Speak directly to the analyst to clarify any post sales queries you may have.

The World Health Organization (WHO) endorses that gloves should be used to reduce the risk of contamination with blood and other body fluids and decrease the spread and transmission of germs from a health professional to patients and vice versa. In addition, the medical gloves market is expected to grow as they protect against chemical and biological agents, good structural stability, mechanical strength, and resistance. They guarantee durability and multifunctionality in a diversified environment.

In 2022, the Monkeypox disease spread in many countries. One of the preventive measures includes the usage of medical gloves among healthcare professionals. Such factors are contributing to the consistent medical gloves market growth. The WHO issued guidelines to support surveillance, laboratory work, clinical care, infection prevention and control, risk communication, and community engagement to educate vulnerable communities and the public about monkeypox. Recommended personal protective equipment (PPE) includes medical gloves, gown, medical mask, and eye protection - goggles or face shield. This expects to increase the demand for medical gloves among healthcare facilities.

MARKET DRIVERS & OPPURTUINIES

Growing Demand for Powder-free or Non-powdered Medical Gloves

With the use of latex gloves, there has been a growing incidence of allergic or hypersensitivity reactions among healthcare workers. Allergic reactions such as irritant contact dermatitis, a non-immunologic response to an irritant, or skin damage occur on the wrists and hands. Due to this, the global gloves market is expected to boost as people are shifting to adopt non-powdered or powder-free gloves, synthetic gloves, or low-protein latex gloves.A Rise in Development of Novel Medical Gloves

Manufacturers focus on research and development activities to develop novel disposable gloves in the healthcare industry. Vendors are developing newer innovative medical gloves that meet new market requirements. For instance, the University of Nottingham developed a new anti-microbial medical glove that kills microorganisms without adding chemicals.Automated Medical Glove Manufacturing

Automation in medical gloves manufacturing has taken several strides. It has further decreased medical glove costs and helped the global medical gloves market to grow significantly. Companies have established modern automatic medical gloves production lines. Hartalega Holdings, a leading vendor, has become one of the most automated glove production companies since the outbreak of the COVID-19 pandemic.Impact of Stringent Health Regulations

In response to growing concerns among HCPs and industry experts, new research information, and new barrier materials, many standards have been developed for medical glove manufacturing over the years. The FDA requirements for market entry of medical glove manufacturers have also changed accordingly, leading to the production of high-quality gloves. With the latest guidelines mandating the application of gloves, the growth of the medical gloves market is likely to increase worldwide.Preference for Nitrile over Latex Medical Gloves

In recent years, there has been a shift from nitrile gloves to latex ones in the medical segment. Majorly due to various advantages of nitrile gloves and the presence of latex allergies from natural rubber latex material. One of the significant advantages is that nitrile gloves offer higher resistance to chemicals, oils, and acids and have superior strength to natural rubber.The University of Pennsylvania’s Environmental Health and Radiation Safety unit has revealed that nitrile is a synthetic rubber that acts as an excellent material for general-purpose gloves due to its chemical resistance and elasticity. Such properties also make these disposable nitrile gloves common for surgical applications and handling laboratory chemicals, boosting nitrile's growth over latex gloves in the global medical gloves market.

High Risk of Cross Contamination in Healthcare Settings

Hospital-acquired infections have become a significant risk among patients and healthcare workers in healthcare centers worldwide. Cross-contamination occurring at the hands of HCPs is considered the most common HAI transmission. HAIs can lead to serious infections such as central line-associated bloodstream infections, catheter-associated urinary tract infections, ventilator-associated pneumonia (VAP), and methicillin-resistant staphylococcus aureus. Hence, gloves have been mandated in the healthcare center to prevent spreading infections acting as a significant growth factor in the medical gloves market.SEGMENTATION ANALYSIS

Insights By Material

The nitrile gloves market accounted for a major share of 55.20% by revenue, and the latex segment constituted a share of 45.56% by volume in 2021. Nitrile latex gloves are now almost as comfortable and breathable as natural rubber latex gloves. In addition, nitrile latex gloves can be sterilized without affecting their physical properties. Therefore, due to their superior performance, many industries choose nitrile latex gloves in the medical gloves market.Segmentation by Material

- Nitrile

- Latex

- Vinyl

- Neoprene

- Others

Insights By Applications

The global medical gloves market is divided into an examination and surgical segments by application segments. In 2021, the examination segment accounted for a significant share of 81.89% of revenue. Examination gloves prevent infectious agents' disease transmission between patients and healthcare providers. They are available as both sterile and non-sterile in the market. Most examination gloves are made of latex and are widely used in medical examinations, diagnostic examinations, and other lab practices also prefer examination gloves.Segmentation by Application

- Examination

- Surgical

Insights By Category

In 2021, the non-powdered medical gloves market accounted for 68.97% by revenue and 73.12% by volume. Initially, the powdered glove segment had a better industry share. However, powdered gloves were causing serious allergies and skin irritations among users, causing end-users to shift to powder-free gloves. Many organizations made multiple guidelines to avoid the use of powdered gloves. This has drastically reduced the use of powdered gloves in the medical gloves market, giving a higher share to the non-powered.Segmentation by Category

- Non-Powdered

- Powdered

Insights By End-User

The hospital end-user segment accounted for 54.08% of revenue and is likely to retain its industry dominance during the forecast period. Hospitals are the primary contact for health issues. In addition, hospitals are preferred places for surgeries as they are equipped with the required technology, and skilled professionals are placed to handle complex cases. Physicians, nursing staff, and other helpers wear gloves as a part of the standard protocol helping to contribute significantly to the global medical gloves market to prevent the spread of diseases among healthcare workers and patients.Segmentation by End-user

- Hospitals

- Diagnostic Laboratories

- ASCS

- Clinics

- Others

GEOGRAPHICAL OVERVIEW

- North America accounted for the largest share of 33.93% in the global medical glove market. North America is one of the largest consumers of gloves, and the consumption of medical gloves is also high in this region. This is due to the increased awareness among the general population regarding hand hygiene and well-established healthcare settings which are accessible to a majority of the population in the region.

- The APAC region is a mixture of developed and developing countries with large populations. APAC comprises a mix of healthcare markets at different stages of development. Japan, for instance, is one of the world's largest and most well-developed healthcare industries. The surgical trends in Japan reflect the growing emphasis on cost-containment, demand for advanced and minimally invasive technologies, and efforts to reduce the dependency on expensive, high-acuity care settings.

- In 2021, Europe accounted for 31.13% of the global medical gloves market. Significant factors contributing to the growth of the industry in Europe are growth in the aging population, the prevalence of chronic diseases, and the emergence of epidemics and pandemics. Germany, France, Italy, Spain, and the UK account for the largest share of the European medical glove market.

Segmentation by Geography

- APAC

- China

- Japan

- India

- South Korea

- Australia

- Vietnam

- Philipines

- Thailand

- Malaysia

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Netherlands

- Poland

- Latin America

- Brazil

- Mexico

- Argentina

- Columbia

- Chile

- Middle East & Africa

- Turkey

- Saudi Arabia

- South Africa

- UAE

- Iran

COMPETITIVE LANDSCAPE

The global medical gloves market is highly competitive and dynamic, with many global, regional, and local vendors offering a diverse range of gloves for examination and surgical applications. Approximately 400 vendors are offering a wide array of medical gloves worldwide. Key players in the global medical gloves market include Ansell, Kossan Rubber Industries, Hartalega Holdings, and Supermax, which have consistently grown over the last few years. Moderate to high growth of major players will continue to boost the global medical gloves market.Key Vendors

- ANSELL

- Hartalega Holdings

- Kossan Rubber Industries

- Mercator Medical

- Supermax

- Top Glove

Other Prominent Vendors

- A1 Glove

- Happy Hand Gloves

- Hycare International

- Kanam Latex Industries

- Meditech Gloves

- Maxwell Glove Manufacturing Berhad

- Tan Sin Lian Industries

- VLHS

- Winmed Group

- YTY Group

- ACTEON

- AKZENTA INTERNATIONAL

- AlboLand

- American Nitrile

- Amigo Surgicare

- Amkay Products

- ANSELL

- B. Braun Melsungen

- Bergamot

- BERNER International

- Cardinal Health

- CEABIS

- Demophorius Healthcare

- DIDACTIC

- Elcya

- ERENLER MEDIKAL

- Franz Mensch

- GLOVE RESOURCES

- Hartalega Holdings Berhad

- Hepro

- HUM

- HYGECO

- Innovative Gloves

- INTCO MEDICAL TECHNOLOGY

- Indoplas Philippines

- KALTEK

- Kossan Rubber Industries

- Leboo Healthcare Products

- LOW DERMA

- Medadv

- MEDIBASE

- Medilivescare Manufacturing

- Mercator Medical

- Mölnlycke Health Care

- MRK Healthcare

- Neomedic

- Phoenix Rubber Products

- Pidegree Industrial

- Polyco Healthline

- PM Gloves

- Quality Latex Products

- RFB Latex

- Riverstone Holdings

- Robinson Healthcare

- Safeshield gloves

- Sara healthcare

- SHIELD Scientific

- SHOWA GROUP

- Smart Glove

- Sri Trang Agro-Industry Public Company

- Semperit AG Holding

- Supermax

- Top Glove

- TROGE MEDICAL

- Unigloves

- WRP Asia Pacific

- Wujiang Evergreen

KEY QUESTIONS ANSWERED:

1. What is the size of the global medical gloves market?2. What is the growth rate of the global medical gloves market?

3. What are the key driving factors in the medical gloves market?

4. Who are the key vendors in the medical gloves market?

5. Which region holds the largest global medical gloves market share?

Table of Contents

Companies Mentioned

- ANSELL

- Hartalega Holdings

- Kossan Rubber Industries

- Mercator Medical

- Supermax

- Top Glove

- A1 Glove

- Happy Hand Gloves

- Hycare International

- Kanam Latex Industries

- Meditech Gloves

- Maxwell Glove Manufacturing Berhad

- Tan Sin Lian Industries

- VLHS

- Winmed Group

- YTY Group

- ACTEON

- AKZENTA INTERNATIONAL

- AlboLand

- American Nitrile

- Amigo Surgicare

- Amkay Products

- ANSELL

- B. Braun Melsungen

- Bergamot

- BERNER International

- Cardinal Health

- CEABIS

- Demophorius Healthcare

- DIDACTIC

- Elcya

- ERENLER MEDIKAL

- Franz Mensch

- GLOVE RESOURCES

- Hartalega Holdings Berhad

- Hepro

- HUM

- HYGECO

- Innovative Gloves

- INTCO MEDICAL TECHNOLOGY

- Indoplas Philippines

- KALTEK

- Kossan Rubber Industries

- Leboo Healthcare Products

- LOW DERMA

- Medadv

- MEDIBASE

- Medilivescare Manufacturing

- Mercator Medical

- Mölnlycke Health Care

- MRK Healthcare

- Neomedic

- Phoenix Rubber Products

- Pidegree Industrial

- Polyco Healthline

- PM Gloves

- Quality Latex Products

- RFB Latex

- Riverstone Holdings

- Robinson Healthcare

- Safeshield gloves

- Sara healthcare

- SHIELD Scientific

- SHOWA GROUP

- Smart Glove

- Sri Trang Agro-Industry Public Company

- Semperit AG Holding

- Supermax

- Top Glove

- TROGE MEDICAL

- Unigloves

- WRP Asia Pacific

- Wujiang Evergreen

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 539 |

| Published | August 2022 |

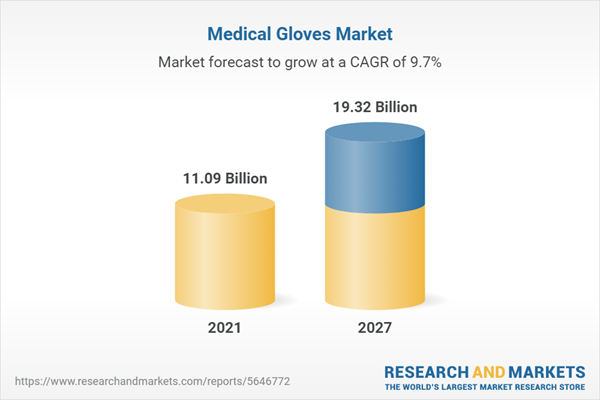

| Forecast Period | 2021 - 2027 |

| Estimated Market Value in 2021 | 11.09 Billion |

| Forecasted Market Value by 2027 | 19.32 Billion |

| Compound Annual Growth Rate | 9.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 73 |