Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increasing Industrialization and Infrastructure Development

India's Harmonic Filter Market has witnessed substantial growth in recent years, primarily fueled by the rapid pace of industrialization and infrastructure development in the country. As India continues to establish itself as a global manufacturing and technology hub, the demand for electrical power and automation systems has surged. This upsurge in industrial and infrastructure activities has resulted in the widespread utilization of power electronic devices and non-linear loads, including variable frequency drives (VFDs), rectifiers, and uninterruptible power supplies (UPS). These devices are known to introduce harmonic distortions into the electrical grid, leading to disruptions and inefficiencies.To address these challenges, industries and commercial establishments are increasingly embracing harmonic filters. Harmonic filters play a crucial role in mitigating harmonic distortions and upholding the quality of electrical power supply. They enhance the efficiency of electrical systems, minimize downtime, and prolong the lifespan of delicate equipment. Consequently, the demand for harmonic filters in India's industrial and infrastructure sectors is on the rise.

Furthermore, government initiatives such as "Make in India" and the establishment of special economic zones (SEZs) have attracted a multitude of multinational companies to establish manufacturing units in India. These companies are making substantial investments in advanced manufacturing processes and automation technologies, further intensifying the need for harmonic filters. In conclusion, the escalating industrialization and infrastructure development in India serve as robust drivers for the Harmonic Filter Market, as businesses acknowledge the significance of power quality and reliability in their operations.

Growing Awareness of Power Quality Issues

Another significant driver of the Harmonic Filter Market in India is the growing awareness of power quality issues among consumers, businesses, and industries. As technology becomes increasingly integrated into daily life and industrial processes, the sensitivity of electronic equipment to power disturbances has risen. Any disruption in power quality can result in costly downtime, equipment damage, and production losses.The prevalence of harmonic distortions, voltage sags, and other power quality problems has increased due to the proliferation of non-linear loads and renewable energy sources such as solar and wind. Consumers and industries are recognizing the detrimental effects of poor power quality, and this awareness is propelling the adoption of harmonic filters as an effective solution to address these issues.

Furthermore, regulatory bodies and power utilities are imposing more stringent standards and guidelines for power quality and harmonics. Compliance with these regulations has become mandatory for industries, incentivizing them to invest in harmonic mitigation solutions. This regulatory push, combined with the heightened understanding of the impact of power quality issues, is driving the growth of the Harmonic Filter Market in India.

Expansion of Renewable Energy Generation

India has been actively promoting the utilization of renewable energy sources, such as solar and wind, to mitigate its carbon footprint and address the mounting energy demands. While renewable energy presents a sustainable and environmentally friendly solution, it poses distinctive challenges to the electrical grid, encompassing harmonics and voltage fluctuations. The intermittent nature of renewable energy generation can result in voltage variations and harmonic distortions within the grid.To ensure the seamless integration of renewable energy sources without compromising power quality, harmonic filters play a crucial role. These filters assist in alleviating the harmonics generated by inverters and converters within renewable energy systems, ensuring a stable and dependable power supply. With India's ongoing expansion of renewable energy capacity, the demand for harmonic filters is expected to align with this growth.

Moreover, governmental incentives and policies that support renewable energy initiatives are attracting investments to the sector, leading to an increased installation of solar and wind farms. The Harmonic Filter Market is poised to benefit from this trend as renewable energy developers prioritize grid compatibility and power quality enhancement through harmonic filtering solutions.

In conclusion, the expansion of renewable energy generation, driven by government initiatives and environmental concerns, serves as a pivotal driver for India's Harmonic Filter Market. As the nation continues to strike a balance in its energy mix with renewables, the significance of harmonic filters in maintaining grid stability and power quality will undoubtedly grow, cementing their critical role in the evolving energy landscape.

Key Market Challenges

Lack of Awareness and Education

One of the primary challenges confronting the Harmonic Filter Market in India is the pervasive lack of awareness and education regarding harmonic issues and their impact on electrical systems. Many consumers, businesses, and even some industries remain unaware of the existence and consequences of harmonics in power systems.Harmonics are electrical disturbances characterized by the presence of non-sinusoidal waveforms and frequencies that are integer multiples of the fundamental frequency (typically 50 Hz or 60 Hz). These harmonics can result in several adverse effects, including increased energy losses, equipment overheating, reduced equipment lifespan, and a decline in power system efficiency. However, due to the lack of awareness, these issues often go unnoticed until significant problems arise.

Furthermore, the intricate technical nature of harmonic mitigation solutions like harmonic filters can be overwhelming for non-specialists. This lack of understanding frequently leads to delayed or inadequate harmonic management measures. To tackle this challenge, stakeholders in the Harmonic Filter Market, including manufacturers, government bodies, and industry associations, should invest in educational initiatives and awareness campaigns. These efforts should target both end-users and professionals in the electrical and engineering fields to ensure a better comprehension of the significance of harmonic filters in maintaining power quality and system reliability.

Cost Constraints and Budgetary Limitations

One of the prominent challenges faced by the Harmonic Filter Market in India is the cost sensitivity of consumers, businesses, and industries. High-quality harmonic filters can be relatively expensive, particularly for small and medium-sized enterprises (SMEs) and residential consumers. This cost constraint often discourages potential buyers from investing in harmonic mitigation solutions, despite their awareness of the issues caused by harmonics.In India, where price considerations often play a crucial role in decision-making, the Harmonic Filter Market must address the challenge of making these essential products more affordable and accessible. Manufacturers and suppliers need to develop cost-effective solutions without compromising on quality. Additionally, government incentives and subsidies for harmonic filter adoption could encourage more businesses and industries to invest in these solutions.

Furthermore, there is a need to educate consumers and decision-makers about the long-term cost benefits of harmonic filters. While the initial investment may appear high, the potential savings in terms of reduced energy consumption, equipment maintenance, and downtime can justify the expense over time. Convincing stakeholders of the economic advantages of harmonic filters is crucial for overcoming the cost-related challenges in the market.

Regulatory and Standards Compliance

India's Harmonic Filter Market encounters challenges associated with regulatory compliance and adherence to international standards. As the nation endeavors to enhance its power infrastructure and grid reliability, regulatory bodies are imposing more stringent guidelines concerning harmonic distortion levels and power quality standards. While these regulations are crucial for protecting the electrical grid and ensuring a consistent power supply, they also present obstacles for businesses and industries.To meet regulatory requirements, the installation of advanced harmonic mitigation solutions is often necessary, which can be technically intricate and expensive. Businesses may face difficulties in navigating the regulatory landscape and ensuring compliance, especially if they lack expertise in power quality management. Moreover, the absence of a unified standard for harmonic limits in India can cause confusion and inconsistencies in implementation.

To overcome these challenges, it is imperative for the government to collaborate with industry associations and experts to establish clear and comprehensive guidelines for harmonic management. This includes defining standardized harmonic limits, offering technical support to businesses, and streamlining the compliance process. By establishing a well-defined regulatory framework and promoting adherence to international standards, India's Harmonic Filter Market can surmount regulatory obstacles and ensure sustained growth and adoption of harmonic filters in the country.

Key Market Trends

Increasing Adoption of Active Harmonic Filters

One notable trend in the India Harmonic Filter Market is the increasing adoption of active harmonic filters. Active harmonic filters are advanced, digitally-controlled devices designed to effectively mitigate harmonics and other power quality issues. They offer several advantages over traditional passive filters, including higher efficiency, dynamic compensation capabilities, and adaptability to changing load conditions.The demand for active harmonic filters is on the rise as industries and commercial establishments seek more robust solutions to address harmonics and power quality problems. Active filters can actively monitor the power system in real-time and inject compensating currents to neutralize harmonic distortions, making them highly effective in mitigating harmonics caused by non-linear loads and renewable energy sources.

As industries become more reliant on sensitive electronic equipment and automation technologies, the need for precise and adaptive harmonic filtering solutions is growing. This trend is expected to continue as businesses prioritize power quality and operational efficiency, driving the growth of active harmonic filters in the Indian market.

Integration of IoT and Smart Grid Technologies

The Harmonic Filter Market in India is witnessing a growing inclination towards incorporating Internet of Things (IoT) and smart grid technologies into harmonic filtering systems. IoT-enabled harmonic filters are equipped with sensors, communication modules, and advanced analytics capabilities, facilitating real-time monitoring and control of power quality parameters.These intelligent harmonic filters continuously gather data on harmonic levels, voltage quality, and other electrical parameters, enabling proactive maintenance and optimization of filtering performance. Moreover, they establish communication with other grid devices and management systems, thereby contributing to the development of more intelligent and efficient electrical grids.

Aligned with India's commitment to modernize its power infrastructure and enhance grid reliability, the integration of IoT and smart grid technologies into harmonic filtering solutions serves the broader objective of achieving a more interconnected and data-driven energy ecosystem. This trend not only enhances the efficacy of harmonic filters but also lays the foundation for more advanced grid management and optimization strategies.

Growth in Renewable Energy Integration

The integration of renewable energy into the Indian power grid is a significant trend impacting the Harmonic Filter Market. India has actively promoted the use of solar, wind, and other renewable sources to meet its growing electricity demand and reduce carbon emissions.However, the intermittent nature of renewable energy generation can introduce voltage fluctuations and harmonics into the grid, posing challenges to power quality and stability. Consequently, there is an increasing demand for harmonic filters to ensure the seamless integration of renewable energy sources.

Harmonic filters play a crucial role in mitigating the harmonics generated by inverters and converters in solar and wind power systems. They contribute to maintaining grid stability, reducing equipment wear and tear, and ensuring a reliable power supply.

As India continues to expand its renewable energy capacity and invest in clean energy projects, the Harmonic Filter Market is expected to grow accordingly. The commitment of the renewable energy sector to power quality and grid compatibility is likely to drive the demand for harmonic filtering solutions, making this trend a key driver of market growth in the coming years.

In conclusion, the India Harmonic Filter Market is witnessing several important trends, such as the adoption of active harmonic filters, the integration of IoT and smart grid technologies, and the increasing demand driven by renewable energy integration. These trends reflect the evolving landscape of power quality management in India and underscore the industry's dedication to addressing harmonic issues in an increasingly complex and dynamic electrical grid.

Segmental Insights

Voltage Level Insights

The Medium Voltage segment emerged as the dominant player in the global market in 2023. Utilities and distribution companies are increasingly investing in power quality solutions to ensure the reliability of the grid. This includes deploying harmonic filters in substations and distribution networks to maintain voltage stability. The growth of data centers, particularly in urban areas, has heightened the significance of power quality.Medium voltage harmonic filters play a vital role in ensuring the uninterrupted operation of data centers, which are highly sensitive to electrical disturbances. As India continues to expand its renewable energy capacity, the demand for medium voltage harmonic filters will persist. Collaborating with renewable energy developers and utilities can unlock opportunities in this sector. Data centers are critical infrastructure for the IT and telecommunications industries. Offering specialized medium voltage harmonic filter solutions for data center applications presents a niche opportunity.

End User Insights

The Industrial segment is projected to experience rapid growth during the forecast period. The industrial segment encompasses a wide array of industries, including manufacturing, automotive, chemical, and pharmaceutical. Within the India Harmonic Filter Market, the industrial sector plays a vital role in power quality management across various industries. Clean and stable electrical power is paramount for the efficient and reliable operation of industrial machinery and processes, underscoring the indispensability of harmonic filters.The demand for harmonic filters is driven by India's ongoing industrialization and infrastructure development. As industries expand and modernize, the utilization of non-linear loads, variable frequency drives (VFDs), and automation systems increases, leading to the emergence of harmonics issues. Automation and robotics are becoming increasingly integrated into industrial processes, heightening the sensitivity to power quality and necessitating the implementation of harmonic filters to ensure precise control and mitigate the risk of equipment damage.

Seizing the significant opportunity in the Indian market involves offering customized harmonic filter solutions tailored to the specific needs of different industries. Gaining a comprehensive understanding of the unique requirements across sectors is crucial. Enhancing market presence can be achieved by providing comprehensive services, including installation, commissioning, maintenance, and monitoring. Industrial customers highly value service packages that guarantee long-term performance.

Regional Insights

West India emerged as the dominant region in the India Harmonic Filter market in 2023. The Western region of India is renowned for its industrialization and economic development. It boasts major cities like Mumbai (Maharashtra) and Ahmedabad (Gujarat), which host a diverse range of industries including manufacturing, services, and information technology.The Western region is characterized by a strong industrial presence encompassing automotive manufacturing, chemicals, textiles, and pharmaceuticals. The continuous growth and modernization of industries drive the demand for harmonic filters. Additionally, the region is witnessing the development of numerous renewable energy projects, particularly wind farms and solar power plants. The integration of these renewable energy sources into the grid necessitates the use of harmonic filters to ensure power quality.

The industrial sector plays a vital role in driving the Harmonic Filter Market in the Western region. The expansion of manufacturing facilities and the widespread deployment of variable frequency drives (VFDs) and other non-linear loads contribute to harmonic issues that require effective mitigation. Government initiatives like the "Make in India" campaign and the development of industrial corridors further attract investments in the industrial sector. Compliance with power quality standards and the usage of harmonic filters are often mandated in these projects.

In conclusion, the Western region of India presents both unique opportunities and challenges for the Harmonic Filter Market. Harmonic filter providers looking to succeed in this dynamic industrial landscape should focus on addressing cost sensitivity, delivering customized solutions, and offering comprehensive services.

Report Scope:

In this report, the India Harmonic Filter Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Harmonic Filter Market, By Filter Type:

- Active

- Passive

- Hybrid

India Harmonic Filter Market, By Voltage Level:

- Low Voltage

- Medium Voltage

- High Voltage

India Harmonic Filter Market, By Phase:

- Single Phase

- Multi Phase

India Harmonic Filter Market, By End User:

- Telecom

- Industrial

- Commercial

- Others

India Harmonic Filter Market, By Region:

- North India

- South India

- East India

- West India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Harmonic Filter Market.Available Customizations:

India Harmonic Filter Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB India Limited

- Schneider Electric India Private Limited

- Larsen & Toubro Limited

- Emerson Network Power Pvt. Ltd

- Eaton Technologies Pvt Ltd

- Crompton Greaves Ltd.

- Siemens India

- Schaffner India

- NeoWatt Power Solutions Co. Pvt. Ltd.

- EPCOS India Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 77 |

| Published | October 2023 |

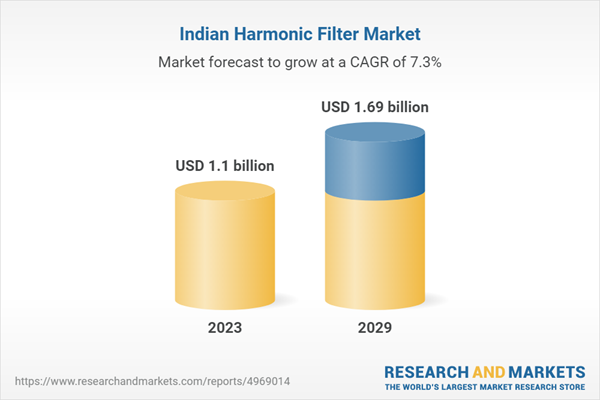

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 1.1 billion |

| Forecasted Market Value ( USD | $ 1.69 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | India |