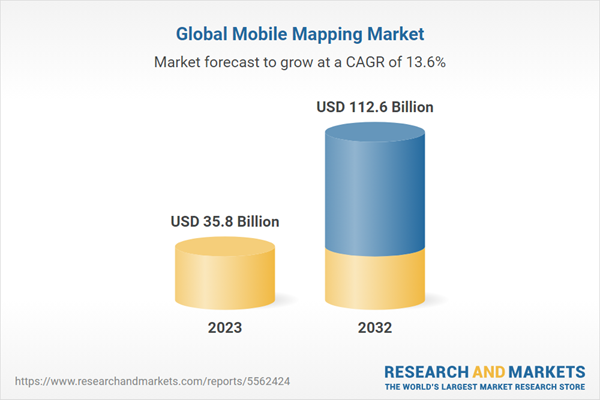

The global mobile mapping market size reached US$ 35.8 Billion in 2023. Looking forward, the market is projected to reach US$ 112.6 Billion by 2032, exhibiting a growth rate (CAGR) of 13.58% during 2023-2032. The widespread adoption of smartphones, significant advancements in GPS and GIS technologies, increasing infrastructure development initiatives, location-based advertising, rising number of autonomous vehicles, and emergency response requirements are some of the major factors propelling the market.

Mobile mapping is a technology-driven process that involves the collection, analysis, and presentation of geospatial data using mobile devices. It enables the creation of accurate and up-to-date maps, typically in real-time, by leveraging various technologies such as Global Positioning System (GPS), Geographic Information System (GIS), and mobile computing. Mobile mapping systems typically consist of specialized hardware, such as GPS receivers, laser scanners, and digital cameras, integrated with mobile devices like smartphones or tablets. These systems capture detailed location-based data and other relevant information, such as street views, terrain elevation, and 3D models of the surroundings.

The collected data is processed and analyzed using software applications specifically designed for mobile mapping. These applications enable the conversion of raw data into actionable insights, facilitating tasks such as route planning, asset management, urban planning, and infrastructure development. Mobile mapping finds applications in various industries and sectors, including transportation, urban planning, environmental monitoring, and emergency management. It offers numerous benefits, including improved accuracy, efficiency, and cost-effectiveness compared to traditional mapping methods. Mobile mapping technology has revolutionized data collection and analysis, empowering businesses and organizations to make informed decisions based on reliable geospatial information.

The widespread use of smartphones and mobile devices has led to an increased demand for location-based services. Mobile mapping applications provide users with real-time navigation, location tracking, and geospatial information, driving the market growth. Additionally, businesses are leveraging mobile mapping technologies to target customers with location-specific advertisements and offers. Location-based marketing allows companies to reach their target audience effectively and provide personalized experiences, driving the demand for mobile mapping solutions. Other than this, the rise of autonomous vehicles and ride-sharing services has created a need for precise mapping and navigation systems.

Mobile mapping technologies, including LiDAR and 3D mapping, are essential for the safe and efficient operation of autonomous vehicles, fueling market growth. Besides this, mobile mapping tools are instrumental in disaster management and emergency response situations. They enable authorities to quickly assess affected areas, plan evacuation routes, and coordinate relief efforts, contributing to the market's growth. In line with this, the development of more accurate and reliable Global Positioning System (GPS) and Geographic Information System (GIS) technologies has significantly enhanced the capabilities of mobile mapping.

Improved accuracy and positioning capabilities are driving the adoption of mobile mapping solutions across various industries. Moreover, governments and organizations worldwide are investing in infrastructure development projects, such as transportation, urban planning, and smart cities. Mobile mapping plays a crucial role in these projects by providing accurate geospatial data for efficient planning, construction, and maintenance.

GIS technology enables the efficient storage, analysis, and visualization of geospatial data, providing valuable insights for decision-making. The integration of GPS and GIS technologies with mobile devices has made mobile mapping solutions more powerful and versatile, driving their adoption in various industries such as transportation, logistics, and urban planning.

Real-time tracking and geolocation capabilities aid in coordinating rescue operations and allocating resources efficiently. The integration of mobile mapping with communication systems enables better situational awareness and coordination among response teams. As governments and organizations recognize the importance of efficient disaster management, the demand for mobile mapping solutions in this sector is growing rapidly, driving the market forward.

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services. According to the report, hardware represented the largest segment.

Hardware components are essential for capturing and collecting geospatial data accurately. Mobile mapping systems rely on specialized hardware devices such as GPS receivers, laser scanners, cameras, and sensors to capture precise location information, images, and other relevant data. The quality and capabilities of these hardware components directly impact the accuracy and effectiveness of the mobile mapping process. Additionally, the demand for advanced hardware components in mobile mapping is driven by technological advancements. As technology evolves, hardware components become more sophisticated, compact, and capable of capturing high-resolution data in real-time.

This drives the market as organizations and industries seek to upgrade their mobile mapping systems to benefit from the latest hardware advancements. Other than this, the complexity of mobile mapping applications often requires a combination of hardware components to achieve comprehensive data collection. For instance, integrating GPS receivers, laser scanners, and cameras enables the creation of detailed and comprehensive maps. This necessitates the acquisition of multiple hardware components, contributing to the larger market share.

Moreover, the hardware segment tends to have higher unit costs compared to software or services. Hardware components are physical assets that require manufacturing, assembly, and distribution, leading to higher price points. This, coupled with the need for ongoing hardware maintenance and upgrades, further drives the market size of the hardware segment.

A detailed breakup and analysis of the market based on the type has also been provided in the report. This includes 3D mapping, licensing, indoor mapping, location based services, and location based search. According to the report, 3D mapping accounted for the largest market share.

3D mapping offers a higher level of visual representation and accuracy compared to 2D mapping. It provides a three-dimensional view of the environment, allowing for more realistic and immersive mapping experiences. The demand for 3D mapping is driven by industries such as architecture, urban planning, and entertainment, where precise and detailed spatial information is crucial. Additionally, the advancements in technology have made 3D mapping more accessible and cost-effective. The development of LiDAR (Light Detection and Ranging) technology, coupled with improved data processing capabilities, has made it easier to capture and create detailed 3D models.

This has led to increased adoption across various sectors, including construction, real estate, and virtual reality. Other than this, 3D mapping has a wide range of applications. It is used for infrastructure planning, simulations, virtual tours, gaming, and augmented reality experiences. The versatility and potential of 3D mapping solutions attract a larger customer base, contributing to its dominance in the market.

Furthermore, 3D mapping enables better data visualization and analysis. It allows for the integration of various datasets, such as terrain elevation, building structures, and vegetation, providing a comprehensive view for decision-making and planning purposes. The ability to analyze spatial data in three dimensions enhances the value and utility of 3D mapping solutions.

The report has provided a detailed breakup and analysis of the market based on the application. This includes imaging services, aerial mobile mapping, emergency response planning, internet application, facility management, and satellite. According to the report, imaging services represented the largest segment.

Imaging services provide visual data that is highly valuable in various industries. Mobile mapping solutions equipped with imaging capabilities enable the capture of high-resolution images, street views, and panoramic views. These images are used in applications such as urban planning, environmental monitoring, infrastructure development, and real estate. The ability to visualize and analyze the environment through imaging services significantly enhances decision-making processes, driving the demand for these services. Additionally, the advancements in camera technology and image processing algorithms have improved the quality and accuracy of imaging services.

High-resolution cameras, along with software enhancements, enable the capture of detailed and precise images, ensuring the reliability of the data. This has led to increased adoption across industries that heavily rely on visual information, such as architecture, construction, and tourism. Other than this, imaging services have a wide range of applications and can be customized to meet specific industry requirements. They are used for mapping urban areas, assessing infrastructure conditions, conducting site surveys, and creating virtual tours. The versatility and flexibility of imaging services make them applicable in multiple sectors, attracting a larger customer base and contributing to their market dominance.

Furthermore, the increasing demand for visual content and immersive experiences has driven the growth of imaging services. Businesses and consumers seek engaging and visually appealing content, and mobile mapping solutions provide a means to deliver such content. Industries such as advertising, media, and entertainment utilize imaging services to create compelling visuals and immersive experiences, further driving the market size of this segment.

A detailed breakup and analysis of the market based on the end-user has also been provided in the report. This includes government, oil and gas, mining, military, and others. According to the report government represented the largest segment.

Governments at various levels, including local, regional, and national, have a significant need for accurate geospatial data and mapping services. They utilize mobile mapping technologies for urban planning, infrastructure development, disaster management, and environmental monitoring. Governments require reliable and up-to-date geospatial information to make informed decisions, allocate resources efficiently, and ensure the well-being of their constituents. The scale and scope of government operations and responsibilities make them a major consumer of mobile mapping solutions, driving the market size in this segment. Additionally, government agencies often have the financial resources to invest in mobile mapping technologies.

Public sector budgets allow for the acquisition of advanced hardware, software, and services necessary for effective mapping and data analysis. The financial capacity of governments contributes to their significant share in the market as they can afford to implement and maintain mobile mapping systems. Other than this, governments have regulatory and planning responsibilities that necessitate the use of accurate and comprehensive geospatial information. They play a crucial role in urban development, land management, transportation planning, and emergency response. Mobile mapping solutions provide the necessary tools and data for governments to carry out these functions effectively, making them the largest segment in the market by end user.

The report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. According to the report, North America was the largest market for mobile mapping.

North America has a highly developed and technologically advanced infrastructure. The region boasts a well-established telecommunications network, widespread smartphone adoption, and advanced mapping technologies. The combination of these factors provides a strong foundation for the adoption and utilization of mobile mapping solutions. Additionally, North America has a diverse range of industries that heavily rely on mobile mapping. Sectors such as transportation, logistics, construction, and urban planning have a high demand for accurate and up-to-date geospatial data. These industries benefit from the efficiency, cost-effectiveness, and enhanced decision-making capabilities offered by mobile mapping technologies.

Other than this, the region is home to several key players in the mobile mapping industry. Prominent companies specializing in mapping solutions, including hardware, software, and services, are based in the region. Their presence contributes to the growth and development of the mobile mapping market in North America. Furthermore, government initiatives and investments in infrastructure development, smart cities, and public safety further drive the demand for mobile mapping in the region. The public sector's commitment to utilizing advanced mapping technologies reinforces North America's position as the largest market for mobile mapping.

Collaborations with hardware manufacturers, software developers, and industry-specific organizations help in developing comprehensive and tailored mobile mapping solutions. Other than this, they consistently introduce innovative products and features to meet evolving customer demands. They focus on developing user-friendly interfaces, mobile applications, and cloud-based platforms to enhance the accessibility and usability of mobile mapping solutions. Innovation in areas such as 3D mapping, augmented reality, and virtual reality are driving the adoption of mobile mapping in various sectors.

Besides this, key players are actively expanding their market reach by targeting new industries, sectors, and geographical regions. They conduct market research and analysis to identify untapped opportunities and tailor their solutions to specific industry needs. By expanding into new markets, key players are able to reach a broader customer base and drive the overall growth of the mobile mapping market.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Trimble Inc. has introduced the Trimble MX50, which includes Trimble-designed profiling lasers, a 360-degree panoramic camera, and a GNSS/IMU system, further enhancing the accuracy and capabilities of their mobile mapping solutions.

2. What is the expected growth rate of the global mobile mapping market during 2024-2032?

3. What are the key factors driving the global mobile mapping market?

4. What has been the impact of COVID-19 on the global mobile mapping market?

5. What is the breakup of the global mobile mapping market based on the component?

6. What is the breakup of the global mobile mapping market based on the type?

7. What is the breakup of the global mobile mapping market based on application?

8. What is the breakup of the global mobile mapping market based on the end-user?

9. What are the key regions in the global mobile mapping market?

10. Who are the key players/companies in the global mobile mapping market?

Mobile mapping is a technology-driven process that involves the collection, analysis, and presentation of geospatial data using mobile devices. It enables the creation of accurate and up-to-date maps, typically in real-time, by leveraging various technologies such as Global Positioning System (GPS), Geographic Information System (GIS), and mobile computing. Mobile mapping systems typically consist of specialized hardware, such as GPS receivers, laser scanners, and digital cameras, integrated with mobile devices like smartphones or tablets. These systems capture detailed location-based data and other relevant information, such as street views, terrain elevation, and 3D models of the surroundings.

The collected data is processed and analyzed using software applications specifically designed for mobile mapping. These applications enable the conversion of raw data into actionable insights, facilitating tasks such as route planning, asset management, urban planning, and infrastructure development. Mobile mapping finds applications in various industries and sectors, including transportation, urban planning, environmental monitoring, and emergency management. It offers numerous benefits, including improved accuracy, efficiency, and cost-effectiveness compared to traditional mapping methods. Mobile mapping technology has revolutionized data collection and analysis, empowering businesses and organizations to make informed decisions based on reliable geospatial information.

The widespread use of smartphones and mobile devices has led to an increased demand for location-based services. Mobile mapping applications provide users with real-time navigation, location tracking, and geospatial information, driving the market growth. Additionally, businesses are leveraging mobile mapping technologies to target customers with location-specific advertisements and offers. Location-based marketing allows companies to reach their target audience effectively and provide personalized experiences, driving the demand for mobile mapping solutions. Other than this, the rise of autonomous vehicles and ride-sharing services has created a need for precise mapping and navigation systems.

Mobile mapping technologies, including LiDAR and 3D mapping, are essential for the safe and efficient operation of autonomous vehicles, fueling market growth. Besides this, mobile mapping tools are instrumental in disaster management and emergency response situations. They enable authorities to quickly assess affected areas, plan evacuation routes, and coordinate relief efforts, contributing to the market's growth. In line with this, the development of more accurate and reliable Global Positioning System (GPS) and Geographic Information System (GIS) technologies has significantly enhanced the capabilities of mobile mapping.

Improved accuracy and positioning capabilities are driving the adoption of mobile mapping solutions across various industries. Moreover, governments and organizations worldwide are investing in infrastructure development projects, such as transportation, urban planning, and smart cities. Mobile mapping plays a crucial role in these projects by providing accurate geospatial data for efficient planning, construction, and maintenance.

Mobile Mapping Market Trends/Drivers

Growing adoption of smartphones and mobile devices

With the increasing number of smartphone users, there is a rising demand for location-based services and applications. Mobile mapping applications provide users with real-time navigation, accurate positioning, and geospatial information, enhancing their overall experience. The convenience and portability of smartphones make them ideal devices for accessing mobile mapping services, driving the market growth. Moreover, the integration of mobile mapping with other applications, such as social media and e-commerce, further expands its reach and utility, attracting a larger user base.Advancements in GPS and GIS technologies:

The advancements in Global Positioning System (GPS) and Geographic Information System (GIS) technologies have significantly contributed to the growth of the market. These technologies have become more accurate, reliable, and accessible, enabling precise positioning and mapping capabilities. Improved GPS accuracy allows for better navigation, tracking, and location-based services.GIS technology enables the efficient storage, analysis, and visualization of geospatial data, providing valuable insights for decision-making. The integration of GPS and GIS technologies with mobile devices has made mobile mapping solutions more powerful and versatile, driving their adoption in various industries such as transportation, logistics, and urban planning.

Increasing use of mobile mapping in disaster management and emergency response

Mobile mapping tools are playing an increasingly critical role in disaster management and emergency response situations. During natural disasters or emergencies, accurate and up-to-date geospatial information is crucial for effective decision-making and resource allocation. Mobile mapping solutions allow authorities to quickly assess affected areas, identify hazards, and plan evacuation routes.Real-time tracking and geolocation capabilities aid in coordinating rescue operations and allocating resources efficiently. The integration of mobile mapping with communication systems enables better situational awareness and coordination among response teams. As governments and organizations recognize the importance of efficient disaster management, the demand for mobile mapping solutions in this sector is growing rapidly, driving the market forward.

Mobile Mapping Industry Segmentation

This report provides an analysis of the key trends in each segment of the global mobile mapping market report, along with forecasts at the global and regional levels from 2024-2032. The report has categorized the market based on component, type, application, and end-user.Breakup by Component:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services. According to the report, hardware represented the largest segment.

Hardware components are essential for capturing and collecting geospatial data accurately. Mobile mapping systems rely on specialized hardware devices such as GPS receivers, laser scanners, cameras, and sensors to capture precise location information, images, and other relevant data. The quality and capabilities of these hardware components directly impact the accuracy and effectiveness of the mobile mapping process. Additionally, the demand for advanced hardware components in mobile mapping is driven by technological advancements. As technology evolves, hardware components become more sophisticated, compact, and capable of capturing high-resolution data in real-time.

This drives the market as organizations and industries seek to upgrade their mobile mapping systems to benefit from the latest hardware advancements. Other than this, the complexity of mobile mapping applications often requires a combination of hardware components to achieve comprehensive data collection. For instance, integrating GPS receivers, laser scanners, and cameras enables the creation of detailed and comprehensive maps. This necessitates the acquisition of multiple hardware components, contributing to the larger market share.

Moreover, the hardware segment tends to have higher unit costs compared to software or services. Hardware components are physical assets that require manufacturing, assembly, and distribution, leading to higher price points. This, coupled with the need for ongoing hardware maintenance and upgrades, further drives the market size of the hardware segment.

Breakup by Type:

- 3D Mapping

- Licensing

- Indoor Mapping

- Location Based Services

- Location Based Search

A detailed breakup and analysis of the market based on the type has also been provided in the report. This includes 3D mapping, licensing, indoor mapping, location based services, and location based search. According to the report, 3D mapping accounted for the largest market share.

3D mapping offers a higher level of visual representation and accuracy compared to 2D mapping. It provides a three-dimensional view of the environment, allowing for more realistic and immersive mapping experiences. The demand for 3D mapping is driven by industries such as architecture, urban planning, and entertainment, where precise and detailed spatial information is crucial. Additionally, the advancements in technology have made 3D mapping more accessible and cost-effective. The development of LiDAR (Light Detection and Ranging) technology, coupled with improved data processing capabilities, has made it easier to capture and create detailed 3D models.

This has led to increased adoption across various sectors, including construction, real estate, and virtual reality. Other than this, 3D mapping has a wide range of applications. It is used for infrastructure planning, simulations, virtual tours, gaming, and augmented reality experiences. The versatility and potential of 3D mapping solutions attract a larger customer base, contributing to its dominance in the market.

Furthermore, 3D mapping enables better data visualization and analysis. It allows for the integration of various datasets, such as terrain elevation, building structures, and vegetation, providing a comprehensive view for decision-making and planning purposes. The ability to analyze spatial data in three dimensions enhances the value and utility of 3D mapping solutions.

Breakup by Application:

- Imaging Services

- Aerial Mobile Mapping

- Emergency Response Planning

- Internet Application

- Facility Management

- Satellite

The report has provided a detailed breakup and analysis of the market based on the application. This includes imaging services, aerial mobile mapping, emergency response planning, internet application, facility management, and satellite. According to the report, imaging services represented the largest segment.

Imaging services provide visual data that is highly valuable in various industries. Mobile mapping solutions equipped with imaging capabilities enable the capture of high-resolution images, street views, and panoramic views. These images are used in applications such as urban planning, environmental monitoring, infrastructure development, and real estate. The ability to visualize and analyze the environment through imaging services significantly enhances decision-making processes, driving the demand for these services. Additionally, the advancements in camera technology and image processing algorithms have improved the quality and accuracy of imaging services.

High-resolution cameras, along with software enhancements, enable the capture of detailed and precise images, ensuring the reliability of the data. This has led to increased adoption across industries that heavily rely on visual information, such as architecture, construction, and tourism. Other than this, imaging services have a wide range of applications and can be customized to meet specific industry requirements. They are used for mapping urban areas, assessing infrastructure conditions, conducting site surveys, and creating virtual tours. The versatility and flexibility of imaging services make them applicable in multiple sectors, attracting a larger customer base and contributing to their market dominance.

Furthermore, the increasing demand for visual content and immersive experiences has driven the growth of imaging services. Businesses and consumers seek engaging and visually appealing content, and mobile mapping solutions provide a means to deliver such content. Industries such as advertising, media, and entertainment utilize imaging services to create compelling visuals and immersive experiences, further driving the market size of this segment.

Breakup by End-User:

- Government

- Oil and Gas

- Mining

- Military

- Others

A detailed breakup and analysis of the market based on the end-user has also been provided in the report. This includes government, oil and gas, mining, military, and others. According to the report government represented the largest segment.

Governments at various levels, including local, regional, and national, have a significant need for accurate geospatial data and mapping services. They utilize mobile mapping technologies for urban planning, infrastructure development, disaster management, and environmental monitoring. Governments require reliable and up-to-date geospatial information to make informed decisions, allocate resources efficiently, and ensure the well-being of their constituents. The scale and scope of government operations and responsibilities make them a major consumer of mobile mapping solutions, driving the market size in this segment. Additionally, government agencies often have the financial resources to invest in mobile mapping technologies.

Public sector budgets allow for the acquisition of advanced hardware, software, and services necessary for effective mapping and data analysis. The financial capacity of governments contributes to their significant share in the market as they can afford to implement and maintain mobile mapping systems. Other than this, governments have regulatory and planning responsibilities that necessitate the use of accurate and comprehensive geospatial information. They play a crucial role in urban development, land management, transportation planning, and emergency response. Mobile mapping solutions provide the necessary tools and data for governments to carry out these functions effectively, making them the largest segment in the market by end user.

Breakup by Region:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

The report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. According to the report, North America was the largest market for mobile mapping.

North America has a highly developed and technologically advanced infrastructure. The region boasts a well-established telecommunications network, widespread smartphone adoption, and advanced mapping technologies. The combination of these factors provides a strong foundation for the adoption and utilization of mobile mapping solutions. Additionally, North America has a diverse range of industries that heavily rely on mobile mapping. Sectors such as transportation, logistics, construction, and urban planning have a high demand for accurate and up-to-date geospatial data. These industries benefit from the efficiency, cost-effectiveness, and enhanced decision-making capabilities offered by mobile mapping technologies.

Other than this, the region is home to several key players in the mobile mapping industry. Prominent companies specializing in mapping solutions, including hardware, software, and services, are based in the region. Their presence contributes to the growth and development of the mobile mapping market in North America. Furthermore, government initiatives and investments in infrastructure development, smart cities, and public safety further drive the demand for mobile mapping in the region. The public sector's commitment to utilizing advanced mapping technologies reinforces North America's position as the largest market for mobile mapping.

Competitive Landscape

Key players continuously invest in research and development to enhance their mobile mapping technologies. They focus on improving the accuracy, resolution, and speed of data collection, as well as enhancing data processing and analysis capabilities. Advancements in technologies such as LiDAR, artificial intelligence, and machine learning are driving the capabilities and competitiveness of mobile mapping solutions. Additionally, mobile mapping companies often form strategic partnerships and collaborations with other industry players. These partnerships allow for the integration of complementary technologies and expertise, expanding the functionality and applicability of mobile mapping solutions.Collaborations with hardware manufacturers, software developers, and industry-specific organizations help in developing comprehensive and tailored mobile mapping solutions. Other than this, they consistently introduce innovative products and features to meet evolving customer demands. They focus on developing user-friendly interfaces, mobile applications, and cloud-based platforms to enhance the accessibility and usability of mobile mapping solutions. Innovation in areas such as 3D mapping, augmented reality, and virtual reality are driving the adoption of mobile mapping in various sectors.

Besides this, key players are actively expanding their market reach by targeting new industries, sectors, and geographical regions. They conduct market research and analysis to identify untapped opportunities and tailor their solutions to specific industry needs. By expanding into new markets, key players are able to reach a broader customer base and drive the overall growth of the mobile mapping market.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Google LLC (Alphabet Inc.)

- Hexagon AB

- Trimble Inc.

- Topcon Corporation

- Javad GNSS Inc.

- OpTech LLC

- Mitsubishi Corporation

- Cyclomedia Technology B.V.

- EveryScape Inc.

Recent Developments

In 2023, Leica Geosystems, part of Hexagon AB, announced the latest addition to its Leica Pegasus TRK portfolio of mobile mapping solutions, the Leica Pegasus TRK100. It is designed for GIS professionals, the new mobile mapping system is a powerful, easy-to-use geospatial solution built for large-scale infrastructure measurement and digital twin creation.Trimble Inc. has introduced the Trimble MX50, which includes Trimble-designed profiling lasers, a 360-degree panoramic camera, and a GNSS/IMU system, further enhancing the accuracy and capabilities of their mobile mapping solutions.

Key Questions Answered in This Report

1. What was the size of the global mobile mapping market in 2023?2. What is the expected growth rate of the global mobile mapping market during 2024-2032?

3. What are the key factors driving the global mobile mapping market?

4. What has been the impact of COVID-19 on the global mobile mapping market?

5. What is the breakup of the global mobile mapping market based on the component?

6. What is the breakup of the global mobile mapping market based on the type?

7. What is the breakup of the global mobile mapping market based on application?

8. What is the breakup of the global mobile mapping market based on the end-user?

9. What are the key regions in the global mobile mapping market?

10. Who are the key players/companies in the global mobile mapping market?

Table of Contents

1 Preface3 Executive Summary12 Value Chain Analysis14 Price Analysis

2 Scope and Methodology

4 Introduction

5 Global Mobile Mapping Market

6 Market Breakup by Component

7 Market Breakup by Type

8 Market Breakup by Application

9 Market Breakup by End-User

10 Market Breakup by Region

11 SWOT Analysis

13 Porters Five Forces Analysis

15 Competitive Landscape

List of Figures

List of Tables

Companies Mentioned

- Google LLC (Alphabet Inc.)

- Hexagon AB

- Trimble Inc.

- Topcon Corporation

- Javad GNSS Inc.

- OpTech LLC

- Mitsubishi Corporation

- Cyclomedia Technology B.V.

- EveryScape Inc. etc.

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | April 2024 |

| Forecast Period | 2023 - 2032 |

| Estimated Market Value ( USD | $ 35.8 Billion |

| Forecasted Market Value ( USD | $ 112.6 Billion |

| Compound Annual Growth Rate | 13.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |