49: General Fusion Inc.: Company Snapshot

Table 50: General Fusion Inc.: Recent Developments

Table 51: HB11 Energy Holdings Pty Ltd: Company Snapshot

Table 52: HB11 Energy Holdings Pty Ltd: Recent Developments

Table 53: Helion Energy Inc.: Company Snapshot

Table 54: Helion Energy Inc.: Recent Developments

Table 55: Marvel Fusion GmbH: Company Snapshot

Table 56: Marvel Fusion GmbH: Recent Developments

Table 57: MIFTI: Company Snapshot

Table 58: Princeton Fusion Systems Inc.: Company Snapshot

Table 59: Princeton Fusion Systems Inc.: Recent Developments

Table 60: TAE Technologies Inc.: Company Snapshot

Table 61: TAE Technologies Inc.: Recent Developments

Table 62: Tokamak Energy Ltd: Company Snapshot

Table 63: Tokamak Energy Ltd: Recent Developments

Table 64: Zap Energy Inc.: Company Snapshot

Table 65: Zap Energy Inc.: Recent Developments

Table 66: Acronyms Used in This Report

List of Figures

Summary Figure: Global Market Shares of Nuclear Fusion Technologies, by Region, 2035

Figure 1: Comparison between Prescriptive and Goal-Setting Approaches

Figure 2: Nuclear Fusion Industry Market Value Chain

Figure 3: Global Patent Applications on Nuclear Fusion Technologies, 2016-2022

Figure 4: Global Shares of Patent Applications on Nuclear Fusion Technologies, by Region, 2021

Figure 5: Key Drivers Fueling the Growth of the Market for Nuclear Fusion Technologies

Figure 6: Funds Raised, by Nuclear Fusion Companies, Till 2022

Figure 7: Shares of Funds Raised, by Nuclear Fusion Companies, Through 2022

Figure 8: Roadmap and Expected Timeline for ITER Project

Figure 9: Number of New Nuclear Fusion Start-ups, 2017-2022

Figure 10: Global Total Primary Energy Consumption Projections, 2020-2050

Figure 11: Global Projections of Shares of Primary Energy Consumption, by Energy Source, 2050

Figure 12: Oil Supply in the Net Zero Pathway, 2020 & 2050

Figure 13: Key Opportunities the Market for Nuclear Fusion Technologies

Figure 14: Oil & Gas Company Investments in Nuclear Fusion Power

Figure 15: Major Challenges Faced by Nuclear Fusion Power Plant Facilities

Figure 16: Shares of the Cost for Magnetic Confinement Fusion Reactors

Figure 17: Regulatory Hazards of Particular Concern for Commercial Fusion Facilities

Figure 18: Global Market Shares of Nuclear Fusion Technologies, by Type, 2035

Figure 19: Global Market Shares of Nuclear Fusion Technologies, by Type, 2040

Figure 20: Global Market Shares of Nuclear Fusion Technologies, by Application, 2035

Figure 21: Global Market Shares of Nuclear Fusion Technologies, by Application, 2040

Figure 22: Global Projections of Electricity Consumption, by Energy Source, 2025-2050

Figure 23: Global Market Shares of Electricity Generation by Nuclear Fusion, by Region, 2035

Figure 24: Global Market Shares of Electricity Generation by Nuclear Fusion, by Region, 2040

Figure 25: Global Market Shares of Nuclear Fusion Space Propulsion Systems, by Region, 2035

Figure 26: Global Market Shares of Nuclear Fusion Space Propulsion Systems, by Region, 2040

Figure 27: Global Market Shares of Other Applications of Nuclear Fusion Technologies, by Region, 2035

Figure 28: Global Market Shares of Other Applications of Nuclear Fusion Technologies, by Region, 2040

Figure 29: Global Market Shares of Nuclear Fusion Companies, by Region, 2022

Figure 30: Global Market Shares of Nuclear Fusion Technologies, by Region, 2035

Figure 31: Global Market Shares of Nuclear Fusion Technologies, by Region, 2040

Figure 32: U.S. Market Shares of Electricity Generation, by Energy Source, 2022 and 2050

Figure 33: Canadian Market Shares of Electricity Generation, by Energy Source, 2022 and 2050

Figure 34: Mexican Market Shares of Electricy Generation, by Energy Source, 2021

Figure 35: North American Market Shares of Nuclear Fusion Technologies, by Application, 2035

Figure 36: North American Market Shares of Nuclear Fusion Technologies, by Application, 2040

Figure 37: North American Market Shares of Nuclear Fusion Technologies, by Country, 2035

Figure 38: North American Market Shares of Nuclear Fusion Technologies, by Country, 2040

Figure 39: European Market Shares of Nuclear Fusion Projects by Public (Government and Institutions) and Private Organizations, 2022

Figure 40: German Market Shares of Electricy Generation, by Energy Source, 2021

Figure 41: U.K. Market Shares of Electricy Generation, by Energy Source, 2021

Figure 42: French Market Shares of Electricy Generation, by Energy Source, 2021

Figure 43: Italian Market Shares of Electricy Generation, by Energy Source, 2021

Figure 44: Spanish Market Shares of Electricy Generation, by Energy Source, 2021

Figure 45: European Market Shares of Nuclear Fusion Technologies, by Application, 2035

Figure 46: European Market Shares of Nuclear Fusion Technologies, by Application, 2040

Figure 47: European Market Shares of Nuclear Fusion Technologies, by Country, 2035

Figure 48: European Market Shares of Nuclear Fusion Technologies, by Country, 2040

Figure 49: APAC Market Shares of Nuclear Fusion Projects, by Public (Government and Institutions) and Private Organizations, 2022

Figure 50: Chinese Market Shares of Electricy Generation, by Energy Source, 2022 and 2050

Figure 51: Japanese Market Shares of Electricy Generation, by Energy Source, 2022 and 2050

Figure 52: Indian Market Shares of Electricy Generation, by Energy Source, 2022 and 2050

Figure 53: Thai Market Shares of Electricy Generation, by Energy Source, 2022 and 2050

Figure 54: APAC Market Shares of Nuclear Fusion Technologies, by Application, 2035

Figure 55: APAC Market Shares of Nuclear Fusion Technologies, by Application, 2040

Figure 56: APAC Market Shares of Nuclear Fusion Technologies, by Country, 2035

Figure 57: APAC Market Shares of Nuclear Fusion Technologies, by Country, 2040

Figure 58: RoW Market Shares of Nuclear Fusion Projects, by Public (Government and Institutions) and Private Organizations, 2022

Figure 59: RoW Market Shares of Nuclear Fusion Technologies, by Application, 2035

Figure 60: RoW Market Shares of Nuclear Fusion Technologies, by Application, 2040

Figure 61: Shares of Strategic Approaches Adopted, by Nuclear Fusion Companies, 2021-2023*

Figure 62: Shares of Nuclear Fusion Companies, by Technology, 2022

Figure 63: Shares of Nuclear Fusion Companies, by Fuel Type, 2022

Figure 64: Nuclear Fusion Companies Funding Range, 2021 and 2022

Figure 65: Shares of Capacity Factor for U.S., by Energy Source, 2021

Figure 66: Average External Costs of Selected Energy Sources

Figure 67: Average Capital Investment Required, by Energy Sources

Figure 68: Average LCOE, by Energy Sources

Figure 69: Time by Proof-of-Concept to Early Commercialization for Energy Technologies