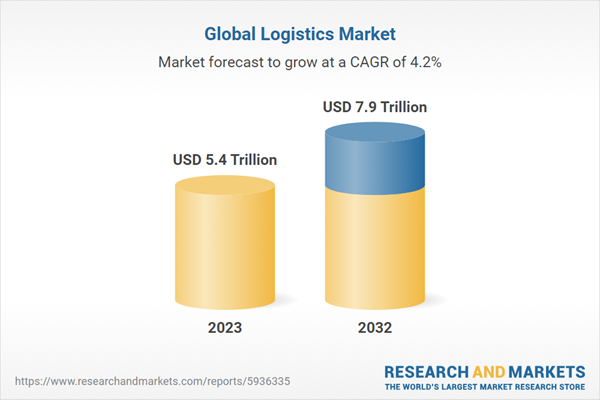

The global logistics market size reached US$ 5.4 Trillion in 2023. The market is projected to reach US$ 7.9 Trillion by 2032, exhibiting a growth rate (CAGR) of 4.2% during 2023-2032. The market is experiencing robust growth, driven by rapid expansion of e-commerce sector, rising technological advancements, such as the Internet of Things (IoT), ongoing globalization of trade, increasing focus on environmental sustainability, and growing consumer demand for faster delivery systems.

Major Market Drivers: Key drivers influencing the market growth include the expansion of the e-commerce sector and rapid technological advancements, including automation, and artificial intelligence (AI), to streamline logistics processes.

Key Market Trends: The key market trends involve the increasing focus on sustainability, as companies adopt eco-friendly practices like using electric vehicles (EVs) and optimizing delivery routes. Additionally, the integration of blockchain technology for enhanced transparency and security in supply chain management, is bolstering the market growth.

Geographical Trends: Asia-Pacific leads the market due to increasing industrialization, urbanization, and an expanding e-commerce sector. Other regions are also showing significant growth, fueled by the expanding manufacturing base, rapid technological advancements, and increasing digital penetration.

Competitive Landscape: The market is characterized by the presence of several key players focusing on expanding geographical reach and service offerings through strategic partnerships and acquisitions. Moreover, companies are also investing in research and development (R&D) to innovate in areas like autonomous vehicle logistics, drone delivery, and smart warehousing.

Challenges and Opportunities: The market faces various challenges, such as adapting to rapidly changing consumer demands, managing the complexities of global supply chains, and addressing environmental concerns. However, the increasing demand for last-mile delivery solutions, and the potential for technological innovations to create more efficient and sustainable logistics systems, is creating new opportunities for the market growth.

Third-party logistics (3PL) holds the largest market share as it involves outsourcing logistics operations to third-party businesses, allowing them to handle a variety of services, including transportation, warehousing, cross-docking, inventory management, packaging, and freight forwarding. It has the ability to provide cost-effective, scalable, and efficient logistics solutions, enabling client businesses to focus on their core competencies. Moreover, the rising growth of e-commerce and online retailers, prompting the adoption of 3PL services for streamlined supply chain operations, is favoring the market growth.

Second-party logistics (2PL) focuses on the transportation aspect of the supply chain, including trucks, ships, or planes for transporting goods from one point to another. They offer specialized modes of transportation and provide their services to shippers directly.

Fourth-party logistics (4PL) providers represent a more integrated approach to logistics management. They act as a single point of contact for all supply chain-related activities by managing resources, technology, infrastructure, and other 3PL services on behalf of their clients.

Roadways hold the largest in the market, due to their extensive network, flexibility, and cost-effectiveness for short to medium-distance transport. It is crucial for last-mile deliveries and for transporting goods within continents or regions where road infrastructure is well-developed. Road transport offers the advantage of door-to-door service, high frequency of departures, and the ability to handle a wide range of cargo types.

Seaways handles a significant portion of international cargo movement, especially for bulky and heavy goods. It is favored for its cost efficiency in transporting large volumes of goods over long distances. Seaports act as critical hubs in the global supply chain, facilitating the transfer of goods between continents.

Railways are known for their efficiency in moving large quantities of goods over long distances on land. It is particularly effective for bulk commodities and standardized containers. Rail transport offers a more environmentally friendly alternative to road transport, with lower emissions and higher fuel efficiency.

Airways is critical for time-sensitive, high-value goods such as pharmaceuticals, electronics, and perishable items. Air transport provides the fastest shipping method, essential for just-in-time supply chain models, and connects distant global markets effectively.

The manufacturing industry holds the largest share of the market, as it heavily relies on efficient logistics for the procurement of raw materials and distribution of finished products. It encompasses a wide range of industries, such as electronics and machinery, requiring specialized logistics solutions for managing supply chain disruptions, maintaining inventory levels, and ensuring timely delivery to prevent production delays. The complexity and scale of manufacturing logistics demand robust and adaptable supply chain infrastructure.

Consumer goods include a wide range of products, such as clothing, household items, and personal care products, that require efficient logistics for inbound raw materials and outbound finished products. It is characterized by seasonal peaks, requiring flexible and scalable logistics solutions. The growth of e-commerce has significantly impacted this sector, increasing the demand for faster and more efficient delivery services.

The retail logistics sector focuses on the distribution channel, requiring a responsive supply chain to adapt to fluctuating consumer demands and seasonal variations. It involves managing inventory across multiple locations, ensuring product availability, and handling returns efficiently.

Food and beverages (F&B) require specialized logistics solutions due to the perishable nature of products. It demands efficient cold chain logistics for transportation and storage to maintain product quality and safety to comply with food safety regulations, manage short shelf-life products, and cope with seasonal fluctuations in demand.

Information technology (IT) hardware logistics involves handling sensitive and high-value products like computers, servers, and networking equipment. It requires precision in handling, storage, and transportation, often with stringent delivery timelines.

The healthcare logistics sector demands high precision and adherence to strict regulatory standards, especially for pharmaceuticals, medical devices, and biotechnology products. It involves the movement of temperature-sensitive and life-saving products, requiring specialized handling and storage.

The chemicals logistics sector promotes the transportation and storage of potentially hazardous materials that require strict adherence to safety and environmental regulations. Logistics providers in the chemical sector must have specialized equipment and trained personnel to handle these materials safely.

Logistics in the construction sector involves the movement of heavy and oversized equipment and materials like steel, cement, and machinery. It requires specialized transportation and handling equipment, as well as careful coordination to ensure timely delivery to construction sites.

The automotive logistics industry involves managing the supply chain for vehicle manufacturers and suppliers. It includes the transportation of raw materials, components, and finished vehicles, requiring highly efficient logistics to maintain just-in-time manufacturing processes.

Telecom logistics involves the distribution of telecommunications equipment, such as cell towers, cables, and networking devices. It requires specialized handling and timely delivery to ensure continuous service and network expansion.

The oil and gas logistics segment is utilized for the movement of crude oil, natural gas, and related products. It requires specialized transportation methods like pipelines, tankers, and trucks and faces unique challenges like handling volatile materials and operating in remote and often harsh environments.

The Asia-Pacific region holds the largest market, fueled by increasing industrialization, urbanization, and an expanding e-commerce sector. Moreover, the significant manufacturing base in the region, which necessitates efficient logistics for domestic and international trade, is catalyzing the market growth. Additionally, the presence of leading logistic companies in the region, coupled with the increasing focus on sustainability and efficient logistics practices is strengthening the market growth. Moreover, the imposition of supportive policies by regional governments promoting eco-friendly logistics practices is positively influencing the market growth.

The logistics market in North America is driven by the region's well-established infrastructure, advanced technological integration, and strong e-commerce sector. Furthermore, the adoption of robust supply chain management solutions and innovative approaches, such as automated warehousing and advanced fleet management systems, is catalyzing the market growth.

Europe's logistics sector is characterized by a well-developed transportation infrastructure, stringent regulatory standards, and a focus on sustainability. The region benefits from its strategic geographic location, serving as a central hub for trade between many countries.

The logistics market in Latin America is evolving, driven by increasing industrial activities, a growing middle class, and improvements in trade agreements. Moreover, the rising investment in infrastructure development and technology integration to enhance its logistics capabilities and integrate more effectively into the global supply chain is also boosting the market growth.

The Middle East and Africa (MEA) region shows potential for substantial growth in the logistics sector due to its strategic geographic position and significant investments in logistics infrastructure. In addition to this, the increasing trade activities, urbanization, and infrastructure development projects in the region are fostering the market growth.

In May 2023, FedEx Express launched a one-step logistics solution for hazardous and dangerous commodities in Cebu to minimize the risk of contamination through chemicals.

In October 2022, DHL announced GoGreen Plus service to help reduce carbon dioxide emissions from transportation through carbon offsetting.

2. What is the future of logistics industry?

3. What are the major trends in logistics?

4. What has been the impact of COVID-19 on the global logistics market?

5. What is the breakup of the global logistics market based on the model type?

6. What is the breakup of the global logistics market based on the transportation mode?

7. What is the breakup of the global logistics market based on the end use?

8. What are the key regions in the global logistics market?

9. Who is the largest logistics company?

10. Is logistics a growing industry?

Logistics Market Analysis:

Market Growth and Size: The market is witnessing stable growth, driven by the expansion of e-commerce, technological advancements, and increasing globalization. Moreover, the widespread diversification of services, such as traditional transportation, warehousing, and advanced supply chain management solutions is boosting the market growth.Major Market Drivers: Key drivers influencing the market growth include the expansion of the e-commerce sector and rapid technological advancements, including automation, and artificial intelligence (AI), to streamline logistics processes.

Key Market Trends: The key market trends involve the increasing focus on sustainability, as companies adopt eco-friendly practices like using electric vehicles (EVs) and optimizing delivery routes. Additionally, the integration of blockchain technology for enhanced transparency and security in supply chain management, is bolstering the market growth.

Geographical Trends: Asia-Pacific leads the market due to increasing industrialization, urbanization, and an expanding e-commerce sector. Other regions are also showing significant growth, fueled by the expanding manufacturing base, rapid technological advancements, and increasing digital penetration.

Competitive Landscape: The market is characterized by the presence of several key players focusing on expanding geographical reach and service offerings through strategic partnerships and acquisitions. Moreover, companies are also investing in research and development (R&D) to innovate in areas like autonomous vehicle logistics, drone delivery, and smart warehousing.

Challenges and Opportunities: The market faces various challenges, such as adapting to rapidly changing consumer demands, managing the complexities of global supply chains, and addressing environmental concerns. However, the increasing demand for last-mile delivery solutions, and the potential for technological innovations to create more efficient and sustainable logistics systems, is creating new opportunities for the market growth.

Logistics Market Trends

Expansion of the e-commerce sector

The rising expansion of the e-commerce sector, leading to a surge in demand for more diverse and faster shipping options, is providing a thrust to the market growth. In line with this, the sudden shift towards online commerce, compelling logistics companies to enhance their distribution networks and integrate advanced technologies for real-time tracking and efficient handling of goods, is fostering the market growth. Additionally, the rising prevalence of reverse logistics, which involves the handling of returns, thus complicating the logistics process, is providing a thrust to the market growth. Moreover, logistics companies are focusing on developing more responsive and flexible supply chains, capable of adapting to the fluctuating demands of e-commerce.Rapid technological advancements

The widespread integration of the Internet of Things (IoT) to enhance supply chain visibility and control is providing a thrust to the market growth. Moreover, the introduction of sensors and radio frequency identification (RFID) tags to provide real-time data on the location and condition of goods, enabling more effective tracking and inventory management, is acting as a growth-inducing factor. Besides this, the development of blockchain technology as a tool for improving supply chain transparency and security, particularly in international trade, is fostering the market growth. As a result, the increasing utilization of rapidly growing technological advancements to improve operational efficiency and enhance the customer experience by providing more accurate and timely information about shipments is anticipated to drive the market growth.Rising globalization of trade

The rising globalization of trade among companies, compelling logistics providers to navigate a complex web of customs regulations and trade agreements, is creating a positive outlook for the market growth. In line with this, the rising need for advanced logistics solutions and expertise in international logistics management, including understanding diverse cultural nuances and business practices for the efficient supply chain, is boosting the market growth. Additionally, the volatility in markets across the globe, such as fluctuations in fuel prices, trade wars, and currency exchange rates, which necessitates the need for a flexible and resilient supply chain strategy that can adapt to changing global scenarios, is bolstering the market growth.Growing concerns over environmental sustainability

The rising environmental concerns and the implementation of stringent regulations, prompting logistics providers to adopt sustainable practices, are boosting the market growth. In line with this, the increasing investment in alternative fuels and electric vehicles (EVs) to reduce greenhouse gas emissions is favoring the market growth. Along with this, companies are also exploring innovative packaging solutions that are sustainable and cost-effective. Additionally, the ongoing shift towards the development of urban logistics hubs to reduce congestion and pollution in city centers is amplifying the market growth. Apart from this, the increasing collaboration between companies, suppliers, customers, and competitors to share best practices and develop industry-wide standards for sustainability, such as joint investments in renewable energy projects, shared warehousing, and transportation resources, is fueling the market growth.Increasing consumer demand for faster delivery

The rising consumer expectation for rapid delivery systems is catalyzing the market growth. Logistics companies are experimenting with micro-fulfillment centers, which are smaller warehouses located closer to consumers, drastically reducing delivery times. Additionally, partnerships with local retailers and the use of advanced software for route optimization are becoming common strategies. Moreover, rapid innovations, such as the adoption of aerial drones or underground delivery networks to bypass traffic congestion are fueling the market growth. Besides this, the rising demand for speed compelling companies to innovate and experiment with new methods to meet consumer expectations efficiently and sustainably is positively impacting the market growth. In addition to this, the growing interest in alternative delivery methods to cater to the need for speed, such as the development of autonomous ground vehicles for last-mile deliveries, is enhancing the market growth.Logistics Industry Segmentation:

The report provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2023-2032. The report has categorized the market based on model type, transportation mode, and end-use.Breakup by Model Type:

- 2 PL

- 3 PL

- 4 PL

- 3 PL accounts for the majority of the market share

Third-party logistics (3PL) holds the largest market share as it involves outsourcing logistics operations to third-party businesses, allowing them to handle a variety of services, including transportation, warehousing, cross-docking, inventory management, packaging, and freight forwarding. It has the ability to provide cost-effective, scalable, and efficient logistics solutions, enabling client businesses to focus on their core competencies. Moreover, the rising growth of e-commerce and online retailers, prompting the adoption of 3PL services for streamlined supply chain operations, is favoring the market growth.

Second-party logistics (2PL) focuses on the transportation aspect of the supply chain, including trucks, ships, or planes for transporting goods from one point to another. They offer specialized modes of transportation and provide their services to shippers directly.

Fourth-party logistics (4PL) providers represent a more integrated approach to logistics management. They act as a single point of contact for all supply chain-related activities by managing resources, technology, infrastructure, and other 3PL services on behalf of their clients.

Breakup by Transportation Mode:

- Roadways

- Seaways

- Railways

- Airways

Roadways holds the largest share in the industry

A detailed breakup and analysis of the market based on the transportation mode have also been provided in the report. This includes roadways, seaways, railways, and airways. According to the report, roadways accounted for the largest market share.Roadways hold the largest in the market, due to their extensive network, flexibility, and cost-effectiveness for short to medium-distance transport. It is crucial for last-mile deliveries and for transporting goods within continents or regions where road infrastructure is well-developed. Road transport offers the advantage of door-to-door service, high frequency of departures, and the ability to handle a wide range of cargo types.

Seaways handles a significant portion of international cargo movement, especially for bulky and heavy goods. It is favored for its cost efficiency in transporting large volumes of goods over long distances. Seaports act as critical hubs in the global supply chain, facilitating the transfer of goods between continents.

Railways are known for their efficiency in moving large quantities of goods over long distances on land. It is particularly effective for bulk commodities and standardized containers. Rail transport offers a more environmentally friendly alternative to road transport, with lower emissions and higher fuel efficiency.

Airways is critical for time-sensitive, high-value goods such as pharmaceuticals, electronics, and perishable items. Air transport provides the fastest shipping method, essential for just-in-time supply chain models, and connects distant global markets effectively.

Breakup by End Use:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

Manufacturing represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end use. This includes manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others. According to the report, manufacturing represented the largest segment.The manufacturing industry holds the largest share of the market, as it heavily relies on efficient logistics for the procurement of raw materials and distribution of finished products. It encompasses a wide range of industries, such as electronics and machinery, requiring specialized logistics solutions for managing supply chain disruptions, maintaining inventory levels, and ensuring timely delivery to prevent production delays. The complexity and scale of manufacturing logistics demand robust and adaptable supply chain infrastructure.

Consumer goods include a wide range of products, such as clothing, household items, and personal care products, that require efficient logistics for inbound raw materials and outbound finished products. It is characterized by seasonal peaks, requiring flexible and scalable logistics solutions. The growth of e-commerce has significantly impacted this sector, increasing the demand for faster and more efficient delivery services.

The retail logistics sector focuses on the distribution channel, requiring a responsive supply chain to adapt to fluctuating consumer demands and seasonal variations. It involves managing inventory across multiple locations, ensuring product availability, and handling returns efficiently.

Food and beverages (F&B) require specialized logistics solutions due to the perishable nature of products. It demands efficient cold chain logistics for transportation and storage to maintain product quality and safety to comply with food safety regulations, manage short shelf-life products, and cope with seasonal fluctuations in demand.

Information technology (IT) hardware logistics involves handling sensitive and high-value products like computers, servers, and networking equipment. It requires precision in handling, storage, and transportation, often with stringent delivery timelines.

The healthcare logistics sector demands high precision and adherence to strict regulatory standards, especially for pharmaceuticals, medical devices, and biotechnology products. It involves the movement of temperature-sensitive and life-saving products, requiring specialized handling and storage.

The chemicals logistics sector promotes the transportation and storage of potentially hazardous materials that require strict adherence to safety and environmental regulations. Logistics providers in the chemical sector must have specialized equipment and trained personnel to handle these materials safely.

Logistics in the construction sector involves the movement of heavy and oversized equipment and materials like steel, cement, and machinery. It requires specialized transportation and handling equipment, as well as careful coordination to ensure timely delivery to construction sites.

The automotive logistics industry involves managing the supply chain for vehicle manufacturers and suppliers. It includes the transportation of raw materials, components, and finished vehicles, requiring highly efficient logistics to maintain just-in-time manufacturing processes.

Telecom logistics involves the distribution of telecommunications equipment, such as cell towers, cables, and networking devices. It requires specialized handling and timely delivery to ensure continuous service and network expansion.

The oil and gas logistics segment is utilized for the movement of crude oil, natural gas, and related products. It requires specialized transportation methods like pipelines, tankers, and trucks and faces unique challenges like handling volatile materials and operating in remote and often harsh environments.

Breakup by Region:

- Asia-Pacific

- Europe

- North America

- Latin America

- Middle East and Africa

Asia-Pacific leads the market, accounting for the largest logistics market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. According to the report, Asia-Pacific accounted for the largest market share.The Asia-Pacific region holds the largest market, fueled by increasing industrialization, urbanization, and an expanding e-commerce sector. Moreover, the significant manufacturing base in the region, which necessitates efficient logistics for domestic and international trade, is catalyzing the market growth. Additionally, the presence of leading logistic companies in the region, coupled with the increasing focus on sustainability and efficient logistics practices is strengthening the market growth. Moreover, the imposition of supportive policies by regional governments promoting eco-friendly logistics practices is positively influencing the market growth.

The logistics market in North America is driven by the region's well-established infrastructure, advanced technological integration, and strong e-commerce sector. Furthermore, the adoption of robust supply chain management solutions and innovative approaches, such as automated warehousing and advanced fleet management systems, is catalyzing the market growth.

Europe's logistics sector is characterized by a well-developed transportation infrastructure, stringent regulatory standards, and a focus on sustainability. The region benefits from its strategic geographic location, serving as a central hub for trade between many countries.

The logistics market in Latin America is evolving, driven by increasing industrial activities, a growing middle class, and improvements in trade agreements. Moreover, the rising investment in infrastructure development and technology integration to enhance its logistics capabilities and integrate more effectively into the global supply chain is also boosting the market growth.

The Middle East and Africa (MEA) region shows potential for substantial growth in the logistics sector due to its strategic geographic position and significant investments in logistics infrastructure. In addition to this, the increasing trade activities, urbanization, and infrastructure development projects in the region are fostering the market growth.

Leading Key Players in the Logistics Industry:

The leading players are actively engaging in strategic expansions, technological advancements, and collaborations to enhance their market presence and operational efficiency. Moreover, some companies are investing heavily in digital transformation initiatives, incorporating technologies like artificial intelligence (AI), the Internet of Things (IoT), and blockchain to improve supply chain visibility, forecasting accuracy, and overall efficiency. Besides this, they are focusing on sustainability, adopting green logistics practices, such as using electric vehicles (EVs) and optimizing routes for reduced carbon emissions. Along with this, major providers are forming strategic partnerships and acquisitions to expand their geographic reach, diversify their service offerings, and enhance their customer base.Competitive Analysis

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:- J.B. Hunt Transport Services

- C.H. Robinson Worldwide, Inc.

- Ceva Holdings LLC

- FedEx Corp.

- United Parcel Service, Inc.

- Expeditors International of Washington Inc.

- XPO Logistics Inc.

- Kenco Group

- Deutsche Post DHL Group

- Americold Logistics, LLC

- DSV Air & Sea Inc.

Latest News:

In March 2023, DSV signed a contract to purchase two American-based shipping and logistics firms, Global Diversity Logistics and Sand M Moving Systems West to strengthen its position cross-border.In May 2023, FedEx Express launched a one-step logistics solution for hazardous and dangerous commodities in Cebu to minimize the risk of contamination through chemicals.

In October 2022, DHL announced GoGreen Plus service to help reduce carbon dioxide emissions from transportation through carbon offsetting.

Key Questions Answered in This Report

1. How big is the logistics market?2. What is the future of logistics industry?

3. What are the major trends in logistics?

4. What has been the impact of COVID-19 on the global logistics market?

5. What is the breakup of the global logistics market based on the model type?

6. What is the breakup of the global logistics market based on the transportation mode?

7. What is the breakup of the global logistics market based on the end use?

8. What are the key regions in the global logistics market?

9. Who is the largest logistics company?

10. Is logistics a growing industry?

Table of Contents

1 Preface3 Executive Summary5 COVID-19 Impact on the Industry

2 Scope and Methodology

4 Introduction

6 Global Logistics Market

7 Market Breakup by Model Type

8 Market Breakup by Transportation Mode

9 Market Breakup by End-Use

10 Market Breakup by Region

11 Competitive Landscape

List of Figures

List of Tables

Companies Mentioned

- J.B. Hunt Transport Services

- C.H. Robinson Worldwide Inc.

- Ceva Holdings LLC

- FedEx Corp.

- United Parcel Service Inc.

- Expeditors International of Washington Inc.

- XPO Logistics Inc.

- Kenco Group

- Deutsche Post DHL Group

- Americold Logistics LLC

- DSV Air & Sea Inc.

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | January 2024 |

| Forecast Period | 2023 - 2032 |

| Estimated Market Value ( USD | $ 5.4 Trillion |

| Forecasted Market Value ( USD | $ 7.9 Trillion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |