Free Webex Call

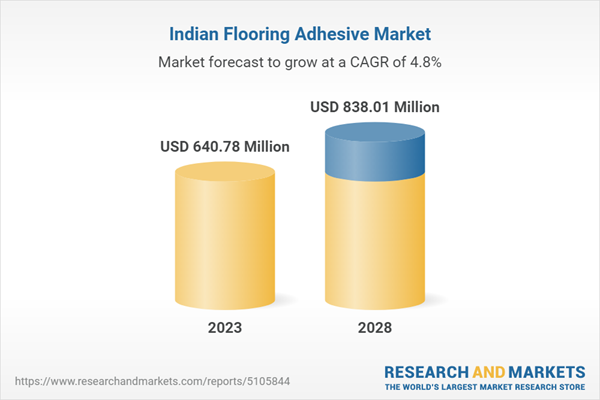

India Flooring Adhesive Market has reached reach USD 640.78 million by 2023 and is anticipated to project robust growth in the forecast period with a CAGR of 4.84% through 2029. Flooring adhesives are not just essential for the installation of floor coverings; they are the backbone that ensures a robust bond between the floor surface and the covering material. This bond enhances the longevity and durability of the flooring, making it a crucial factor in the overall quality of any construction project. With the Indian construction industry witnessing a significant boom, the demand for high-quality flooring solutions has surged to meet the growing needs of the market. Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The residential sector, in particular, has emerged as a significant contributor to this growth. More and more homeowners are investing in renovation and home improvement projects, seeking to elevate the aesthetics and functionality of their living spaces. At the same time, the commercial and industrial sectors are also playing a pivotal role in propelling the market expansion. The demand for durable and aesthetically pleasing flooring solutions is on the rise in workplaces, retail spaces, and manufacturing units, as businesses recognize the impact of a well-designed floor on their overall image and productivity.

In conclusion, it is evident that the flooring adhesive market in India is on a strong growth trajectory, driven by the rising demand across residential, commercial, and industrial sectors. With continued advancements in adhesive technology and the expanding construction industry, the future of India's flooring adhesive market appears promising. As more projects come to fruition and the market evolves, it is crucial for manufacturers and suppliers to stay at the forefront of innovation, consistently delivering high-quality and reliable solutions to meet the diverse needs of customers across the country.

Key Market Drivers

Growth in Construction Industry

India's construction industry is not only one of the fastest-growing in the world but also boasts a unique set of factors that fuel its expansion. The remarkable growth can be attributed to rapid urbanization, a burgeoning population, and the implementation of government initiatives such as the 'Housing for All' scheme. This comprehensive development strategy has created a surge in construction activities, which in turn drives the demand for various construction materials, including flooring adhesives.Flooring adhesives, often overlooked but crucial in the overall construction process, play a vital role in ensuring the longevity and durability of floor coverings. These adhesives create a strong and reliable bond between the floor surface and the covering material, offering stability and resistance to wear and tear. As construction projects multiply across residential, commercial, and industrial sectors, the need for these adhesives escalates, propelling the growth of the market.

Unquestionably, the residential sector plays a significant role in driving the demand for flooring adhesives. With the increasing construction of new homes and a rising trend in home renovations, homeowners are now more inclined to invest in high-quality flooring solutions. The desire for aesthetically pleasing and long-lasting flooring options amplifies the need for reliable and durable flooring adhesives, further boosting the market.

However, it is not just the residential sector that contributes to the flourishing market. The commercial and industrial sectors also play a vital role in driving the demand for flooring adhesives. With the surge in office spaces, retail outlets, and manufacturing units, businesses are now seeking flooring solutions that are not just functional but also aesthetically pleasing. These sectors require durable and visually appealing flooring options, thereby increasing the demand for flooring adhesives and adding momentum to the market's expansion.

Considering the remarkable growth of India's construction industry, it comes as no surprise that the demand for flooring adhesives is expected to follow suit. As the construction sector continues its upward trajectory, the need for reliable and high-performance flooring adhesives will only intensify. This correlation signifies the immense potential of the construction industry to further fuel the growth of the flooring adhesive market in India, cementing its position as a key driver of the country's overall economic growth.

Rise in Disposable Income

As India's economy continues to grow at a rapid pace, the disposable income of its citizens has witnessed a substantial increase. This surge in income has not only brought about a change in lifestyle but has also led to a significant shift in consumption patterns. With greater financial resources at their disposal, more and more individuals are now investing in home improvement and renovation projects to enhance the aesthetics and functionality of their living spaces.This evolving trend in home improvement directly impacts the demand for construction materials, particularly flooring adhesives. Flooring adhesives play a pivotal role in installing various types of floor coverings, ensuring their durability and longevity. With the rise in disposable income, homeowners are now able to afford higher-quality flooring solutions, which in turn drives the demand for reliable and effective flooring adhesives.

The residential sector plays a significant role in shaping this scenario. As homeowners seek to upgrade and personalize their living spaces, there is a surge in demand for diverse flooring options, ranging from classic ceramic tiles to contemporary luxury vinyl tiles. This growing demand for high-quality flooring translates into an increased need for advanced and efficient flooring adhesives, propelling the market's growth.

Moreover, the commercial sector also contributes significantly to the demand for flooring adhesives. As businesses strive to create aesthetically pleasing and professional workspaces, the need for attractive and durable flooring solutions escalates. With the increased disposable income, businesses are now more willing to invest in premium flooring options, which further stimulates the demand for high-quality and reliable flooring adhesives.

The rise in disposable income among Indian households serves as a major driving force behind the growth of the country's flooring adhesive market. As incomes continue to rise and the desire for quality living and working spaces intensifies, the demand for flooring adhesives is set to maintain its upward trajectory. This trend highlights the immense potential of rising disposable income to further fuel the growth of India's flooring adhesive market, creating new opportunities for manufacturers and suppliers in the industry.

Key Market Challenges

Variability in Climatic Conditions

India's geographical expanse encompasses a wide range of climatic zones, each with its own unique characteristics. From the cold, snow-covered regions of the Himalayas to the hot and humid coastal areas, the country experiences a remarkable diversity in climate.This climatic variability has a direct impact on the performance and effectiveness of flooring adhesives. Different types of adhesives behave differently under varying temperature and humidity conditions. For instance, in cold and dry regions, certain adhesives may perform well, providing strong bonding strength. However, the same adhesives may not be as effective in hot and humid areas, where high temperatures can cause them to soften and lose their bonding strength. Similarly, high humidity can hinder the curing process of some adhesives, affecting their overall effectiveness.

Conversely, in low-temperature environments, some adhesives may become brittle and less effective, posing challenges for their application. As such, manufacturers of flooring adhesives need to carefully consider these climatic variables when formulating their products, ensuring that they meet the specific requirements of different regions.

This climatic variability poses a unique challenge for the flooring adhesive market in India. Manufacturers and suppliers must offer a diverse range of products tailored to the specific needs of different climatic conditions. This requirement increases production complexity and costs, as manufacturers need to develop formulations that can perform optimally in various climates.

Moreover, customers in India need to be well-informed about the suitability of different adhesives for their specific locations and climatic conditions. Educating customers about the impact of climate on adhesive performance adds another layer of complexity to the market. However, it also presents an opportunity for manufacturers to innovate and develop solutions specifically tailored to the diverse needs of the Indian market.

The variability in India's climatic conditions, while posing a significant challenge, also offers manufacturers an opportunity to demonstrate their expertise and develop innovative solutions. By addressing the specific demands of different climatic zones, manufacturers can ensure the continued growth and success of the flooring adhesive market in India.

Key Market Trends

Rising Preference for High-Performance Adhesives

Traditionally, flooring adhesives were perceived as mere bonding agents, serving a basic function. However, with advancements in adhesive technology, these products have undergone a remarkable transformation, evolving into solutions that offer superior performance and a wide range of benefits.The shift towards high-performance adhesives is being driven by the growing awareness and demand for quality products that can withstand the test of time and various environmental conditions. In the residential sector, homeowners are increasingly seeking durable and aesthetically pleasing flooring solutions that can elevate the ambiance of their living spaces. With the rise of luxury vinyl tiles, engineered wood, and other high-end flooring materials, the need for adhesives that can effectively bond these surfaces has grown exponentially.

These high-performance adhesives not only provide a strong bond but also ensure the longevity and integrity of the flooring, making them the preferred choice among homeowners who value both durability and aesthetics. Moreover, they offer enhanced resistance to temperature and moisture, which further contributes to the overall performance and durability of the flooring.

The commercial and industrial sectors are also wholeheartedly embracing this trend. Businesses and industries demand flooring solutions that can withstand heavy foot traffic, wear and tear, and harsh environmental conditions without compromising on performance or aesthetics. High-performance adhesives have proven to meet these demanding requirements, offering superior bonding strength, durability, and long-lasting performance.

The rising preference for high-performance adhesives is not limited to a particular region or market segment; it is a significant trend observed in India's flooring adhesive market. As consumers continue to seek out high-quality, durable, and reliable flooring solutions, the demand for these advanced adhesives is poised to grow steadily. This trend underlines the immense potential of high-performance adhesives to drive the future growth of India's flooring adhesive market, as they become the go-to choice for professionals and homeowners alike.

By continuously innovating and pushing the boundaries of adhesive technology, manufacturers are catering to the evolving needs of the market, offering a diverse range of high-performance adhesives that deliver exceptional results across various applications. As the demand for quality and performance escalates, the market for high-performance adhesives will continue to thrive, shaping the future of the flooring industry in India.

Segmental Insights

Type Insights

Based on the category of type, the acrylic adhesives segment emerged as the dominant player in the Indian market for Flooring Adhesive in 2023. Acrylic resins are highly regarded for their unique characteristics, including fast-setting time and superior adhesion to challenging substrates. They not only provide excellent environmental resistance but also play a vital role in the development of waterborne and heat-resistant adhesives, as well as Ultraviolet (UV) light-curing adhesives.These versatile resins find particular preference in the installation of resilient and wooden floorings, especially on moisture-free porous or rugged surfaces. Thanks to their remarkable resistance to plasticizer migration, they offer long-lasting and durable bonds that stand the test of time. Their exceptional performance and reliability make them a top choice for various applications in the adhesive industry.

Application Insights

The tile & stone segment is projected to experience rapid growth during the forecast period. The increasing construction spending in emerging economies, driven by infrastructure development and urbanization, is expected to significantly boost the demand for flooring adhesives in tile and stone applications over the forecast period. This can be attributed to the growing need for durable and high-performance adhesives that can withstand heavy foot traffic and provide long-lasting adhesion.Carpet, as a prominent second-generation adhesive product, has gained popularity for indoor applications due to its superior properties. These properties include ease of installation, cost-effectiveness, and sustainability, making it an attractive choice for both residential and commercial settings. The rising demand for low-pile carpets, especially in residential settings, can be attributed to their ability to enhance comfort, reduce noise, and offer a wide range of design options.

Furthermore, the increasing disposable income and rising living standards have contributed to a higher rate of carpet installations in the country. As consumers seek to create cozy and aesthetically pleasing living spaces, the demand for carpets as a flooring option has witnessed a positive impact on the industry's growth. This trend is expected to continue as more homeowners and businesses prioritize the use of carpets to enhance the overall ambiance and comfort of their spaces.

Regional Insights

West India emerged as the dominant player in the India Flooring Adhesive Market in 2023, holding the largest market share in terms of value. West India, comprising major states like Maharashtra and Gujarat, stands as one of the most economically prosperous regions in the country. With its flourishing economy, the region witnesses a rise in disposable incomes, leading to an upsurge in spending on construction and home improvement projects. Consequently, there is an increasing demand for construction materials, particularly flooring adhesives, in this thriving area.The dominance of West India in the flooring adhesive market can be attributed to rapid urbanization and infrastructure development. Metropolises like Mumbai and Pune are experiencing a construction boom, with a multitude of residential, commercial, and infrastructure projects underway. These ongoing construction activities fuel the demand for a wide range of adhesives, including epoxy and polyurethane (PU) adhesives, renowned for their exceptional bonding strength and durability.

As the region's economic prosperity continues to propel growth, the demand for high-quality flooring adhesives remains robust. With a focus on innovation and meeting the diverse needs of the construction industry, West India is poised to maintain its prominent position in the flooring adhesive market for the foreseeable future.

Report Scope:

In this report, the India Flooring Adhesive Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Flooring Adhesive Market, By Type:

- Epoxy Adhesives

- Polyurethane Adhesives

- Acrylic Adhesives

- Vinyl Adhesives

- Others

India Flooring Adhesive Market, By Technology:

- Water-Based

- Solvent-Based

- Hot Melt

India Flooring Adhesive Market, By Application:

- Tile & Stone

- Carpet

- Wood

- Laminate

- Others

India Flooring Adhesive Market, By Region:

- North India

- East India

- West India

- South India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Flooring Adhesive Market.Available Customizations:

India Flooring Adhesive Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

1. Product Overview

2. Research Methodology

3. Executive Summary

4. India Flooring Adhesive Market Outlook

5. North India Flooring Adhesive Market Outlook

6. South India Flooring Adhesive Market Outlook

7. West India Flooring Adhesive Market Outlook

8. East India Flooring Adhesive Market Outlook

9. Market Dynamics

10. Market Trends & Developments

13. Competitive Landscape

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Pidilite Industries Ltd.

- Huntsman Corporation

- MYK LATICRETE INDIA PVT.

- Bostik India Pvt. Ltd.

- Sika India Pvt. Ltd.

- ARDEX ENDURA (INDIA) PRIVATE LIMITED

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | October 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 640.78 Million |

| Forecasted Market Value ( USD | $ 838.01 Million |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | India |