The Butadiene Market size is estimated at 14.11 Million tons in 2024, and is expected to reach 16.94 Million tons by 2029, growing at a CAGR of 3.71% during the forecast period (2024-2029).

The COVID-19 outbreak, nationwide lockdowns around the globe, disruption in manufacturing activities and supply chains, and production halts impacted the market in 2020. However, the market saw a surge in 2021. The demand for automotive manufacturing units, plastic, and polymer increased comparatively compared to 2020. This positively impacted the demand for styrene-butadiene and polybutadiene rubber, used in tires, building crack fillers, concrete additives, etc. The use of protective gloves made from nitrile rubber has increased in the current situation, thus stimulating the demand in the butadiene market.

This product will be delivered within 2 business days.

The COVID-19 outbreak, nationwide lockdowns around the globe, disruption in manufacturing activities and supply chains, and production halts impacted the market in 2020. However, the market saw a surge in 2021. The demand for automotive manufacturing units, plastic, and polymer increased comparatively compared to 2020. This positively impacted the demand for styrene-butadiene and polybutadiene rubber, used in tires, building crack fillers, concrete additives, etc. The use of protective gloves made from nitrile rubber has increased in the current situation, thus stimulating the demand in the butadiene market.

Key Highlights

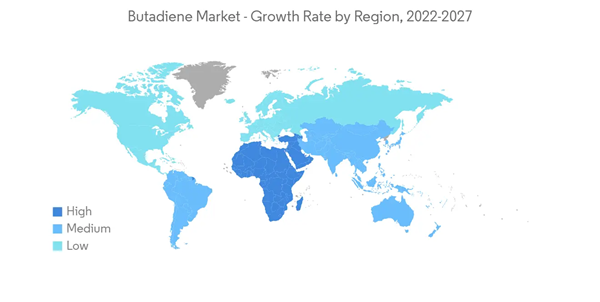

- The developing downstream market in Asia-Pacific is expected to drive the market's growth.

- However, the hazardous effects caused by butadiene upon exposure and the closure of several tire manufacturing plants are likely to hamper the market's growth.

- The innovation of bio-butadiene to produce products like synthetic rubber, thermoplastic elastomers, nylon, etc., is likely to create opportunities for the market in the coming years.

- Asia-Pacific accounts for the highest market share and is expected to dominate the market during the forecast period.

Butadiene Market Trends

Tire and Rubber to Dominate the Market

- Butadiene is majorly used for manufacturing synthetic rubbers and elastomers, which include polybutadiene rubber (PBR), styrene-butadiene rubber (SBR), nitrile rubber (NR), and polychloroprene (Neoprene). These, in turn, are used for producing other goods and materials.

- PBR and SBR are used for producing tires. Neoprene and nitrile rubber are used for producing gloves, seals, gaskets, hoses, wetsuits, foams, and water, among others. Styrene-butadiene (SB) latex is used for producing carpet and paper coatings.

- Polybutadiene rubber (BR, PBR) is a synthetic general-purpose elastomer occasionally used as a substitute for natural rubber due to its low cost and vast volume (NR).

- In a non-polar solvent, it is generated through anionic polymerization or coordination polymerization of 1,3-butadiene. Because it allows for both tight control of the molecular weight (MW) and high stereoregularity, this is frequently the method of choice.

- The U.S. Tire Manufacturers Association (USTMA) projects total United States tire shipments of 342.1 million units in 2022, compared to 335.2 million units in 2021 and 332.7 million units in 2019. United States' tire manufacturing has an annual economic footprint of USD 170.6 billion.

- According to the European Tyre and Rubber Manufacturers' Association, there are more than 6000 companies producing rubber goods in Europe. 98% of them are SMEs who operate in a highly integrated value chain to respond to the very specific needs of their customers.

- With the increase in automobile production across the world, the demand for tires and rubbers substantially increased in various countries, thereby increasing the demand for butadiene.

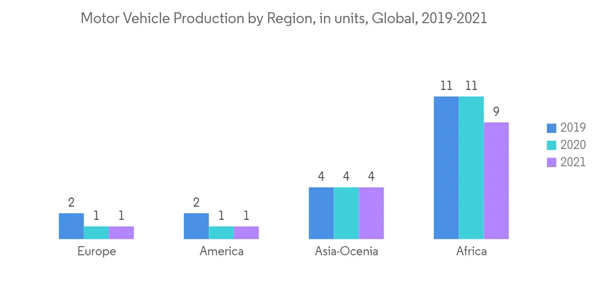

- According to OICA, the total number of vehicles produced in 2021 was 80,145,988 and witnessed a growth rate of 3% compared to 2020. Europe produced a total of 16,330,509 units of motor vehicles, America produced 16,151,639 units, and Africa holds a production number of 931,056 units in 2021.

Increasing Demand in the Asia-Pacific Region

- The Asia-Pacific region dominated the butadiene market. The downstream market in Asia-Pacific witnessed a huge spur in the past few years, owing to which the demand for butadiene has rapidly increased.

- China is one of the largest chemical manufacturing hubs in the world, with a wide range of industries. The Chinese butadiene market is expected to witness significant growth due to the presence of a large number of indigenous players.

- According to the World Bank, China's net export of butadiene rubber (BR) and synthetic rubber in 2021 amounted to USD 377,211.44 and 187,926,000 kg in quantity.

- In India, there are 41 tire manufacturers and around 6,000 non-tire manufacturers producing seals, conveyor belts, and extruded and molded rubber profiles to be used in automotive, railway, defense, aerospace, and other applications.

- According to the World Bank, India's net export of butadiene rubber (BR) and synthetic rubber in 2021 summed up to USD 232,943.90 and 123,199,000 kg in quantity.

- Butadiene is used to produce intermediates like styrene-butadiene (SBR) and others, which are further used to manufacture automotive products, including tires and conveyor belts. The Asia-Pacific region holds the highest production share in the global automotive market with 46,732,785 units in 2021.

- According to the OICA, in 2021, total industrial production in India was about 4,399,112 vehicles, including passenger, commercial, three-wheeler, two-wheeler, and quadricycles. The government's reforms such as 'Aatma Nirbhar Bharat' and 'Make in India' are likely to boost the automotive industry in the near future.

Butadiene Industry Overview

The butadiene market is fragmented in nature. These companies (not in any particular order) include China Petroleum & Chemical Corporation (Sinopec), China National Petroleum Corporation, TPC Group, Shell plc, and Exxon Mobil Corporation.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Assumptions

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Drivers

4.1.1 Developing Downstream Market in Asia-Pacific

4.1.2 Other Drivers

4.2 Restraints

4.2.1 Hazardous Effects Caused by Butadiene

4.2.2 Closure of Several Tire Manufacturing Plants

4.3 Industry Value Chain Analysis

4.4 Porter's Five Forces Analysis

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Power of Buyers

4.4.3 Threat of New Entrants

4.4.4 Threat of Substitute Products and Services

4.4.5 Degree of Competition

4.5 Feedstock Analysis

4.6 Technological Snapshot

5 MARKET SEGMENTATION (Market Size in Volume)

5.1 Application

5.1.1 Polybutadiene (PBR)

5.1.2 Chloroprene

5.1.3 Styrene-Butadiene (SBR)

5.1.4 Nitrile Rubber (Acrylonitrile Butadiene NBR)

5.1.5 Acrylonitrile Butadiene Styrene (ABS)

5.1.6 Adiponitrile

5.1.7 Sulfolane

5.1.8 Ethylidene Norbornene

5.1.9 Styrene-Butadiene Latex

5.1.10 Other Applications

5.2 End-user Industry

5.2.1 Plastic and Polymer

5.2.2 Tire and Rubber

5.2.3 Chemical

5.2.4 Other End-user Industries

5.3 Geography

5.3.1 Asia-Pacific

5.3.1.1 China

5.3.1.2 India

5.3.1.3 Japan

5.3.1.4 South Korea

5.3.1.5 Rest of Asia-Pacific

5.3.2 North America

5.3.2.1 United States

5.3.2.2 Canada

5.3.2.3 Mexico

5.3.3 Europe

5.3.3.1 Germany

5.3.3.2 France

5.3.3.3 United Kingdom

5.3.3.4 Italy

5.3.3.5 Rest of Europe

5.3.4 South America

5.3.4.1 Brazil

5.3.4.2 Argentina

5.3.4.3 Rest of South America

5.3.5 Middle-East and Africa

5.3.5.1 Saudi Arabia

5.3.5.2 South Africa

5.3.5.3 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Market Share (%) Analysis

6.3 Strategies Adopted by Leading Players

6.4 Company Profiles (Overview, Financials**, Products and Services, and Recent Developments)

6.4.1 BASF SE

6.4.2 Braskem

6.4.3 China National Petroleum Corporation

6.4.4 China Petroleum & Chemical Corporation

6.4.5 Dow

6.4.6 Evonik Industries AG

6.4.7 Exxon Mobil Corporation

6.4.8 Formosa Plastics Corporation

6.4.9 INEOS

6.4.10 JSR Corporation

6.4.11 LG Chem

6.4.12 LOTTE CHEMICAL TITAN HOLDING BERHAD

6.4.13 LyondellBasell Industries Holdings BV

6.4.14 Reliance Industries Limited

6.4.15 Repsol

6.4.16 Shell PLC

6.4.17 SABIC

6.4.18 TPC Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

7.1 Innovation of Bio-butadiene

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BASF SE

- Braskem

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- Dow

- Evonik Industries AG

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- INEOS

- JSR Corporation

- LG Chem

- LOTTE CHEMICAL TITAN HOLDING BERHAD

- LyondellBasell Industries Holdings BV

- Reliance Industries Limited

- Repsol

- Shell PLC

- SABIC

- TPC Group

Methodology

LOADING...