Key Players are Peloton Interactive, Nautilus, Technogym, and Johnson Health Tech Co

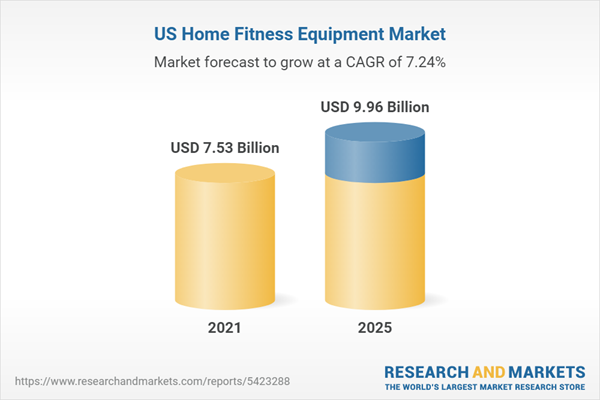

The US home fitness equipment market has increased significantly during the years 2018-2020, the market flourished more progressively in 2020 owing to spread of COVID-19. Furthermore, projections are made that the market would rise in the next four years i.e. 2021-2025 tremendously.

The home fitness equipment market is expected to increase due to rising millennial population, growing prevalence of obesity, rapid urbanization, increasing incidence of chronic diseases, surging online sales of fitness equipment, soaring fitness conscious population, etc. Moreover, the market faces some challenges such as space limitation, high cost of fitness equipment, etc.

The market is fairly fragmented with several market players operating in different states. The key players of the home fitness equipment market are Peloton Interactive, Inc., Nautilus, Inc., Technogym S.p.A., and Johnson Health Tech Co. Ltd., and are profiled with their financial information and respective business strategies.

Scope of the Report

This report provides an in depth analysis of the US home fitness equipment market by value and by type. The report also provides a detailed analysis of the COVID-19 impact on the home fitness equipment market in the US.

The report also assesses the key opportunities in the market and outlines the factors that are and will be driving the growth of the industry. Growth of the US home fitness equipment market has also been forecasted for the period 2021-2025, taking into consideration the previous growth patterns, the growth drivers and the current and future trends.

Company Coverage

- Peloton Interactive, Inc.

- Nautilus, Inc.

- Technogym S.p.A.

- Johnson Health Tech Co. Ltd.

Table of Contents

1. Executive Summary

2. Introduction

2.1 Fitness: An Overview

2.2 Home Fitness: An Overview

2.2.1 Home Fitness: Pros and Cons

2.3 Home Fitness Equipment: An Overview

2.3.1 Benefits of Using Fitness Equipment at Home

2.3.2 List of Commonly Used Home Fitness Equipment

2.4 Home Fitness Equipment Segmentation: An Overview

2.4.1 Home Fitness Equipment Segmentation by Type

2.4.2 Home Fitness Equipment Segmentation by Distribution Channel

3. The US Market Analysis

3.1 The US Home Fitness Equipment Market: An Analysis

3.1.1 The US Home Fitness Equipment Market by Value

3.1.2 The US Home Fitness Equipment Market by Type (Treadmill, Elliptical Machine, Exercise Cycle, Rowing Machine, and Others)

3.2 The US Home Fitness Equipment Market: Type Analysis

3.2.1 The US Home Treadmill Market by Value

3.2.2 The US Home Elliptical Machine Market by Value

3.2.3 The US Home Exercise Cycle Market by Value

3.2.4 The US Home Rowing Machine Market by Value

3.2.5 The US Home Other Fitness Equipment Market by Value

4. Impact of COVID-19

4.1 Impact of COVID-19 on Economy

4.1.1 The Economic Effects of COVID-19

4.1.2 Impact of COVID-19 on Fitness Industry

4.1.3 Impact of COVID-19 on Home Fitness Equipment

5. Market Dynamics

5.1 Growth Driver

5.1.1 Rising Millennial Population

5.1.2 Growing Prevalence of Obesity

5.1.3 Rapid Urbanization

5.1.4 Increasing Incidence of Chronic Diseases

5.1.5 Surging Online Sales of Fitness Equipment

5.1.6 Soaring Fitness Conscious Population

5.2 Challenges

5.2.1 Space Limitation

5.2.2 High Cost of Fitness Equipment

5.3 Market Trends

5.3.1 Growing Influence of Social Media

5.3.2 Rise in Trend of Wearable Devices

5.3.3 Introduction of Innovative Home Fitness Equipment

6. Competitive Landscape

6.1 The US Home Fitness Equipment Market Players: A Financial Comparison

6.2 The US Home Fitness Equipment Market Players by Research & Development (R&D) Expenses

7. Company Profiles

7.1 Peloton Interactive, Inc.

7.1.1 Business Overview

7.1.2 Financial Overview

7.1.3 Business Strategy

7.2 Nautilus, Inc.

7.2.1 Business Overview

7.2.2 Financial Overview

7.2.3 Business Strategy

7.3 Technogym S.p.A.

7.3.1 Business Overview

7.3.2 Financial Overview

7.3.3 Business Strategy

7.4 Johnson Health Tech Co. Ltd.

7.4.1 Business Overview

7.4.2 Business Strategy

List of Tables & Figures

Table 1: The US Home Fitness Equipment Market Players: A Financial Comparison; 2020

Figure 1: Components of Fitness

Figure 2: Home Fitness: Pros and Cons

Figure 3: Benefits of Using Fitness Equipment at Home

Figure 4: List of Commonly Used Home Fitness Equipment

Figure 5: Home Fitness Equipment Segmentation by Type

Figure 6: Home Fitness Equipment Segmentation by Distribution Channel

Figure 7: The US Home Fitness Equipment Market by Value; 2018-2020 (US$ Billion)

Figure 8: The US Home Fitness Equipment Market by Value; 2021-2025 (US$ Billion)

Figure 9: The US Home Fitness Equipment Market by Type; 2020 (Percentage, %)

Figure 10: The US Home Treadmill Market by Value; 2018-2020 (US$ Billion)

Figure 11: The US Home Treadmill Market by Value; 2021-2025 (US$ Billion)

Figure 12: The US Home Elliptical Machine Market by Value; 2018-2020 (US$ Billion)

Figure 13: The US Home Elliptical Machine Market by Value; 2021-2025 (US$ Billion)

Figure 14: The US Home Exercise Cycle Market by Value; 2018-2020 (US$ Billion)

Figure 15: The US Home Exercise Cycle Market by Value; 2021-2025 (US$ Billion)

Figure 16: The US Home Rowing Machine Market by Value; 2018-2020 (US$ Million)

Figure 17: The US Home Rowing Machine Market by Value; 2021-2025 (US$ Million)

Figure 18: The US Home Other Fitness Equipment Market by Value; 2018-2020 (US$ Billion)

Figure 19: The US Home Other Fitness Equipment Market by Value; 2021-2025 (US$ Billion)

Figure 20: The US Number of Unemployed Persons & Unemployment Rate; April 2019-April 2020 (Million & Percentage, %)

Figure 21: The US Estimate Timescale for Return to Gym/Exercise Classes due to COVID-19 Pandemic as of April 2020 (Percentage, %)

Figure 22: The US Use of Video Conferencing for Fitness Classes by Age during the COVID-19 Pandemic as of April 2020 (Percentage, %)

Figure 23: The US Millennial Population; 2016-2036 (Million)

Figure 24: The US Obesity Rate; 2011-2018 (Percentage, %)

Figure 25: The US Urban Population; 2016-2020 (Percentage, %)

Figure 26: The US Chronic Diseases Growth Rates; 2016-2025 (Percentage, %)

Figure 27: The US E-commerce Penetration; 2015-2020 (Percentage, %)

Figure 28: The US Fitness Market Revenue; 2015-2019 (US$ Billion)

Figure 29: The US Social Network Users; 2020-2025 (Million)

Figure 30: The US Adult Wearable Users and Penetration; 2018-2022 (Million & Percentage, %)

Figure 31: The US Home Fitness Equipment Market Players by Research & Development (R&D) Expenses; 2019-2020 (US$ Million)

Figure 32: Peloton Interactive, Inc. Total Revenue; 2017-2020 (US$ Million)

Figure 33: Peloton Interactive, Inc. Total Revenue by Segments; 2020 (Percentage, %)

Figure 34: Peloton Interactive, Inc. Total Revenue by Region; 2020 (Percentage, %)

Figure 35: Nautilus, Inc. Net Sales; 2016-2020 (US$ Million)

Figure 36: Nautilus, Inc. Net Sales by Segments; 2020 (Percentage, %)

Figure 37: Nautilus, Inc. Net Sales within Each Business Segment by Product Lines; 2020 (Percentage, %)

Figure 38: Nautilus, Inc. Net Sales by Region; 2020 (Percentage, %)

Figure 39: Technogym S.p.A. Revenues; 2016-2020 (US$ Million)

Figure 40: Technogym S.p.A. Revenues by Distribution Channel; 2020 (Percentage, %)

Figure 41: Technogym S.p.A. Revenues by Region; 2020 (Percentage, %)

Executive Summary

Fitness equipment is a sub-category of the larger sporting goods sector. Fitness equipment can be used at home to complete a good fitness routine. Home fitness equipment is defined as a machine that is used to perform any fitness activity, or to exercise at home. The major fitness equipment that are used for physical exercise at home include treadmills, weight machines, elliptical machines, stationary bicycles, strength building machines, and others.

There are two broad categories of home fitness equipment: cardiovascular training equipment and strength training equipment. Cardiovascular training equipment includes ski machines, elliptical machines, rowing machines, stair-steppers, treadmill, and exercise cycle. Strength training equipment includes ankle weights, exercise mat, hand weights, resistance bands, weighted arm bands, and tubing. The home fitness equipment market can be segmented on the basis of type, and distribution channel.

Companies Mentioned

- Johnson Health Tech Co. Ltd.

- Nautilus, Inc.

- Peloton Interactive, Inc.

- Technogym S.p.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 63 |

| Published | September 2021 |

| Forecast Period | 2021 - 2025 |

| Estimated Market Value ( USD | $ 7.53 Billion |

| Forecasted Market Value ( USD | $ 9.96 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | United States |

| No. of Companies Mentioned | 4 |