These centers provide care for various types of wounds, debridement of wounds with infections, HBOT for non-healing & chronic wounds, and specialized dressings. The centers are taking measures to make HBOT available to its patients, considering its effectiveness in healing chronic and non-healing wounds. Moreover, wound care centers benefit greatly from innovations in medical solutions for wound care treatment. For instance, UlceRx Therapy Solution Kit launched by SIGVARIS are compression stockings that assist centers in treating venous leg ulcers. Similarly, Healogics, Inc. organized an awareness campaign about the impact of heart health on wound healing, and nearly 82% of leg amputations in the U.S. need to be performed due to poor blood circulation in the limb, which can be avoided by compression therapy.

The COVID-19 pandemic adversely impacted the overall industry as many centers were closed and reduced patient volumes to curb the spread of the virus. After the initial disruptions caused by the pandemic, companies as well as the U.S. government began undertaking corrective actions to help the economy and businesses recover. To facilitate wound care during the COVID-19 pandemic, Healogics, Inc., a provider of wound care, launched its Telehealth Program, which was immediately made available to more than 600 wound care centers and 4,000 associated wound care providers.

U.S. Wound Care Centers Market Report Highlights

- The Hyperbaric Oxygen Therapy (HBOT) procedure segment held the largest revenue share in 2022 due to the high demand for chronic wound treatment for arterial ulcers and diabetic foot ulcers and its high success rate

- The specialized dressings segment is expected to witness significant growth during the forecast period owing to the launch of various advanced and innovative specialized dressings in the market

- In October 2020, the “Local Coverage Article: Surgical Dressings” was updated by the CMS Durable Equipment Medical Administrative Contractors (DMEMACs) to include payments for primary & secondary use of alginate and many other dressings with fiber gelling. Before this update, these products were not reimbursed when applied as primary dressings

- The market potential is driving numerous service providers to strengthen their industry presence by opening new centers and entering into partnerships with other firms

- For instance, in May 2022, EmergeOrtho opened a new office in Fuquay-Varina, North Carolina. This new location expanded its specialty orthopedic services in the Triangle Region

This product will be delivered within 1-3 business days.

Table of Contents

Chapter 1 Report Scope and Methodology1.1 Market Segmentation

1.2 Estimates and Forecast Timeline

1.3 Research Methodology

1.3.1 Information procurement

1.3.2 Purchased Database

1.3.3 Internal Database

1.3.4 Secondary Sources

1.3.5 Primary Research

1.3.6 Details of Primary Research

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Validation

1.6 Model Details

1.6.1 Volume Price Analysis

1.7 List of Secondary Sources

1.8 List of Abbreviations

1.9 Report Objectives

1.9.1 Objective - 1

1.9.2 Objective - 2

1.9.3 Objective - 3

Chapter 2 Executive Summary

2.1 Market Snapshot

2.2 Market Segmentation

2.3 Competitive Landscape

Chapter 3 Market Variables, Trends, & Scope

3.1 Market Lineage Outlook

3.1.1 Parent market outlook

3.1.2 Ancillary Market Outlook

3.2 Market Dynamics

3.2.1 Market driver analysis

3.2.1.1 Increasing geriatric & diabetic population

3.2.1.2 High demand for wound care

3.2.1.3 Initiatives by wound care centers

3.2.2 Market restraint analysis

3.2.2.1 High cost of treatment

3.2.2.2 Lack of awareness about the complications associated with chronic wounds

3.2.2.3 Hurdles with wound care billing collection

3.3 Business Environment Analysis Tools

3.3.1 U.S. Wound Care Centers - Porter’s Five Forces Analysis

3.3.1.1 Competitive rivalry: High

3.3.1.2 Threat of new entrants

3.3.1.3 Threat of substitutes

3.3.1.4 Bargaining power of suppliers

3.3.1.5 Bargaining power of buyers

3.3.2 U.S. Wound Care Centers- PESTEL Analysis

3.3.2.1 Political and legal

3.3.2.2 Economic

3.3.2.3 Social

3.3.2.4 Technology

3.4 Regulatory Scenario & Reimbursement Outlook

3.4.1 Regulatory Scenario

3.4.2 Reimbursement Scenario

3.5 Penetration & Growth Prospect Mapping, 2022

3.6 Impact of COVID-19: Qualitative Analysis

Chapter 4 U.S. Wound Care Centers Market: Procedure Analysis

4.1 U.S. Wound Care Centers Procedure Market Share Analysis, 2022 & 2030

4.2 U.S. Wound Care Centers Procedure Market: Segment Dashboard

4.2.1 Hyperbaric Oxygen Therapy

4.2.1.1 Hyperbaric oxygen therapy market, 2018 - 2030 (USD Billion)

4.2.2 Debridement

4.2.2.1 Debridement market, 2018 - 2030 (USD Billion)

4.2.3 Specialized Dressing

4.2.3.1 Specialized dressing market, 2018 - 2030 (USD Billion)

4.2.4 Negative Pressure Wound Therapy

4.2.4.1 Negative pressure wound therapy market, 2018 - 2030 (USD Billion)

4.2.5 Compression Therapy

4.2.5.1 Compression therapy market, 2018 - 2030 (USD Billion)

4.2.6 Infection Control And Others

4.2.6.1 Infection control and others market, 2018 - 2030 (USD Billion)

Chapter 5 Competitive Analysis

5.1 Participant’s Overview

5.2 Financial Performance

5.3 Participant Categorization

5.4 Participant Categorization

5.5 Company Market Position Analysis

5.6 List of Few Wound Care Centers

5.7 Strategy Mapping

5.7.1 New Service launch

5.7.2 Partnerships

5.7.3 Acquisition

5.7.4 Regional expansion

5.7.5 Funding

5.8 Company Profiles

5.8.1 TOWER WOUND CARE CENTER.

5.8.2 SNF Wound Care

5.8.3 WOUND INSTITUTE OF AMERICA

5.8.4 EmergeOrtho

5.8.5 North Shore Health and Hyperbarics

5.8.6 Baptist Health South Florida

5.8.7 Natchitoches Regional Medical Center

5.8.8 Schoolcraft Memorial Hospital

5.8.9 Clarion Hospital

5.8.10 Healogics, Inc.

Chapter 6 KOL Comments

List of Tables

Table 1 List of secondary sources

Table 2 List of abbreviation

Table 3 U.S. Wound Care Centers Market, By Procedure, 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 U.S. wound care centers market segmentation

Fig. 2 Market research process

Fig. 3 Information procurement

Fig. 4 Primary research pattern

Fig. 5 Market research approaches

Fig. 6 Value-chain-based sizing & forecasting

Fig. 7 QFD modeling for market share assessment

Fig. 8 Market formulation & validation

Fig. 9 Market snapshot & segmentation outlook

Fig. 10 Competitive landscape

Fig. 11 U.S. wound care centers market lineage outlook

Fig. 12 U.S. wound care centers ancillary market outlook

Fig. 13 U.S. wound care centers market dynamics

Fig. 14 Market driver relevance analysis (Current & future impact)

Fig. 15 Prevalence of chronic wound in U.S., 2022

Fig. 16 Percentage of Medicare beneficiaries’ inpatient stays for severe wound care, by facility type, 2018

Fig. 17 Market restraint relevance analysis (Current & future impact)

Fig. 18 Penetration & growth prospect mapping, 2022

Fig. 19 U.S. wound care centers procedure market share analysis, (USD Billion)

Fig. 20 U.S wound care centers procedures market: Segment dashboard

Fig. 21 Hyperbaric oxygen therapy market, 2018 - 2030 (USD Billion)

Fig. 22 Debridement market, 2018 - 2030 (USD Billion)

Fig. 23 Specialized dressing market, 2018 - 2030 (USD Billion)

Fig. 24 Negative pressure wound therapy market, 2018 - 2030 (USD Billion)

Fig. 25 Compression therapy market, 2018 - 2030 (USD Billion)

Fig. 26 Infection control and others market, 2018 - 2030 (USD Billion)

Fig. 27 Market participant categorization

Fig. 28 Company market position analysis

Fig. 29 Strategy mapping

Companies Mentioned

- TOWER WOUND CARE CENTER.

- SNF Wound Care

- WOUND INSTITUTE OF AMERICA

- EmergeOrtho

- North Shore Health and Hyperbarics

- Baptist Health South Florida

- Natchitoches Regional Medical Center

- Schoolcraft Memorial Hospital

- Clarion Hospital

- Healogics, Inc.

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 65 |

| Published | February 2023 |

| Forecast Period | 2022 - 2030 |

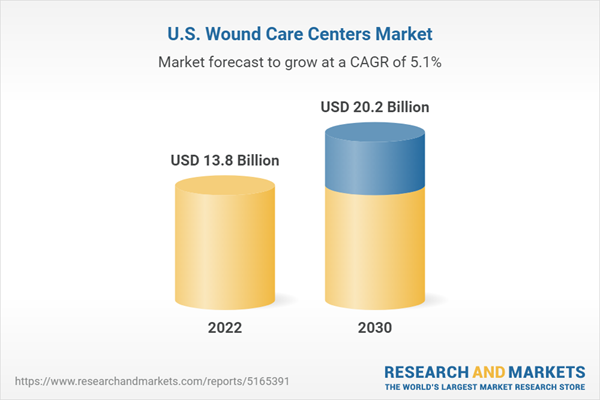

| Estimated Market Value ( USD | $ 13.8 Billion |

| Forecasted Market Value ( USD | $ 20.2 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |