Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.2.1. Specimen Segment

1.2.2. End-use Segment

1.3. Research Assumptions

1.4. Information Procurement

1.4.1. Primary Research

1.5. Information or Data Analysis

1.6. Market Formulation & Validation

1.7. Market Model

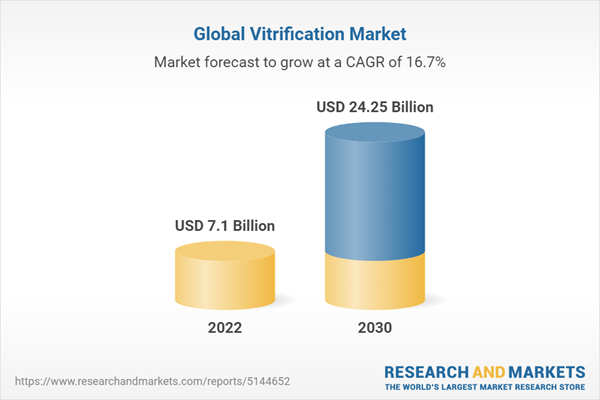

1.8. Global Market: CAGR Calculation

1.9. Objectives

1.9.1. Objective 1

1.9.2. Objective 2

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/Ancillary Market Outlook

3.2. Market Trends and Outlook

3.3. Market Dynamics

3.3.1. Increase In Delayed Childbearing/Parenthood

3.3.2. Social Acceptance Of Fertility Preservation Techniques

3.3.3. Rising Awareness About Reproductive Health

3.3.4. Increase In Prevalence Of Infertility And Infecundity

3.4. Market Restraint Analysis

3.4.1. Technical And Ethical Challenges Of Fertility Preservation

3.4.2. Low Risk-Benefit Ratio

3.5. Business Environment Analysis

3.5.1. PESTEL Analysis

3.5.2. Porter’s Five Forces Analysis

3.5.3. COVID-19 Impact Analysis

3.6. Device Benchmarking

Chapter 4. Specimen Business Analysis

4.1. Global Vitrification Market: Specimen Movement Analysis

4.2. Oocytes

4.2.1. Oocytes Market, 2018 - 2030 (USD Million)

4.2.2. Devices

4.2.2.1. Devices Market, 2018 - 2030 (USD Million)

4.2.3. Kits & Consumables

4.2.3.1. Kits & Consumables Market, 2018 - 2030 (USD Million)

4.3. Embryo

4.3.1. Embryo Market, 2018 - 2030 (USD Million)

4.3.2. Devices

4.3.2.1. Devices Market, 2018 - 2030 (USD Million)

4.3.3. Kits & Consumables

4.3.3.1. Kits & Consumables Market, 2018 - 2030 (USD Million)

4.4. Sperm

4.4.1. Sperm Market, 2018 - 2030 (USD Million)

Chapter 5. End-use Business Analysis

5.1. Global Vitrification Market: End-use Movement Analysis

5.2. IVF Clinics

5.2.1. IVF Clinics Market, 2018 - 2030 (USD Million)

5.3. Biobanks

5.3.1. Biobanks Market, 2018 - 2030 (USD Million)

Chapter 6. Regional Business Analysis

6.1. Global Vitrification Market Share By Region, 2022 & 2030

6.2. North America

6.2.1. North America Vitrification Market, 2018 - 2030 (USD Million)

6.2.2. U.S.

6.2.2.1. Key Country Dynamics

6.2.2.2. Competitive Scenario

6.2.2.3. Regulatory Framework

6.2.2.4. Target Disease Prevalence

6.2.2.5. U.S. Vitrification Market, 2018 - 2030 (USD Million)

6.2.3. Canada

6.2.3.1. Key Country Dynamics

6.2.3.2. Competitive Scenario

6.2.3.3. Regulatory Framework

6.2.3.4. Target Disease Prevalence

6.2.3.5. Canada Vitrification Market, 2018 - 2030 (USD Million)

6.3. Europe

6.3.1. Europe Vitrification Market, 2018 - 2030 (USD Million)

6.3.2. Germany

6.3.2.1. Key Country Dynamics

6.3.2.2. Competitive Scenario

6.3.2.3. Regulatory Framework

6.3.2.4. Target Disease Prevalence

6.3.2.5. Germany Vitrification Market, 2018 - 2030 (USD Million)

6.3.3. UK

6.3.3.1. Key Country Dynamics

6.3.3.2. Competitive Scenario

6.3.3.3. Regulatory Framework

6.3.3.4. Target Disease Prevalence

6.3.3.5. UK Vitrification Market, 2018 - 2030 (USD Million)

6.3.4. France

6.3.4.1. Key Country Dynamics

6.3.4.2. Competitive Scenario

6.3.4.3. Regulatory Framework

6.3.4.4. Target Disease Prevalence

6.3.4.5. France Vitrification Market, 2018 - 2030 (USD Million)

6.3.5. Italy

6.3.5.1. Key Country Dynamics

6.3.5.2. Competitive Scenario

6.3.5.3. Regulatory Framework

6.3.5.4. Target Disease Prevalence

6.3.5.5. Italy Vitrification Market, 2018 - 2030 (USD Million)

6.3.6. Spain

6.3.6.1. Key Country Dynamics

6.3.6.2. Competitive Scenario

6.3.6.3. Regulatory Framework

6.3.6.4. Target Disease Prevalence

6.3.6.5. Spain Vitrification Market, 2018 - 2030 (USD Million)

6.3.7. Denmark

6.3.7.1. Key Country Dynamics

6.3.7.2. Competitive Scenario

6.3.7.3. Regulatory Framework

6.3.7.4. Target Disease Prevalence

6.3.7.5. Denmark Vitrification Market, 2018 - 2030 (USD Million)

6.3.8. Sweden

6.3.8.1. Key Country Dynamics

6.3.8.2. Competitive Scenario

6.3.8.3. Regulatory Framework

6.3.8.4. Target Disease Prevalence

6.3.8.5. Sweden Vitrification Market, 2018 - 2030 (USD Million)

6.3.9. Norway

6.3.9.1. Key Country Dynamics

6.3.9.2. Competitive Scenario

6.3.9.3. Regulatory Framework

6.3.9.4. Target Disease Prevalence

6.3.9.5. Norway Vitrification Market, 2018 - 2030 (USD Million)

6.4. Asia Pacific

6.4.1. Asia Pacific Vitrification Market, 2018 - 2030 (USD Million)

6.4.2. Japan

6.4.2.1. Key Country Dynamics

6.4.2.2. Competitive Scenario

6.4.2.3. Regulatory Framework

6.4.2.4. Target Disease Prevalence

6.4.2.5. Japan Vitrification Market, 2018 - 2030 (USD Million)

6.4.3. China

6.4.3.1. Key Country Dynamics

6.4.3.2. Competitive Scenario

6.4.3.3. Regulatory Framework

6.4.3.4. Target Disease Prevalence

6.4.3.5. China Vitrification Market, 2018 - 2030 (USD Million)

6.4.4. India

6.4.4.1. Key Country Dynamics

6.4.4.2. Competitive Scenario

6.4.4.3. Regulatory Framework

6.4.4.4. Target Disease Prevalence

6.4.4.5. India Vitrification Market, 2018 - 2030 (USD Million)

6.4.5. South Korea

6.4.5.1. Key Country Dynamics

6.4.5.2. Competitive Scenario

6.4.5.3. Regulatory Framework

6.4.5.4. Target Disease Prevalence

6.4.5.5. South Korea Vitrification Market, 2018 - 2030 (USD Million)

6.4.6. Australia

6.4.6.1. Key Country Dynamics

6.4.6.2. Competitive Scenario

6.4.6.3. Regulatory Framework

6.4.6.4. Target Disease Prevalence

6.4.6.5. Australia Vitrification Market, 2018 - 2030 (USD Million)

6.4.7. Thailand

6.4.7.1. Key Country Dynamics

6.4.7.2. Competitive Scenario

6.4.7.3. Regulatory Framework

6.4.7.4. Target Disease Prevalence

6.4.7.5. Thailand Vitrification Market, 2018 - 2030 (USD Million)

6.5. Latin America

6.5.1. Latin America Vitrification Market, 2018 - 2030 (USD Million)

6.5.2. Brazil

6.5.2.1. Key Country Dynamics

6.5.2.2. Competitive Scenario

6.5.2.3. Regulatory Framework

6.5.2.4. Target Disease Prevalence

6.5.2.5. Brazil Vitrification Market, 2018 - 2030 (USD Million)

6.5.3. Mexico

6.5.3.1. Key Country Dynamics

6.5.3.2. Competitive Scenario

6.5.3.3. Regulatory Framework

6.5.3.4. Target Disease Prevalence

6.5.3.5. Mexico Vitrification Market, 2018 - 2030 (USD Million)

6.5.4. Argentina

6.5.4.1. Key Country Dynamics

6.5.4.2. Competitive Scenario

6.5.4.3. Regulatory Framework

6.5.4.4. Target Disease Prevalence

6.5.4.5. Argentina Vitrification Market, 2018 - 2030 (USD Million)

6.6. MEA

6.6.1. MEA Vitrification Market, 2018 - 2030 (USD Million)

6.6.2. South Africa

6.6.2.1. Key Country Dynamics

6.6.2.2. Competitive Scenario

6.6.2.3. Regulatory Framework

6.6.2.4. Target Disease Prevalence

6.6.2.5. South Africa Vitrification Market, 2018 - 2030 (USD Million)

6.6.3. Saudi Arabia

6.6.3.1. Key Country Dynamics

6.6.3.2. Competitive Scenario

6.6.3.3. Regulatory Framework

6.6.3.4. Target Disease Prevalence

6.6.3.5. Saudi Arabia Vitrification Market, 2018 - 2030 (USD Million)

6.6.4. UAE

6.6.4.1. Key Country Dynamics

6.6.4.2. Competitive Scenario

6.6.4.3. Regulatory Framework

6.6.4.4. Target Disease Prevalence

6.6.4.5. UAE Vitrification Market, 2018 - 2030 (USD Million)

6.6.5. Kuwait

6.6.5.1. Key Country Dynamics

6.6.5.2. Competitive Scenario

6.6.5.3. Regulatory Framework

6.6.5.4. Target Disease Prevalence

6.6.5.5. Kuwait Vitrification Market, 2018 - 2030 (USD Million)

Chapter 7. Competitive Landscape

7.1. Company Categorization

7.2. Strategy Mapping

7.3. Company Market Position Analysis, 2022

7.4. Company Profiles/Listing

7.4.1. Vitrolife

7.4.1.1. Overview

7.4.1.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.1.3. Product Benchmarking

7.4.1.4. Strategic Initiatives

7.4.2. Genea Biomedx

7.4.2.1. Overview

7.4.2.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.2.3. Product Benchmarking

7.4.2.4. Strategic Initiatives

7.4.3. NidaCon International AB

7.4.3.1. Overview

7.4.3.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.3.3. Product Benchmarking

7.4.3.4. Strategic Initiatives

7.4.4. Minitube

7.4.4.1. Overview

7.4.4.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.4.3. Product Benchmarking

7.4.4.4. Strategic Initiatives

7.4.5. IMV TECHNOLOGIES GROUP (Cryo Bio System)

7.4.5.1. Overview

7.4.5.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.5.3. Product Benchmarking

7.4.5.4. Strategic Initiatives

7.4.6. The Cooper Companies, Inc. (A CooperSurgical Fertility Company)

7.4.6.1. Overview

7.4.6.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.6.3. Product Benchmarking

7.4.6.4. Strategic Initiatives

7.4.7. FUJIFILM Corporation (FUJIFILM Irvine Scientific)

7.4.7.1. Overview

7.4.7.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.7.3. Product Benchmarking

7.4.7.4. Strategic Initiatives

7.4.8. Biotech, Inc.

7.4.8.1. Overview

7.4.8.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.8.3. Product Benchmarking

7.4.8.4. Strategic Initiatives

7.4.9. Kitazato Corporation

7.4.9.1. Overview

7.4.9.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.9.3. Product Benchmarking

7.4.9.4. Strategic Initiatives

7.4.10. Shenzhen VitaVitro Biotech

7.4.10.1. Overview

7.4.10.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.10.3. Product Benchmarking

7.4.10.4. Strategic Initiatives

List of Tables

Table 1 List Of Secondary Sources

Table 2 List Of Abbreviations

Table 3 Global Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 4 Global Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 5 North America Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 6 North America Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 7 North America Vitrification Market by Country, 2018 - 2030 (USD Million)

Table 8 U.S. Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 9 U.S. Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 10 Canada Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 11 Canada Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 12 Europe Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 13 Europe Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 14 Europe Vitrification Market by Country, 2018 - 2030 (USD Million)

Table 15 UK Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 16 UK Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 17 Germany Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 18 Germany Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 19 France Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 20 France Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 21 Italy Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 22 Italy Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 23 Spain Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 24 Spain Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 25 Denmark Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 26 Denmark Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 27 Sweden Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 28 Sweden Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 29 Norway Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 30 Norway Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 31 Asia Pacific Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 32 Asia Pacific Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 33 Asia Pacific Vitrification Market by Country, 2018 - 2030 (USD Million)

Table 34 China Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 35 China Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 36 Japan Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 37 Japan Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 38 India Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 39 India Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 40 South Korea Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 41 South Korea Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 42 Australia Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 43 Australia Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 44 Thailand Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 45 Thailand Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 46 Thailand Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 47 Latin America Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 48 Latin America Vitrification Market by Country, 2018 - 2030 (USD Million)

Table 49 Brazil Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 50 Brazil Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 51 Mexico Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 52 Mexico Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 53 Argentina Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 54 Argentina Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 55 Middle East & Africa Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 56 Middle East & Africa Vitrification Market by Country, 2018 - 2030 (USD Million)

Table 57 South Africa Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 58 South Africa Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 59 Saudi Arabia Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 60 Saudi Arabia Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 61 UAE Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 62 UAE Vitrification Market by End-Use, 2018 - 2030 (USD Million)

Table 63 Kuwait Vitrification Market by Specimen, 2018 - 2030 (USD Million)

Table 64 Kuwait Vitrification Market By End-Use, 2018 - 2030 (USD Million)

Table 65 Participant’s Overview

Table 66 Financial Performance

Table 67 Key Companies Undergoing Expansions

Table 68 Key Companies Undergoing Acquisitions

Table 69 Key Companies Undergoing Collaborations

Table 70 Key Companies Launching New Products/Services

Table 71 Key Companies Undergoing Partnerships

Table 72 Key Companies Undertaking Other Strategies

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value-chain-based sizing & forecasting

Fig. 6 QFD modeling for market share assessment

Fig. 7 Market formulation & validation

Fig. 8 Market segmentation & scope

Fig. 9 Market driver impact

Fig. 10 Market restraint impact

Fig. 11 Porter’s analysis

Fig. 12 PESTEL analysis

Fig. 13 Global vitrification market: Specimen outlook and key takeaways

Fig. 14 Global vitrification market: Specimen movement analysis

Fig. 15 Global oocytes market, 2018 - 2030 (USD Million)

Fig. 16 Global devices market, 2018 - 2030 (USD Million)

Fig. 17 Global kits & consumables market, 2018 - 2030 (USD Million)

Fig. 18 Global embryo market, 2018 - 2030 (USD Million)

Fig. 19 Global devices market, 2018 - 2030 (USD Million)

Fig. 20 Global kits & consumables market, 2018 - 2030 (USD Million)

Fig. 21 Global sperm market, 2018 - 2030 (USD Million)

Fig. 22 Global vitrification market: End-use outlook and key takeaways

Fig. 23 Global vitrification market: End-use movement analysis

Fig. 24 Global IVF clinics market, 2018 - 2030 (USD Million)

Fig. 25 Global biobanks market, 2018 - 2030 (USD Million)

Fig. 26 Global vitrification market: Regional outlook and key takeaways

Fig. 27 North America vitrification market, 2018 - 2030 (USD Million)

Fig. 28 US key country dynamics

Fig. 29 US vitrification market, 2018 - 2030 (USD Million)

Fig. 30 Canada key country dynamics

Fig. 31 Canada vitrification market, 2018 - 2030 (USD Million)

Fig. 32 Europe vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 33 Germany key country dynamics

Fig. 34 Germany vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 35 France key country dynamics

Fig. 36 France vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 37 UK key country dynamics

Fig. 38 UK vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 39 Italy key country dynamics

Fig. 40 Italy vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 41 Spain key country dynamics

Fig. 42 Spain vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 43 Denmark key country dynamics

Fig. 44 Denmark vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 45 Sweden key country dynamics

Fig. 46 Sweden vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 47 Norway key country dynamics

Fig. 48 Norway vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 49 Asia-Pacific vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 50 Japan key country dynamics

Fig. 51 Japan vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 52 China key country dynamics

Fig. 53 China vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 54 India key country dynamics

Fig. 55 India vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 56 South Korea key country dynamics

Fig. 57 South Korea vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 58 Australia key country dynamics

Fig. 59 Australia vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 60 Thailand key country dynamics

Fig. 61 Thailand vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 62 Latin America vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 63 Brazil key country dynamics

Fig. 64 Brazil vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 65 Mexico key country dynamics

Fig. 66 Mexico vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 67 Argentina key country dynamics

Fig. 68 Argentina vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 69 MEA vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 70 South Africa key country dynamics

Fig. 71 South Africa vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 72 Saudi Arabia key country dynamics

Fig. 73 Saudi Arabia vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 74 UAE key country dynamics

Fig. 75 UAE vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 76 Kuwait key country dynamics

Fig. 77 Kuwait vitrification market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 78 Market participant categorization

Fig. 79 Vitrification market position analysis, 2022

Fig. 80 Strategy framework