The Batter and Breader Premixes Market size is estimated at USD 2.80 billion in 2024, and is expected to reach USD 3.79 billion by 2029, growing at a CAGR of 6.30% during the forecast period (2024-2029).

During the COVID-19 pandemic, the batter and breader premixes market was affected moderately. Moreover, the demand for packaged and convenience food increased during the pandemic, but the manufacturers witnessed a decrease in production due to the lockdown, and the supply chain was affected badly due to supply chain disruptions, stopping of manufacturing activity, and restricted raw material availability.

The primary factor driving the growth of the batter and breader premixes market is the increasing inclination of the consumers toward convenience foods, including processed meat and seafood. The growing trend of fast food culture both among young and youth populations has also attributed to the growth of the market. These premixes are used in restaurants to improve food presentation by preventing cracks, splits, and fall-offs.

Rising consumer demand for nutritious, low-calorie, organic, and gluten-free ingredients is fostering the breader premixes market participants with more nutritional content in the market landscape.

This product will be delivered within 2 business days.

During the COVID-19 pandemic, the batter and breader premixes market was affected moderately. Moreover, the demand for packaged and convenience food increased during the pandemic, but the manufacturers witnessed a decrease in production due to the lockdown, and the supply chain was affected badly due to supply chain disruptions, stopping of manufacturing activity, and restricted raw material availability.

The primary factor driving the growth of the batter and breader premixes market is the increasing inclination of the consumers toward convenience foods, including processed meat and seafood. The growing trend of fast food culture both among young and youth populations has also attributed to the growth of the market. These premixes are used in restaurants to improve food presentation by preventing cracks, splits, and fall-offs.

Rising consumer demand for nutritious, low-calorie, organic, and gluten-free ingredients is fostering the breader premixes market participants with more nutritional content in the market landscape.

Batter and Breader Premixes Market Trends

Increasing demand for convenience food and ready to cook meals

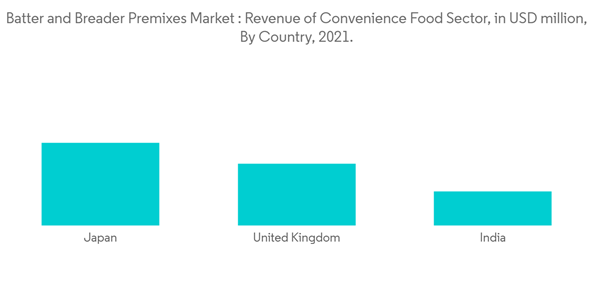

The rising standard of living, growing working population, and increasing disposable income as a result of the growing economy, particularly in emerging economies such as India, Brazil, and China, has resulted in an increase in demand for convenience and processed meals. The expansion of the batter and breader premixes market is boosted by an increase in the number of quick-service restaurants and food outlets, as well as the growing embrace of fast-food culture. Emerging economies have been rising faster than industrialized economies in terms of processed foods in recent years, owing to the rapid rise of the processed food industry in these countries. Consumer preferences have gradually shifted away from traditional ways of food preparation at home and toward purchasing packaged meals. Consumer preferences have gradually evolved toward processed meat items, such as frozen meat and seafood products and sausages, as their lives have changed.Europe Holds a Prominent Market Share

Consumers' high disposable income and fast food consumption fuel this segment's growth. The demand for batter and breader premixes in this region has increased due to the increased penetration of quick-service restaurants and increased consumption of chicken and beef. The high demand for fried food has prompted industry operators to create new items that appeal to consumers' local preferences. Ease of use, high nutritional value, functionality, and quick delivery are just a few of the many attributes processors look for in premixes, and companies are increasingly bringing innovative and creative ideas to meet this demand. With the growing demand for the batter and breader premixes, players are expanding their presence in the region. For instance, Bowman Ingredients invested EUR 8 million in a new European manufacturing facility as it looks to expand its global presence and meet growing customer demand.Batter and Breader Premixes Industry Overview

Emphasis is given to the merger, expansion, acquisition, and partnership of the companies along with new product development as strategic approaches adopted by the leading companies to boost their brand presence among consumers. The Major Players in the batter & breader premixes market include Bowman Ingredients, Blendex Company, Ingredion Incorporated, Cargill, Incorporated, Breading & Coating Ltd, McCormick & Company, Bunge Limited, Associated British Foods plc, Archer Daniels Midland Company, Kerry Group and other. The batter and breader premix market are fragmented with the presence of various major players, such as Bungee, Kerry, and Bowman Ingredients, among others. Players in the market are actively involved in various activities, such as expansions, product innovations, etc.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET DYNAMICS

5 MARKET SEGMENTATION

6 COMPETITIVE LANDSCAPE

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bunge Limited

- Kerry Group PLC

- Newly Weds Foods Inc.

- Bowman Ingredients

- McCormick & Company Inc.

- Ajinomoto Co. Inc.

- The Archer Daniels Midland Company

- Breading & Coating Ltd.

- House-Autry mills Inc.

- Ingredion Incorporated

Methodology

LOADING...